New CMAI study outlines prospects for light olefins

A recent study, "2002 World Light Olefins Anal ysis," from Chemical Mar ket Associates Inc. (CMAI), Houston, provides a historical perspective and an outlook for global ethylene and propylene markets. The study covers capacity, supply, demand, trade, prices, profitability, technology, and production costs.

CMAI expects a recovery in the US economy by yearend 2002 and in the global economy during 2003. Near-term energy prices will remain well below peak levels experienced in 2000-01, providing needed relief to weakened economies around the world.

Assuming global economic growth has resumed by 2003, CMAI expects demand growth for ethylene and propylene derivatives to return to growth rates of 5.0%/year or greater.

Low inventories of light olefin derivatives and various end-use chains due to an extended period of destocking in 2000-01 could result in strong demand growth in 2003 if restocking begins.

Stagnant demand growth and unprecedented levels of new light-olefins capacity commissioned in 2000-02 resulted in surplus capacity and a severe reduction in global capacity utilization. Reduced operating rates and weak market conditions will persist throughout 2002, resulting in capacity rationalization and continued market restructuring.

CMAI expects early signs of a recovery by 2003 with sustained improvement and strong market conditions in 2004.

Capacity closures and the lack of new construction could result in strong market conditions in 2004-06.

The next wave of ethylene capacity additions currently being developed in the Middle East and in Asia from 2005-09 could dampen market conditions beyond 2006 if these projects are executed as planned.

Demand growth vs. GDP

Light olefin demand typically grows faster than GDP. During the past 5 years, the average annual growth rate (AAGR) of world ethylene demand was 4.0% and the AAGR of world propylene demand was 5.1%. During this time, the AAGR of world aggregate GDP was 2.8%.

CMAI expects the AAGR of ethylene and propylene during the next 5 years to be 5.0% and 5.2%, respectively. Propylene demand growth has historically outpaced ethylene demand growth; CMAI expects this trend to continue.

Ethylene demand

CMAI forecasts worldwide ethylene demand growth for 2001 at a modest 0.3%, increasing to slightly less than 92 million tonnes (OGJ, Mar. 11, 2002, p. 66).

Global growth stagnation was heavily influenced by a severe contraction in US demand, which declined 10% in 2001.

Polyethylene production, which consumed an estimated 58% of global ethylene production in 2001, dominated worldwide ethylene demand.

By 2006, annual global ethylene demand will exceed 117 million tonnes.

Global ethylene capacity will increase to slightly more than 127 million tonnes by 2006. CMAI assumes closures in the US and Japan and incremental expansions of existing units in the Middle East, Western Canada, and Southeast Asia.

Propylene demand

In 2001, worldwide polymer-grade (PG) and chemical-grade (CG) propylene demand was 50.2 million tonnes, with PP production representing about 63% of the total.

Propylene demand growth was stagnant in 2001 due to recessing or slow-growing economies.

Economic recovery during the next 5 years will allow propylene AAGRs to average 5.3%, according to CMAI.

Of all of the major derivatives, PP is the propylene derivative with the largest current size (31.3 million tonnes) and expected production growth rates.

Ethylene feedstocks

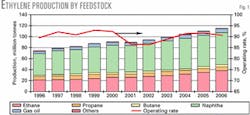

The CMAI study pegs total ethylene production for 2001 at slightly more than 90 million tonnes (Fig. 1). Naphtha cracking made up 54% of the total ethylene production, followed by ethane at 29%, and propane and gas oil at 6% each. Butane cracking represented about 4% of global ethylene production for 2001.

Ethylene production of 90 million tonnes represented a nameplate capacity utilization of about 87%. This was a sharp decline from the previous 2 years.

North America had one of the lowest utilizations during 2001, which CMAI estimates at about 84%.

The strongest region was Northeast Asia at 95% followed by West Europe and the Middle East estimated at 91% each.

CMAI forecasts global capacity utilization to remain near 87% during 2002, after which a sustained period of recovery will occur through 2006.

Ethane cracking will show the strongest growth, increasing at a 7.7%/year during the forecast period. Gas oil cracking will grow at 6.4%/year, propane at 5.3%/year, naphtha 3.6%/year, and butane 3.0%/year.

Even with the rapid growth in lighter feedstocks by 2006, NGLs will make up 43% of total ethylene production in 2006, according to CMAI.

Propylene supply

One of the key issues of the world propylene market deals with the sourc ing of propylene.

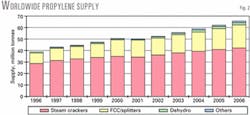

According to the CMAI analysis, worldwide production of PG and CG propylene for petro chemical consump tion in 2001 will be 50.2 million tonnes (Fig. 2), of which:

- 34.3 million tonnes are a byproduct of ethylene from steam crackers.

- 14.7 million tonnes are a byproduct of motor gasoline or distillates from oil refinery FCC units.

- 0.8 million tonnes originate from "on-purpose" propane dehydrogenation.

- 0.5 million tonnes are from "other" sources such as metathesis.

Although steam crackers are the largest current source of propylene, they will show the slowest growth in propylene production over the forecast period.

CMAI expects that steam cracker propylene will grow by 4.3% during the next 5 years, which is slightly lower than the expected ethylene production growth of 5.0% in the same period, due to the expectation for slightly lighter (less propylene yielding) steam cracker feedstocks.

Propylene from refinery FCC splitters, propane dehydrogenation, and other sources will grow at even stronger rates to meet the remainder of the propylene petrochemical demand requirements.

Propylene from FCC units will be an increasingly important supply to the world petrochemical market, and worldwide propylene prices are expected to rise high enough to justify capital investments and to cover logistical and recovery costs.

In fact, CMAI's supply and demand models forecast that AAGRs for propylene supplied from refineries to the petrochemical industry will be 5.8% from 2001-06.

Ethylene capacity additions

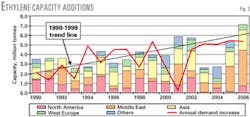

Unprecedented levels of new olefins capacity (Fig. 3) will be commissioned in 2000-02 in every major region of the world, causing competitive markets for these products, according to CMAI.

While the Asian financial crisis resulted in expansion project delays and some cancellations, effective capacity growth was still noticeably large in 2001 and 2002.

During 2000-02, major projects have been or are being added in North America, South America, the Middle East, West Europe, and Asia.

Most new capacity located in the Middle East and Asia will be associated with export-oriented derivative plants of polyethylene, polypropylene, and ethylene glycol.

Exporters in these regions, therefore, will attempt to export to countries with high cost production or high import needs.

No grassroots crackers have been announced in Europe. Low cost, gas based, export-oriented competition from the Middle East has convinced higher cost, naphtha-based European producers to only debottleneck existing plants to meet incremental domestic demand.

While CMAI forecasts demand growth to exceed or match capacity additions during 2003-05, a new round of capacity additions starting in 2006 could outpace demand growth again.

Ethylene capacity utilization

CMAI expects operating rates to remain near 87% during 2002 as the industry attempts to manage a significant amount of surplus capacity during a time of sluggish demand growth. Recovery in the US and global economies by 2003 will result in a strong recovery for petrochemical demand growth allowing for the new capacity additions of 2001-02 to be absorbed.

CMAI predicts the world average steam cracker utilization rate to rise above 90% by 2004 and stay at this stronger level through 2006.

Ethylene trade

Ethylene equivalent trade is defined as the amount of ethylene traded as ethylene monomer or in the form of a chemical derivative. In 2000, about 6.5 million tonnes of ethylene equivalents were traded: 44% as polyethylene, 24% as ethylene oxide and ethylene glycol, 11% as vinyls, and about 9% in the form of ethylene monomer. CMAI predicts annual ethylene equivalent trade to increase to nearly 15 million tonnes by 2006.

Propylene trade

In 2000, about 2.0 million tonnes of propylene equivalents were traded throughout the world: 42% as PP, 18% as acrylonitrile, and 20% in the form of propylene monomer.

CMAI expects North America to continue to be the major exporter of propylene equivalents during the next 5 years. West Europe will shift towards a more balanced position for propylene equivalents because domestic propylene derivative demand will continue to grow more quickly than local propylene capacity.

The Middle East will become a major net exporter of propylene equivalents after the start-up of several new PP plants in 2001-05. Northeast Asia (mainly China) will continue to grow as a strong net importer of propylene equivalents, mainly PP and acrylonitrile.

Ethylene prices

CMAI predicts that ethylene prices will begin to recover in 2003 as market conditions improve and supply and demand come into balance. By 2004-06, a sustained recovery will be under way and worldwide prices will reach about $600/tonne. Ethylene profit margins will rise to reinvestment levels based on higher capacity utilization and moderate production costs.

Propylene prices

In 2002, propylene prices will continue a downward trend reaching a worldwide average of $325-75/tonne, according to CMAI. In 2004-06, worldwide propylene prices will increase to relatively high levels as ethylene markets become tighter and PP markets become more profitable.