How US Gulf of Mexico development, finding, cost trends have evolved

The US Gulf of Mexico is a major source of domestic oil and gas supplies. Recently, some have begun to speculate that this important producing area will soon experience a decline in production, with significant implications for higher domestic natural gas (and oil) prices, supply shortages, and decreased energy security.

This three-part series of articles examines the future of the Gulf of Mexico in light of these concerns.

This first article reviews the development and production history of the offshore Gulf of Mexico, focusing on deepwater areas in more than 200 m of water.

The second article will focus on shallow water areas. The third article will examine how continued technology developments and public policies will shape the future of oil and gas resources in the gulf.

Development, output history

The first offshore well was drilled in the Gulf of Mexico in 1947 by Kerr-McGee in 20 ft of water on what is now Ship Shoal Block 32.

Today, more than 50 years later, the Gulf of Mexico Outer Continental Shelf (OCS) has established itself as one of the world’s great hydrocarbon basins. In 2000, the gulf OCS represented approximately 25% of US oil and gas production, equal to 1.7 million b/d of oil and natural gas liquids (NGL) and 4.9 tcf/year of wet (4.8 tcf/year of dry) gas.

The early outlook

In the mid-1980s, the gulf OCS experienced its first decline in production. This prompted a set of pronouncements that this was a mature, rapidly depleting region with limited remaining potential.

As early as 1973, a report by the US Department of Interior (DOI) concluded that all potentially productive blocks up to about 600 ft of water in federal offshore Louisiana would be leased by 1978, and all exploration and production would be complete by 1985.1 With the continuing decline of production on the shelf and the view that the deepwater reservoirs were of low quality, much of the industry began to believe that the offshore gulf was so lacking in future potential that it deserved to be called the "Dead Sea."

Recent oil production

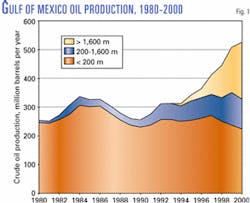

However, with new leasing policies and progress in offshore technology, oil (and NGL) production rebounded from 700,000 b/d in 1985 to 1 million b/d by the early 1990s. Since shallow water oil production remained relatively flat, deepwater oil production was the driver for this rebound. For the past three years, shallow water oil production has again declined, while deepwater production has jumped dramatically. As of 2000, oil (and NGL) production from the Gulf of Mexico offshore reached 1.7 million b/d, and production from deep waters exceeded that from shallow waters for the first time (Fig. 1).

Since 1997, overall US oil production has declined by about 12%. Without the surge in deepwater production, the decline in US production would have been much greater. Oil production from the deepwater gulf is currently reducing US dependence on oil imports by as much as 900,000 b/d.

Recent gas production

After experiencing a similar early production history and mid-1980s decline in production as oil, gulf OCS gas production has grown steadily, reaching 5.2 tcf wet (5.1 tcf dry) by 1997. Since then, gas production has declined, though slightly, for the past three years.

The steeper decline in gas production from shallow waters has been offset by increasing deepwater production, which has doubled since 1998 (Fig. 2). Today, deepwater gas production makes up about one-quarter of total gulf offshore gas production, and about one third of its reserves.

Replacing reserves

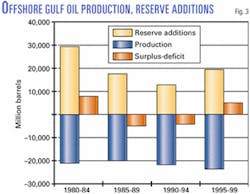

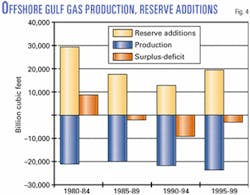

A look at the region’s history of replacing reserves provides some perspective on the rollercoaster production history of the gulf OCS. During 1980-99, more oil reserves were added from the gulf than were produced but 8 tcf more gas was produced than was added by new reserves.2

In the first half of the 1980s, during the period of declining production, operators were able to replace the oil and gas reserves they produced (Figs. 3 and 4). And, in the later half of the 1990s, gas reserves additions are close to replacing production, and more oil reserves have been added than were produced. The recent oil and gas reserves replacement history provides a positive note for the gulf OCS, at least for the near term.

Today’s outlook

Even with recent success, opinions are mixed about the longer term potential in the Gulf of Mexico.

In one camp, the perspective is that the offshore gulf is maturing, and economic reserves will be increasingly difficult to find.3 In the other camp, the perspective is that considerable potential remains. The more optimistic view is premised on the belief that the industry will be able to take advantage of the gulf’s extensive existing infrastructure to develop smaller fields, in deeper waters, and in deeper formations. This infrastructure consists of 6,400 producing wells, 4,000 active platforms, 29,000 miles of pipelines, and 7,500 active leases.

The analysis accompanying this series of articles tends to support the more optimistic view, with the caveat that continued technological advances and supportive public policy are necessary to realize the full potential of the gulf offshore.

To best understand its potential development opportunities, it is useful to divide the Gulf of Mexico into two plays:

- A mature, depleting shallow water play.

- An emerging, world-class deepwater play.

The outlook for the shallow water play will be the subject of the second article in this three-part series. Undoubtedly, the greatest remaining potential in the offshore Gulf of Mexico exists in the deepwater, the focus of this article.

Deepwater Gulf of Mexico

Deepwater overview

The step from shallow water to deepwater development in the Gulf of Mexico began in the late 1970s and early 1980s:

- Cognac field, discovered by Shell on Mississippi Canyon Block 194, was a milestone for the gulf. It broke the 1,000-ft water depth barrier; set a record for a deepwater fixed platform at 1,014 ft; and, with gas production at 130 MMcfd (peak), demonstrated that deepwater reservoirs could be of high quality.

- Exxon’s Lena field (MC281), in 1,017 ft of water, confirmed the viability of the deepwater reservoirs, with production starting in 1984.

Ten years after Cognac, in 1989, Shell and Conoco provided the next set of deepwater milestones in Green Canyon:

- Shell’s Bullwinkle (GC65) platform was set in 1,330 ft of water depth, pushing the water depth limits for fixed structures.

- Conoco’s Jolliet field (GC184) broke the fixed structure and water depth link by placing a tension leg platform (TLP) in 1,722 ft of water.

In the early 1990s deepwater development accelerated with 12 fields coming on line, centered in Mississippi Canyon and Garden Banks:

- Zinc field (MC354) demonstrated that a subsea development (at 1,500 ft of water) and tied back to a shallower water platform, was viable at large scale.

- Most notable was Shell’s Auger field (GB426) with a peak capacity of 300 MMcfd that established an important deepwater hub at 3,000 ft of water.

The second half of the 1990s has been marked by an acceleration in new field discoveries, records for deepwater exploration and development, and, most significantly, the discovery of giant size fields, as further discussed below.

Pace of significant deepwater discoveries

The future potential of the deepwater offshore Gulf of Mexico rests greatly on the ability to continue to find large fields.

After the initial flush of large deepwater discoveries in the late 1970s and early 1980s, the next 10 years of exploration in the gulf’s deepwater were disappointing. Only 15 large fields with reserves more than 100 million bbl of oil equivalent (BOE) were found. These disappointing results contributed to the speculation that the potential of the deepwater may not be promising. Leading OCS resource assessment groups, such as the Minerals Management Service (MMS) (1995) and the National Petroleum Council (NPC) (1992), established relatively low expectations for the future resource potential of the deepwater gulf.

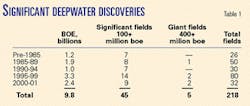

However, the pace of discoveries picked up dramatically in the mid and late 1990s. From the pace of 7 to 8 significant deepwater gulf OCS every five years, the second half of the 1990s saw a jump to 14 significant deepwater discoveries (Table 1).

In 2000 and 2001, 9 more significant fields were discovered. More importantly, since 1998, four giant fieldsin excess of 400 million BOEhave been found (Mad Dog, Crazy Horse, Crazy Horse North, Trident). In total, over 218 fields have been discovered to date in the deepwater gulf, 45 of which are "significant," containing reserves in excess of 100 million BOE.

Moreover, these significant fields are increasingly being found in deeper water, at 800-1,600 m. This includes BP’s 1 billion plus BOE Thunder Horse discovery (its name was changed from Crazy Horse in response to Native American concerns). These results contradict earlier conventional wisdom, which held that the quality of the reservoirs would tend to decline in progressively deeper waters.

The vast majority (over 80%) of the significant hydrocarbon discoveries in the deepwater Gulf of Mexico have been oil fields. However, these fields contain considerable quantities of associated gas. In terms of meeting future domestic gas requirements, a major issue is how oil prone is the gulf. Of note, the MMS still believes that nearly two-thirds of remaining gas resources in the deepwater will be nonassociated gas.4

High productivity

An important factor contributing positively to the economics of the deepwater gulf has been the high oil and gas production rates experienced by new wells. For example:

- A Shell Ursa field (Mississippi Canyon Block 854) well produced 30,000 b/d of oil and lease condensate.

- A BP Troika field (Green Canyon Block 244) well produced 31,000 b/d of oil and 66 MMcfd of gas.5

This positive experience has led to a dramatic revision in development strategies and production economics. For example, Shell’s 1 tcf Mensa field, where a single well produced 100 MMcfd, will be developed with only 3 subsea wells. To illustrate how this new information on production rates has changed the economic outlook, the 1992 NPC gas study6 assumed that a field of this size would require 30 to 40 wells (rather than 3) to develop.

Cutting edge

Cutting edge offshore technology has continued to push the limit of offshore exploration, and more importantly, development into increasingly deeper waters of the gulf:

- New technologies are breaking the traditional relationship between water depth and platform costs (for fixed platforms) that in the past hindered deepwater economics. Compliant towers, tension leg platforms (TLPs), SPARs, and floating production systems have allowed the industry to cost-effectively push into deeper and deeper waters.

- 3D seismic, among other technologies, have led to improvements in exploration success rates.

- Technology improvements have allowed continued reductions in drilling costs and improvements in drilling efficiencies. These advances, combined with improvements in 3D seismic, have lowered offshore finding costs (for all water depths) from about $15/BOE in 1986 to $5/BOE in 1996 (in today’s dollars).7

- Technology advances in the area of subsea completions have allowed the economic development of increasingly smaller fields. Today, subsea completions account for approximately 40% of deepwater gas production and 25% of deepwater oil production.8

- The concept of anchoring an area with a central platform and using subsea tiebacks has changed the capital requirements and economics of the deepwater gulf. Shell launched this "hubs and corridors" deepwater development strategy:

- Bullwinkle and Shell’s earlier Cognac platforms provided hubs and corridors for subsea tiebacks by smaller deepwater fields.

- Since then, Shell has placed TLP-based hubs in five strategic locations: Auger, Mars, Ram-Powell, Ursa, and Brutus.

- Other discoveries (such as Mensa, Troika, Angus, etc.) are tied back to these (and other) platforms.

One new, multicompany application of this approach is the first-of-its-kind Canyon Express deepwater gas project. This is a combination central hub and subsea system with a 500 MMcfd pipeline system that will take production from three discoveries in Mississippi Canyon, operated by three different companies, in waters greater than 6,500 ft deep:

- The 500 bcfe Camden Hills field in Mississippi Canyon 384, discovered by Marathon, to be developed by 2 subsea wells.

- The 300 bcfe Aconcagua field in Mississippi Canyon 305, discovered by TotalFinaElf, to be developed by 3 to 4 subsea wells.

- The 100 bcfe King’s Peak field in Mississippi Canyon 217 and Desoto Canyon 133 and 177, discovered by Amoco (now BP), to be developed by four subsea wells.

Production from these fields will be transported over 50 miles to the existing Canyon Station platform, operated by Williams Field Services, located in Main Pass 261. First production is scheduled for the summer of 2002. The system will allow the three smaller fields to be economically produced, which would not be the case if each were developed on its own.

Another development that will further enable the industry to move into increasingly deeper waters is the recent MMS decision allowing the use of floating production, storage, and offloading systems (FPSOs) for use in ultradeep waters in the gulf. Based on extensive environmental and safety reviews, the MMS decided to accept applications for installing FPSOs, for use in the deepwater Gulf of Mexico.

Deepwater leasing

Since 1995, the combination of improved technology, deepwater incentives, and large well production rates has resulted in a dramatic shift in gulf OCS leasing activities, demonstrating continued optimism for the deepwater gulf.

The passage of the Deep Water Royalty Relief Act in 1995, which provides royalty relief for a portion of production for deepwater leases, became effective in 1996. This led to a major increase in deepwater leases (Table 2) and a doubling in the average bid per deepwater lease block.8

By 1995, a third of gulf OCS leases were in deep water. Today, more than half of the leases in the gulf OCS exist in deep water. Notably, the vast majority of these leases exist in more than 800 m of water.9 Moreover, the deepwater gulf is not just a play for the majors. To date, approximately 40 different operators have drilled deepwater wells in the gulf.10

Resource perspectives

The strong exploration success and progress in technology is now reflected in the more optimistic estimates of the resource potential for the offshore gulf in general and the deepwater offshore in particular.

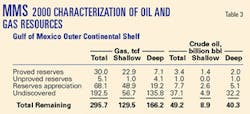

Today, the total resource endowment in the offshore gulf, which includes proved reserves, growth of discovered fields, and new discoveries, is estimated to be 296 tcf of gas and 49 billion bbl of crude oil (Table 3), according to the MMS.4

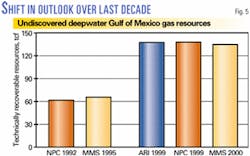

The most recent 2000 MMS assessment for the deepwater Gulf is several fold higher than the prior 1995 MMS assessment. Similarly, the most recent NPC estimates of total remaining gas resource potential for the gulf is 303 tcf,11 compared with 193 tcf in the 1992 NPC study.

Perspectives on potential undiscovered deepwater gas resources are the primary factor contributing to these more optimistic assessments (along with expected continued growth in discovered fields). Estimates of undiscovered gas resource potential doubled from the early 1990s to the later part of the decade, even without accounting for discoveries that occurred between the two sets of assessments (Fig. 5). Importantly, these resource assessments do not include much potential for some recently defined, highly prospective but relatively untested deepwater plays such as:

- The Mississippi Fan Foldbelt, where the large Mad Dog (Green Canyon 826), Neptune (Atwater 575), and Atlantis (Green Canyon 699) prospects were discovered.

- The relatively untested Perdido Foldbelt.

- The heavily leased but relatively untested Tertiary Fan/Mesozoic play.

Economic potential

However, not all of this resource potential will be economic to produce.

In attempting to forecast future oil and gas production from the deepwater Gulf of Mexico, a number of key factors need to be considered. These include the size, distribution, and water depths of undiscovered fields; the cost of platforms, wells and subsea completions; the exploration success rate and discovery process; and progress in technology.

Each of these factors has been input into Advanced Resources’s Gulf of Mexico Natural Gas & Crude Oil Capacity and Production Forecasting Model (ARGOM). This model is described in Reference 12.

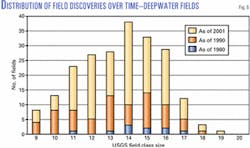

A critical factor is the future size and productivity of new oil and gas field discoveries. Fig. 6 shows the distribution of fields by size class discovered in the deepwater gulf at three points in time, 1980, 1990, and 2001.

As time has progressed and technology advanced, smaller fields have increasingly become economic to develop. Over time, the size of the marginally economic fields has become smaller, from class 15 (or 70 million BOE) in 1980 to class 13 (20 million BOE) in 1990 to class 11 or 12 (5-10 million BOE) today.

This shows that as technology improves, and as (or if) prices increase, ever-smaller fields will become economic. Also important is the ability of these small fields to take advantage of existing infrastructure. Consequently, as technologies continue to develop in the future, it is reasonable to expect that ever-smaller fields will contribute to "filling in" the left-hand side of this distribution of discovered fields.

Another interesting feature of this distribution of deepwater discoveries over time is that several giant, size class 18 and 19 (500 to 1,000 million BOE), fields have been discovered more recently, implying distinct discovery process paths for each of the deepwater categories and particularly for the ultradeepwater areas.

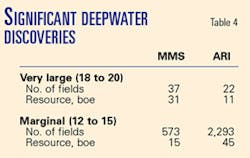

Table 4 provides Advanced Resources’ view of future deepwater discoveries and compares that with data from MMS. ARI and MMS currently agree on the size of the remaining undiscovered resource. However, ARI believes a much greater proportion of the remaining fields will be moderate size and smaller fields, in size classes 12 to 15 (10 to 75 million BOE). MMS believes much of the remaining resource potential exists in larger fields.

If the MMS vision prevails, the ultimate size of the deepwater resource will prove to be considerably larger than set forth today.

Using Advanced Resources’ view of the remaining resource base, recent oil and gas prices ($18/bbl, $2.50/Mcf), and current technology, ARI estimates that roughly 100 tcf of gas and 20 billion bbl of crude oil is economic in the deepwater gulf. At anticipated levels of deepwater production, this amounts to over 40 years of future supplies.

Even greater supply potential could be realized with future technological advances and supportive government policies. The extent of this potential will be explored in depth in the third article in this series.

Production potential

A review of the historical trends and recent developments in the deepwater Gulf leads to the following conclusions:

- As more is learned about the geology, resource characteristics, and well productivities of deepwater prospects, assessments of future resource potential have grown more optimistic.

- Technological advances, occurring at a rapid pace, have allowed the industry to continue to access a greater proportion of this resource, and more cost effectively.

- Supportive government policies in the second half of the 1990s have helped accelerate deepwater developments, with a significant gain for US energy security.

While considerable economic resource potential appears to remain in the deepwater gulf, the critical question is how much production from the deepwater we can expect, and when. This will depend on a number of factors, with public policy playing a key role.

In the near term, factors affecting deepwater production will be demand growth, oil and gas prices, and the extent to which financial incentives, such as royalty relief, are available to stimulate development. In the longer term, factors influencing the future of the Gulf of Mexico include:

- The pace and extent of technological advances.

- Access to currently restricted areas of the Eastern Gulf.

- Future environmental requirements affecting offshore development.

- Financial incentives available to stimulate development.

- Availability of ultradeepwater infrastructure to bring new supplies to market.

The impact of these factors on future shallow and deepwater Gulf of Mexico oil and gas production will be explored in more detail in the third article in this series in coming weeks.

References

- "Offshore Petroleum Studies Estimated Availability of Hydrocarbons to a Water Depth of 600 Feet From Federal Offshore Louisiana and Texas Through 1985," US Department of Interior, Bureau of Mines, December 1973.

- "US Crude Oil, Natural Gas, and Natural Gas Liquids Reserves 2000 Annual Report," Energy Information Administration, DOE/EIA-0216 (2000), December 2001.

- Nehring, Richard, "The Gulf of Mexico: Rising Star or Over the Hill?" presentation made at the Energy Information Administration Annual Energy Outlook Conference, Mar. 27, 2001.

- "Outer Continental Shelf Petroleum Assessment," US Department of Interior, Minerals Management Service, 2000.

- Craig, M.J.K., and Hyde, S.T., "Deepwater Gulf of Mexico more profitable than previously thought," OGJ, Mar. 10, 1977, pp. 41-50.

- "The Potential for Natural Gas in the United States," National Petroleum Council, December 1992

- "Performance Profiles of Major Energy Producers," Energy Information Administration, DOE/EIA-0206 (00), January 2002.

- "Deepwater Gulf of Mexico, America’s Emerging Frontier," US Department of Interior, Minerals Management Service, OCS Report MMS 2000-0022, April 2000.

- "Offshore Statistics by Water Depth," US Department of Interior, Minerals Management Service, www. temporarygomr.com/homepg/fastfacts/WaterDepth/WaterDepth.html, 3/25/2002.

- Kallaur, Carolita, (associate director, Minerals Management Service), "The Deepwater Gulf of MexicoLessons Learned," presentation to the Institute of Petroleum’s International Conference on Deepwater Exploration and Production, in association with OGP, London, United Kingdom, Feb. 22, 2001.

- "Natural Gas: Meeting the Challenges of the Nation’s Growing Natural Gas Demand," National Petroleum Council, December 1999.

- Eppink, J.E., Kuuskraa, V.A, and Kuck, B.T., "Assessment of Natural Gas and Oil Supply Issues in the Deepwater Gulf of Mexico," paper OTC 12225 presented at the 2001 Offshore Technology Conference, Houston, Apr. 30-May 3, 2001.

The authors

Michael Godec ([email protected]), a senior technical advisor with Advanced Resources, has 18 years’ experience, working with government agencies, industry associations, and private energy companies worldwide. His expertise includes energy market analysis and forecasting, environmental and economic impact assessments, energy policy analysis, asset valuation, and due diligence. He has a BSc in chemical engineering from the University of Colorado and an MSc from Washington University.

Vello A. Kuuskraa is president of ARI, a firm that provides technical and consulting services in geology, engineering, and economics for natural gas and oil. He served on the US Secretary of Energy’s "Assessment of the U.S. Natural Gas Resource Base" and was a member of the National Academy of Sciences’ Committee on the National Energy Modeling System. He received an MBA degree (highest distinction) from the Wharton School, University of Pennsylvania, and a BS degree in mathematics/economics from North Carolina State University.

Brian T. Kuck, a full-time consultant with ARI, provides geologic and financial analysis on oil and gas projects. He is responsible for ARI’s Unconventional Natural Gas Production Model (MUGS) (used by US DOE’s National Energy Modeling System) and its Gulf of Mexico Natural Gas & Crude Oil Capacity and Production Forecasting Model (ARGOM). He received a BS degree in geology from Washington and Lee University and has been accepted to enter Rice University’s Jones School of Management.