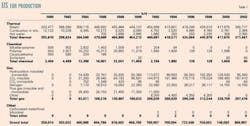

California steam EOR produces less; other EOR continues

About this report… Every 2 years, the Oil & Gas Journal surveys worldwide projects that use various injection technologies to enhance oil recovery from reservoirs. This article describes events and trends affecting EOR activity levels and tables showing EOR projects surveyed.

Oil & Gas Journal's exclusive biennial enhanced oil recovery (EOR) survey shows a marked decrease in production from California steamfloods at the beginning of 2002 compared to the survey in 2000. But most EOR projects listed in the 2000 survey continue producing, many with new operators.

EOR's contribution to US oil production is 700,000 b/d (Tables 1 and 2), a 50,000 b/d decrease from the 2000 survey. Production decline in mature steam operations in Kern County, Calif. accounts for this decrease.

Some of the operator changes in this year's survey result from:

- Occidental Permian Ltd.'s acquiring properties from Altura Energy Ltd.

- Phillips Petroleum Co.'s operating properties formerly operated by ARCO in Alaska, with BP PLC operating other ARCO EOR properties.

- Kinder Morgan CO2 LLC's acquiring the SACROC Unit from Devon Energy Corp.

- Pennwest Ltd.'s operating Numac Energy Ltd.'s, Joffre Viking CO2 projects in Alberta.

- Devon Energy Canada Ltd.'s changing the name of its Northstar Energy Ltd. unit and acquiring Anderson Exploration Ltd.'s EOR project.

- Conoco Canada Ltd.'s acquiring Gulf Canada Ltd. projects.

- Mobil Canada Ltd.'s changing its name to ExxonMobil Canada Ltd.

- Denbury Oil Co.'s acquiring another of JP Oil Co.'s EOR property.

Tables A through F (see Special Report: Enhanced Oil Recovery) list projects in the 2002 EOR survey. These are projects in which injectants other than water or methane are injected to enhance oil recovery.

Operators use the injectants during the initial production stage, after the primary depletion stage, or after the secondary production stage, which also is known as tertiary recovery.

The most common projects are:

- Steam injection in heavy oil fields.

- Carbon dioxide floods in lighter oil fields.

- Hydrocarbon miscible gas injection in lighter oil fields.

- Chemical and polymer injection.

Fewer projects

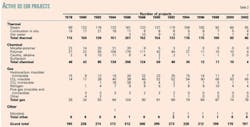

In Table 2, the substantial decrease in active US EOR projects was due to operators' consolidating a number of projects and eliminating other projects.

For instance, AERA Energy LLC consolidated its reporting of Midway-Sunset and Coalinga projects. The previous survey listed 37 AERA Energy projects, while this update lists 17; but reported acreage remains nearly the same at 11,100 acres compared to 11,400 in 2000.

Enhanced oil recovery from its projects declined to 138,700 from 168,000 bo/d, while its operated wells in the South Belridge field declined to 7,430 from 8,014.

Also in Kern Country, ChevronTexaco Corp. consolidated seven Chevron Kern River projects into one. Acreage remained the same but enhanced oil production decreased to 3,228 from the 21,227 bo/d in the 2000 survey. For this survey, ChevronTexaco still kept Chevron and Texaco projects separate.

Devon Energy Corp., new operator of five polymer projects in the Alba field and of a CO2 project in the Alvord South field, all in Wise County, Tex., decided not to update these projects because of their maturity and the fact that tertiary injectants were no longer being used.

It also said these projects were either being sold or considered for sale. Mitchell Energy Corp. formerly operated these projects.

Oxy Permian

With its acquisition of Altura Energy Ltd.'s properties in 2000, Occidental Permian Ltd., a unit of Occidental Oil & Gas Corp., became the largest owner of Permian basin CO2 floods.

Altura Energy was a joint venture, formed in 1997, by Amoco Corp. and Shell Oil Co, to operate their Permian basin properties. Both Amoco and Shell were pioneers in developing CO2 flood technologies for enhancing oil recovery.

Oxy Permian operates both the Occidental Permian Ltd. and Oxy USA Inc. properties.

Ron Hinn, benchmarking director of Oxy Permian, indicates that the company is committed to future development of additional CO2 floods over the next decade. The company's Permian basin portfolio represents about one-third of Occidental Oil & Gas Corp.'s worldwide production.

It recently dedicated the Cogdell CO2 flood, Scurry and Kent counties, Tex., and plans to initiate one of the largest CO2 flood projects in recent years. Phase I of the Hobbs Unit CO2 flood, Hobbs and Lea counties, NM, will require an initial investment of about $130 million and will be Oxy Permian's largest capital investment project during 2002, according to the company.

It expects to recover about 75 million bbl of oil from Phase I and begin the second phase in 2008.

Jeff Simmons, manager of integrated reservoir management for Oxy Permian, says that one major technology advance for CO2 flooding is improved reservoir characterization. For instance, the Hobbs Unit project will simultaneously flood two zones. A high-permeability zone will be developed on 160 acre, 9-spot patterns while an underlying tighter zone will have 80 acre, 5-spot patterns.

Another change contributing to the extended life of Permian basin CO2 floods is that companies have increased CO2 slug size, yielding greater EOR recovery than originally envisioned.

Hinn says the Denver Unit flood, Yoakum and Gains counties, Tex., initial design called for injecting a 20% hydrocarbon pore volume (HCPV) CO2 slug. In subsequent years, the operator increased slug size to 60% and 80% HCPV, and now Oxy plans a further increase to 100% HCPV.

Other changes that have made CO2 flooding more economical, as noted by Oxy Permian, are:

- Off-the-shelf visualization and modeling programs that can be run on personal computers.

- Less costly facilities that include lined vessels and piping instead of corrosion resistant steel.

- Phasing production to level load facilities.

But other technologies such as horizontal wells, 4D seismic, and crosswell tomography have found only limited use. For example, Simmons says horizontal well success has been spotty in the Permian basin CO2 floods because these wells have not increased the throughput productivity index significantly.

In the case of 4D seismic, he says, the low porosities in the floods have limited its use. And, as far as crosswell tomography, he indicates, the cost is still relatively high compared to 3D seismic surveys that provide information over a greater areal extent.

Processing of produced gas has also changed over the years (see sidebar).

Price factors

Oil, CO2, and fuel prices affect most enhanced oil recovery projects. One ballpark number is that CO2 flooding in West Texas becomes economical at $18/bbl, but this assumes that the price of CO2 remains less than $1/ Mscf.

Fuel gas has a considerable effect on steamfloods. At the beginning of 2001, heavy oil prices in California were about $18/bbl, but because fuel gas had increased operators cut steam injection and oil production for most steamfloods declined steeply.

For instance, because natural gas prices climbed to $16.23/MMbtu at the beginning of 2001, AERA Energy cut steam injection in the Belridge field and production decreased by about 8,000 bo/d. Its net cash flow from the project also turned negative for a couple of months, until gas prices began to moderate and its steam optimization program took effect.

California oil operators further suffered towards the end of the year when heavy oil prices declined to $11/bbl, although by the end of March 2002 prices had climbed back to $20/bbl.

California's energy crisis in 2001 affected a number of heavy oil producers with cogeneration facilities. For instance, when the utility company failed to pay for the electricity generated, Berry Petroleum Inc. shut down its cogeneration thus lowering steam injection volumes that decreased its heavy oil production

Barry reported its 2001 net income was affected by lower crude oil prices, the termination of its hedge contracts with bankrupt energy trader Enron Corp., and the high natural gas prices during the first part of the year. Its cogeneration facilities are now back on line.

Carrizo Oil & Gas Co., operator of a steamflood in Texas also felt the effect of fuel costs. Its operations include six producing leases in Camp Hill field, Anderson County, Tex. and it has a lease-hold position in two offset leases that are not currently producing.

Carrizo started a steamflood pilot project in the early 1990s on one of the producing leases and says the pilot succeeded technically, but implementation on a large scale would be expensive, and its profitability depends on the fuel cost for generating steam. It now operates the project as an inverted 5-spot waterflood. And when gas prices are not prohibitive, it uses the steam generators on location to heat the injection water, but not in an amount sufficient to generate high-quality steam.

Consequently, Carrizo says it has a semi-mature hot waterflood with the potential for offset development accompanied by implementation of a high-quality steamflood. But it has delayed additional development with steam flooding while it explores alternative sources of steam.

Specifically, it says economics look best with cogeneration, but it prefers to have a third party install the cogeneration units and sell electricity while selling the steam to Carrizo at a cost lower than it can generate by itself.

EOR potential

CO2 sequestration may become an import stimulus to enhanced oil recovery. For example PanCanadian Petroleum Ltd. indicates its Weyburn miscible flood project, which obtains its CO2 from previously vented CO2 from the Dakota Gasification Synfuels plant, Beulah, ND, has the potential to be recognized as world's largest joint-implemented project for reducing CO2 emissions.

It estimates that over the next 15 years about 14 million net tons of CO2 will be stored in the reservoir rather than vented to the atmosphere.

Heavy oil is still one of the largest targets for enhanced oil recovery. A number of pilot steam-assisted gravity drainage (SAGD) projects look promising in Canada. SAGD involves drilling one horizontal lateral for steam injection above anothor lateral that serves as the oil drain.

The PanCanadian Resources Ltd. Christina Lake SAGD project may produce between 50,000 and 70,000 b/d from up to 700 horizontal wells, by 2009. A possibly $350 million expansion of Japan Canada Oil Sands Ltd. (Jacos) SAGD Hangingstone pilot may result in the production of about 50,000 bo/d by 2006.

Firebag

SuncorEnergy Inc.'s Firebag project is expected to produce 35,000 b/d in 2004 and reach 140,000 b/d by 2010.

In the first reported SAGD project in the US, Derrick Resources Inc., in 2001, started a SAGD project in Wyoming but had to shut it in to await resolution of water disposal problems.

Besides SAGD's potential, Imperial Oil Resources Ltd. has continued to expand its cyclic steamflood in its Cold Lake bitumen properties. Imperial currently produces about 120,000 b/d of bitumen, and plans to invest $650 million for Phases 11-13. These phases may add an average of 30,000 b/d by late 2002.

Imperial also has plans to develop Nabiye and Mahihkan North areas of Cold Lake, with production start-up in 2006. Its development plans include conventional cyclic-steam technology, but it says feasibility studies are also underway to assess other technologies such as SAGD. It plans to invest about $1 billion in these projects over the next 5-10 years.

Wyoming may see additional CO2 flood development. Howell Petroleum Inc. says it has internally approved a CO2 pilot in its Sour Lake field, but the planned PetroSource Corp. CO2 has been delayed. PetroSource had planned to break ground in 2001 on a CO2 pipeline from LaBarge, Wyo. to the Powder River fields in Wyoming that would transport CO2 now vented at the ExxonMobil LaBarge gas plant.

California has also a number of oil fields that could benefit from CO2 injection, but an economical source for CO2 is still under study by a number of companies.

Chinese operating companies did not update the information in the survey, but PetroChina Co. Ltd. did say that 18 areas, 187 sq km in the Daging field, are being polymer flooded.