Resource studies indicate large gas potential in Bangladesh

Substantial oil and gas resources can have a far-reaching impact on any nation and its citizens. Development of these hydrocarbons in a cost-effective, efficient, and environmentally sound manner can lead to a higher standard of living, foster strong economic growth and progress, provide enhanced employment opportunities, and significantly expand the country's use of advanced technologies.

An in-depth assessment of the nation's resource base is essential to:

1. Maximize the value and potential of these hydrocarbon resources, and

2. Formulate an appropriate energy development policy that enables the petroleum industry to fuel the country's social and economic growth.

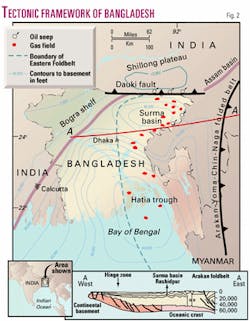

With an area of 207,000 sq km and only 64 exploration wells drilled to date, Bangladesh ranks as one of the world's most significant, underevaluated hydrocarbon provinces.1 2 Bangla- desh comprises one of the largest fluviodeltaic-slope fan complexes in the world-the Bengal Fan. Most exploration has been conducted in eastern Bangladesh; the western part and offshore areas are relatively underexplored with limited seismic and drilling (Fig. 1).In this two-part article, the authors review various studies of Bangladesh's natural gas reserves and its resource potential that have been conducted by Petrobangla, the state oil company of Bangladesh, and other entities. As shown here, these evaluations provide sound facts about the size of Bangladesh's gas reserves and resource potential.

Petroleum systems

A countrywide assessment begins with an understanding of the regional geology and the petroleum systems that contribute to the resource base.

The Bengal basin of Bangladesh consists of two major tectonic and sedimentological regimes: the western platform shelf (the Bogra shelf) and the eastern Bengal foredeep (Fig. 2).

The Bogra shelf constitutes a passive margin setting characterized by a series of prograding shelf breaks. The carbonates of the Eocene shelf edge or Hinge Zone form the prominent shelf break that separates the Bogra shelf from the Bengal foredeep.4

The western Bengal foredeep is characterized by an extensional tectonic regime, while the eastern portion is characterized by wrenching in a compressive foldbelt regime. The Tangail-Tripura high further divides the Bengal foredeep into two sub-basins: the Surma basin to the north and the Hatia trough to the south.2

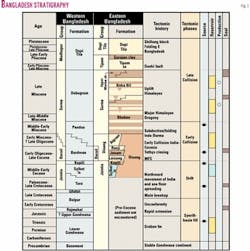

The Bengal basin, with a maximum sediment thickness of over 20 km, was deposited during four major tectonic stages of basin development. The stratigraphy of eastern and western Bangladesh along with the tectonic history and phases are described in Fig. 3.

The Bengal basin can be divided into three main petroleum systems: the Surma and Hatia systems that contain all discovered and producing hydrocarbon accumulations in Bangladesh and the Bogra system in western Bangladesh that has yet to be effectively explored (Fig. 4). The Bogra system can be further subdivided into three systems, bringing the countrywide total to five.5

The Surma petroleum system includes the Surma basin and a portion of the eastern foldbelt north of the Tangail-Tripura high. This system is characterized by Plio-Pleistocene to Recent compression and folding which created traps in upper to middle Miocene sandstone reservoirs. The hydrocarbon source is primarily from middle Oligocene Jenam shales with fair oil potential, which have generated gas with condensate yields as high as 20 bbl/MMscf. Additional source rock contributions are predicted from the lower to middle Miocene Bhuban shales (Fig. 3).

The Hatia petroleum system includes the Hatia trough and a portion of the eastern foldbelt south of the Tangail-Tripura high. This system is also characterized by Plio-Pleistocene to Recent compression and folding that created traps in the upper Miocene to Pliocene age. The hydrocarbon source is most likely the gas-prone Miocene Bhuban shales, which have generated natural gas with minimal condensate yield.

The Bogra petroleum system, which remains to be effectively explored, includes the western shelf, slope, and basinal area of the Bengal foredeep, which are characterized by extensional tectonics in a passive margin setting and underlain by continental crust (Fig. 4). The petroleum system of the western platform shelf is characterized by potential stratigraphic buildups and fault blocks, creating traps ranging in age from Paleozoic through Miocene sediments. The hydrocarbon sources are considered to be the Gondwana coals and Paleo-Eocene carbonates and shales (Fig. 3).

The rest of the Bogra petroleum system is most likely sourced from good oil-prone Paleo-Eocene Cherra-Sylhet-Kopili shales and carbonate in the slope area and Oligo-Miocene Barail-Surma shales in the basinal area. The trap types range from extensional faulting with rollover anticlines to stratigraphic traps in turbidite and slope fan complexes.

Analogies from around the world document the main trap types in deltaic complexes as extensional faulting and rollover anticlines. Given the high sedimentation rates for the Bengal delta and slope fan complex, these trap types may contribute significantly to Bangladesh's resource base.

Two key factors-an attractive variety of plays with Paleocene-Eocene oil prone potential source rock and a considerable portion of the sedimentary column (from Permian to Neogene) that is accessible for testing-indicate the Bogra system could be Bangladesh's highest potential petroleum system that needs to be effectively explored.

Resource base

Based on the existing technical and knowledge database, Bangladesh's resource base can be divided into three main categories:6 Existing field discoveries, field growth, and new field discoveries.

1. Field discoveries-consists of prior production and estimates of reserves in existing fields. The most recent estimation study, "Bangla- desh Petroleum Potential and Resource Assessment 2001," was prepared by the Hydrocarbon Unit (HCU) of Bangladesh's Energy and Mineral Resource Division and published in January 2002. According to HCU, the proved plus probable ultimate recoverable gas (URG) reserves estimate for Bangladesh's 22 existing gas fields is 20.44 tcf (Table 1).

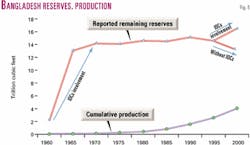

As of June 2001, cumulative production totaled 4.3 tcf from 13 fields, leaving 16.14 tcf in proved plus probable reserves remaining countrywide. The remaining gas reserves would have been less than 12 tcf if the international oil companies (IOCs) had not been invited to participate in Bangladesh's first exploration bid round in 1993 (Fig. 5). HCU also estimated an additional 8.03 tcf of possible reserves from existing fields.

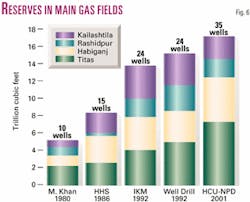

Titas, Habiganj, Kailashtila, and Rashidpur fields are four of Bangladesh's largest fields. Combined they contain more than 55% of the country's total reserves and the majority of its development wells.

By reviewing the development of the four fields based on comparisons with previous Petrobangla studies7-10 and HCU's recent study,11 it is clear (Fig. 6) that reserves have increased significantly from initial estimates in 1980. This rise is due to the extension of reservoirs and field limits as more development wells were drilled from the existing 2D database, without the use of selected, advanced technologies that can dramatically affect field reserves growth.

2. Field growth-Most of Petrobangla's gas fields have not been fully appraised as a majority of the development/appraisal wells were drilled in the central part of the structure and have not been optimized through the use of 3D seismic surveys.

At the same time, major gas fields such as Titas and Habiganj have produced for many years without any significant pressure drop or water production. For example, the initial estimate of URG at Titas field was 2.1 tcf in 1992. This field has produced 1.9 tcf-or about 90% of its initial URG estimate-during the past 32 years with little pressure drop and no increase in water production. In Titas field, three recently drilled step-out wells still have shown no gas-water contact.

The application of new technologies and enhanced recovery techniques within existing gas fields can further increase reserves significantly. To estimate the field growth potential of Bangladesh, only Petrobangla-operated fields were considered since most of Petro- bangla's fields were developed without the use of selected, advanced technologies. Based on the HCU assessment, the total proved plus probable URG in Petrobangla-operated fields is approximately 16 tcf.

The selected, advanced technologies that can significantly impact field reserves growth in Bangladesh are:6

- 3D seismic surveys.

- Petrophysical thin bed analysis.

- Compression.

- Reservoir management.

The application of these technologies is documented around the world and has demonstrated an overall increase in reserves from a hydrocarbon basin, trend, and petroleum system perspective. Petrobangla has also recognized growth potential in existing fields due to application of these technologies.3

3D seismic surveys

3D surveys have had major positive impacts industrywide on exploration success rates, finding costs, reserves replacement, and field reserves growth when integrated with geological and engineering data. One case history documented the effect of the application of 3D seismic data on field growth at 76 top-producing fields, 42 of which were fully covered by 3D seismic. For those 42 fields, the average field growth through positive annual reserve revisions was more than twice the average for all 76 fields.12

Additionally, 3D seismic data promote field growth by identifying high risk versus low risk well locations and identifying new low risk well locations previously undetected. Also, 3D seismic is effective in optimizing well locations to encounter intervals with higher net pay counts, critical to improved production performance in complex depositional systems with reservoir heterogeneities as found in the Bengal basin.

Unocal acquired the first and only 3D seismic survey in Bangladesh over onshore Bibiyana field in 1999 during field appraisal. With 2D seismic and wells, Bibiyana's proved plus probable reserves were estimated at 2.1 tcf. After analysis with 3D seismic, the field's estimated proved plus probable reserves rose over 10% to 2.4 tcf even before drilling optimized 3D wells. Possible reserves-estimated at 3 tcf-were made with greater confidence due to a better understanding of the reservoirs' heterogeneities since Bibiyana-like most of Bangladesh's gas fields-is dominated by fluvial, tidal, and overbank facies.

So, the overall potential growth to Bangladesh's proved plus probable reserves base through 3D seismic is estimated at a conservative 3.2 tcf, 20% of the proved plus probable URG of 16 tcf in Petrobangla-operated fields.

Thin bed analysis

Continued identification of thin bed pay zones will increase Bangladesh's proved plus probable reserves base. The presence of thin bed pay zones in existing fields was recently confirmed from two petrophysical approaches.

The first approach used new high-resolution wireline resistivity tools in recently drilled wells that can detect significant zones of thin-bed pays exemplified by such fields as Bibiyana and Rashidpur. Conventional log analyses documented 122 m of total maximum net pay for Bibiyana. However, analysis of the same borehole with thin bed logging tools increased the total net pay over 250% to 324 m.

The existence of thin bed pay zones in other fields of the Surma basin was also confirmed in Petrobangla's Rashidpur field.13 The Rashidpur well No. 5, considered noncommercial using conventional analysis, became commercial by using thin bed technology to identify additional reservoirs. The well, producing from thin bed pay since early 2000, produces 18 MMcfd.

The second approach applied newer analytical techniques to older well log suites that include dipmeter data on previously drilled wells and also detected the presence of significant thin bed pay potential in all four wells at the Kailashtila field; the actual increase is pending final evaluations.

Recognizing that thin bed pays may not exist in every field, the overall potential growth to Bangladesh's proved plus probable reserves base is conservatively estimated at 4.8 tcf, 30% of the proved plus probable URG in Petrobangla-operated fields of 16 tcf.

Gas compression

Compression is a proven technological application that will establish an element of reserves growth limited only by the economic tradeoff of the increasing cost of lowering the abandonment pressure. However, where contractual delivery pressures are high as in Bangladesh, reserves added through compression are often considered as proved undeveloped because compression is almost certainly commercially viable.

Current reserve totals for all of Petrobangla's gas fields are based on depletion down to an average abandonment wellhead pressure of 1,100 psi. This pressure is determined from the delivery line pressure of the pipeline, allowing for pressure losses through the gas treatment plant and flowlines. By installing compression between wells and pipelines, the abandonment wellhead pressure can be reduced to 300 to 500 psi, thus significantly increasing recovery efficiency.

A field study conducted by Well Drill10 shows field reserves growth of at least 30-40% by reducing average abandonment wellhead pressure from 1,100 psi to 600 psi for Titas, Habiganj, Kailashtila, and Rashidpur fields. The HCU study also stated that 2.03 tcf can be added by applying compression to 11 gas fields (Table 1). Overall, compression is conservatively estimated to add at least another 3.2 tcf on a countrywide basis, 20% of the proved plus probable URG in Petrobangla-operated fields of 16 tcf.

Reservoir management

Reservoir management incorporates all technologies to economically produce the maximum amount of hydrocarbons from any field area.

In addition to using the latest technologies to identify and quantify reserves and resource potential, reservoir management focuses on the optimum depletion strategy and drilling, completion, and production technology to maximize recovery. This is frequently achieved by utilizing reservoir simulation incorporating the most current production and field data. Optimal reservoir management over the life of the fields in Bangladesh is conservatively expected to add at least 1.6 tcf, 10% of the proved plus probable URG in Petrobangla-operated fields of 16 tcf.

Collectively, a total of 12.8 tcf in additional reserves can be added to Bangladesh's proved plus probable reserves base by applying these advanced but readily available technologies to Petrobangla's existing gas fields. In a recent report,14 Petrobangla stated that substantial reserves could be added as field growth with more appraisal drilling, 3D seismic surveys, petrophysical thin bed analysis, use of compression, and appropriate reservoir management techniques.

The third category of Bangladesh's resource base, new field discoveries, will be taken up in the second and concluding part of this article.

Next week: Comparing various studies of Bangladesh reserves and resources.