New Horizon Exploration relies on focus, persistence to succeed in innovative Trinidad project

Second in a series.

New Horizon Exploration Inc. has completed the first year's obligation of its work commitment to the Trinidad and Tobago state oil company.

But more importantly the milestone represents how persistence, patience, and an innovative approach pays off for a small US independent seeking to carve out a niche in another country.

The Richardson, Tex.-based NHE is undertaking a redevelopment-enhanced oil recovery project in Parrylands oil field on the Carib bean nation's southern island of Trinidad.

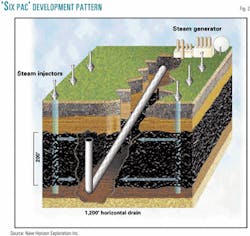

The project's highlight is an innovative combination of horizontal drilling and steam-assisted gravity drainage (SAGD)-an EOR technology proven in Canada. The so-called Six-Pac approach, involving a typical pattern of six vertical wells for each horizontal well plus steam injection, is intended to resuscitate production of low-gravity crude in an oil field that peaked decades ago.

Ultimately, NHE will have invested up to $35 million during 2001-05 to recover as much as 50% of 60 million bbl of crude oil in place from the Parrylands Block E. The block was carved out of acreage that had long ago been relinquished by a Trinidadian subsidiary of Royal Dutch/Shell Group; recovery of lighter-gravity crude in the nearby Block D and Forest Reserve block totaled 42 million bbl and 260 million bbl, respectively, through 1989.

Through first half 2001, NHE had invested over $5 million in the project. The firm spudded its 20th well last November, which represented 20% of its 5-year program. By April of this year, NHE Pres. Greg Boyles hopes to have the second year of the company's drilling obligation completed. By the end of the third year of the 5-year commitment, Boyles predicts his company will have completed its work commitment obligation.

The project's output is expected to peak at 10,000 b/d of moderately heavy crude oil over its 7-12 year life, according to Boyles. While only time-and prevailing oil prices-will tell how strong the project's internal rate of return will be, he remains confident that it has already demonstrated the kind of operating success he's seeking in order to help him duplicate that success with niches in other countries.

NHE background

NHE, incorporated in Texas in 1985, has operated in California, Colorado, Louisiana, New Mexico, Oklahoma, and Texas.

Boyles's own early background, as an engineer with Penn Central Corp. railroad, offers little hint of the oil and gas entrepreneur to come. In late 1977, he began to look into oil and gas investments, participating in seven or eight wells as a limited private partner. Although he lost his entire investment, the experience piqued his interest enough to embark on a crash course of self-education on the operations side of the business.

"I began reading all the primers I could get-books on the oil and gas business from well logging to mud programs, drilling, the mechanics behind how a rig worksellipsewhile I was still driving trains.

"And in 1979, I made a resolution to leave the railroad and buy stock in a little independent in Dallas and just be brave."

As a minority stockholder in the company, Boyles was an unsalaried officer of the company who opted to work in the field alongside drillers, sometimes working rig floors as a roughneck over the next 2-3 years. At the same time, he and his friends and family continued to invest in the business, enjoying what Boyles termed "early, mediocre success-certainly, when oil was $41/bbl, it was easy to call yourself successful with a 5-10 b/d well."

Within 4-5 years' time, he acquired all of the assets of the now-defunct independent and formed New Horizon. From then until 1990, the company worked mainly in the Fort Worth and Permian basins, "ellipsefollowing the steps of most small Texas independents, and it was not really a difficult challenge because everybody out there was doing the same thing. We were reworking old fields, and while oil prices were high, that type of environment worked; and when they were low, it didn't work."

SAGD, search abroad

It eventually became apparent to Boyles that such opportunities were limited in the US-especially the Lower 48 onshore-and he began looking for a new recipe for success abroad. He came across Murphy Oil Canada Ltd.'s SAGD heavy oil EOR operations in Saskatchewan and searched for reservoir analogs where the same approach could be tried in the Lower 48. However, with most analogous prospects already played out or under tertiary recovery, Boyles began to look outside the US for such analogs in the early 1990s.

"Having conducted my global search, I found about 10 countries that had [analagous] sites that were proven but yet undeveloped, where a guy with an enhanced recovery plan could move into the area, drill new wells, and have predictable success-or least be able to anticipate a range of success between X and Y; and X and Y, of course, would be an acceptable return on your efforts."

Boyles's approach was to find a proven productive area of a certain age rock, porosities, and permeabilities that matched the reservoir in the Murphy SAGD project. He then classified those 10 countries according to degree of risk. Of the three countries at the top of that list, only Trinidad and Tobago was English-speaking, which was a final plus for Boyles.

Having found a suitable site for his project proposal in 1995, Boyles acquainted himself with the important players in Trinidad and Tobago's oil and gas sector, promoting the Six-Pac concept for the Parrylands site to Petroleum Co. of Trinidad & Tobago Ltd. (Petrotrin).

NHE opted to emphasize an aggressive work commitment and a strong program of technology and skills transfer. That latter point, says Boyles, seemed especially important in the talks with Petrotrin.

"We offered to install 16 Six-Pacs over a 5 year period and activate up to 8 steam generators to quickly, smartly, and safely develop a block that has possibly 60 million bbl in place-and through the whole experienceellipseshare everything we've learned in the most transparent method possible."

Boyles attributes his success to his persistence at remaining in contact with Petrotrin officials and using "gentle persuasion" to continue to press the "human element" of his proposal: "You can't be a fly in the ointment, so to speak, but you do have to be 'buzzing around.'"

Petrotrin gave the company just 30 days to facilitate a contract, and Boyles, working closely with Petrotrin's manager of business development, quickly ironed out a very simple farmout agreement in October 1999. It took another 10 months thereafter to gain approval from the Ministry of Energy for the JV of Petrotrin and NHE's local subsidiary New Horizon Exploration Trini- dad & Tobago Ltd.

Project details

NHE's plan for Parrylands Block E included arranging for the first land drilling rig to be delivered to Trinidad in almost 2 decades.

The company spent $600,000 to buy and refurbish a drilling rig formerly owned by Pennzoil Corp. that last saw duty in a sulfur mining operation. The rig, rated to 6,000 ft, spent a harrowing 2 weeks being delivered from Point Lisas via Trinidad's narrow, twisting roads and mountain highways through heavily populated areas to the Parrylands jungle location.

The rig drills two thirds of the wells as directional wells and the remainder as true vertical wells, targeting the Pliocene Forest formation at 1,200 ft. Crude gravities are 16-18°.

Most of the existing wells on the block operated by Petrotrin currently produce at stripper levels, averaging 3 b/d, tapping lighter gravity crudes in the Miocene Cruz at 3,000 ft. NHE's program also calls for it to take over operation of the existing Cruz wells and to optimize their recovery rates.

NHE had inherited 744 acres with 34 development wells, all of which had yielded well control data from the shallower horizons the company was targeting. The Forest reservoir has a pay thickness of 200 ft and covers 320 net acres. Porosity is 34-36%, and permeability is >750 md.

"The new drilling that we've undertaken has validated the well control and the initial data that's been acquired from the past," Boyles said. "And in the process, we have found that our reservoir pressures are in line with where we expected them; our permeabilities and porosities are slightly higher than the old logs were suggesting."

The vertical well completions entail simple perforations, and NHE equips each well with a progressive cavity pump. NHE was able to find a local manufacturer that could supply wellheads rated to 10,000 psi at a quarter of the usual cost.

Each of the six vertical wells in a Six-Pac pattern is expected to produce at a rate of 15-20 b/d under cold production, and the horizontal well in each pattern is expected to produce 75-180 b/d under cold production.

With the installation of a 1,200 ft horizontal lateral to serve as a drain for the SAGD project, NHE then begins a cyclic steam (huff-and-puff) program, firing up a 25 MMbtu steam generator to inject 1,000 b/d of steam. With the SAGD project under full steamflood and the horizontal drain in place, a Six-Pac can produce 1,000 b/d of oil. Each 20-acre pattern may cover 3-6 million bbl of OOIP. The cyclic steaming creates cavities around both the vertical and the horizontal wells to help create more movement of the oil entrained within the reservoir.

After the cold production and huff-and-puff stages are well under way, NHE converts the vertical wells that were initially producers into steam injectors.

"Then we go into a continuous steamflood mode until such time as the steam breaks through and has practically swept that chamber leading down into the horizontal drain," Boyles said.

The Six-Pac plan envisions a 7-12 year production life, with a 4-5 year plateau of 1,000 b/d, creating a bell-shaped production curve vs. the usual hyperbolic curve typical of most wells.

By the end of the second year of the program, Boyles expects NHE to be producing 8,000 b/d from Parrylands Block E. While the project in theory could peak at 16,000 b/d if production could be sustained simultaneously at peak from each Six-Pac, it is likely to average 10,000 b/d for most of the time all 96 vertical wells and 16 horizontal wells are on line; as each Six-Pac is implemented, production ramps up in a stairstep fashion. Production could get a further boost as NHE moves along the horizontal drilling learning curve, notes Boyles: "We're discussing multilaterals, and we're taking a look at some [multilateral] packages, putting in 'crow's feet' to access more compartments."

To market production, NHE installed a 4-in. oil sales pipeline extending 3,800 ft from the production facilities of the first Six-Pac to tap into a 10-in. Petrotrin oil pipeline that transports crude oil from Parrylands Block E 11 miles to the Point-a-Pierre refinery farther north along the coast.

Project return, game plan

Boyles envisions a project internal rate of return 17-47%, based on many variables, with the price NHE receives for its oil being the most critical-"17% might occur at $12[/bbl] oil, and 47% might occur at $16/bbl, with the production response" that he anticipates.

Of course, $12-16/bbl for 16-18° gravity crude oil means a global crude price environment that sees West Texas Intermediate at $18-20/bbl.

If oil prices were to collapse, says Boyles, "ellipseIn this particular environment and with this kind of reservoir, we could phase out of the steam cycle and go back to where our lift costs are considerably less. We have calculated that our lift costs while steaming will be in the $3.20/bbl range, and we've calculated that, with cold production, lift costs will be slightly less than the $1/bbl range. So we can still have positive cash flow even if, say, WTI is $12."

Strategy outlook

With a Trinidad project success under his belt, Boyles would then likely eschew any ambitious rank wildcat program in another country.

"By drilling wells throughout the Lower 48, I had the same kind of success that everybody else who has drilled in an aggressive manner across the board: I've had a few real money-makers; I've had the majority be marginal, break-even-type propositions; and I've failed miserably on my wildcats using some of the most sophisticated tools out there.

"But in the oil business, there is another avenue for people: to be a developer of proven reserves. That's less risky, if you can define your reservoir, your type of target, and use the right methodology.

His preference would be to follow up the redevelopment-EOR matrix NHE established on the Parrylands block with a similar program elsewhere in Trinidad and then move into other countries.

"One of the first things I will want to explore is whether or not my joint venture partner [Petrotrin] would be willing to allow me to develop other, similar sites.

"Second, and maybe while it's occurring, I would be asking the minister of energy and the presidents of the national oil companies in these countries that I want to move into next: 'Would you please allow me the opportunity to do the same that I'm doing here [in Trinidad]?' I suspect that I would receive positive feedback in both cases."

In addition, the surge in cash flow from the Trinidad project will enable the small company to acquire the tools, technology, and other skilled personnel needed to take on more-challenging reservoirs. Boyles would like to undertake the next project sequentially, having wrapped up the Parrylands project in 3 years: "You've got to finish something before you start something else in order to be effective."

By staying focused and being selective, Boyles hopes to duplicate his success in Trinidad in other, low-risk countries.

"When we were drilling in the Lower 48ellipseI was hoping to find a 30-50 million bbl field, and they were all found," he said. "We 'found' one [in Trinidad] on a global scene that was found but not developed, and it would take us only 3 years to fully develop it. Some people might go through a whole lifetime and never find something like that, if they let serendipity be their play, as opposed to defining a course of action."