US reserve values strengthened in 2001 along with rising acquisition activity compared with 2000 even though commodity prices declined last year, said Cornerstone Ventures LP's latest report.

Oil and natural gas merger and acquisition transactions that closed in the US during 2001 were worth $71.6 billion, a 12% increase from M&A transactions' aggregate deal value of $64 billion for 2000. The $55.1 billion Chevron Corp.-Texaco Inc. merger accounted for most of the 2001 aggregate deal value, the Houston-based investment banking firm said.

Value changes

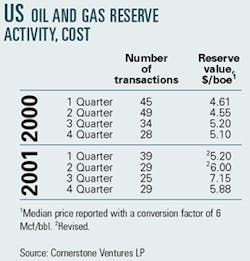

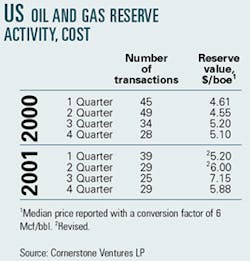

"In terms of the per-unit value of domestic onshore oil and gas transactions, 2001 was characterized by a steady increase in reserve values from the first quarter value of $5.20/boe through the third quarter when median values peaked at $7.15/boe. During the last quarter of the year, the transaction median value dropped rather sharply to $5.88/boe," said Cornerstone.

The median reserves value for 54 deals in 2001-for which transaction values and reserve quantities were disclosed-was $6.26/boe, a 25% increase from 2000's median value of $4.87/boe, achieved despite falling commodity prices.

Cornerstone's data indicated 2001 transaction activity was the lowest in many years, with only 121 deals closing, a 29% drop from 2000's already low figure of 156 deals. That compares with 205 deals closed in 1999.

Of the 121 transactions completed during 2001, only 91 reported dollar values, with 44 of them falling below $25 million and amounting to only 0.36% of the aggregate deal value, 12 valued at $25-50 million, 9 valued at $50-100 million, and 27 valued greater than $100 million. The latter represented $70.4 billion, or 98.26%, of the total.

"These incremental breakpoints reflected a widening gap in the median value based on the size of the deal: from $4.05/boe for deals under $25 million to $7.14/boe for deals over $100 million," Cornerstone said.

Natural gas, oil statistics

The weighted average of all natural gas-dominated deals in 2001 was $1.14/Mcfe, a 40% increase from 2000's weighted average of 81¢/Mcfe. Overall, the median value for gas-dominated transactions during 2001 was $1.12/Mcfe, a 40% increase from 2000's figure of 80¢/Mcfe.

The median value for oil-dominated deals during 2001 was $5.95/boe, a 30% increase from 2000's median value for oil-dominated deals of $4.56/ boe.

Canadian deals

Canadian transaction activity in 2001 was robust, with 131 transactions closing compared with 2000, when 87 deals closed; and with 1999, when 85 deals closed (OGJ, Apr. 30, 2001, p. 32).

The aggregate deal value for 2001 was $30.452 billion (Can.), a 114% increase from 2000's aggregate value of $14.231 billion (Can.).

"Canadian activity was led primarily by US companies acquiring relatively large Canadian independents," Cornerstone said.

Major deals that increased the M&A total included Conoco Inc.'s buying Gulf Canada Ltd. for $6.9 billion; Devon Energy Corp., Oklahoma City, acquiring Calagary-based Anderson Exploration Ltd. for $4.6 billion; Burlington Resources Inc., Houston, buying Calgary-based Canadian Hunter Exploration Inc. for $2.1 billion; Anadarko Petroleum Corp.'s acquisition of Berkley Petroleum Corp. for $1.2 billion; and Calpine Corp.'s purchase of Encal Energy Ltd. for $1.4 billion.

The Conoco-Gulf Canada deal in June was the largest dollar value takeover of an exploration and production company recorded in the Canadian oil industry (OGJ, Oct. 22, 2001, p. 66). Meanwhile, Devon was on a buying spree last year, and the Anderson deal gave Devon the biggest North American oil and gas reserves total of any independent (OGJ, Sept. 10, 2001, p. 44).

The median reserve value for Canadian oil and natural gas transactions that closed during 2001 was $8.52/boe (Can.), up 45% from 2000's median value of $5.88/boe (Can.).

The median value for 2001 was derived from 68 deals where transaction values and reserve quantities were disclosed.

Gas-dominated transactions accounted for 62% of the deals and 66% of the total reserves traded, a significant increase from 2000's figure of 41% for gas-dominated transactions.

The median value for 2001 gas-dominated deals was $1.59/Mcfe (Can.), a 34% increase from 2000's median value of $1.19/Mcfe (Can.).

The median value for oil-dominated deals for 2001 was $7.79/boe (Can.), a 50% increase from the median value of $5.20/boe (Can.) for 2000.