Russian oil privatization proved an unprecedented clearance sale

Soon after the breakup of the Soviet Union, numerous operating units of the former Soviet oil-related ministries were contentiously divided into regional and technological groups subject to immediate corporatization and subsequent privatization.

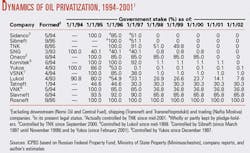

Starting from late 1992, 300 formally independent but fully state-controlled "production associations" (amalgamations), enterprises, and research centers dealing with oil exploration, production, refining, and product distribution in Russia have gradually developed into a dozen vertically integrated and partly privatized oil companies, led by the "eldest" Russian majors-OAO Lukoil, OAO Yukos, and Surgutneftegaz (SNG).

Originally established as wholly state-owned, each of those companies was to be fully privatized through a successive sell-off of its government stock. From the very start, 45% or 51% of every newly born company's equity was temporarily reserved as federal property, whereas the remaining shares were offered to the company's employees (at low prices and sometimes even free) and to outside investors (through cash auctions and investment tenders).

In addition, under the controversial "shares-for-loans" scheme in 1995-96, the cash-strapped government collateralized (and finally surrendered) its controlling stakes in the leading oil producers (Yukos, SNG, Sidanco Oil Co., Sibneft, and partly in Lukoil) against commercial bank loans totaling a paltry $500 million.

Despite some holdbacks and a year-long impasse caused by the August 1998 financial crisis, privatization of Russia's core industry moved ahead with unprecedented speed and scope. As a result, by the beginning of the new millennium the federal government has virtually lost control over the mostly privatized oil sector (see table).

Still, the budgetary demands seem to outweigh the fear of the nation's energy insecurity. This year, the government plans to put more state-owned oil assets on the block: 19.7% of JSC Slavneft, 36.8% of Eastern Oil Co. (VNK), 5.7% of Nafta Moskva, and 5.9% of Lukoil.