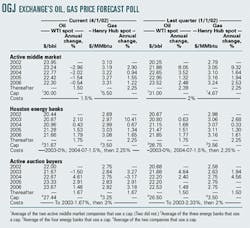

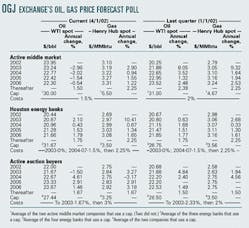

The strong price consensus late last year between Houston energy banks and the active middle market of those companies acquiring reserves dissipated as that middle market responded quicker to the rising price of both oil and natural gas in the first quarter, according to the latest quarterly oil and price forecast poll by Oil & Gas Journal Exchange.

"The current middle market 2002 oil price of $23.95/bbl is up more than $3/bbl from the previous quarter, while the banks' 2002 oil price of $20.44/bbl is down slightly from last quarter's $20.67/bbl (OGJ, Feb. 25, 2002, p. 34)," OGJ Exchange COO and Vice-Pres. Bill Marko said in referring to OGJ Exchange's pricing poll for the first quarter. Looking over the next 2 years, however, the oil price differential between the two groups is less than $2/bbl, he said.

"The current middle market survey price of $3.10/MMbtu for natural gas is up from $2.79/MMbtu in the previous quarter, while the banks' price of $2.69/MMbtu is down slightly from $2.98/MMbtu in the previous quarter," Marko said. Looking forward, both the middle market and banks' prices escalate rapidly in 2003, then more slowly in subsequent years, he added.

Property sales

Meanwhile, after US asset sales totaled more than $3 billion during the first quarter, what started out as a huge year for property transactions seems to have petered out-at least temporarily, Marko noted.

"First quarter 2002 deal flow was extremely brisk in terms of gross sales. Companies such as Anadarko Petroleum Corp., Burlington Resources Inc., Devon Energy Corp., and El Paso Corp. marketed nearly $3 billion in assets," the OGJ Exchange executive said. That was notable compared with other active periods when property sales totaled $6-8 billion/year, he added.

The reasons for those recent divestments varied among companies. "But they all had one important thing in common-they were motivated sellers," Marko said. "The specific sellers named above were selling larger packages, many of which were larger than $100 million," he said. "While packages of this size yield high gross sales numbers, they do not fulfill the need of the broader market for smaller packages in the $20-60 million range."

Therefore, said Marko, "There is still a great deal of demand in the market by acquisitive companies and those focusing in specific operating areas for packages of this size."

The deal flow is expected to increase again later in this quarter. "Buyers of these large packages may become sellers of smaller packages as they either directly churn assets acquired or sell other assets to raise capital," Marko observed. "Companies are only now beginning in earnest to plan 2002 sales programs, having just now completed 2001 reporting."

In addition, he said, "There may be other 'Enron [Corp.] effects' in the market, for both midstream companies needing to sell assets and for upstream companies needing to address trading positions they had with Enron.

"Finally, companies will continue to recognize the seller's market that continues in the domestic acquisitions and divestments business. Recent low deal flow combined with relatively stable commodity pricing will continue to create a seller's market in the near future."