OGJ Newsletter

Market Movement

Rodríguez appointment locks Venezuela to OPEC policy

In his first meeting with the press since being named president of Petroleos de Venezula SA, Alí Rodríguez Araque last week emphasized that Venezuela still firmly supports the objectives and decisions of the Organization of Petroleum Exporting Countries. Asked if Venezuela would increase its oil production to ease the country’s economic problems, Rodríguez said, "Long experience has taught us that cooperation is a key factor for maintaining stability in the oil market." Rodríguez also is secretary general of OPEC.

He was named president of PDVSA by newly restored President Hugo Chávez in an effort to return the country’s oil operations to normal (OGJ, Apr. 29, 2002, p. 5). At his press briefing, Rodríguez noted that one of the first acts by Chávez, upon his return to office after being briefly displaced by an attempted military coup, was to pledge Venezuela’s support of OPEC oil policies.

"One of the conditions for having a good role in OPEC is to have a strong economy in Venezuela. And one of the reasons for my PDVSA appointment is to support this position," Rodríguez said.

Price is right

The average price for OPEC’s basket of seven benchmark crudes recently pushed above $25/bbl, well within the group’s targeted range of $22-28/bbl, "which is where we want to see it," Rodríguez said. Maintaining cooperation on oil supplies with non-OPEC producers, especially Russia, is the key to such market stability, he said.

"We are persistently analyzing the market and even though prices are at a good level right now, we are always looking to strengthen our cooperation with non-OPEC producers, which is essential during difficult times," Rodríguez said. He added that he is encouraged by reports that US economic growth this year has been better than expected. He expressed hopes that global demand for oil will increase through 2002, although, he said, "we see the demand growth forecast as being modest."

Rodríguez earlier indicated that OPEC ministers would likely maintain the group’s current production quotas at their next meeting in June. At his press briefing, he said OPEC members will carefully assess supply, demand, and prices before making any decision, however. "We will create a difficult situation if we do not seriously take into account an analysis of the market situation before we act," Rodríguez said.

US producers hedge

Robert Morris, industry analyst for Salomon Smith Barney Inc., reported last week that most of the 24 producers he follows have taken advantage of recent high prices to hedge future oil and natural gas production against possible price drops later this year.

"Companies in our E&P coverage group, on average, have hedged nearly 50% of their estimated second and third quarter North American natural gas volumes and nearly 28% of their estimated crude oil production," he said.

Producers apparently are more bullish about prices over the longer term, however. "These same companies, on average, have hedged only 32% of their estimated fourth quarter 2002 and 7% of estimated full-year 2003 North American natural gas production. At the same time, they have hedged roughly 24% of their estimated fourth quarter 2002 and less than 4% of estimated full-year 2003 crude oil volumes," Morris said.

Budgets sag

Another clear trend emerging from first quarter conference calls to financial analysts, he said, is that most US exploration and production companies are awaiting more evidence that recent increases in commodity prices are sustainable before raising their drilling budgets for 2002. "Despite the significant uptick in natural gas and crude oil prices since the beginning of the year, E&P companies do not appear eager to increase full-year spending plans at this juncture," he said.

Initial 2002 exploration and development budgets on average are based on spot prices of roughly $22/bbl for benchmark US crudes and $3/Mcf for gas. Compared with equivalent future contract prices on the New York Mercantile Exchange of $25.10/bbl for oil and $3.20/Mcf for gas, those proposed budgets "equate to roughly 80% of after-tax operating cash flow," said Morris.

Even using Salomon’s more modest price projections of $22.75/bbl for oil and $2.85/Mcf for gas for 2002 as a whole, those budgets still amount to only 86% of the companies’ projected cash flow, he said. That doesn’t reflect a lack of geoscience personnel or "drill-ready" projects, Morris said. "Most E&P companies are indicating that they are more likely to apply any incremental excess cash flow from higher-than-anticipated commodity prices near-term to reduce debt [or] pursue acquisition opportunities to augment their future drilling inventory," he said.

Industry Scoreboard

null

null

null

Industry Trends

So far this year, US natural gas production is declining faster than first anticipated, said Raymond James & Associates Inc. in a recent report. And with this fall in gas supplies, gas prices are expected to creep higher later in the year, RJA said.

RJA had considered its earlier expectations that US gas production would fall sequentially 1.5%/quarter during 2002 as "out on a limb," which would result in a 5-6% year-over-year decline in gas production by midsummer. "About a month ago, we were surprised by our preliminary first quarter [exploration and production company] production survey that suggested…production may be down sequentially close to 2% and year-on-year down by 3%. In the past week, however, even that bullish estimate has been eclipsed by the actual production announcements from the E&P companies," RJA noted.

"We now have a statistically significant sampling of US E&P companies that tells us that not only is US gas production falling, but it is falling faster than even our bullish projections," the analyst said (see table).

RJA noted that while totals will likely change over the next few weeks as more production reports trickle in from other E&P companies, "...[I]t is becoming clear that the US is facing a major natural gas supply problem that is likely to lead to higher gas prices over the summer and a potential gas price explosion next winter."

Given that the US rig count bottomed in March, RJA said that there would be "no way" for gas production to increase in the second quarter.

POSSIBLY becoming a trend, the US rig count climbed for the third consecutive week, with an increase in drilling for natural gas, officials at Baker Hughes Inc., Houston, reported Apr. 26.

There were 766 rotary rigs working in the US and its waters during the week ended Apr. 26, up 17 from the week before, but well below the 1,212 units that were drilling during the same period last year without a falloff in activity.

Canada had 84 rotary rigs working, down 12 from the previous week, compared with 188 a year ago.

The number of active US land rigs increased by 15 to 645. The number of units working in inland waters also was up 2 to 19. Those rigs actually drilling offshore were unchanged at 102.

Of the total rigs working in the US, 634 were drilling for natural gas, up 21 from the week before. Another 130 rigs were drilling for oil, down 2. The remaining two rigs were unclassified.

Government Developments

In order to reform its natural gas market, Germany will have to make it possible for outside oil and gas companies "to secure fair and nondiscriminatory access" to the country’s gas pipeline grid in accordance with the European gas directive, said BP PLC Chief Executive John Browne during a speech Apr. 29 at Humboldt University in Berlin.

Browne added that while Europe’s gas market liberalization is providing opportunities to build positions in Germany, there are still barriers preventing companies such as BP from entering the German gas market.

"First, we need to complete the strategic move of selling our stake in Ruhrgas [AG]," Browne said. "This is not an operating investment, but a financial one, and is centered around the gas pipeline business, which is not part of our core strategy." Sale of its Ruhrgas stake, Browne said, would then pave the way for the company to increase its operating activities in energy trading and marketing in the country.

Browne said that BP welcomes the recent announcement of a task force to deliver full implementation of the European gas directive by next January.

Germany’s evolving natural gas market will play a major role in helping the country meet the greenhouse gas emissions reduction targets set by the Kyoto Protocol on global climate change, Browne said, adding that there should also be a new international dialogue to address the challenge of climate change.

"The new dialogue should have a simple goal-to set incentives which encourage all possible efforts to decarbonize the world and stabilize total emissions below the level of risk," he said.

Pakistan’s privatization commission received on Apr. 15 a total offer of $176.3 million from the highest bidders for the divestment of the government’s shareholding in nine oil and gas concessions. Total production from the concessions is more than 20,000 boe/d, or 9, 700 b/d of oil and 62 MMcfd of gas, and they contain more than 50 million boe in reserves.

The government’s stake in the Badin-I concession received the highest bid of $131.5 million, which was offered jointly by BP Pakistan Exploration & Production Inc. and Occidental Oil & Gas Pakistan LLC.

These two companies also offered the highest bid of $8.5 million for the Badin-II concession state interests. Attock Oil Co. Ltd., meanwhile, was the highest bidder for the Turkwalbid concession stake, offering $1.6 million.

The government equity in Adhi oil field received a top bid of $11.3 million from Pakistan Oilfields Ltd., while Western Acquisition Inc. made the highest offer of $532,500 for the Ratana concession state interest.

Western Acquisition also made a solo bid of $107,500 for the state’s Mazarani field stake and was the highest bidder for the Dhurnal field interest with a $3.8 million bid. Winning bids for the state equity in Pariwali and Minwal fields were $18.7 million and $201,000, respectively, from Fauji Foundation and Pyramid Energy International Inc, respectively.

Quick Takes

The US Department of the Interior’s Bureau of Land Management said Apr. 29 it will hold an oil and gas lease sale in the National Petroleum Reserve-Alaska (NPR-A) June 3 in Anchorage. The bid deadline is May 31.

About 3 million acres are being offered in the northeastern corner of the reserve, which include 298 tracts that did not receive bids in the May 1999 sale. That land will be reoffered along with one new 320-acre site in the northeastern corner of the sale area adjacent to existing state leases near the Colville River Delta.

A US Geological Survey assessment of estimated oil and gas resources in NPR-A is due to be released in mid-May and is expected to be higher than earlier calculations (OGJ Online, Mar. 28, 2002).

Elsewhere on the exploration front, a group led by ENI SPA and BG Group has made a natural gas discovery in the Sicily Channel off southwestern Sicily. Operator ENI drilled the exploration well on the Panda exploration prospect. The well, which was drilled to 20 km in 460 m of water, found a 300 m gross gas interval. On test, the well flowed a total 19 MMcfd of gas from two intervals. Flow rates were constrained by limits of the testing equipment, ENI said. Initial estimates of reserves are 300-400 bcf of gas. The discovery, the first to be drilled by the consortium, lies on the ENI-operated G.R14.AG license. BG Group has a 37.5% interest in the license, ENI 37.5%, and Edison SPA 25%. The consortium has rights to acreage totaling 2,400 sq km in this area. That gas could be earmarked for delivery into the Italian market. BG plans to build a $300 million LNG receiving terminal in Brindisi on the southeastern coast of Italy. Plans call for the terminal’s first 4 billion cu m train to come on line as early as 2006.

Morocco’s national oil company, Office National de Recherches et d’Explorations Pétrolières, has entered into two contracts with Petronas Carigali Overseas Sdn. Bhd.-a unit of Petronas Carigali Sdn. Bhd.-for reconnaissance of an onshore area in Morocco’s Missour basin and offshore in the Rabat Safi Haute Mer area. The contracts will lead to the granting of reconnaissance licenses by the Moroccan Ministry of Energy. Under terms of the contracts, Petronas Carigali will carry out field work and associated geological and geophysical works in the two areas.

Devon Energy Corp., Oklahoma City, and Petro-Canada, Calgary, have announced significant natural gas flows at their Tuk M-18 well 15 miles south of Tuktoyaktuk in the Mackenzie Delta of Canada’s Northwest Territories. The well was drilled to 9,850 ft into the Cretaceous Kamik sands. M-18 was tested at restricted rates of up to 30 MMcfd of natural gas and has estimated reserve potential of 200-300 bcf. It has estimated sustied deliverability of 60-80 MMcfd. Devon and Petro-Canada hold a 50:50 equal ownership in the Devon-operated well as part of the companies’ multiyear Mackenzie Delta partnership.

The Federal Energy Regulatory Commission has approved two gas pipeline proposals made by units of Williams Cos. Inc., Tulsa, that will serve the US West Coast.

Northwest Pipeline Corp. received a certificate to construct and operate natural gas pipeline facilities in Thurston and Grays Harbor counties, Wash., valued at $75.2 million. Much of the gas from the project will fuel a 650 Mw electric power plant under construction in Grays Harbor, FERC said.

In a separate action, Kern River Gas Transmission Co. won approval to build a $28.9 million lateral pipeline northeast of Los Angeles. The line will transport gas to a 720 Mw electric power plant under construction near Victorville, Calif.

A lack of gas pipeline capacity to the state was a contributing factor to California’s gas and power price spikes of the past 2 years (OGJ, Feb. 12, 2001, p. 70). FERC officials said the environmental impact from construction of the two lines "would be minimal."

El Paso Energy ParTners Co. LP has entered into an agreement with Pioneer Natural Resources Co. and Mariner Energy Inc. to construct, install, own, and operate a new production hub platform and associated facilities for Falcon field on East Breaks Blocks 579, 580, and 623 in the Gulf of Mexico. Pioneer will serve as operator of the field.

El Paso anticipates that the new platform, dubbed Falcon Nest, will be completed and on line in first quarter 2003. The company also will construct and own about 20 miles of 18-in. pipeline connecting the platform to an offshore natural gas gathering system. Falcon Nest will be installed in 390 ft of water on Mustang Island Block 103 and will have an initial design capacity of 300 MMcfd of natural gas. In addition to Falcon field blocks, Pioneer and Mariner are dedicating nine blocks in the area for Falcon Nest processing and gathering.

"Falcon Nest…will be built with the expansion capability to attract the development of additional natural gas discoveries from this new production area," said Robert G. Phillips, CEO of El Paso Energy Partners.

In other development action, ExxonMobil Corp. subsidiary Mobil Equatorial Guinea Inc. has awarded a contract valued at $100 million to FMC Technologies Inc. unit FMC Energy Systems for subsea systems to be installed in 1,411-2,625 ft of water off Africa. The systems are for ExxonMobil’s Zafiro Southern Expansion area project off Equatorial Guinea. The contract calls for the supply of 19 subsea trees, five hinge-over subsea templates and production manifold systems, a water injection manifold, topsides and subsea control systems, and related equipment and services. Equipment deliveries and installation activities commenced in March. Subsea systems for future delivery will be produced at FMC Energy Systems’ facilities in Houston and Kongsberg, Norway.

PLUSPETROL SA, operator for the Camisea upstream consortium (OGJ, Apr. 8, 2002, p. 9) said partners of the Camisea natural gas project in Peru plan to build a $120 million natural gas liquids fractionating plant at a beach in Pisco, Paracas province, on Peru’s south coast.

About $90 million of the facility costs will be for the fractionation plant and storage tanks, and $25-30 million will be employed for a loading terminal. Construction is expected to begin by yearend, with gas production scheduled to start up by mid-2004. In the first stage, the consortium will complete the land purchase and prepare an environmental impact study to present to Peru’s minister of energy and mines.

Norberto Benito, Pluspetrol’s general manager, said the fractionation plant will be built away from the Paracas Bay natural reserve, and only the terminal would be in the sea. He added that similar installations, including a crude oil and refined products terminal, are already operating in the area of the proposed facility.

Liquids will be piped to the plant for separation from the Camisea gas fields production center at Las Malvinas on the Urubamba River.

CHEVRON PRODUCTS CO. has introduced a lower-emissions fuel for diesel engines that is available in limited quantities to its commercial customers in Southern California. The California Air Resources Board has verified the technology’s emission results showing particulate matter (PM) reductions of 63% and nitrogen oxides (NOx) reductions of 14%. Chevron is using the technology through an agreement with Lubrizol Corp.

Chevron said the fuel reduces emissions from most existing-design diesel engines without hardware add-ons, engine modifications, or replacements. It is a "water-in-fuel" diesel blend that utilizes Lubrizol’s proprietary technology to lower PM and NOx emissions in diesel engines. The fuel is created using a high-speed blending process that creates water droplets less than 1 micron in size. Additives encapsulate the droplets and prevent them from coalescing, making them "invisible" to the engine while improving combustion, to reduce emissions.

Initially available to commercial accounts at Chevron’s Montebello, Calif., terminal, the product is marketed to customers with centrally fueled fleets or equipment, including buses, waste management fleets, agricultural-construction equipment, and stationary power generators.

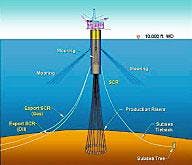

THE DEEPSTAR concept engineering and cost analysis recently completed by Halliburton Co.’s engineering unit, KBR, for a spar deep-draft caisson vessel (DDCV) has determined that such variables as hull vortex-induced vibration (VIV) and the type of mooring system materials chosen can drastically affect total costs associated with ultradeepwater spar construction and maintenance.

"The study assessed technical aspects of the major riser and mooring system alternatives rigorously and quantified the cost savings, including sensitivities for uncertainties related to hull VIV response," said Shankar Bhat, KBR’s project manager.

"We discovered that total system costs in 10,000 ft water depth are significantly impacted by [a] synthetic mooring system, uncertainties in hull VIV response, single-casing risers with [a] split tree, or combinations of these," he said. "It is possible to achieve step reductions in total system cost. Some of the findings were unexpected," he said.

KBR reviewed options for mooring system and riser design for a spar DDCV supporting a very large topsides and having a large number of risers that would work in ultradeep water on a high-pressure, high-temperature reservoir (OGJ Online, Nov. 1, 2001).

The 6-month study was commissioned by the joint industry project DeepStar, a consortium of 15 oil companies and 48 service companies. DeepStar said it intends to begin studies in May or June on the next phase of the research.

In other production news, three groups of independents have recently brought on stream new oil and natural gas production from three blocks on the Outer Continental Shelf in the Gulf of Mexico, reported interest owner Magnum Hunter Resources Inc., Irving, Tex. The blocks are East Cameron Block 184, South Timbalier Block 274, and Eugene Island Block 397. Two new wells were brought on line on EC Block 184, which lies 100 miles southwest of Iberia, La., in 90 ft of water. The wells are producing from 11,500 ft at an aggregate rate of 36 MMcfd of gas and 1,050 b/d of oil. Magnum Hunter holds a 30% interest in the two wells and three leases, which include Blocks 179, 184, and 185. Dallas-based Remington Oil & Gas Corp. serves as operator, with a 57.5% working interest, while Wiser Oil Co., also of Dallas, holds 12.5% interest.

One new well was placed on production from a depth of 12,500 ft on ST Block 274, which lies in 260 ft of water 90 miles south of New Orleans. The well is flowing 10 MMcfd of gas and 1,056 b/d of oil. Operator Spinnaker Exploration Co., Houston, holds 90% interest, while Magnum Hunter has 10%. The two companies also plan to drill an exploration well on ST Block 275, using the same drilling rig, which was skidded on the platform. Both companies hold equal interest in that block. On EI Block 397, the A-1 well was completed and is flowing 1,000 b/d of oil and 444 Mcfd of gas. EI Block 397 is 140 miles south of Iberia in 470 ft of water. Meanwhile, the A-2 well is in the process of completion, Magnum Hunter said. "There are plans to drill up to five additional wells from the 12-slot platform during 2002," the company added. Houston-based W&T Offshore Inc., with 50% interest, operates the block. Magnum Hunter holds 12.5% interest in the block, while Remington holds the remaining 37.5%.