Market Movement

IEA revises oil demand forecast

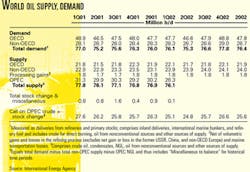

Oil market fundamentals point to significant future tightening in the market, says the International Energy Agency. The Paris-based agency notes that crude prices already reflect the loss of 45 million bbl of crude following Iraq's export suspension and the ongoing conflict between the Israelis and Palestinians. These factors offset weak product demand and comfortable inventories. While IEA has lowered its estimates for first quarter 2002 demand, it has raised its estimates of third and fourth quarter demand while lowering its estimates of supply from Organization for Economic Cooperation and Development countries.

Supply, stocks

Russian oil production for April is estimated to have been nearly unchanged from March's 7.16 million b/d, a record high in the post-Soviet era. Meanwhile, Iraq's 30-day suspension of crude exports pulled down worldwide oil supply1.4 million b/d to 74.5 million b/d in April as output by the remaining 10 members of the Organization of Petroleum Exporting Countries was unchanged, according to IEA.

During the first quarter of 2002, OPEC production was down 3.1 million b/d from a year earlier. Although non-OPEC production was up 1.5 million b/d for the same period, a large amount of crude was removed from the market. During that quarter, global oil demand contracted 900,000 b/d.

A small industry stockdraw-just 2 million b/d-in the first quarter leaves OECD industry oil stocks at the high end of their 5-year range, but if the global economy recovers as much as is expected this year, the market will quickly tighten.

Stocks normally rise during the second and third quarters. However, should current exporter output targets remain in effect on top of the recently lost Iraqi supply, IEA reckons that OECD industry stocks will trend toward the bottom of their 5-year average by the end of the third quarter. An extension of exporter output cuts into the fourth quarter would further erode stocks.

IEA warns that a repeat of the events of 1999, when OECD industry stocks plunged 230 million bbl in less than 2 quarters, is a real possibility. "In 1999, markets demonstrated that they can turn quickly, contributing to extreme price volatility and instability. Producers will need to make timely decisions to meet market demands."

DemandThe agency estimates that average 2002 global oil product demand will be 76.44 million b/d. This is up 20,000 b/d from previous estimates, although a 30,000 b/d simultaneous upward revision to 2001 demand slightly lowers demand growth to 420,000 b/d for this year.

Oil demand and the economy currently seem to be moving in opposite directions. While US GDP increased 5.8% in the first quarter, preliminary estimates indicate that oil demand contracted 3.2% as warm weather weakened March deliveries. In France, consumer spending increased in March at its strongest rate in 8 months, while oil demand plummeted.

IEA notes that it is common for oil demand to lag the economy by several months when the latter experiences rapid acceleration. Most indicators point to a slow recovery in oil demand this year, in fact. "Even US GDP appears to have expanded at a subdued pace if government and military spending and the rebuilding of inventories depleted during last year's recession are stripped out."

Industry Scoreboard

null

null

null

Industry Trends

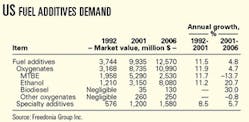

US FUEL ADDITIVES demand is expected to grow 4.8%/year during 2001-06 to $12.6 billion in 2006, said Freedonia Group Inc., a Cleveland market research firm, in a new study.

Growth is expected to decline sharply compared with 1992-2001 because of the anticipated phase-out of methyl tertiary butyl ether. MTBE is being phased out in response to concerns that the additive contaminates groundwater as a result of leaks from gasoline storage tanks.

Currently, 12 states have passed legislation that would severely limit, or eliminate entirely, the use of MTBE. The US Environmental Protection Agency and Congress are considering a federal phase-out of MTBE (OGJ, Jan. 14, 2002, p. 18).

The Freedonia Group said market value for oxygenated fuel additives, including MTBE, ethanol, biodiesel, and others, will increase 4.7%/year to $11 billion, although the volume is forecast to increase less than 1%/year (see table).

MTBE accounted for the majority of US oxygenate demand in 2001, but ethanol is forecast to become the leading oxygenate in use by 2006, the study said.

Ethanol also will benefit from proposed legislation that would promote greater production and use of renewable fuels, Freedonia Group said.

Meanwhile, the MTBE phase-out push gains momentum. BP PLC has signed contracts with several ethanol suppliers in order to phase out the use of MTBE in the gasoline BP sells in California by the end of this year.

"We considered all of the factors within our control and determined that we could transition from MTBE to ethanol early," said Bob Malone, BP's regional president.

California Gov. Gray Davis (D) has delayed the state's MTBE ban until Jan. 1, 2004. A 1999 executive order had directed refiners to stop selling gasoline that contains MTBE by Dec. 31, 2002.

Renewable Fuels Association Pres. Bob Dinneen commended BP. "I believe California consumers will reward oil companies like BP that make an early switch away from MTBE. And I hope other companies marketing gasoline in California will follow BP's lead," he said.

Meanwhile, MTBE producers and some oil companies say a ban on MTBE will mean higher prices and a possible fuel shortage.

The Oxygenated Fuels Association issued a statement critical of BP's switch to ethanol. "It is no surprise that oil companies like BP are once again putting profits ahead of people ellipse. They just don't care about consumers paying up to double today's prices for gasoline because it means higher profits in their pockets."

Government Developments

THE UNITED NATIONS Security Council agreed to a "smart sanctions" plan designed to increase civilian goods to the Iraqi people by streamlining import controls, US officials said last week.

The new sanctions protocol is predicated on the assumption that Iraq will allow the UN to resume weapons inspections (OGJ Online, May 7, 2002). Iraq has sharply criticized the smart sanctions proposal over the past year, and it is unclear what the country's next course of action will be. However, Baghdad has halted its official exports of oil over mere procedural disputes with the UN organization overseeing the oil-for-aid sales program.

This program is meant to provide no revenues to the government of Iraqi President Saddam Hussein but to raise funds to purchase food, medicine, and other necessities for the Iraqi people and to rebuild the country's war-ravaged oil infrastructure.

Analysts at presstime were speculating over another possible halt to the country's oil exports in protest over what Iraqi officials claimed was "harassment" of Iraq with the new sanctions regime.

Under the new system, effective May 30, a UN escrow account for Iraqi oil revenue and restrictions on items of potential military and military-related use continues.

INDUSTRY SPOKESMEN praised a British Columbia government-commissioned report that found no scientific or legal reason to maintain long-standing exploration moratoriums off Canada's West Coast. British Columbia Energy Minister Richard Neufeld said the report of an independent scientific panel is a major step towards lifting moratoriums on exploration and development off the Queen Charlotte Islands off the northern coast of British Columbia. He said the report, which calls for more scientific research by the province and by Ottawa, confirms the potential for safe exploration in the environmentally sensitive region. The provincial government is providing an additional $2 million (Can.) for further technological research.

Pierre Alvarez, president of the Canadian Association of Petroleum Producers, said the report is a small but positive step. "You clearly now have a basis for discussion among technical experts at the federal and provincial levels," Alvarez said. He noted that the moratoriums remain effective and that many jurisdictional issues have yet to resolved.

RUSSIA AND KAZAKHSTAN agreed on a joint boundary dividing their interests in the northern Caspian Sea, Russian officials said May 13. As part of the deal, the two countries agreed to equally develop petroleum reserves in previously disputed areas in Kurmangazi, Tsentralniye, and Khvalinskoye fields.

In addition, a joint state-controlled company owned by the two nations will build ships, barges, and offshore drilling rigs to serve foreign oil companies that explore and produce in the Caspian Sea.

But Caspian Sea border challenges remain. Investors are waiting on other Caspian nations to reach a consensus on how the sea will be divided; a summit this spring failed to resolve the issue.

Quick Takes

STATOIL ASA has awarded contracts valued at $330 million to the Swiss ABB Group for maintenance and modification work on six oil and natural gas platforms in the North Sea and at the Kollsnes gas plant near Bergen, Norway.

The 5-year platform contract is for Troll A, four Sleipner platforms, and Veslefrikk. Initial stages of the agreement also include the Huldra and Kvitebj rn platforms. The contract has options for three 2-year extensions and covers project management, engineering, procurement, fabrication, and installation work.

ABB said completion of the work is expected in the third quarter.

BP PLC has updated reserves figures for its Atlantis discovery in the southern Green Canyon region of the Gulf of Mexico to 575 MMboe from 300 MMboe, based on appraisal well data obtained in fall 2001.

Operator BP has a 56% interest in Atlantis, and partner BHP Billiton Ltd., Melbourne, has 44%. Both companies have approved expenditures allowing them to progress with development engineering and the procurement of long lead-time items.

BHP Billiton said full project approval is expected later this year upon completion of a final capital cost estimate and project schedule after front-end engineering and design work. Production currently is scheduled to begin in 2005. The gross capital cost is expected to be more than $2 billion, with BP shouldering more than $1 billion and BHP Billiton, about $1 billion.

Located in 4,400-7,100 ft of water, Atlantis will be developed with a moored semisubmersible production facility with a gross design capacity of 150,000 b/d of oil and 180 MMscfd of gas. It also will have a separate semisubmersible drilling unit, the partners said.

Atlantis, which covers six blocks, is 125 miles south of New Orleans near Green Canyon Block 743. Together with Holstein and Mad Dog, the three BP-operated properties account for more than 1 billion bbl of oil gross.

Oil and gas produced at Atlantis will be transported to a platform at Ship Shoal Block 332 via the Caesar and Cleopatra pipelines and from there to Texas and Louisiana (OGJ, Feb. 25, 2002, p. 8).

HUNGARIAN petrochemical company, Tiszai Vegyi Kombinát Rt. (TVK), Tiszaujvaros, has awarded Wiesbaden-based Linde AG a contract valued at 160 million euros for an ethylene plant at Tiszaújváros in northeastern Hungary. The new plant is part of TVK's planned 430 million euro petrochemical development project.

Linde will provide its proprietary ethylene technology and cracking furnaces and will carry out engineering, equipment and materials procurement, construction supervision, and commissioning. TVK will effect the civil work and plant construction.

The new plant, which also will have the capability to process naphtha, will increase capacity at Tiszaújváros to 610,000 tonnes/year of ethylene from 360,000 tonnes/year. The feedstock for the ethylene production is gas oil. The plant is scheduled to go into operation in fourth quarter 2004.

In other petrochemical news, Philadelphia-based Sunoco, Inc., said it will permanently shut down a 200-million lb/year polypropylene line at its Sunoco Chemical La Porte, Tex., plant during the third quarter. The plant, which operates three lines, currently produces 1 billion lb/year of polypropylene. Sunoco said current trends in the polyolefins markets have made it prohibitive to produce products on older assets with high conversion costs. Sonoco's remaining capacity will be more than 2 billion lb/year.

INTERGEN, the electric power alliance between Royal Dutch/Shell Group and US engineering company Bechtel Corp., has arranged financing for the $748 million La Rosita Energy natural gas-fired, combined-cycle, power plant to be built in Mexico's Baja California.

Intergen will build, own, and operate the 1,065 Mw plant, which is expected to begin commercial operations by first half 2003.

InterGen, which arranged $563 million of nonrecourse commercial bank senior debt financing for La Rosita's construction and operation, said the project represents the largest financing for a Mexican power project. Bechtel Power Corp. is building the plant. Natural gas for the project will be transported through a new 212-mile pipeline from California and Arizona to Mexico.

ASHLAND INC., Covington, Ky., pleaded guilty in US District Court to criminal charges related to a May 16, 1997, fire and explosion at its former Minnesota refinery, the Department of Justice said. As part of the plea, Ashland agreed to pay more than $7 million in fines and restitution connected with the charges.

"Ashland continues to regret this tragic incident and the consequences it created for our employees. The safety and well-being of our employees is a fundamental responsibility, and Ashland fully accepts that," a company spokesman said. "This was a tragedy, and there were no winners."

Ashland pled guilty to two criminal counts that charged it with negligent endangerment under the Clean Air Act and submitting a false certification to environmental regulators. Ashland also agreed to a deferred prosecution for a violation of the New Source Performance Standards (NSPS) of the Clean Air Act.

Under terms of the plea agreement, Ashland agreed to pay $3.5 million restitution to the primary victim, a former Ashland employee and member of the Emergency Response Team (ERT), medical coverage for him and his family, and $10,000 each to four other Ashland employees injured in the fire.

Ashland will also pay a criminal fine of $3.5 million; sponsor a workshop at a national petroleum conference dealing with NSPS for petroleum wastewater systems; take out full-page notices in the two major Twin Cities newspapers acknowledging its guilt and how the case was resolved; pay $50,000 to each of the three local fire departments that responded to the fire; and add another $50,000 to its own ERT budget.

Ashland also agreed to conduct a $3.7 million upgrade of all of its process sewers, junction boxes, and drains at the St. Paul Park refinery (now owned by Marathon Ashland Petroleum LLC, a joint-venture between Ashland and Marathon Oil Co.) to prevent another accident. Justice officials said the charges stem from a fire and explosion on a day refinery workers were pumping hydrocarbons into the refinery's sewer system for treatment and recycling.

During the May 13 guilty plea hearing, Ashland admitted it knew a manhole cover was not sealed, as required to prevent vapor emissions, when it drained the hydrocarbons to the sewer and that it negligently allowed an extremely hazardous substance to be released to the air, endangering the workers.

Ashland also admitted submitting a certification to the Minnesota Pollution Control Agency in July 1997 falsely stating that the company's sewer system was in compliance with the Clean Air Act, although the company failed to disclose the unsealed manhole cover, the resulting fire, or the extensive corrective action undertaken in response to the fire.

In other refining news, Tonawanda, NY-based Praxair Inc. and Valero Logistics Operations LP have exchanged certain pipeline assets of different capacities in order to enhance their respective hydrogen systems. The action doubles the capacity of Praxair's Houston-Texas City, Tex., hydrogen pipeline in response to increased hydrogen refiner demand. Refiners' demand for hydrogen has grown by 10-15%/year over the past 5 years. The growth rate is expected to increase to nearly 20%/year, based on the need for low-sulfur gasoline and diesel fuels to comply with new Environmental Protection Agency regulations coming into effect in 2004 and 2006. Praxair announced in October 2001 plans to build along its US Gulf Coast pipeline system two hydrogen plants having a combined estimated capacity of 200 MMcfd. The first start-up is scheduled for early 2004.

Thailand has decided to proceed with the Thai-Malay natural gas pipeline and related gas separation plant project long stalled by local opposition. (OGJ Online, Apr. 5, 2002). The pipeline may continue to face opposition, however.

To avoid the area where most project opponents live and yet avoid the necessity for another environmental impact assessment (EIA), the planned 36-in. diameter onshore pipeline through the southern Thai province of Songkhla on the Malay Peninsula will be rerouted slightly from the original route where EIAs have already been conducted. Thailand's Environment Act does not require an EIA if a new route is less than 5 km from the original.

The Thaksin Shinawatra administration also decided that the pipeline, extending from Cakerawala gas field on Block A-18 of the Thai-Malay joint development area in the southern Gulf of Thailand, would come ashore at Ban Nairat in Tambon Taling Chan, 4.8 km from the original route at Ban Kobsak in Tambon Sakom.

Two proposed 425 MMcfd gas separation units would also be relocated to Ban Nairat.

Both onshore pipeline routes are in the Chana district of Songkhla Province in southern Thailand, where most adamant opponents live. The alternative route of the inland line is expected to be shorter than that previously planned, which was 87 km from the Chana district to Kedah in northern Malaysia.

Thaksin's go-ahead decision came one day after Malaysian Prime Minister Mahathir Mo- hamad suggested that a proposed Thai-Malay gas pipeline be built through Malaysia to overcome the Thai concerns about environmental damage.

The delayed pipeline had been planned for completion in the third quarter to deliver 390 MMcfd of gas to Malaysia. Opponents of the pipeline in Songkhla insisted they would continue to oppose the project and were ready to react to any kind of threat from the government. "Our actions depend on what the government does. We will not use violence unless the government forces us to," said Kittiphob Sudhisawand, the leader of opposition to the pipeline. "Shifting the project 5 km means nothing, because the negative impact of the project is unchanged or even greater because the new site is in the middle of eight villages," he said.

PETROLEO BRASILIERO SA (Petrobras), also experiencing environmental woes, reported May 15 that a 16,000 l. spill of light Nigerian crude off the city of Angra dos Reis, Rio de Janeiro state, was contained by booms and 63 support vessels.

The spill occurred the evening of May 14 during the unloading and loading of the Brotas tanker. Petrobras executives said cause of the spill was under investigation. About 500 Petrobras employees took part in the spill containment efforts.

Fernando Jordao, the mayor of Angra dos Reis, asked Petrobras for more details and complained that Petrobras had been slow in reporting the spill. Municipality officials also said they will request that federal environmental authorities fine Petrobras $4 million.

The incident is the latest in a recent series of Brazilian oil spills. Ibama, Brazil's federal environmental agency, fined Petrobras $10 million for oil spills from two platforms in the Campos basin. The P-36 production semisubmersible sank Mar. 20, 2001, as a result of damage sustained on Mar. 15 in explosions and a fire that killed 11 workers. The P-36, insured for $500 million, spilled 1.2 million l. of diesel and 300,000 l. of crude after it sank. About a month later, 26,000 l. of oil spilled from the P-7 platform (OGJ, Apr. 23, 2001, p. 8). That spill was blamed on defective valves.

In July 2000, the 189,000 b/d Presidente Getulio Vargas refinery in Araucaria, Parana state, spilled 4 million l. of oil. In January 2000, 1.2 million l. of crude spilled in Guanabara Bay. That spill was blamed on ruptured piping in the Reduc refinery.

Irving Oil Ltd. receives first Terra Nova crude oil cargoIrving Oil Ltd.'s 250,000 b/d St. John refinery, Canada's largest, received its first cargo of crude oil from Terra Nova field off Newfoundland last month. The Vancouver Spirit tanker docked at the Irving Canaport monobuoy and pumped 660,000 bbl into storage tanks for delivery to the refinery. Irving Oil has been a strong supporter of Atlantic Canadian development, purchasing crude oil from the Hibernia field, also off Newfoundland, in addition to the Terra Nova crude. The refinery recently completed a $1 billion upgrade. Irving Oil serves customers in eastern Canada, Quebec, and New England. Photo courtesy of Irving Oil Ltd.