OGJ Newsletter

Market Movement

OPEC quota compliance takes dive…

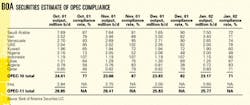

OPEC's 82% quota compliance for December marked a 5 percentage point drop from levels in November. The fall could place further tension on an already strained agreement among OPEC and non-OPEC countries to cut production starting Jan. 1 in an effort to buoy sinking oil prices.

"We expect compliance with new quotas will be a struggle," said Tyler Dann, analyst with Bank of America Securities, in a research note. "We expect 'real' production cuts vs. November levels to be only 0.7-0.8 million b/d from OPEC and 0.3-0.4 million b/d from non-OPEC."

The deterioration in quota compliance among OPEC members was broadly based, Dann said, with "notable production increases" from Algeria, Iran, and the UAE (see table).

"More than offsetting the weaker compliance in the OPEC-10 [excluding Iraq] was weaker-than-expected exports out of Iraq, as some buyers had reduced purchases while Iraq negotiated a new export agreement with the UN," Dann said.

…amid OPEC overproduction trend

According to Middle East Economic Survey, certain OPEC members continue to exceed their own production quotas despite the group's production falling 730,000 b/d last month.

MEES estimates that OPEC production now stands at 25.77 million b/d, including Iraq. Output from the 10 OPEC members with quotas (Iraq's output is set by UN sanctions rules) fell by 10,000 b/d in December to 23.77 million b/d. That amount is 569,000 b/d above the OPEC 10 target of 23.201 million b/d. Nigeria accounts for most of the excess, producing 300,000 b/d above its agreed quota, MEES said. Most of OPEC's production decline came from a 720,000 b/d shortfall in Iraqi production precipitated by a dispute between Iraq and the UN over pricing.

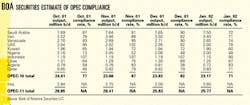

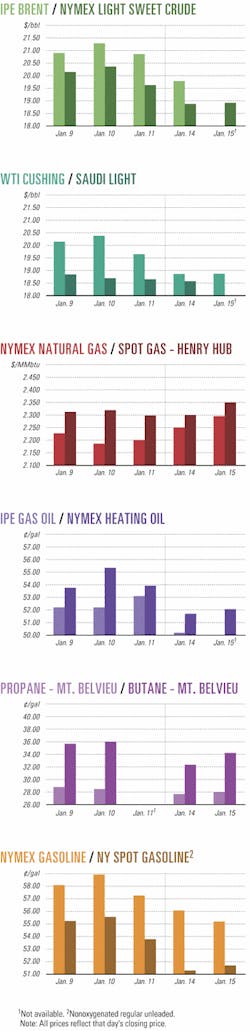

Evidence that OPEC is not maintaining quota discipline is having a market impact: Crude futures prices in London and New York had fallen by more than $2 during Jan. 8-17, with both benchmark next-month contracts slipping below $19/bbl last week.

Non-OPEC compliance hindered

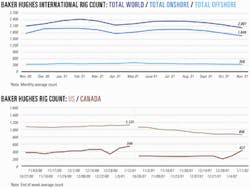

Adding to the bearish tone on futures markets, some early indicators suggest that OPEC might not be alone in its struggle to comply with production cut pledges.

Russian firm Sibneft-which claimed to have the fastest rate of production growth of any major Russian oil company last year-announced increased production targets for 2002.

Because it is one of the oil companies that recently agreed to cut its output in support of the Russian government's agreement with OPEC's efforts to cut output to bolster oil prices, oil traders have interpreted the move as putting pressure on the Russia-OPEC pact.

Sibneft said that this year it aims to boost production at an even faster rate, with output targeted to rise by 26.3% to 516,000 b/d. The output increases are being driven by a dual strategy of intensive investment in developing new fields and in raising productivity at existing fields.

Most of Russia's oil companies have announced expansion plans for the coming year, but none are as ambitious as those of Sibneft, which oil analysts say is likely to meet its targets.

Industry Scoreboard

null

null

Industry Trends

Energy Executives are making advances in information security, but some still feel susceptible to security breaches, according to recent survey results compiled by accounting and tax firm KPMG LLP.

Of the 102 energy leaders polled, 35% said that they believed their companies were somewhat susceptible to a serious violation of information security. Of those surveyed, 27% said threats to information security have increased in the past 2 years, while 41% expect threats to increase in the next few years.

Also, 42% of the respondents said that employees topped the list of those who posed the greatest threat to information security, followed by hackers 33%, competitors 21%, and customers 3%.

In addition, the survey-administered 1 month prior to last fall's terrorist attacks on the US-noted that 83% of respondents have developed a catastrophe response plan.

Christopher Roach, partner, KPMG risk and advisory services, said that while many energy companies may have shelved such response plans, "Given the events of Sept. 11, I've got to believe that people are starting to dust those off."

Roach added that a large percentage of the plans he has seen have focused strictly on technology. "Technology is a small component of an overall corporate security plan," he said. "The starting point is awareness and training within an organization to address its people."

ENERGY PRICES continue to be volatile. The raw energy component of the US product price index plummeted 53% in 2001, following an 85.6% increase in 2000, the Bureau of Labor Statistics reported.

The price index for finished energy supplies, including gasoline and heating oil, fell 17.2% in 2001, compared with a 16.6% increase in 2000, BLS said. And the intermediate energy goods price index fell 17.2% for 2001, vs. a 19% increase for 2000.

On a month-to-month basis, the raw energy product index, including petroleum, natural gas, and coal, fell 20.5% in December, nearly offsetting a 28.3% gain in November. However, crude oil plunged 21.6% last month, following a 7.4% decline in November.

The price index for finished energy goods dropped 4% in December, following a 3.8% decline in November.

Indexes for gasoline and LPG led December's finished products decline, tumbling 8.2% and 19.3%, respectively. Falling prices for home heating oil, residential natural gas, diesel fuel, and residential electric power also contributed to the decline in the finished energy goods index.

The index for intermediate energy materials fell 4.5% in December, surpassing the 1.6% drop in November. Diesel fuel was down 19.5% in December, compared with a 1.8% decrease the previous month. Prices for LPG, jet fuel, and commercial natural gas also dropped more rapidly in December than they did in November.

Electricity prices, on the other hand, declined 1.2% in December after rising 1.8% in November, the government said. Prices for natural gas feeding electric utilities also decreased but at a slower pace.

Government Developments

LAWSUITS over energy-related disputes against governmental entities in the US are the mode du jour.

Delta Petroleum Corp. and coplaintiffs are suing the federal government for $1.2 billion for preventing them from developing 40 federal leases off California. The Delta group's suit seeks compensation for leasing bonuses and rentals. The companies also plan to seek reimbursement for exploration costs and related expenses.

Plaintiffs allege breach of contract, citing postleasing amendments added to a federal statute governing offshore activities that alter the leaseholders' rights, Delta said.

The leases are in the Santa Maria basin off Santa Barbara and San Luis Obispo counties and in the Santa Barbara Channel off Santa Barbara and Ventura counties.

Delays at the state and federal level, fueled by public opposition, have kept the leases, sold in 1981-85, from being developed (OGJ Online, Jan. 10, 2002).

Coastal Petroleum is involved in a similar suit against the state of Florida. Coastal has said that by denying it a drilling permit for its offshore properties, Florida is taking its property without compensation.

OTHER LITIGATION is threatened in conjunction with the White House Office of Management and Budget's plan to review-and possibly rescind-current rules governing how refiners and power plants monitor stationary source pollution.

OMB says it needs to retool New Source Review rules to avoid production constraints in the electric power and oil sectors.

Nine northeastern states, however, warned the White House Jan. 8 that they would sue if EPA lowers air pollution standards for refiners and power plants.

Attorneys general of New York, Connecticut, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, Rhode Island, and Vermont said efforts to downgrade the program would increase the incidence of airborne lung diseases in their states (OGJ Online, Jan. 14, 2002).

Some natural gas producers are also unhappy with the proposal because it could encourage utilities to add capacity to older, less-efficient, coal-fired plants, which environmental groups and some scientists blame for much of the region's elevated smog levels.

Gas producers also fear that if EPA relaxes rules on coal-fired generation, demand for natural gas will decrease.

Refiners, however, opt for changes, saying the Clinton administration enforced the NSR rules too aggressively and that EPA's interpretations of NSR discouraged even routine maintenance.

API Pres. Red Cavaney said, "…[A] lot of things that were just routine maintenance were penalized." He added that many companies have halted changes at their plants due to the large penalties EPA has levied on some firms.

Environmental groups and top administration officials claim that industry often expanded capacity or made other plant changes without first going through required reviews, preventing regulators from ensuring that air pollution guidelines were being met.

EPA and the Justice Department have filed numerous lawsuits on the issue.

Congress likely will consider NSR and multipollutant legislation this year because of the wide impact of both across the energy sector, industry officials said.

Quick Takes

AN UPGRADE is under way on the Dada Gorgud semisubmersible rig, which has worked in the Caspian Sea since it was built in 1980.

BP, the lead stakeholder in Azerbaijan Inter- national Operating Co., confirmed that Caspian Shipyard, a joint venture of Azerbaijan, Russia, and Singapore's Keppel FELS Energy & Infrastructure, is handling the $20 million modernization.

SOCAR owns Dada Gorgud, which is managed by Caspian Drilling, a JV of SOCAR and Santa Fe International Services. This is the rig's fourth upgrade; completion is slated for March.

Once the semi is ready, AIOC plans to drill the first well in the Azerbaijani part of the Azeri-Chirag-Guneshli (ACG) oil fields complex. BP leds AIOC with 34.14% interest. Partners are SOCAR 10%, Unocal 10.28%, Russia's Lukoil 10%, Statoil 8.56%, ExxonMobil 8%, TPAO 6.75%, Devon 5.62%, Itochu 3.9% and Delta Hess 2.72%.

AIOC is developing the ACG fields with estimated reserves of 4.6 billion bbl.

OFFSHORE NORTHERN EUROPE tops development news.

Talisman Energy signed a contract with Pegasus International UK to perform detailed design engineering for Kildrummy field. (The field has been renamed since its discovery last year, when it initially was called Lucy, Talisman said.)

Kildrummy will be tied back 6.9 km west to the Piper Bravo platform. Both Kildrummy and Piper Bravo are on Block 15/17.

Pegasus will design the subsea system, including production and gas lift flowlines and tie-in spools, subsea distribution skid, subsea isolation valve structure, field architecture, and riser system. Work is to be completed in March.

Talisman will develop the field using one or more gas-lifted production wells.

In the Norwegian Sea, Statoil has awarded Aker Maritime a contract worth 5 billion kroner ($560 million) for work on a gas-condensate field. Kristin is being developed with a floating production platform that will be tied to 12 subsea wells.

The Aker Stord yard will conduct design and procurement activities for the semisubmersible platform hull and the topsides, including the utilities, process, and riser modules and the flare boom. Aker Stord also will fabricate the utilities and process modules and hook up the topsides. In addition, the contractor is responsible for mating topsides and hull.

Engineering is to begin this month, with construction work slated for January 2003. First production is expected in October 2005.

CARPATHIAN RESOURCES, an Australian company, has discovered oil on its Postoma 1 prospect in the Vienna basin of the Czech Republic.

Carpathian Resources said the well intersected its primary target, the Lab sand, at 1,450-1,461 m, and the well flowed 16.8 cu m/day.

Carpathian is preparing for a long-term production test and permanent production facilities. Postoma 1 was the company's first well drilled on the Breclav license, which is surrounded by producing fields.

Carpathian operates the well with 17.65% interest. Geocan Energy, Unigeo, and Ceska Naftarska Spolecnost each hold 27.45%.

Elsewhere on the exploration front, the state oil companies of Malaysia, Viet Nam, and Indonesia have agreed to form a JV to explore Blocks 10 and 11.1 off Viet Nam. This is the first alliance within the Tripartite Cooperation Arrangement, which was signed in November 2000 (OGJ Online, Dec. 11, 2000). The partners in Con Son Joint Operating Co. are Petrovietnam Investment & Development Co. 40%, Petronas Carigali Overseas 30%, and Pertamina 30%. The blocks are in the Nam Con Son basin on the southern continental shelf of Viet Nam, 210 km southeast of Vung Tau. This year, the partners will reprocess seismic data and conduct additional geological and geophysical studies. In 2003, the JV plans to drill two exploration wells. Petronas said Malaysian and Indonesian blocks are being evaluated for similar arrangements. Off China, CNOOC and Shell have signed a production sharing contract for exploration of the Bonan area of Bohai Bay. Shell will operate the PSC on Block 11/26. The contract calls for at least two wells to be drilled in 2 years with an option for two additional wells to be drilled during the subsequent 4 years. The block is in 25 m of water and 30 km northwest of Longkou.

SOUTH KOREA has become the latest country to announce plans to build LNG facilities this year-joining China, Norway, Nigeria, and Australia.

Pohang Iron & Steel, the second-largest steelmaker in South Korea, plans to build a $290 million LNG terminal to cut costs and ensure stable fuel supplies for its power plants. Construction of the 1.7 million tonne/year terminal at Kwangyang, south of Seoul, is expected to begin in June with completion slated for March 2005.

The switch to gas from oil and coal would save the company $10 million/year, said Pohang, which wants to reduce purchases from state-run Korea Electric Power. Any surplus gas could be sold to other companies or could supply future power plants.

Pohang has preliminary plans to import LNG from Southeast Asia, Australia, and the Middle East.

Elsewhere, North West Shelf Venture has awarded John Holland, an Australian engineering and construction company, an $11 million contract for civil works on its $1.6 billion LNG expansion project. John Holland will undertake all civil works and concrete foundations for the major off-plot process facilities associated with the fourth train of the Burrup Peninsula LNG plant. This includes civil works for the sulphinol and thermal combustion units and air separation and power generation facilities. Also, it includes installation of all underground cabling linking the off-plot process facilities with new and existing substations. John Holland will begin work on the 11-month project in late January. In US LNG news, Shell Gas & Power, a unit of Royal Dutch/Shell Group, acquired rights to all the additional storage capacity that El Paso Corp. is planning at the Elba Island LNG terminal near Savannah, Ga. Shell was the highest bidder in an auction among four bidders for 3.3 bcf of new storage capacity at the terminal. The gas in storage can be transported from the terminal at a rate of 360 MMcfd. The LNG terminal contract is for 30 years. Financial terms were not released. El Paso received FERC authorization to begin receiving LNG shipments at Elba Island on Dec. 1, 2001. The expansion, expected to be operational in 2005, will cost $145 million, El Paso said. The terminal provides gas for Georgia, Florida, and South Carolina.

TOPPING PIPELINE news, Bay Gas Storage, a unit of EnergySouth, has completed the 18-mile Whistler gas pipeline.

The 24-in., 43 MMcfd pipeline connects Bay Gas to Gulf South Pipeline Co.'s 30-in. line near Whistler, Ala. (OGJ Online, Dec. 5, 2000). Gulf South transports gas to Alabama Power's Barry power plant.

Bay Gas Storage is developing a second natural gas storage cavern, which will bring working gas capacity to 3 bcf, more than doubling the company's capacity. The company previously completed a second 20-in. pipeline interconnect with Florida Gas Transmission.

Meanwhile, driven by plans for new gas-fired power plants, Allegheny Energy, Salt River Project, and Sempra Energy have proposed a new pipeline and storage complex to connect the Las Vegas area with Kingman, Ariz. The new complex, Desert Crossing Gas Storage & Transportation System, would include a 10 bcf storage facility and a 300 mile, 800 MMcfd pipeline connecting the storage complex with the interstate pipeline system. The storage facility would be capable of delivering gas to peaking plants on short notice. The companies are hosting an open season to gauge interest from potential buyers willing to sign firm contracts. Crescent Petroleum has completed studies for a proposed $3 billion Qatar-to-Pakistan offshore gas pipeline. OPEC News Agency reported the pipeline route would be mainly in Iranian waters. It would extend from Ras Laffan through Hamriyah, then Dibba on the Gulf of Oman, terminating at Gadani, Pakistan. The section between Hamriyah and Dibba would be onshore. The project has been under discussion since 1991. Pakistan and Crescent signed a memorandum of understanding for the 1.6 bcfd Gulf South Asia project almost 2 years ago. Gas for the pipeline could be supplied by TotalFinaElf via its stake in the Ras Laffan LNG project in Qatar (OGJ Online, July 26, 2000).

THE AUGER tension leg platform has gained another subsea production system.

Shell Exploration & Production said the Serrano subsea production system is the third subsea system to produce via Auger. Shell, the 100% owner of Serrano, began producing from Serrano's first well Dec. 1 and from the second well Dec. 8.

The wells, on Garden Banks Blocks 516 and 472 in the Gulf of Mexico, were producing 52.5 MMcfd of gas and 4,625 b/d of oil at last report. Serrano production is via a subsea flowline sled on Garden Banks 516, which is tied back 6 miles to Auger via a single production flowline.

Serrano is 220 miles southwest of New Orleans in 3,400 ft of water. Auger's first subsea production system, Macaroni, began production in 1999. The second, Oregano, began production in October 2001.

Serrano development costs are $120 million, excluding lease costs. Total recovery is estimated at 50 MMboe. Peak production is estimated at 160 MMcfd of gas this year.

In other production news, Petrobras produced a record 1,507,532 b/d of oil in December, up 6% from November. Most was produced in Brazil, although 38,414 b/d came from activity abroad through subsidiary Braspetro. In Brazil, Petrobras produced 40.5 million cu m of natural gas in December, a 5% increase over November. Counting production abroad, Petrobras produced a total of 43.6 million cu m of natural gas last month. The company brought on stream three wells for the floating system that includes platforms P-40 and P-38. It also started production at three other wells, two in Espadarte field and one in Marlim Sul field, all in the Campos basin. As additional wells come on stream, especially in Marlim Sul field, Petrobras expects new oil output records. It anticipates Marlim Sul will produce 150,000 b/d by December 2002 vs. its current production of 78,000 b/d. Anadarko Petroleum has begun oil production from Hassi Berkine field on Blocks 404 and 403 in Algeria's Sahara Desert nearly 2 months ahead of schedule. The oil will be processed through a 75,000 b/d production train of the central processing facility at Hassi Berkine South field. A gathering system, injection lines, crude oil storage, and export facilities have been installed as part of the facility expansion. Hassi Berkine is on Block 403, operated by the Algerian national oil company Sonatrach and Agip (Algeria), and on Block 404, operated by Sonatrach and Anadarko. Anadarko has 74.5% and Agip 25.5% of the unitized field. Anadarko Pres. and CEO John Seitz said, "Algeria represents a growing portion of Anadarko's global production over the next 2 years, as gross production capacity expands to more than 500,000 b/d."

IN REFINERY news, Valero Energy plans a $300 million upgrade of its 220,000 b/d Texas City, Tex., refinery.

Valero will build a 45,000 b/d delayed coker, which, it said, will improve profitability and process heavier, more sour crude. Completion is expected by January 2004.

Valero will need the heavy, sour capacity to cope with a new feedstock. The company negotiated a long-term supply contract with PMI Comercio Internacional, an affiliate of Mexican state company Pemex, for 90,000 b/d of Maya crude, beginning after completion of the coker project.

Bill Greehey, Valero chairman and CEO, said project completion will provide the Texas City refinery with more than 260,000 b/d of throughput capacity.

"When we bought the Texas City refinery from Basis Petroleum, we paid less than 10¢ on the dollar of replacement cost. One of the biggest reasons for the very low purchase price was its limited ability to upgrade bottom-of-the-barrel refined products," Greehey said, adding the coker project will resolve that limitation.