Trade recovery pushes world LPG demand past 200 million tonnes

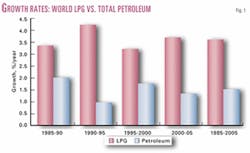

World LPG demand continues to grow faster than total petroleum demand.

For 1985-2005, Purvin & Gertz Inc., Houston, estimates that total LPG demand growth will average more than 3.6%/year, while total petroleum demand during this same time will grow about 1.9%/year (Fig. 1).

The increased demand for LPG, mainly for petrochemical feedstock and residential-commercial end use sectors, has caused historical trade patterns for LPG to change during the past several years.

Originally, the changes in trade patterns were forecast to last a few years, then return to historical norms. Continued economic slowdown in the Far East, however, as a result of the Asian financial crises of the late 1990s, has delayed that return to normalcy for several years.

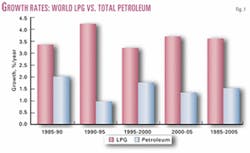

The historical surplus of LPG in the "East of Suez" region (the trading world east of the Suez Canal) has changed, as Middle East petrochemical consumption has increased, causing less liquid to be available for export. Demand for LPG in the Far East continues to grow, expanding the imbalance.

All of this has moved the East of Suez region from being a net exporter of LPG to a net importer. Purvin & Gertz forecasts that these trade patterns will continue until 2004, when additional LPG supplies will grow sufficiently to allow the East of Suez region again to become a net exporter of LPG (Fig. 2).

This historic departure results from more LPG production in the Middle East being used internally to satisfy growing demand-most notably from the petrochemical feedstocks sector-and from Far East economies resuming their growth patterns after stalling or even falling as a result of the Asian financial crises.

The Middle East has surpassed Western Europe in LPG consumption for petrochemical production.

Shifting demand

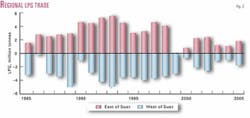

Global demand for LPG is about 208 million tonnes/year (tpy). World LPG demand surpassed 200 million tpy for the first time in 2001, when it was 202 million tonnes.

The growth in total LPG demand has been especially pronounced since 1985 (Fig. 3), when demand was 116 million tonnes. From 1985 to 2000, world LPG demand has increased nearly 3.6%/year, compared to 1.7% for total petroleum demand.

The developing economies of the world, particularly Asia and Latin America, have continued to demonstrate the most dynamic growth in LPG, even with the economic slowdown in several regions of the world.

While the Asian economies had a significant slowdown due to the financial crisis that started in 1997 and many economies had negative growth rates, they have recovered and continue to move upward, albeit slower than exhibited in the late 1990s.

In 1985, total world LPG demand was about 116 million tonnes. Of this total, about 23% of the demand was from East of Suez. By comparison, Purvin & Gertz estimates that world LPG demand in 2005 will near 235 million tonnes, with 36% of the demand East of Suez.

Growth rates for world LPG demand differ significantly in the various geographical regions of the world, and growth rates have changed during the past several years. From 1990 to 2000, the world average growth rate for LPG demand was about 3.7%. The Middle East had the highest growth in demand, increasing more than 9%/year during this period.

Asia and Africa both had growth rates exceeding 6%/year, while Western Europe had growth of less than 2%; North America was near 2%/year. Latin America increased its LPG demand at just 5.5%/year.

In sharp contrast, the regional demand growth for Eastern Europe and the former Soviet Union dropped during this time due to the contraction of the regional economies.

In 1985, North America was the largest consuming region, with more than 40 million tonnes of total LPG demand. By 2005, Purvin & Gertz forecasts that demand for LPG in North America will increase to more than 67 million tpy. Total LPG demand in Asia will increase from slightly more than 20 million tonnes in 1985 to more than 56 million tonnes in 2005. During this same period, LPG demand in Western Europe will grow from 19 tpy to more than 31 tpy.

From 1990 to 2000, the countries of Asia exhibited a demand growth of 4%/year for LPG. Within the region, China had the largest demand growth. From 1990 to 2000, China had a growth rate of more than 20%/year for LPG demand.

The countries that comprise Southeast Asia had total LPG demand growth of more than 10% during this timeframe. LPG demand in India grew at near 9.7%/year during the decade. Japan, as the most developed economy in the region, had growth of less than 1%/year, while Korea exhibited a growth of more than 8%/year.

Purvin & Gertz expects growth in the 1990s in Asia will slow somewhat during the next 5 years, with the exception of India and Japan. And from 2000 to 2005, LPG demand in India will grow by more than 9%/year, while demand in Japan will grow at more than 1%/year.

The growth for Asia will be near 3%/year. LPG demand growth in China will decrease significantly from the recent past but at 5.1%/year will remain very healthy.

The Middle East is another region whose LPG demand will grow faster than the world average. From 1990 to 2000, LPG demand in the region increased by an average of just above 9%.

Saudi Arabia, the United Arab Emirates, and Qatar had growth higher than the average, due mainly to the start-up of several large petrochemical projects that use LPG as a feedstock. The UAE exhibited demand growth for LPG of more than 17%/year during the last decade of the century. Iranian demand grew during this timeframe at slightly less than 5%/year.

From 2000 to 2005, demand growth in Saudi Arabia will exceed the historical average during the last decade, as the local petrochemical industry continues to grow significantly.

Demand growth in Saudi Arabia will be more than 10%/year during this period. The Middle East average during the forecast period will be more than 10%/year. Additional petrochemical facilities will be added in Iran and the UAE during the forecast period.

The countries of Asia have typically relied on term contracts with Middle Eastern LPG producers to supply their domestic requirements. With the growing demand in Asia, and less LPG available from the Middle Eastern countries due to internal consumption, demand is being increasingly met from other sources.

Growing LPG volumes from West Africa and Algeria are now filling this shortfall in Asian supply. During the late 1990s, large fully refrigerated cargoes of LPG were transported from Africa to the Far East to satisfy demand in the region. The increased reliance on new sources of LPG was further demonstrated by the movement of LPG from the North Sea to China, which also occurred in 1999.

While these movements were unusual when they first occurred, they are now quite commonplace. Trade between West African and Algerian sources to ports in the Far East are now a staple of the shipping market and not considered unusual anymore.

End use market changes

LPG demand by end use is also changing rapidly and is one of the primary factors causing the changing trade patterns.

By 2005, 55% of worldwide residential-commercial LPG demand will be East of Suez, while this region will also consume 20% of worldwide LPG for petrochemical production. East of Suez will account for 36% of world market share for LPG consumption.

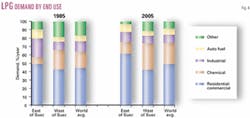

In 1985, half of all LPG used East of Suez went to the residential-commercial sector. The chemical end use sector consumed only 10% of the LPG, while about 20% was consumed by other industrial uses of LPG. The auto-fuel market and "other" uses comprised nearly equal amounts of LPG at 10% each (Fig. 4).

By 2005, these use patterns East of Suez should change, based on analysis conducted by Purvin & Gertz. We expect the residential-commercial end use sector will grow and comprise almost 62% of total LPG use.

Chemical applications will also grow, consuming nearly 13% of total LPG. The three remaining categories of industrial, auto fuel, and "other" should all comprise a smaller percentage of the overall LPG use, totaling more than 25% of LPG used in the region.

West of Suez has a very similar future. In 1985, about 43% of total LPG consumption was by the residential-commercial sector, while chemical consumption of LPG was responsible for about 23% of total consumption. The remaining three categories together accounted for approximately 34% of total consumption, with the "other" category (the largest of the three) accounting for about 18%.

This consumption pattern will change by 2005. Residential-commercial consumption will remain about 43% of the total, but demand by the chemical end-use sector will grow to about 31% of the total. The three remaining categories combined will represent about 26% of total LPG consumption.

These consumption patterns demonstrate that residential-commercial and chemical end uses for LPG will continue to dominate the demand picture well into this new century. In fact, they will both continue to increase as a percentage of the total demand for all uses of LPG.

Between 2000 and 2005, LPG demand for chemical production, will remain relatively constant, at about 19.5% of world LPG consumption. Residential-commercial end use should decrease slightly, to approximately 49.5% of 2005 world use from 50.5% of 2000 world use.

The "other" use categories, along with industrial and auto fuel, will continue to absorb the remaining use, but regional variations will be significant, especially in the auto-fuel sector, which heavily depends on government policies and tax structures.

The actual growth rates for various end uses of LPG vary significantly in the geographic regions of the world. For the residential-commercial end use sector, most markets are reasonably mature.

Based on analysis by Purvin & Gertz, growth rates for residential-commercial use of LPG in most areas of the world should remain in single digits.

Asia will have the highest regional growth rates. Overall imports into the region should increase to more than 26 million tonnes in 2005 from the 1995 value of around 20 million tonnes. This will correspond to total residential-commercial demand in the region growing to more than 44.4 million tonnes in 2005 from 22.6 million tonnes in 1995.

In 2000, the world average consumption for LPG in the residential-commercial sector was about 16 kg/person, compared to slightly more than 10 kg/person in 1985. By 2005, Purvin & Gertz expects world consumption to increase to slightly less than 18 kg/person for this market sector.

India and China will continue to lead this category as LPG becomes available to a larger portion of the population. These two countries will account for a substantial amount of total world residential-commercial LPG demand. We expect total consumption to grow to almost one fifth of total world demand by 2005 from about 5% of total world demand in 1985.

The East of Suez region will exhibit the greatest percentage increase in residential-commercial use, as the 2005 average per-capita consumption of almost 12.3 kg will have grown from the 1985 average of less than 5 kg.

In comparison, the figure was slightly more than 10 kg/person in 2000. The markets West of Suez are extremely mature, and we do not expect significant increases in the per capita consumption.

In 2000, the average was near 23 kg/person, and we expect that this will stay relatively constant through 2005, as any market increases will be offset by decreases in other areas, especially as natural gas networks increase in size.

Based on Purvin & Gertz' analysis, 45% of the total world residential-commercial LPG consumption of 116 million tonnes in 2005 will be East of Suez. In 1985, the region used only 26% of a 51 million-tonne market.

During the past several years, the chemical end-use sector has had a wide variety of regional changes. Worldwide, the sector has grown considerably, especially in the Middle East and Western Europe.

From 1995 to 2000, Middle East consumption of LPG for petrochemical consumption increased to more than 4.4 million tpy from 1.7 million tpy. By 2005, Purvin & Gertz expects that it will increase to more than 8.0 million tpy.

Much of the growth seems staggering due to the relatively small starting base for petrochemical use in early 1990s. Several LPG-producing countries in the region, however, have literally built a petrochemical industry from the ground up.

Plans for future expansion would increase the overall consumption of LPG for petrochemical use in the region. In Western Europe and North America-more-mature chemical markets-growth in the petrochemical end-use sector will be between 1.6 and 1.7%/year during 1995-2005.

In the chemical end-use sector for LPG, the East of Suez market will consume about 58 million tonnes in 2005, compared to only 23 million tonnes in 1985. These consumption figures include both base demand and price-sensitive demand for petrochemical production.

Even with these increases, the West of Suez chemical end-use sector will continue to dominate worldwide petrochemical use of LPG. During the past several years, the Middle East has added more than 4 billion lb of ethylene-production capacity.

Regional production capacity will increase in the future in Southeast Asia, the Indian subcontinent, and Northeast Asia, but at slower rates than observed during the past 5 years.

The auto fuel end-use category will exhibit growth in several regions. LPG demand will grow in the Middle East and Africa at double-digit rates during the forecast period.

Eastern Europe and the former Soviet Union countries will increase overall auto-fuel consumption at greater than 5%. Auto-fuel consumption in other regions will be fairly low, averaging only about 2%. India has approved the use of LPG as an auto fuel, and the market there could be significant, provided that LPG is available at a reasonable price.

The percentage of LPG consumed in the East of Suez markets for the auto fuel and industrial markets will remain relatively steady at 43% in 2005, compared to 40% in 1985.

The overall world market in these segments will increase to 36 million tonnes in 2005 from 22 million tonnes in 1985. The increases in LPG demand for auto fuel will be strongly driven by environmental factors and tax policies in developing countries.

Shifting supply growth

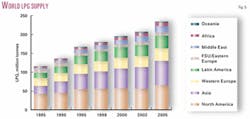

World LPG supply has grown dramatically since 1985.

During that year, world supply was about 114 million tonnes. About 25% of this supply came from sources East of Suez.

By 2005, Purvin & Gertz estimates that 37% of world's LPG supply, or about 87 million tonnes, will come from East of Suez. We expect the overall worldwide supply of LPG in 2005 will exceed 235 million tonnes.

The changing sources of supply and shifting demand in the maturing markets have continued to force changes in world trade patterns for LPG. Purvin & Gertz expects world LPG supplies to grow in every region of the world and to surpass 235 million tpy before 2005 (Fig. 5).

On a percentage basis, production increases will be particularly strong in Africa, Latin America, and Southeast Asia. Refinery LPG production will grow in every region of the world. The regions with strongest LPG-supply growth are primarily being driven by new gas-processing facilities, including LNG and GTL production.

Latin American LPG production will increase to more than 31 million tonnes in 2005 from 23.7 million tonnes in 2000, or 5.6%/year. African LPG production will increase at 5%/year during this period, while LPG production in Southeast Asia will grow at slightly more than 5%/year.

There are several new supply projects expected East of Suez during the next 5 years. Projects in the Middle East countries, especially Saudi Arabia and Qatar, will continue to add to world supplies.

The start-up of several large gas fields off Iran will also contribute to world LPG supplies.

The return of Iraq to world energy markets is hard to predict. Currently, however, it is unlikely Iraq will significantly affect world LPG markets before to 2005.

Oil and gas production in Southeast Asia and Oceania will increase LPG supplies before 2005. Additional production will come from facilities in the Timor Sea area, the Natuna Sea, and Papua New Guinea. Projects in this region will add more than 4 million tpy of LPG to world markets by 2005.

West of Suez will also add to world LPG volumes before to 2005. West Africa has become a prolific LPG producer in the past several years because of additional gas-processing facilities. This will continue to be the case, as additional LNG and GTL facilities are constructed.

Most notably, the Nigerian LNG expansions will add to incremental LPG production, and projects at Cawthorne Channel and Escravos will add to production capacity prior to 2005.

In the longer term, the West Niger Delta projects may add LPG production capacity in the later years of this decade. Angola, Algeria, and Egypt will also add to world LPG supplies because of LPG production increases in the next several years.

The increase in LPG production in Algeria demonstrates how the region has changed. Production in Algeria is more than 5.0 million tpy, with more than 3.5 million tpy exported. By 2005, Purvin & Gertz expects Algerian exports of LPG will be more than 8.5 million tpy.

LPG production in Western Europe, particularly the North Sea, continues to climb. The region is an exporter of LPG and plays an important role in worldwide LPG supply and demand. In 2000, Western Europe produced 21.0 million tonnes of LPG will increase that to more than 23 million tpy by 2005. Of this production, nearly 10 million tonnes will be exported from the North Sea.

Between 2000 and 2005, LPG production in Latin America will grow to more than 31.1 million tpy from 23.7 million tpy. Much of the increased LPG will come from additional gas processing in Venezuela, Bolivia, Peru, and Argentina.

Venezuela plays a large and important role in the export markets in the region and should continue to dominate the regional picture. Some additional projects, most notably Camisea in Peru, are now firming up plans for the latter half of this decade.

Additional LPG may be produced from LNG projects in Peru and Bolivia. Much of the LPG production on the West Coast of South America will be aimed primarily at export markets.

The change in supply sources and demand centers will continue to change world LPG trade patterns. The Far East will continue to remain the largest importing region in the world for LPG, but the imports will come from increasingly diverse sources.

This has already occurred during the past several years, as supplies from West and North Africa are now regularly shipped to Far East destinations. Several cargoes of North Sea production have also been sent to the Far East, at times on a regular basis.

Trade patterns and the US

For the past several years, new emerg ing trade patterns have increasingly affected the more-mature markets of North America, and in particular, the US. In the consumption of LPG, the US continues to play the swing role due to large storage capacity and a petrochemical market that depends heavily on LPG for a feedstock.

When prices are attractive, large cargoes of LPG move to the US Gulf Coast, where the buyers can either store the product for later use or consume it for ethylene production.

During the past several years, the US has had huge swings in the storage levels of LPG on the Gulf Coast. In 1998, propane inventories in the US exceeded 76 million bbl. Propane inventories fell to slightly more than 35 million bbl by spring 1999 and climbed to more than 60 million bbl by late in the year.

Inventories fell to normal levels but climbed to more than 70 million bbl in fall 2001. At that time, total LPG inventories (propane and butane) were well above 100 million bbl. The US is able to absorb large swings in imports, at the same time exporting product to Central America and the Caribbean Basin countries.

Also, the large petrochemical consumption of LPG can help draw down inventories as prices fall. In January 2002, US LPG inventories were more than 75 million bbl.

The US increased export capacity along the Gulf Coast in 2002, making the Gulf Coast a significant player in the world export markets. While the US did influence world LPG trade before this expansion of export capacity, it was primarily due to import capacity.

The US now regularly exports LPG to the Far East from both the West Coast and Gulf Coast. Cargoes have also moved to Australia from the Gulf Coast during the past year.

During the past several years, increasing Canadian natural gas exports to the US have also helped increase LPG production. Some of the LPG has been extracted from the natural gas in new facilities in the US, confusing the issue of whether the gas liquids should be classified as US or Canadian production.

The authors

Ajey Chandra is a principal in the Houston office of Purvin & Gertz Inc. After 12 years with Amoco Corp., he joined Purvin & Gertz in 1998 and was elected a principal in 2000. He holds a BS in chemical engineering from Texas A&M University and an MBA from the University of Houston. He is a member of GPA and SPE.

Ronald L. Gist is a principal in the Houston office of Purvin & Gertz Inc., joining the company in 1996. He began his career with E.I. DuPont de Nemours & Co. in 1971 after receiving both BS and MS degrees in chemical engineering from Colorado School of Mines. Gist is a member of the Southwest Chemical Society and is Purvin & Gertz' representative to GPA's statistical committee.

Ken W. Otto is a director in the Houston office of Purvin & Gertz Inc. He joined E.I. DuPont de Nemours & Co. in 1977, then moved to Champlin Petroleum Co. in 1979 and served 4 years at Corpus Christi Petroleum Co. Otto joined Purvin & Gertz in 1986, was elected principal of the company in 1987, senior principal in 1990, and vice-president in 1997. He holds a BS (1977) in chemical engineering from the University of Texas at Austin.

S. Craig Whitley is a senior principal in Purvin & Gertz Inc.'s Houston office. He joined the company in 1993, working in market analysis of natural gas, LPG, and NGL markets. Whitley has a BS in chemistry and zoology from Northwestern Louisiana State University, Nachitoches. He is a member of GPA, International Association of Energy Economists, National Propane Gas Association, and is Purvin & Gertz' representative on GPA's international committee.

Alfred L. Luaces is a consultant in the Houston office of Purvin & Gertz Inc. After 9 years with ExxonMobil Refining & Supply, he joined Purvin & Gertz in 2000. He holds a BS in mechanical engineering from the University of Florida.