RUSSIAN OIL AND GAS TRANSPORTATION-Conclusion

Exports of natural gas, so important to the Russian economy, cannot occur without a modern, well-maintained pipeline system.

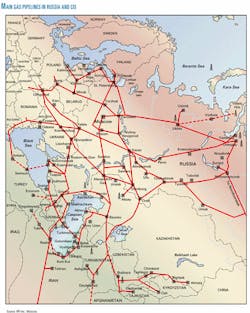

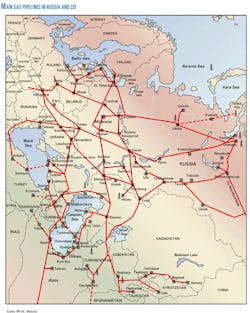

This conclusion of a two-part series on Russian pipelines looks at where natural gas is located, who the potential buyers are, and how the Russians plan to get it to market. Fig. 1 shows the current gas pipe line network.

Gas production

In 2000, Russia's natural gas production was 586 billion cu m (bcm), 135 bcm of which was exported (excluding volumes to CIS). LPG production went up 13%, reaching 6.24 million tonnes.

State-owned OAD Gazprom hopes to stabilize its output at 530 bcm/year (bcmy) of gas during the coming decade, relying primarily on new production from the 100-bcmy Zapolyarnoye gas field.

Fields on Yamal Peninsula and Obsky and Tasovsky bays (containing a total of 2.5 trillion cu m of gas) and, in the future, the giant Shtokmanovskoye gas field will help Gazprom maintain 530 bcmy production at least through the next 2 decades. (For reference, Russia's total proven reserves currently amount to 32.3 trillion cu m.)

Also, special efforts will be made to begin development of the Aneryakhinskoye field, improve the Kharvutinsky area of the Yamburg field, and begin producing the Pestsovy, Vynga-Yakhinskoye, and Yety-Purovskoye fields.

Itera Group, Russia's second largest gas supplier, has been producing about 25 bcmy there. The company plans to produce 30 bcm this year and double its production capacity from gas fields in the Yamal-Nenets autonomous district in 3 years.

According to a new government resolution, independent suppliers will have easier access to Gazprom's gas transportation network. They now will be able to use more than 15% of its capacity, not to exceed the available capacity.

Russia's main gas-producing areas in Komi, Orenburg, and western Siberia are about 30% depleted. Nadym-Pur-Tazovskoye, Shtokmanovskoye, and fields on the Yamal peninsula should be on stream soon to maintain and increase production.

Altogether the new fields will supply about 85% of total output in the next decade.

Markets

Current consumption levels in Europe of about 340 bcmy are projected to increase to 410-450 bcmy in the next 10 years. Russia will provide about 25% of the total gas consumption in the European market. European consumers. however, are not planning to sign additional contracts in the short term.

Moreover, it is becoming evident that other markets will attract Gaz prom's attention in the long run. Shipments to Balkan countries, as well as to Greece and Turkey, will grow from about 23 bcm in 2001 to an estimated 58 bcmy by 2010.

Almost 90% of Russia's gas exports now cross Ukraine. Irregularities in gas supply to Turkey, however, have led Gazprom to blame Ukraine for a lack of reliability in its transit responsibilities and continued unauthorized siphoning of gas by Ukrainian consumers.

As with crude exports, in January 2002 Russia was ready to announce plans to bypass Ukraine. At a recent Gazprom board meeting, however, that plan was abandoned.

Under the 2002 agreement on volumes and terms of gas transit through Ukraine, Russia will ship 124.5 bcm of gas through Ukraine, of which 106.8 bcm will be bound for customers in Europe.

The Yamal-Europe system ultimately will have a capacity of 60 bcmy and cost at least $30 billion.

Commissioning of the second trunkline of this export route via Belarus and Poland, an underwater crossing of the Baltic Sea, as well as the Blue Stream project crossing the Black Sea, could leave the Ukrainian transit system with only 30% of Russia's export flow.

Gazprom and Poland's PGNiG Corp. have already teamed up to address the issue of boosting the capacity of the Yamal-Western Europe gas pipeline by building a second section and a system-connecting link in Poland via Belarus.

The "Contract of the Century," which envisions the shipment of 250 bcm of Russian gas to Poland by 2020, will possibly be extended to 2029. There would be 12.5 bcm delivered in 2010 just for Poland's consumption.

Apart from its resource base, Gazprom is experiencing problems with the existing pipeline network. At least 60% of its pipelines need serious maintenance or outright replacement. This would take some 140 billion rubles (about $4.6 billion), while the company's net profit is only 73 billion rubles (about $2.4 billion).

Blue Stream

By 2003, the $3.3 billion Blue Stream pipeline will become a conduit for 16 bcmy of gas supply to Turkey. It will provide direct access to the Turkish market, avoiding transit via third countries.

The 600-mm pipe—with 35-mm W.T. and working pressure of 22-25 Mpa—is being laid across the Black Sea at a depth of 2,000 m to enable gas flow without intermediate compressor stations.

Italy's ENI has finished laying the subsea section of the gas pipeline and is finalizing its onshore sections in Turkey, which will be commissioned later this year.

Later, there may be opportunities to extend the line to Middle Eastern countries.

Northern European routes

Russia is examining new gas export routes to Europe. A feasibility study will determine a route from the Shtokmanovskoye giant gas field across the Baltic Sea to Germany.

Russian specialists estimate the project will be completed by 2007. Led by Gazprom, the work will potentially involve Finnish energy firm Fortum Corp. and Germany's Ruhrgas AG. The pipeline would deliver up to 30 bcmy of gas.

Far East gas system

Despite extensive energy resources in Russia's Far East, the region still depends on gas from eastern and western Siberia. The high transportation costs have affected local electricity production and industrial and residential users.

With this in mind, the Russian government is moving to create a comprehensive gas supply system in the Far East.

The key role will lie with Dalneftegaz Joint Stock Co. where Rosneft is the major shareholder (51%) through its subsidiary, Sakhalinmorn eftegaz, while the rest will be equally shared by Rosgazifikatsiya (a pipeline construction subcontractor) and the governments of Sakhalin, Khabarovsk, and Primorsky Krai.

The company will be in charge of delivering 7 bcmy of gas to Primorsky Krai (the Russian Far East's most populous region, which includes the port of Vladivostok), 7 bcmy to Khabarovsk, and 5 bcmy to Sakhalin.

The gas supplies will come from the Sakhalin-1 and 2 as well as from Anivskoye field being developed by Sakhalin Oil Co.

Two important trunklines will be constructed: a 1,000-km line to connect Sakhalin Island with the Russian mainland and a 700-km line across the island itself.

Besides gas to Russia's eastern regions, Sakhalin pipeline development is important from an export standpoint and may result in pipeline projects linking the Sakhalin shelf with Japan (through Hokkaido), China, and Korea.

Plans to deliver Sakhalin gas to China's Guangdong province are taking root. Japan's Itochu Corp. and ExxonMobil are performing a feasibility study for a pipeline to transport natural gas to Japan.

Tentatively, this construction project may start in 2005 in order to have the infrastructure in place by 2008 when massive gas production and delivery will start.

The East Siberian Kovykta gas project, led by BP PLC, is also targeting the China market. BP, however, will have to convince Gazprom that the proven Kovykta resources will be enough to provide the 25 bcm needed to make a $2 billion-plus, 5,000-km gas trunkline to Central China economically viable.

The Russian bureaucracy is closely eyeing the project, with the Duma having labeled it as "strategic" and having urged Gazprom to assume a key role in it.

In another move, an alliance including Russia's Gazprom and Stroitransgaz, as well as Royal Dutch/Shell Group and PetroChina Co. Ltd., has agreed to set up a consortium to implement a new pipeline project in China.

The West-East project will cover the construction of a 4,167-km pipeline from western China to near Shanghai and the Yangtse delta, with a capacity of up to 20 bcmy.

The project will help create China's single gas supply system—aimed at improving economic development—by increasing annual gas consumption from the present 25 bcmy to 70-80 bcm by 2010.

Farther south, other Asian markets also emerge as a long-term opportunity for development. The most ambitious proposal is a gas pipeline across Central Asia and Afghanistan to Pakistan and India.

The rapid pace of Russian economic reform will inevitably affect Gazprom and other monopolies. In the future, the business climate should be more predictable, which will improve the ability to manage projects and evaluate risks.

Russia is actively developing new petroleum export routes, and the reconfiguration of its oil and gas transportation system should be watched closely for engineering and equipment supply opportunities.