Market Movement

Mild weather undermines natural gas prices

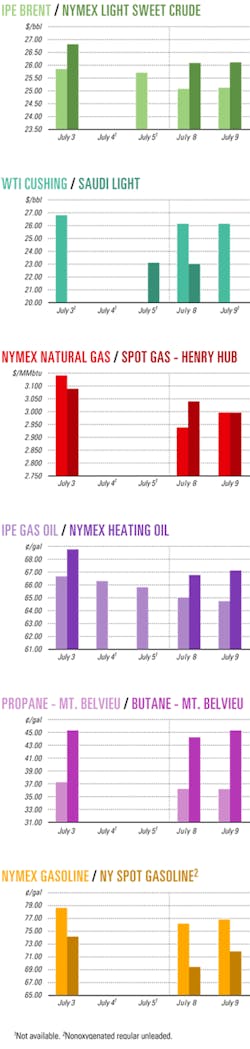

Mild weather and high storage volumes pushed down US natural gas futures prices to levels not seen since March on the New York Mercantile Exchange early last week.

The August natural gas contract plunged 20.3¢ to $2.64/Mcf on July 8, while the September contract dropped 19¢ to $2.93/Mcf in a sell-off apparently triggered when increased gas demand and higher power prices, anticipated by traders as a result of warmer weather in the Northeast, failed to materialize.

The August position rebounded slightly July 9, up 5.2¢ to $2.99/Mcf as part of a general market movement. But only a 20¢ turnaround in NYMEX oil prices late that day prevented another loss, said analysts. The July 10 session wiped out that gain, dropping the price 12.7¢ to $2.86/Mcf and testing Enerfax Daily's prediction that the August contract would find support at $2.85/Mcf.

Price under pressure

"With no hurricanes on the horizon and temperatures only moderate over most of the nation, prices will continue to feel the pressure until fundamentals return," Enerfax said.

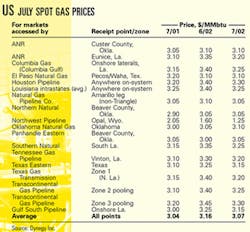

In its monthly survey of the US spot market, Dynegy Inc. reported natural gas for July delivery decreased by 9¢ to $3.07/MMbtu on average (see table).

Spot market gas sales generally were lower by 10-15¢/Mcf July 8-9 before increasing by 5-10¢ July 10. Gas for next-day delivery at Henry Hub was down to $2.98/Mcf July 9 before climbing back to $3.04/Mcf July 10.

The Henry Hub price jumped from an average $2/Mcf in February to $3.80/Mcf in early May before gradually easing back to $3.10-3.50/Mcf through the end of June. That move "was driven by the surprisingly rapid erosion of the 700-800 bcf seasonal surplus that had built up by February," said Stephen A. Smith, founder of Stephen Smith Energy Associates, Natchez, Miss. "The recent price correct responds well with a noticeable slowdown in the rate of gas surplus drawdown over the last few weeks."

Deliverability declines

The jump in natural gas prices early this year following a "quite mild" winter "appeared to confirm what many market observers had long suspected: Domestic gas deliverability was declining rapidly despite the massive surge in gas drilling for the 2 prior years," said Smith. Despite the earlier run-up in natural gas prices and a 75% increase in the gas rig count, US gas production "increased from 52 bcfd in January 2000 to a peak of 54 bcfd in March 2001 and is now slightly below where it started," Smith said.

On the other hand, he said, "An increasing share of gas investment dollars is being directed to projects with some combination of longer lead times or inherently higher reserve-to-production ratios. This would argue that all of the gas production from the 2000-01 spending boom has not yet been seen."

Smith noted that seasonal deficits of 500 bcf generated a relatively mild market price of $4/Mcf in 1995-96 but spiked to $10/Mcf in 2000-01. This, he said, "illustrates that price is influenced not just by the absolute inventory surplus (or) deficit, but by the expected durability of the supply (and) demand imbalance that created the inventory condition."

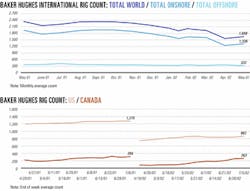

Still, said Paul Horsnell, head of energy research for London-based JP Morgan Chase & Co., "For the last 3 months, gas development activity had been the only source of buoyancy in the drilling statistics."

Industry Scoreboard

null

null

null

Industry Trends

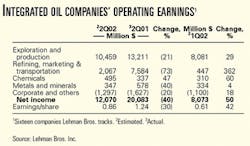

SECOND QUARTER earnings for major oil companies and refiners will prove much stronger than the lackluster first quarter but will still lag year-ago near-record levels, Lehman Bros. Inc. said.

Lehman estimates that the 16 major oil companies it monitors will earn an estimated $12.1 billion in the second quarter, down 40% from second quarter 2001, but an increase of 50% compared with the first quarter of 2002 (see table).

"Although the industry's second quarter outlook is far stronger than the dismal first quarter, we believe that current investor expectations are too high, and estimates will have to come down over the next several weeks to avoid any disappointments," analyst Paul Cheng said in a research note.

The global energy environment has been extremely fluid, Cheng said. "Despite a relatively weak underlying balance of real demand and supply, oil prices have strengthened in April and May driven by several significant political events."

These events included Middle East tensions, an agreement by oil exporters outside the Organization of Petroleum Exporting Countries to extend their export cuts through the second quarter, Iraq's decision to suspend oil exports during April, and a brief disruption of Venezuelan oil operations, he said.

SERVICE COMPANIES' second quarter earnings per share will be less than first quarter earnings because the North American rig count decline continued into April, predicts RBC Capital Markets, a unit of RBC Dain Rauscher Inc.

"Overall, we expect (earnings per share) to trough in the (second quarter) for most companies in our coverage universe with significant (second half) improvement coming from North American natural gas-focused companies," said Kurt Hallead, an RBC analyst in Austin.

For companies with large market capitalization, Hallead expects second quarter earnings to be down an average of 14% from the first quarter and 43% year-over-year. For midcap companies, he expects earnings to be down an average of 16% and 43%, respectively. For equipment companies, he expects earnings to be down an average of 5% sequentially and 19% year-over-year.

But despite optimism within the industry, service company stock prices probably will remain in a trading band of 90-105 on the Philadelphia Oil Service Index (OSX), he said.

Meanwhile, Banc of America Securities analyst James Wicklund of Houston believes the oil service group will see a stock price rally starting mid-July and extending into September.

"While we believe the recent pullback in the OSX is justified by the (gas storage) inventory levels, we continue to expect the seasonal rally," Wicklund said.

Government Developments

CLEAN FUEL regulations are gaining attention in California and New York.

The National Petrochemical & Refiners Association (NPRA) has requested court permission to file a brief supporting California's attempt to obtain a waiver of the 2% oxygenation requirement for reformulated gasoline (RFG) in that state.

Permission to file the brief must be granted by the US 9th Circuit Court of Appeals, which is hearing the case.

California is suing the US Environmental Protection Agency. The lawsuit argues that EPA should not have denied California's request to waive the oxygenate standard for RFG under federal clean air rules (OGJ Online, Oct. 5, 2001).

In June 2001, EPA denied California's request for a waiver from the federal oxygenate standard. The state has banned methyl tertiary butyl ether and said there is not enough ethanol available to replace it (OGJ Online, Sept. 17, 2001).

The brief establishes NPRA's interest in the suit as a national trade association whose members own or operate most US refining capacity. NPRA argues California met its burden to obtain a waiver by showing that a waiver would help the state meet the air quality standard for ozone.

NPRA also points out that "the real-world impact of EPA's decision under current law is to establish an ethanol mandate in RFG within California. This is because California has decided to ban MTBE, the only competing oxygenate. The resulting de facto ethanol mandate conflicts with the overriding goal of the Clean Air Act, which is to improve air quality," an NPRA news release said.

THE NEW YORK State Assembly by a 124-24 vote approved clean fuel legislation that reduces sulfur levels in transportation fuels on a faster timetable than federal regulations now on the books.

The New York proposal would cap the sulfur in all diesel fuel and heating oil used in the state at 15 ppm by the end of 2005. The bill is pending in the Senate Rules committee with a floor vote possible this summer. A federal rule now on the books forces refiners to meet a 15 ppm standard before 2007 on 80% of diesel supply. The remaining 20% would be phased in by 2010 (OGJ Online, June 6, 2001).

The NY plan also directs gasoline producers and marketers to produce and sell a low-sulfur product containing 30 ppm beginning October 2005, although marketers can sell a range of fuels over a 1-year period.

On the federal level, clean sulfur gasoline rules start in 2004. But refiners may make gasoline with a range of sulfur levels as long as all their own production is capped at 300 ppm and their annual corporate average sulfur levels are 120 ppm.

In 2005, federal sulfur levels dramatically drop; the refinery average mirrors the proposed state law.

Quick Takes

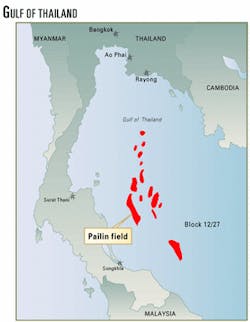

NORTH PAILIN FIELD in the Gulf of Thailand is now producing natural gas and condensate at rates as high as 230 MMcfd, boosting the field's potential production capacity to more than 380 MMcfd if warranted by market demand, said Unocal Thailand Ltd. The Thai unit of operator Unocal Corp. started up production in June from the northern extension as part of the Pailin project partners' overall $820 million field development.

North Pailin produces 6,800 b/d of condensate, raising total condensate production from Pailin, on Block B12/27, to more than 15,300 b/d.

Phase II development facilities are producing 165 MMcfd of gas, boosting the gross contracted gas sales from Pail in field to 330 MMcfd under the agreement with PTT PLC, the partially privatized Thai company formerly known as Petroleum Au thor ity of Thailand.

With additional production from Pailin Phase II, gross natural gas production from the fields operated by Unocal Thailand totals 1.07 bcfd, all of which is sold to PTT for domestic consumption.

Phase I gas production began at Pailin in August 1999. Unocal has installed 11 wellhead platforms and two processing platforms to serve Pailin field, 160 km east of the southern province of Nakon Si Thammarat. Unocal estimates proved gas reserves in the field at 2 tcf.

The project is described by Unocal Thailand as its largest and most complex single project ever undertaken, and one that employs the latest technology to minimize its environmental impact (OGJ, Sept. 27, 1999, p. 36).

Unocal Thailand operates the field with 35% interest. Partners are PTT Exploration & Production PLC 45%, Amerada Hess Exploration (Thailand) Co. 15%, and Moeco Thai Oil Development Co., an affiliate of Mitsui Oil Exploration Co., 5%.

In other production activities, Halley oil field on Block 30/12b in the UK North Sea began production on July 2, said its operator and largest stakeholder, Talisman Energy Inc., Calgary. Initial production flowed at 15,000 b/d of oil. Talisman plans soon to increase this to a plateau rate of 20,000 b/d of oil. Talisman has 60% interest in the field, and Amerada Hess Ltd. has 40%. Talisman said Halley holds 11 MMboe of oil and gas reserves and has an anticipated field life of 5 years. It was developed with an extended-reach well from the Fulmar platform, which is operated by Royal Dutch/Shell Group. Talisman holds a 12.71% interest in Fulmar field. Oil and gas is being processed on Fulmar, with oil being exported via the Phillips Petroleum Corp.-operated Norpipe system to Teesside and natural gas being exported to St. Fergus via the Shell-operated SEGAL pipeline system. A water injection well to provide pressure support to the Halley reservoir is expected to be spudded from the Fulmar platform in August and is to be on stream by December.

PIONEER NATURAL RESOURCES CO., Dallas, has agreed to buy Gulf Canada Tunisia Ltd., thereby acquiring Gulf Canada's 40% participating interest in the Borj El Khadra (BEK) permit in the Ghadames basin in southern Tunisia. The deal remains subject to Tunisian government approval.

Pioneer will join a unit of Italy's Agip SPA, the permit operator, and Paladin Expro Ltd., a unit of London-based Paladin Resources PLC, in exploring the 1.2 million acre permit. The BEK permit is adjacent the Anaguid permit where Pioneer holds a 30% interest.

Pioneer also holds 50% interest and operates the Bazma, Jorf, and El Hamra permits to the north, which cover 2.7 million acres in the TAGI sand play of the Ghadames basin (OGJ Online, May 30, 2001).

The BEK permit borders Agip-operated Oued Zar field, where 10 wells produce oil and gas from the Silurian Acacus sandstone as near as 1 km from the BEK boundary. Pioneer plans to participate in the next exploratory well in the BEK permit, anticipated this month, targeting the Silurian Acacus sand play. The play offers many of the same advantages of the TAGI play already targeted by Pioneer, including proximity to existing production and infrastructure, prolific reservoirs, and low development costs, the company said.

OPERATOR AGIP AUSTRALIA LTD. and partners ExxonMobil Corp. and Tap Oil Ltd., Perth-partners in the development of the Woollybutt oil field in the North West Shelf off Western Australia-have inked an agreement to lease a floating production, storage, and offloading vessel from Vanguard Floating Production Ltd. subsidiary Vanguard Floating Production (Australia) Pty. Ltd.

The Four Vanguard vessel, formerly the 94,000-dwt Four Lakes tanker, will be converted into an FPSO as part of a project to develop the discovery, which the partners earlier had said offered preliminary reserves estimated at 100 million bbl of oil (OGJ, Jan. 3, 2000, p. 31).

The Vanguard unit also will connect the vessel to the offshore field and operate it for the partners.

EUROPE'S FIRST LNG EXPORT FACILITY is moving closer to fulfillment (OGJ Online, Mar. 12, 2002).

Statoil ASA has placed an order with IZAR Fene Shipyard, a unit of the Spanish group IZAR Carenas, for a new barge to support a floating natural gas liquefaction plant in the Sn hvit gas fields complex in the Barents Sea off Norway.

The barge, scheduled for completion in August 2003, will house about 24,000 tons of processing equipment for the LNG plant. It will be 154 m long, 54 m wide, and 9 m high and will have a net weight of 8,500 tonnes of steel. About 70 cargoes/year of LNG will be shipped from the floating plant. The unit will be installed in the harsh environment of the Barents Sea close to Melk ya Island in northern Norway.

The floating LNG plant is part of a project to develop offshore natural gas fields-Albatross, Askeladden, and Sn hvit-not far from Hammerfest. Production from Sn hvit, which has reserves of 193 billion cu m of gas and 113 million bbl of condensate, is due to start in 2006.

In another European LNG project, Gaz de France has approved plans to construct a second LNG terminal at Fos-sur-Mer on the Mediterranean Sea in southeastern France. Construction of the terminal-Fos II-is not expected to begin before 2003 to give French authorities time to investigate environmental and security concerns. However, GdF could call for bids as early as next month for terminal construction. The 300-430 million euro project will involve port, storage, and regasification facilities. The facility will have a maximum natural gas sendout capacity of 8.25 billion cu m/year and will be able to receive LNG carriers with cargoes of 160,000 cu m. The existing Fos I terminal, with a sendout capacity of 4.5 billion cu m/year, currently provides France with 11% of its total natural gas imports.

The new terminal will help supply a liberalized European gas market, expected to grow to 45-50 billion cu m/year by 2006. The new Fos terminal will accommodate another long-term Mediterranean natural gas supplier, Egypt, as well as Algeria, Libya, and other Mediterranean suppliers. GdF has already signed a second agreement with the UK's BG Group PLC and Italy's Edison International involving the purchase of 4.8 billion cu m/year of gas over 20 years, starting in 2006-07. Gas source would be the West Delta Deep Marine field off Egypt (OGJ, Feb. 11, 2002, p. 9). GdF also took part in a joint venture with BG and Edison to build a natural gas liquefaction unit at Idku, near Alexandria. TotalFinaElf SA said it might be interested in taking part in the Fos II terminal project. This would be in addition to its long-mulled project to build a terminal in southwestern France near the Spanish border, where its Artère du Midi gas pipeline joins up with Fos.

IN GAS PROCESSING NEWS, the North Sea Visund field partners, including current operator Norsk Hydro AS and Statoil, which will become operator Jan.1, 2003, plan to deliver natural gas from the field to Statoil's planned 26 million cu m/day gas processing plant at Kollsnes near Bergen, Norway.

The gas will be transported via a proposed 34 km pipeline extending from the platform to a connection with the planned Kvitebj rn pipeline, an 8.5 billion cu m/year trunkline designed to deliver gas from several North Sea fields to the Kollsnes plant (OGJ Online, Apr. 11, 2001).

The 190 million euro plant will also handle gas from Troll field as well as Kvitebj rn field, which holds 52 billion cu m of gas. Visund gas reserves are estimated at 55 billion cu m.

Nils Sellevold, acting operations vice-president for the Troll field group, said the Kollnes plant would be ready to receive gas in 2004.

Kvitebj rn field will begin deliveries under existing sales contracts by October 2004 (OGJ, Apr. 23, 2001, p. 9), and the Visund platform in the Tampen area will be modified so that gas exports from Visund can begin in 2005.

The new gas plant will recover propane, butane, and naphtha from the gas. The liquids will then be transported via the Vestprosess pipeline to Mongstad for fractionation.

EL PASO ENERGY PARTNERS LP, Houston, has completed the expansion of its Petal natural gas salt dome storage facility and 60 mile takeaway pipeline near Hattiesburg, Miss. These projects were completed in conjunction with a 20-year contract with Southern Co., Atlanta.

The expanded Petal storage facility has working gas capacity of 8.65 bcf of natural gas. The new pipeline expands Petal's delivery capabilities to the Southern Natural Gas and Destin Pipeline systems (OGJ, Mar. 11, 2002, p. 9).

Before the expansion, Petal had interconnects to Tennessee Gas Pipeline, Gulf South Pipeline, and Hattiesburg Gas Storage facilities. Related projects adding 20,000 hp of storage compression and 9,000 hp of pipeline compression were completed earlier this year.

El Paso estimates that revenues generated by its new services to Southern will add $7 million in cash flow during the remainder of 2002 and $16 million annually thereafter.

ABU DHABI OIL REFINING CO. has awarded a major, lump sum turnkey contract valued at $480 million to Technip-Coflexip Group, Paris, for the expansion of its Ruwais refinery in Abu Dhabi.

The refinery operator, a unit of state-owned Abu Dhabi National Oil Co., announced the 500,000 b/d expansion plans in late 2000 (OGJ Online, Oct. 19, 2000).

The contractor will modernize existing facilities and add new units for the production of unleaded gasoline and low-sulfur gas oil, including heavy and light naphtha hydrotreating units, a hydrogen sulfide removal unit and sulfur recovery units, a CCR reformer, a gas oil hydrotreater, and an isomerization unit.

The project also includes revamping existing kerosine and gas oil hydrotreaters and an LPG amine treater as well as expansion of utility systems and offsite facilities.

Technip-Coflexip's engineering centers in Rome and Abu Dhabi will provide project management, detailed engineering, equipment and materials procurement, construction management, construction, precommissioning, commissioning, and training.

The project, which does not require any third-party financing, will begin immediately and be completed in July 2005.

In other refining news, Statoil's new 400 million kroner diesel oil unit at its Kalundborg refinery near Copenhagen is 3 months ahead of schedule in delivering diesel with virtually no sulfur content. Kalundborg diesel already has a marked reduction in soot emissions. With the new unit, diesel sulfur content is cut by 80%, to 0.001% from 0.005%, exceeding the European Union requirements set to become standard in 2005. "We expect to produce about 1 million tonnes of sulfur-free diesel annually," said John Berg, vice-president of the Kalundborg refinery. "Initially, we will sell the product to the German market." Next year, Statoil's Mongstad refinery near Bergen also will be upgraded to produce gasoline and diesel oil with virtually no sulfur content.