OGJ Newsletter

Market Movement

IEA: Oil markets' response to supply outages muted

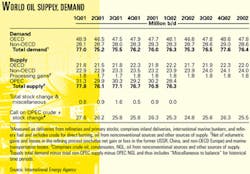

Despite Iraq's Apr. 8 announcement of a 30-day suspension of oil exports and turmoil at Petroleos de Venezuela SA in Venezuela, the oil market has responded in a muted fashion, according to the International Energy Agency, because such events were already incorporated into a "geopolitical risk premium."

Since February, such a premium has centered on conflicts in the Middle East, and until a few weeks ago, most of it was due to the threat of a US-led war against Iraq. Subsequently, in late March the focus shifted to the Israeli-Palestinian conflict.

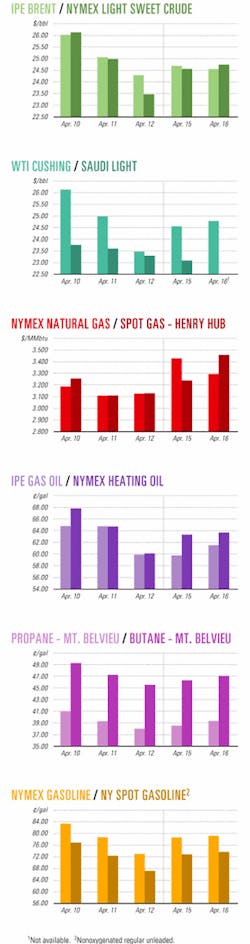

This geopolitical risk premium combined with strengthening oil market fundamentals to increase oil prices $7-8 between the last week in February and the first week in April. Since then prices have retreated slightly. The fundamentals driving the price strength are the US economic recovery, falling US product inventories, strong gasoline demand in the US, and reduced supply from the Organization of Petroleum Exporting Countries.

Adding to the surge in prices, since early February speculators have shifted from a significant net short position for oil on the New York Mercantile Exchange to an even larger net long position, said the Paris-based agency. With the exception of gasoline, product price increases in March lagged those of oil. In the US and Europe, fundamentals led gasoline price gains to outpace crude price gains, while heating oil and gas oil prices were relatively weak worldwide at the close of an unusually warm winter in all three regions of the Organization for Economic Cooperation and Development (OECD).

Refining margins during March strengthened in the US, weakened in Singapore, and were little changed in Europe. US refiners-which produce more gasoline than refiners elsewhere-benefited the most from widening gasoline-to-crude spreads. "Improved margins also reflect the impact of the run cuts that have taken place, as well as lower product inventories. The US is where most of the OECD inventory overhang has been, and the rebalancing process there appears to be well under way," IEA commented.

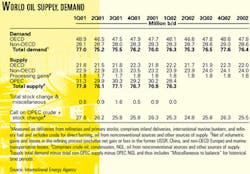

Production

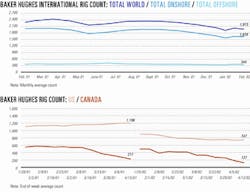

Preliminary estimates indicate that worldwide oil production in March was unchanged from the previous month at 76.3 million b/d. Lower supply from non-OPEC oil exporters offset production gains from the OPEC 10 (excluding Iraq), which increased output 440,000 b/d. Saudi Arabia led this increase with a 240,000 b/d jump from February.

Non-OPEC supply declined 480,000 b/d last month. The largest reduction came from Norway, which lowered output an estimated 320,000 b/d in line with its pledge to reduce first quarter production. IEA noted that early indications suggest Norway met its target by shutting in some North Sea fields. US crude production in March declined 20,000 b/d to 5.88 million b/d, although Alaskan production was unchanged from the previous month.

The agency increased its non-OPEC production growth forecast for 2002 by 80,000 b/d to 1.04 million b/d, with the majority of the revisions coming from non-OECD, notably Russia, China, Brazil, and Angola. The forecast for Canadian production is now lower due to stagnant crude output from Alberta and Saskatchewan, and IEA continues to lower its UK supply forecast due to weaker-than-expected January production. In the Netherlands and Italy, the production forecast has increased following the smooth start-up of new fields.

Industry Scoreboard

null

null

null

Industry Trends

Major oil companies are continuing to step up their investment in alternative fuel initiatives.

ChevronTexaco Technology Ventures (CTV) announced that one of its units, Analytic Energy Systems LLC (AES), will acquire certain assets from Odessa, Fla.-based Dais-Analytic Corp.'s (DAC) fuel processing and fuel cell group for an undisclosed sum. AES is a new subsidiary of ChevronTexaco Corp.

AES will acquire DAC's Woburn, Mass., facility, which develops and commercializes fuel reforming technology and fuel cell systems integration technology. DAC is a privately owned energy technology company based in Odessa, Fla.

"The ability to convert or process readily available hydrocarbons into hydrogen is a critical step in enabling widespread commercialization of fuel cells," said Greg Vesey, president of CTV.

CTV will develop and commercialize new and emerging energy technologies, including fuel cells, fuel processing systems, hydrogen storage and infrastructure, hydrocarbons-to-liquids, and advanced batteries, ChevronTexaco said.

The latest natural gas storage injection data suggest a slightly tightening market despite a storage overhang left over from the heating season during what is normally a seasonally slack period. However, analysts still point to the likelihood of near-term downward pressure on gas prices.

Injections into storage were expected to reach 15-27 bcf for the week ended Apr. 12, according to projections by Oklahoma City-based consulting firm C.H. Guernsey & Co. in an Apr. 15 report. In fact, industry injected 10 bcf into storage for that week, noted UBS Warburg in an Apr. 18 research note following the release of American Gas Association's weekly storage survey.

Guernsey noted, "This makes the first week of net injections following a mild 2001-02 heating season." The estimation is based on the firm's econometric model of gas storage injections and withdrawals. Guernsey's storage level estimate at the beginning of the injection season put the level of gas in storage 104% above the storage level 1 year prior, the company said.

At its current storage levels, industry is "getting a 6-week head start on the injection season," said Donald Murry, vice-president and economist with Guernsey. "If we do not have abnormally warm weather in the key areas using gas for the air conditioning load, the market fundamentals of this supply in storage will help hold down prices during the summer."

But unseasonably warm weather in the US Northeast put a bullish-if perhaps short-lived-spin on the market outlook for natural gas prices.

UBS analyst Ronald Barone said that the net injection of 10 bcf for the week ended Apr. 12 reflected a 2 bcf withdrawal in the East, a 6 bcf injection in the "producing" region, and a 6 bcf injection in the West.

"Though the week's light injection could suggest a tighter market, 1 week's data do not make a trend, and we would still not rule out an actual loosening in near-term supply-demand dynamics as price elasticity reemergesellipseand incremental LNG shipments reach our shores," Barone said.

Government Developments

Industry is cooperating with the US government to exploit a massive unconventional gas resource in the Gulf of Mexico: gas hydrates.

A joint venture of ChevronTexaco Corp., the National Energy Technology Laboratory, and the US Department of Energy will team up for the Gulf of Mexico Gas Hydrates Joint Industry Project (JIP), which will study naturally occurring gas hydrates in the gulf.

"This multiphase, multiyear project will develop technology to assist characterization of deepwater hydrates, to better understand their effect on sea floor stability, and to develop safe and efficient drilling and coring protocols in naturally occurring gas hydrates," the JV said.

Phase I of the JIP will include the collection and analysis of data, which will be compiled into a database. Phase II will involve the drilling and sampling of the areas in the database that show naturally occurring hydrates.

The JV will simultaneously host two workshops in Houston May 9-10 to discuss the JIP. The first workshop will cover drilling, coring, and core analysis, and the second, modeling, measurements, and sensors. Each workshop will then have three breakout sessions to discuss topics in more detail.

In a more conventional Gulf of Mexico exploration initiative, the US Minerals Management Service issued a final notice for western Gulf of Mexico Lease Sale 184, scheduled for Aug. 21 in New Orleans.

The sale will offer 4,085 unleased blocks covering 22.2 million acres off Texas and in deeper waters off Louisiana. The offered blocks are 9-250 miles offshore in water depths of 8-3,000 m. Of these, there are 1,875 blocks in water depths of 800 m or greater.

The final notice includes a number of incentives targeting deep-pay and deepwater oil and natural gas production, MMS said (OGJ Online, Nov. 21, 2001). One such measure affords the suspension of royalties for the first 20 bcf of gas production from a well drilled 15,000 ft or deeper below sea level.

The deep gas initiative applies to new leases in less than 199 m of water and does not apply to oil production. The incentive ends for a year if natural gas prices trigger a $3.50/MMbtu price limit, MMS said.

Gaz de France and TotalFinaElf SA have made offers to the French government to buy the interests in certain gas pipeline systems that they don't already own. GdF has made an initial payment of 176 million euros for the state's 30% stake in Gaz du Sud-Ouest (GSO) and for the state's 70% interest in Cie. Fran

The final amounts to be paid-which is yet to be established by a commission set up for this purpose-must be handed in by Sept. 30. It will include not only the actual price of the gas lines but other assets, as well as account for future pipeline revenues. The final purchase price of the lines will be reduced by the indemnity due to France for early costs related to ending the state's pipeline monopoly concessions, which is scheduled to occur generally by 2017.

Quick Takes

ANOTHER NEW-GENERATION tanker is being readied to join the Polar Tankers fleet in Alaska.

Phillips Petroleum Co. has christened its third Millennium-class tanker, the Polar Discovery, which is slated to carry crude oil from Alaska to the US West Coast. The tanker was christened Apr. 13 in New Orleans.

The contract cost of the Polar Discovery was $168 million. Polar Tankers Inc.-the shipping unit of Phillips Alaska Inc.-is having five of these double-hulled tankers built for the Alaska trade in compliance with the US Oil Pollution Act of 1990.

The first tanker, the Polar Endeavour, arrived in Valdez, Alas., on its maiden voyage in July 2001. This summer, the Polar Resolution is slated to enter the Alaska trade. The Polar Discovery is scheduled to join the Polar Tankers fleet in 2003 (OGJ, Sept. 18, 2000, p. 9).

The Polar Adventure will be delivered in late 2004, followed by the fifth ship, the Polar Enterprise, in 2005.

Kevin Meyers, executive vice-president of Alaska production and operations for Phillips and president of Phillips Alaska, said, "Alaska is one of Phillips's legacy assets, and we plan to maintain daily production there at 375,000-400,000 boe for the foreseeable future."

Each of the five tankers will hold just over 1 million bbl of cargo at full capacity.

UNOCAL CORP. subsidiary Unocal Rapak Ltd. has reported strong oil and natural gas flows from an appraisal well in the deepwater Ranggas oil field off Indonesia.

"The test results are another step towards commercializing our third deepwater oil field in Indonesia," said Brian Marcotte, president of Unocal Indonesia Co. The company plans to spud the Ranggas-5 appraisal well, also on the main Ranggas structure, before the end of April.

The Ranggas-4 appraisal well flowed on test a a rate of 8,158 b/d of oil and 6.4 MMcfd of natural gas from a single interval at 10,174-10,224 ft true vertical depth subsea (TVDS). The drill stem test had flowing tubing pressure of 1,223 psi through a 56/64-in. choke.

The test rates were constrained by equipment, but initial production rates from a well producing from this single zone are estimated at 10,000 b/d of oil and 8 MMcfd of gas.

The Ranggas-4 well encountered 181 ft of net oil pay and 57 ft of net gas pay. The well was drilled in 5,208 ft of water to TD at 11,252 ft TVDS. The well is 2.4 miles north of the Ranggas-1 discovery well and 1.2 miles south of the Ranggas-3 appraisal well (OGJ Online, Sept. 4, 2001).

With the results of the Ranggas-4 well, Unocal estimates the gross discovery volume for the main Ranggas structure at 200-350 million boe, with additional potential on other prospects on the same trend. Earlier, Unocal had estimated the unrisked exploration potential of the entire Ranggas complex at 350-650 million boe.

Unocal also reported on two wells drilled recently to test structures on both the northern and western parts of the large central Ranggas prospect.

The Ranggas Utara-1 well encountered 33 ft of net oil pay and 44 ft of net gas pay. The well was drilled in 5,258 ft of water to TD at 12,650 ft TVDS. The well is 2.5 miles north of the Ranggas-3 well. Although deemed subcommercial as an independent development, this accumulation demonstrated the potential for additional hydrocarbons to be found north of Ranggas field.

The Ranggas West-1 well encountered 85 ft of net gas pay in two intervals. The well was drilled to 9,955 ft TVDS in 4,483 ft of water. The well is 2.9 miles west of Ranggas-3.

In other exploration news, Forest Oil Corp., Denver, announced the Redoubt No. 4 delineation well in Redoubt Shoal field was drilled to 20,203 ft, making it the deepest deviated well drilled in the Cook Inlet of Alaska. Designed to determine the downdip limit of the field, Redoubt No. 4 extended the deepest known oil pay by 50 ft without encountering the oil-water interface. Forest estimated oil reserves in Redoubt Shoal to be at least 100 million bbl (85 million bbl net).

The well encountered the Hemlock formation at 18,872 ft and logged 229 ft of net oil pay. Forest currently is completing the well, which also encountered 589 ft of net natural gas pay in multiple shallow sands. This discovery will be further delineated during development drilling. Forest plans to spud the Redoubt No. 5 within the next month to define the western limit of the oil accumulation and to further delineate the extent of the natural gas field. Forest confirmed that the Redoubt Shoal field development is on schedule for first production by yearend, subject to regulatory approval. Forest owns 100% of Redoubt Shoal field. The Redoubt No. 4 delineation well, along with drilling in other regions, has enabled Forest in the first quarter of 2002 to more than replace its currently forecasted production for the entire year.

Marathon Canada Ltd., a wholly owned subsidiary of Marathon Oil Co., has plugged and abandoned its Annapolis B-24 deepwater exploratory well l off Nova Scotia following a gas kick at an intermediate well depth of 3,500m. "Following a detailed analysis of both the event and the condition of the wellbore," Marathon said, "the company has elected to plug and abandon the Annapolis B-24 well for mechanical reasons." The Annapolis B-24 well is 215 miles south of Halifax in 5,700 ft of water. Marathon is working with its project partners to evaluate alternatives for further drilling on the Annapolis prospect in order to examine its potential, and a decision is expected shortly. Marathon operates the Annapolis prospect, in which it holds a 30% interest. Partners are EnCana Corp. 26%, Norsk Hydro Canada Oil & Gas Inc. 25%, and Murphy Oil Co. Ltd. 19%.

THE AL JUBAIL petrochemical complex owners have outlined expansion plans.

Chevron Phillips Chemical Co. LLC (CPChem) and Saudi Industrial Investment Group (SIIG) announced a $1 billion addition to their existing petrochemical complex in Al Jubail, Saudi Arabia.

Start-up is expected in 2006. A benzene unit will be expanded, while units for new products at the complex will be added that include ethylbenzene, styrene, and propylene. The styrene unit capacity will be 600,000-700,000 tonnes/year, and capacities of the other planned units were not disclosed.

The participants expect that most of the styrene will be exported from the Persian Gulf region. Other products and coproducts will be marketed locally.

CPChem is a joint venture of ChevronTexaco Corp. and Phillips Petroleum Co. CPChem produces olefins and polyolefins and supplies aromatics, alpha olefins, styrenics, and specialty chemicals.

SIIG is a consortium of several Saudi companies focused on industrial investment in the petrochemical industry.

"Our strategy has been to build world-scale facilities with access to advantaged feedstocks and large, growing markets," said Mike Parker, CPChem's senior vice-president, aromatics and styrenics.

The existing Saudi Chevron Phillips facility, which started up in 2000, currently produces benzene, cyclohexane, and gasoline. CPChem and SIIG recently announced a 60,000 tonne/year expansion of the cyclohexane unit.

ROYAL DUTCH/SHELL GROUP unit Shell Gas & Power has secured initial supplies for its proposed LNG regasification terminal in Costa Azul, in the municipality of Ensenada, Baja California, on Mexico's West Coast.

Shell did not identify the sources of the initial supply of 7.5 million tonnes/year for the project, other than to say the sources were in the Asia-Pacific region.

The terminal, which will have a send-out capacity of as much as 1.3 bcfd, is scheduled to come on stream in 2006. Investment costs are estimated at $500 million.

Shell will market the gas to power plants and other potential customers in Baja California and will sell surplus gas to Southern California.

Shell Gas & Power Director Jon Chadwick said, "The development is significant in that it furnishes a supply of LNG to the new terminal, providing Mexico a new supply of gas to meet the growing energy demands of Northwest Mexico, whilst providing an outlet to market the surplus gas to the United States."

Shell said it will consult with local communities and relevant authorities on the environmental and social impact of the planned development.

SUNCOR ENERGY INC. shut down its Millennium oil sands project hydrogen unit earlier this month to replace a leaking gasket that led to a small fire Apr. 9.

The outage of this hydrogen unit-one of two at the oil sands plant-took about 10 days and is expected to reduce average production in April to about 180,000 b/d. There were no injuries, and the hydrogen unit sustained only minimal damage.

The unit generates pure hydrogen that removes sulfur and nitrogen, allowing sour crude oil to be upgraded into sweet crude oil. Suncor used the downtime to bring forward other opportune maintenance work.

Late last year, after commissioning its Project Millennium expansion, Suncor anticipated production challenges during the first 6 months as the company fully integrated its new facilities with base plant production. Since January, the company has seen a steady improvement in production, which during Apr. 1-9 averaged more than 220,000 b/d.

A DUKE ENERGY unit has awarded a contract for construction of the 1,240 Mw natural gas-fired Hanging Rock combined-cycle cogeneration power plant in Hamilton Township, Lawrence County, Ohio.

Duke Energy North America (DENA) let a turnkey engineering contract to Duke/Fluor Daniel for the engineering, procurement, and construction contract. The contract amount was not disclosed.

Construction of the facility was approved late last year (OGJ Online, Oct. 9, 2001). The new plant will contain two sets of 7 FA combustion turbine generators operating in combined cycle with two D11 steam turbine generators.

The plant will help to "serve North America's energy appetite-which is continuing to grow at a baseline rate of 1-2%/year," said Jim Donnell, DENA president and CEO.

Commercial start-up of the facility is slated for third quarter 2003; it will connect to American Electric Power Co. Inc.'s Hanging Rock substation.

BP PLC reported that the Clovelly-Alliance-Meraux (CAM) pipeline was expected to return to operation last week.

The pipeline leaked about 1,800 bbl of crude oil into Little Lake, near Clovelly, La., on Apr. 6. A BP spokesman said 90% of the spilled oil had been recovered or had evaporated by Apr. 17. The US Coast Guard was continuing its investigation of the spill. BP believes a tugboat struck the line, the spokesman said.

"We are in the process of starting the line," he said, adding that it was expected to be in operation by Apr. 18 at the latest.

The US Coast Guard previously reported that scare cannons were used to help keep birds away from the oil, and that professional wildlife rehabilitators are on the scene to recover any affected birds. One rail died of oil contamination.

The pipeline delivers light crude from the Louisiana Offshore Oil Port to Murphy Oil Co.'s Meraux, La., refinery and Phillips Petroleum Co.'s Alliance refinery near Belle Chasse, La. The damaged CAM pipeline has had little effect upon those refineries, because they receive additional supplies from other sources. BP operates the pipeline and owns 70%, while Murphy Oil owns 30%.

Correction

The size of Crowley Marine Services Inc.'s Orlan concrete island drilling structure was misreported (OGJ, Apr. 1, 2002, p. 9). The structure is 312 x 312 ft square.