Turkey determined to remain at the center of East-West energy corridor

Turkey looms large in any discussion of transporting the world's hydrocarbon resources, sitting as it does astride major supply routes to European energy markets for the generous energy wealth of the Caspian Sea region and the Middle East. This characteristic has earned the country the nickname "Energy Bridge between East and West" (Fig. 1).

While conceiving and implementing projects to meet its own energy demand, Turkey also wants to defend its position as the most feasible route for hydrocarbon energy movements to the West.

The Iraq-Turkey crude oil pipeline is one of the most important routes in the region. This crude oil pipeline, along with the Ceyhan marine terminal on the Mediterranean Sea, has been in service for more than 25 years.

Despite United Nations sanctions, which have interrupted the oil transfer since the Persian Gulf crisis, Turkey has yet managed to supply allowed quantities of crude oil to world markets through operations of Botas Petroleum Pipeline Corp.

Botas was established by Turkish Petroleum Corp. on Aug. 15, 1974, to transport Iraqi crude oil to the Gulf of Iskenderun (port of Ceyhan), in keeping with the pipeline agreement between the governments of the Republic of Turkey and the Republic of Iraq in August 1973.

In 1995, Botas was restructured as a state economic enterprise by a decree of the Council of Ministers and was no longer an affiliate company of Turkish Petroleum Corp.

Turkey at the center

With the Caspian Sea region-its large hydrocarbon reserves and promising production estimates-gaining more importance for the energy-consuming world, Turkey is determined to catch up with the growing number of hydrocarbon production projects in the region in line with its mission to take that production to western markets.

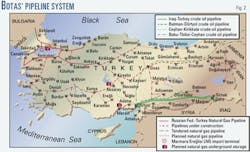

The energy map for Turkey reveals a country-wide web of gas and oil pipelines (Fig. 2). Besides the existing systems, others are about to come on stream, and still others are under construction or being planned.

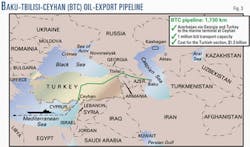

Among these, the Baku-Tbilisi-Ceyhan crude oil pipeline will transport Azeri crudes to world markets via Turkey (Fig. 3), while gas pipelines target both domestic and Western demand. In fact, studies are underway and being accelerated to connect the Turkish gas pipeline system to Europe in order to feed gas demand in the West.

A recent study, presented within the framework of the Tacis INOGATE program of the European Union concluded that Turkey is the inevitable route to transport Caspian gas to the West and Baku-Tbilisi-Ceyhan pipeline is the best route for transporting its crude oil. (Tacis = Technical Assistance to the Commonwealth of Independent States; INOGATE = Interstate Oil and Gas Transports to Europe)

The investment cost of a pipeline is a major factor affecting the overall cost of transport but not the only one. The political and economic stability of the countries being crossed and their geographical conditions have a significant effect on the transport fees.

What follows is a summary of the Baku-Tbilisi-Ceyhan crude oil pipeline project and its status as of December 2001.

After the successful completion of basic engineering, detailed engineering for the Turkish section of BTC project began on June 19, 2001. Each study assumes the first barrel of oil will flow through the main export pipeline at the beginning of 2005 with completion of land acquisition and construction. Tendering for procurement is underway at present to ensure the project stays on schedule.

Upon completion, the BTC crude oil pipeline will operate for at least 40 years, and Botas most probably will operate it. Almost all the Azerbaijan International Operating Co. (AIOC) members, the oil producers in Azerbaijan, are the sponsors of the BTC line and with Italy's ENI recently acquiring a 5% from Socar.

While working on the project, Botas' BTC crude oil pipeline project directorate was granted three standard certificates simultaneously in March 2001: the ISO 9001 "Quality Management Systems," the ISO 14001 "Environmental Management Systems," and the US Occupational Health and Safety Administration (OHSAS) 18001 "Health and Safety Management."

The directorate is the first public-sector institution in Turkey to hold these three certificates, and the first institution in the world to be granted these three certificates at the same time.

Gas for Turkey

Natural gas has been available for Turkish consumption for nearly 15 years. Its use expanded sharply after the signing of the first sales and purchase agreement with the former Soviet Union in 1986. Gas sales began at 500 million cu m in 1987 and reached to some 15 billion cu m (bcm) in 2000.

A dynamic economy together with population growth, industrialization, rapid urbanization, source diversification, and environmental concerns have been responsible for the increasing use of natural gas in Turkey.

Botas started natural gas trading and transportation activities with monopoly rights on import, transmission, distribution, pricing, and sales of the natural gas and LNG within Turkey.

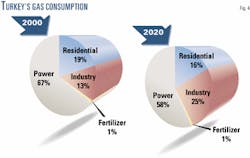

The growing Turkish market can be divided into four main sectors:

- Power generation.

- Fertilizer.

- Residential.

- Industrial.

Demand for natural gas for power generation is driving growth in gas consumption in Turkey as a result of increased gas use in baseload power plants.

Today, Turkey is in the process of drastic industrialization with its dynamic population of more than 65 million. Major increases in Turkey are planned. Increases in energy demand have been such that public companies cannot cover this additional investment.

Consumption projections for natural gas are around 43 bcm in 2005, 55 bcm in 2010, 67 bcm in 2015, and 82 bcm in 2020 in Turkey (Fig. 4).

Botas has already signed eight long-term sales and purchase contracts with six different supply sources including the Russian Federation, Algeria, Nigeria, Iran, Azerbaijan, and Turkmenistan. And, there are other sources yet to be contracted (Table 1).

Turkey's natural gas demand is currently met through four contracts: two agreements with the Russian Federation for a total capacity of 14 bcm/year, an LNG agreement with Algeria for 4 bcm, and an agreement with Nigeria for 1.2 bcm/year.

Supply projects

Several projects are underway or envisioned to increase the supply of natural gas to Turkey and beyond:

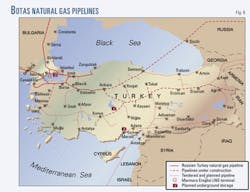

- Extension of domestic transmission system (Fig. 5).

- Blue Stream Pipeline.

- Iran-Turkey Pipeline.

- Azerbaijan-Turkey (Shah Deniz) Pipeline (OGJ Online, Oct. 29, 2001).

- Turkmenistan-Turkey Pipeline.

- Egypt-Turkey Pipeline.

- Iraq-Turkey Project.

- Underground storage project.

The natural gas transmission line to Turkey from the Russian Federation via Ukraine, Moldova, Romania, and Bulgaria follows the route from Istanbul and extends to Ankara. The capacity of the transmission system built in 1988 has become insufficient to supply the increasing demand.

After the construction of loops, new compressor stations, and modification works, the capacity of main transmission system is 62 million cu m/day, up from 39 million cu m/day. Following completion of the interconnected gas pipeline system, a total of 60 cities will have the chance to use natural gas by 2004.

Within the framework of the Blue Stream project agreement signed between Gazexport of Russian Federation and Botas in 1997, 16 bcm/year of capacity are going to be imported by the pipeline across the Black Sea.

The Russian Federation is responsible for construction and operation of the onshore pipeline in Russian territory as well as the offshore section. Turkey has completed construction of the section on Turkish soil from Samsun to Ankara. The J-lay vessel Saipem 7000 is laying the offshore section, and the project is to be completed within first quarter 2002.

The Eastern natural gas transmission pipeline within Turkey will import up to 10 bcm/year from Iran. Gas imports from Iran started Dec. 10, 2001.

Within the scope of the Shah Deniz field in the Caspian Sea, the Azerbaijan-Turkey natural gas pipeline project has been developed. An intergovernmental agreement and natural gas sales and purchase agreement, respectively, were signed. It is planned that natural gas delivery will start in early 2005 with 2 bcm/year and reach to plateau capacity of 6.6 bcm/year in 2007.

The Turkmenistan-Turkey-Europe natural gas pipeline project is planned to transport natural gas via the Caspian Sea, Azerbaijan, and Georgia to Turkey and on to European markets. Within the framework agreement signed in 1998, this pipeline will transport 16 bcm of Turkmen gas to Turkey and 14 bcm to European countries for 30 years. Sales and purchase agreements were signed in May 1999.

The Eastern Anatolia natural gas transmission pipeline has been revised to transmit the maximum possible amount by extending the diameter to 48 in., thus to take Turkmen gas also.

A natural gas sales and purchase contract was initialed with Egypt on Mar. 31, 2001, for delivery of 4 bcm/year of Egyptian natural gas to Turkey by a pipeline crossing the Mediterranean Sea. This contract will be put into force if the Energy Market Regulatory Authority decides that additional gas is required.

On the other hand, studies for the transport of 10 bcm/year capacity of Iraqi gas to Turkey are underway. A draft framework agreement has been prepared with participation of international oil companies. Realization of this project depends on removal of the UN sanctions on Iraq.

Finally, in order to overcome seasonal fluctuations in gas supply and demand, an offshore reservoir in the Marmara Sea with 1.6 bcm/year storage capacity will be used for gas storage. The reservoir will be the first storage facility of Turkey and will start operation in 2004.

Also, salt caverns in the salt lake are planned to be used for underground storage. Following the completion of engineering studies and environmental impact evaluation report, a construction tender is planned for first quarter 2002 (Fig. 6).

Besides all these projects for supply and transmission of gas, one particular project can be regarded as a first step on the way to meet European gas demand: the Turkey-Greece natural gas pipeline project.

In 2000 in Brussels, Turkey, and Greece held a trilateral meeting under the European Commission INOGATE program. A technical working group was established, and preliminary technical and economic studies have been finished on the interconnection of the pipeline systems of two countries and development of the south European gas ring.

With this project, natural gas produced in the Caspian Basin, Russia, the Middle East, southern Mediterranean countries, and other international sources is to be transported via Turkey to Greece first. The next step is the remaining European market.

A kick-off meeting held in Athens Dec. 18, 2001, among Botas, DEPA of Greece, and Société Générale of France for execution of an economic feasibility study of the project through financing from European Union funds and DEPA. This means that we are awaiting European countries and companies to negotiate conditions for gas supply. At present, we are trying to form a fourth gas supply source for Europe.

New law

In order to constitute a financially strong, stable, and transparent natural gas market and to maintain free regulation and control, a new Turkish Natural Gas Market Law was issued May 2, 2001. A major effect of the law is that Botas is no more a monopoly in the Turkish gas market.

The law's aim is to constitute the Energy Market Regulatory Authority, unbundle the import, transmission, storage, and distribution of natural gas, and regulate the legislation and its implementation suitable to European Union regulations.

Before May 2002, Botas will be restructured to build, own, and operate the national transportation network as a state enterprise. Botas will hold the rights to serve all potential users on the major pipeline system but will not be required or authorized to build laterals. Botas may participate in LNG and underground storage facilities, if necessary, as well.

Under the law, new importers together with Botas will undertake supplying natural gas and thus form a competitive and dynamic market within country.

Strategy; rationale

Today, Turkey plays an increasingly important role in the Caspian region as an investor, transporter, and a trade partner. Our strategy in the region is constructed on:

- Being an investor and having a growing role in the oil and gas sectors of the region.

- Strengthening the existing economic ties.

- Ensuring secure transportation of new oil and gas sources to Western markets via Turkey.

A transparent and fair legal system available for local and foreign investors and synchronization with European markets will soon lead to major development and expansion projects. These will make significant contributions to efforts to meet Turkey's and other European countries' gas demands.

Why are we working so hard, then? Why are the eyes of the entire energy world on the Caspian region? Why do giant energy companies try to take part in the region's energy projects? Production and transportation profits cannot be the sole answer to such questions.

The answer must lie in recognition that multiple sources and multiple routes always serve for supply security on one hand and export flexibility on the other.

The author

Emre Engür ([email protected]) is deputy head of the foreign relations and strategies group for Botas, the Turkish Petroleum Pipeline Corp. He has served in this department since September 2001, before which time he was a cost and planning expert for the Baku-Tbilisi-Ceyhan project directorate. He has also served as a specialist in Botas' international projects department and an economist for the company. Engür holds a BSc in econonomics from the Middle East Technical University, Ankara.