New option lets operators eliminate facility disposal liability

Some Gulf of Mexico operators have eliminated their well abandonment, facility-decommissioning liabilities by selling properties close to the end of their producing life to a company formed expressly for assuming those liabilities.

This was the case when Maritech Resources Inc., a division of TETRA Technologies Inc., Houston, bought properties operated by Seneca Resources Corp. and Range Energy Ventures Corp. in Gulf of Mexico Block West Delta 32.

In 1999, TETRA formed Maritech as an exploitation and production company to own, manage, and exploit producing oil and gas properties purchased in conjunction with TETRA's well abandonment and facility-decommissioning business.

Gary C. Hanna, senior vice-president of TETRA and president of Maritech, says "Maritech is an extension of TETRA's service philosophy. Maritech's primary mission is to provide additional value to our clients through creative alternative abandonment solutions and through the base loading of its sister service units."

Currently Maritech operates about 20 properties in the Gulf of Mexico that were acquired in a similar manner to West Delta 32.

Decommissioning process

US federal regulations generally require operators in federal waters to plug and abandon wells and decommission platforms, pipelines, and other equipment within 1 year after a lease terminates. The US Minerals Management Service (MMS) enforces these regulations.

Removing offshore facilities from the US Outer Continental Shelf (OCS) of the Gulf of Mexico has been ongoing since 1973. The yearly removal rate in the OCS, starting in 1988, was slightly more than 100 structures/year. Although the number in 1993 jumped to 179, it has averaged about 95 structures/year from 1994-2000.

The gulf had a peak of about 3,600 operating structures in the OCS during the 1990s, but this number will decline to about 2,600 by 2023, according to a study prepared for the MMS by the Louisiana State University Center for Energy Studies (CES) in 2000.

The CES study estimated that the rate of platform installations will average 142/year through 2023, totaling 3,543 over a 25-year period (starting in 2000), while platform removal rate during the same period will average 186/year, totaling 4,645 structures.

Once a fixed structure is severed, it can be taken ashore for scrapping or refurbishment. But with appropriate permits and economics, the structure also may be toppled in place or taken to another location to form an artificial reef.

Although receiving wide support, the rigs-to-reefs program involves only a small percentage of the gulf's decommissioned platforms. Both the Louisiana Department of Wildlife and Fisheries and the Texas Parks and Wildlife Department have active reef programs that benefit both recreational and commercial fishermen.

Refurbishing and reuse of structures has the problem that many of the decommissioned structures do not meet the current steel specifications required by MMS. According to Hanna, platforms with a 1995 or newer vintage are the best candidates for reuse, although even some of these newer structures may not meet current specifications.

He also indicates that one reason more structures are not taken to rig-to-reef sites is that the costs of transporting structures to these sites may greatly exceed the cost of disposal onshore. Toppling a platform is one option for larger platforms, in the case that regulations permit this option.

TETRA's Maritech subsidiary was formed to assume an operator's obligations of abandonment and decommissioning towards the end of a lease's life. This property may have a negative net worth even if generating a positive cash flow.

Hanna says that Maritech structures each deal differently depending on the issues and problems on a given lease. He indicates that by assuming these liabilities, TETRA can eliminate the work that may involve months of planning and research by the operator. The decommissioning process can be complex and may require close coordination of many different operations such as:

- Complying with strict enforcement of abandonment by regulatory agencies. Both federal and state regulatory agencies require permitting for structural-platform removals, pipeline abandonment, well plug and abandonment, site clearance verification, and final project completion report.

Other regulations that operators must comply with when disposing of their offshore facilities are the Endangered Species Act and the Marine Mammal Protection Act.

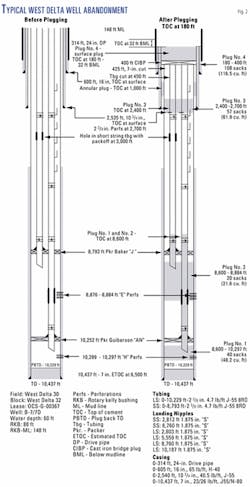

- Plugging wells and preparing facilities by flushing and cleaning process components and preparing the platform or structure for removal. Hydrocarbon zones must be isolated downhole and then the multiple casing strings must be cut to a depth required by regulations. Often this is done without rigs.

According to Hanna, abandoning the wells may be the most complex part of the operation because of the uncertainty about the downhole condition of wells.

- Abandoning pipelines that initially involves pigging and flushing riser to riser and riser to subsea tie-in. Buried pipelines are then left in place.

- Cutting and removing the structures. Removal begins with divers severing components with explosives, mechanical cutters, or grit. Heavy-lift vessels bring the platform deck and structure ashore for recycling, sale, or scrap, or the operator participates in a reefing program that requires transporting the structure to a designated location or toppling it in place.

- Trawling or side-scan sonar surveys after the site is clear.

He adds that TETRA's advantage for assuming these liabilities is its expertise on staff and the benefits it gains from being able to flatten out the workload of its regular abandonment and platform decommissioning business that includes day work, standard work contracts, and turnkey arrangements. With more utilization of its decommission spreads, it can provide more competitive rates for its services.

Typical abandonment and decommissioning costs in the Gulf of Mexico may range from $300,000 to $13 million, according to TETRA.

West Delta 32

Maritech closed the purchase of the West Delta 32 properties in November 2001. The facilities are one part of the prolific West Delta 30 field, which covers about 10 Gulf of Mexico blocks and has produced a cumulative 581 million bbl of oil and 946 bcf of gas since its discovery in 1954. Cumulative production from the properties Maritech purchased has been 154 million bbl of oil and 189 bcf of gas.

The facilities are in 60 ft of water about 6 miles offshore Plaquemine Parrish, La., and initially included 16 platforms and well protectors. Measured well depths are 14,500-17,500 ft, and the wells have depleted 36 intervals.

Of the initial 11 four-pile well protectors, the company has abandoned the wells on 9 and removed 9 of the protector structures.

Remaining platforms include two 28-pile, one 16-pile, one 12-pile, one 4-pile, and two remaining 4-pile well protectors. Currently 12 wells are producing and the 20 remaining nonproducing wells are scheduled to be abandoned. Production in May 2002 was 767 bo/d and 441 Mcfd of gas. Hanna says production has increased and operating expenses on the properties have significantly decreased since Maritech became the operator.

Hanna expects all wells to be abandoned and facilities removed by yearend 2004.