Central gulf leases draw $363 million, 77 bidders

Companies offered $363.2 million in apparent high bids for 506 offshore tracts at Sale 182 in the central Gulf of Mexico, the US Minerals Management Service reported.

MMS received 697 bids totaling $442.4 million from 77 companies. That was down from 780 bids totaling $663.4 million submitted by 90 companies for 547 tracts during the last central gulf lease sale nearly a year ago. High bids in the 2001 sale totaled $505.5 million.

A more even mix of major integrated companies and independents participated in Sale 182, analysts reported. Independents seemed to dominate lease sales last year for both the central and western gulf.

The 10 companies submitting the highest total number of apparent high bids included:

Dominion Exploration & Production Inc., 37 bids totaling $37 million.

Spinnaker Exploration Co. LLC, 42 bids, $28.8 million.

BP Exploration & Production Inc., 39 bids, $27.2 million.

Chevron USA Inc., 29 bids, $26.6 million.

Kerr-McGee Oil & Gas Corp., 36 bids, $15.35 million.

BHP Petroleum (Deepwater) Inc., 27 bids, $15.31 million.

Nexen Petroleum Offshore USA Inc., 30 bids, $13.7 million.

Conoco Inc., 24 bids, $8.3 million.

Magnum Hunter Production Inc., 41 bids, $5.7 million.

Remington Oil & Gas Corp., 25 bids, $3.7 million.

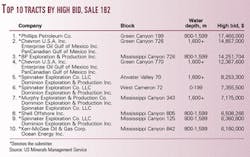

Highest bids

The sale high bid was $17.5 million submitted by Phillips Petroleum Co. for Green Canyon Block 199 located in 800-1,599 m of water. Chevron partnered with Enterprise Oil Gulf of Mexico Inc. and PanCanadian Gulf of Mexico Inc. in the second highest bid of the sale, $14.9 million for Green Canyon Block 726 in more than 1,600 m.

Dominion and Spinnaker partnered together in 4 of the 10 highest single bids of the sale. Those included $8.3 million for Atwater Valley Block 70 in more than 1,600 m of water, $7.4 million for West Cameron Block 72 in less than 200 m, and 6.4 million for Mississippi Canyon Block 125 in 800-1,599 m. The two joined with Murphy Exploration & Production Co. in bidding $7.2 million for Mississippi Canyon Block 343 in more than 1,600 m of water.

Other big bids included $14.3 million by BP for Mississippi Canyon Block 726 in 800-1,599 m of water. Chevron combined with Enterprise and PanCanadian in offering $12.4 million for Green Canyon Block 770 in more than 1,600 m. Shell Offshore Inc. put up $6.5 million for Mississippi Canyon Blcok 805 in 800-1,599 m.

Kerr-McGee, the biggest spending independent in the 2001 central and western gulf sales, was still among the top 10 this year after it combined with Ocean Energy Inc. to offer $6.2 million for Mississippi Canyon 842 in 800-1,599 m of water.

Water depth breakout

Participants in the 2002 sale had a keen interest in deepwater operations.

There were 71 blocks in more than 1,600 m of water that drew bids totaling $108.1 million, with apparent high bids amounting to $94.3 million. Another 81 blocks, in 800-1,599 m, drew total bids of $125.3 million, with apparent high bids of $100.9 million.

The block in deepest water to receive a bid was Atwater Valley 347 in 2,665 m.

But 288 blocks in less than 200 m attracted total bids of $163.6 million with apparent high bids of $125.7 million. Those included 25 blocks in the 8(g) zone, the 3-mile-wide band that borders state jurisdictional waters where the state and federal governments share royalties.

The sale in New Orleans contained 4,447 unleased blocks covering 23.4 million acres, located 3-210 miles offshore in 4-3,425 m of water. Of those leases, 1,370 blocks are in less than 400 m of water, 134 are in 400-799 m, and 2,903 are in 800 m or more.

The lease term for blocks in less than 400 m of water is 5 years, with a minimum bid of $25/acre. For blocks in 400-799 m, the term is 8 years with $25/acre minimum bid. For blocks in 800 m or more, the term is 10 years with minimum bid of $37.50/acre.

Winners will be announced after MMS officials review and accept their bids.

Company details

Four companies that made 30 or more bids summarized their activity.

Kerr-McGee and partners bid high on 20 deepwater and 16 shelf leases, exposing $15.3 million. Kerr-McGee operates all of the blocks with an average 80% working interest.

If awarded, Kerr-McGee would hold interests in 594 gulf leases, operating more than 75% with a 55% average working interest, and boost its total leasehold by 185,000 gross undeveloped acres to more than 3.1 million acres.

Dominion, acting individually and with partners, was apparent high bidder on 23 deepwater and 14 shelf blocks, exposing a net $37 million. Dominion has a 100% working interest in apparent high bids for 10 shelf blocks and 37.5-75% working interest in 27 shelf and deepwater blocks.

The company's apparent high bids on the shelf were concentrated in West and East Cameron. In the deepwater, its apparent high bids were focused in Mississippi Canyon, with several key blocks acquired around the Seventeen Hands and Devils Tower discoveries.

Spinnaker participated in 56 bids, including 41 in more than 200 m of water and 15 in less than 200 m. The company was apparent high bidder on 32 deepwater and 10 shelf blocks, exposing a net $28.8 million.

Spinnaker would operate 17 deepwater and 7 shelf blocks, if awarded, with 77% average working interest. It would participate as nonoperator in 18 blocks with 42% interest. It also has rights to participate in four other deepwater blocks with 25% interest.

Spinnaker held 1.1 million gross and 630,000 net acres in the gulf before the sale, and the tracts it bid cover 234,000 gross and 146,000 net acres.

The company's apparent high bids in deep water are concentrated in the Mississippi Canyon and Atwater Valley protraction areas, while 11 bids are for blocks in the general area of the Murphy Oil Corp.-operated Seventeen Hands discovery, a 2001 gas discovery in 5,450 ft of water on Mississippi Canyon 299 in which Spinnaker's interest is 25%.

Nexen was high bidder on 24 deepwater and 6 shallow-water blocks. The company exposed $13.6 million.

If the bids are accepted, Nexen will acquire 100% working interests in 5 deepwater blocks in the Green Canyon and Mississippi Canyon areas. In partnership with BHP, Nexen will acquire 25-40% interests in nine blocks and 50% interests in 10 blocks in the Green Canyon, Atwater Valley, and south Mississippi Canyon areas.

In shallow water, Nexen will acquire 100% interests in 6 blocks at East and West Cameron, Vermilion, and South Timbalier, close to the company's production operations.

Full award would bring its portfolio to 214 blocks, including 130 in deep water.

Other companies

Remington was apparent high bidder on 25 of 39 blocks bid, all in less than 500 ft of water, exposing a net $3.7 million. Remington would operate 19 blocks, if awarded. That would bring the number of gulf blocks in which it holds interests to 96.

Unocal's Gulf Region USA and Deepwater USA business units were apparent high bidders on 16 shelf and 2 deepwater blocks with bids totaling $5.9 million.

The company said the "deep shelf" gas play was the main focus and "bright spot" prospects that favor its acreage position were a lesser aim of its shallow water bids. Some of the blocks will yield immediate drillsites, others could come into play in 2003.

Before the sale the two Unocal units held interests in 235 deepwater and 105 shelf leases, all exploratory blocks.

Unocal bid on West Cameron 337; East Cameron 80 and 250; Vermilion 290; South Marsh Island 12, 119, and 121; Eugene Island 10, 270, 384, and 389; Ship Shoal 244 and 308; South Timbalier 25, 58, and 83; and Green Canyon 437 and 481.

Samedan Oil Corp. was apparent high bidder alone or with partners on 17 of 20 blocks bid, exposing a net $9.8 million. The total included 10 deepwater and 6 shelf gas blocks. Samedan would operate 13 blocks.

Pogo Producing Co., Houston, bid on six tracts and was high all six. Bonuses totaled $2.7 million. If awarded, Pogo would operate all six. They are: Main Pass 134, Eugene Island 210, 250, 260, and 280, and Ship Shoal 226.

Pogo said it was awarded West Delta Blocks 54 and 83 in state waters following a Mar. 13, 2002, sale and operates both blocks with 100% interest.

Elsewhere, Pogo was awarded two lease blocks, West Delta Block 54 and West Delta Block 83, in the Louisiana state waters lease sale held on March 13, 2002. Pogo is also the sole owner of both of those new state lease blocks.

Pogo holds interests in 82 federal and state blocks excluding Sale 182 tracts.

Devon Energy Corp., Oklahoma City, was apparent high bidder on four shallow water blocks, exposing a net $2.3 million.

Assuming approval, Devon will hold 109 deepwater and 212 shelf blocks, of which 168 are producing and 153 are exploratory. Devon operates 97 gulf platforms.