Ethylene capacity rising, margins continue to suffer

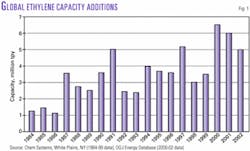

More than 6.2 million tonnes/year (tpy) of worldwide ethylene production capacity came on stream in 2001. This addition to incremental capacity nearly matched the record of 6.6 million tpy added in 2000 (Fig. 1).

Capacity as of Jan. 1, 2002, was 107.0 million tpy, an increase from a worldwide capacity of 100.8 million tpy as of Jan. 1, 2001.

This year's ethylene survey reflects a total of 107.6 million tpy of worldwide capacity as of Mar. 1, 2002. A new unit in UAE, which started up in January 2001, contributed 600,000 tpy to the survey.

In 2001, ethylene markets experienced a slowdown in demand and an overabundance of supply. As a result, many ethylene producers scaled back throughput. But this effort was not sufficient, as ethylene margins reached their lowest levels since the early 1990s.

In the US, operating rates dropped to 82% of capacity in 2001. Ethylene unit closures will occur in the next few years; older, less efficient crackers are prime candidates.1

New units

In the largest European project last year, Dow Chemical Co. added a 600,000-tpy ethylene unit to its Terneuzen, the Netherlands, plant in late 2001. The $500-million expansion increases the site's total capacity to 1.7 million tpy (OGJ, Aug. 20, 2001, p. 68).

According to Sasol Polymers, Optimal Olefins is starting up a new 630,000-tpy unit at its Malaysia ethylene plant in early 2002. Petroliam Nasional Berhad of Malaysia (Petronas, 64%), Dow (24%), and Sasol (12%) jointly own the plant.

In late 2001, state-owned Uzbekneftegas started up a grassroots petrochemical complex in the Shurtan area, south of Uzbekistan. The complex uses natural gas to produce 140,000 tpy of ethylene. The project cost more than $1 billion.

The Borouge joint venture of Abu Dhabi National Oil Co. and Borealis AS, Copenhagen, began first shipments from its $1.2-billion petrochemical complex at Ruwais, UAE, in January 2002. The complex has an ethylene capacity of 600,000 tpy.

ExxonMobil Corp. brought a $2-billion petrochemical facility on stream on Singapore's Jurong Island in mid- 2001. The complex is integrated with ExxonMobil's refinery in Singapore. The plant includes an 800,000-tpy steam cracker that produces ethylene, propylene, and other products for chemical plants in the area.

The two largest ethylene units to start up in 2001 were in Texas.

Formosa Plastics Corp., USA, started up a new 816,000-tpy ethylene unit at its Point Comfort, Tex., petrochemical complex. The addition brings the total ethylene capacity at the plant to 1.5 million tpy.

The largest ethylene plant to start up in 2001 was BASF Fina Petrochemicals' Port Arthur, Tex., plant (OGJ, Oct. 15, 2001, p. 56). The world's largest single-train olefins plant can produce 907,000 tpy of ethylene and 540,000 tpy of propylene. BASF Fina was formed in 1998 by BASF Corp. (60%) and Atofina Petrochemicals Inc. (40%).

Regional review

Table 1 shows rankings of the 10 largest ethylene production complexes in the world. As in last year's survey, Nova Chemicals Corp.'s Joffre plant is the largest in the world. Newcomers to the list include Dow's Terneuzen and Formosa's Point Comfort plants. Six of the complexes are on the US Gulf Coast, five in Texas.

Table 2 ranks ethylene production capacity by region. North America led the world with the largest absolute increase, 1.68 million tpy, followed by Asia-Pacific and Western Europe. South America experienced the largest percentage increase of all the regions.

Table 3 ranks ethylene production capacity by country. The US led the world with an absolute increase of 1.58 million tpy. The aforementioned expansions by Formosa and BASF Fina were offset by a shutdown of capacity in Chevron Phillips Chemical Co.'s Sweeny, Tex., facility.

Singapore ranks second with an increase of 940,000 tpy, mainly due to the new ExxonMobil plant. Yanbu Petrochemical Co. started up an 800,000-tpy unit in February 2001, which vaulted Saudi Arabia to third largest in Table 3. The Yanbu plant was discussed in last year's report (OGJ, April 23, 2001) but did not appear in the survey until this year due to a Jan. 1 reporting date.

Countries previously included in the FSU were reported separately this year. They include Azerbaijan, Belarus, Kazakhstan, Russia, Ukraine, and Uzbekistan.

The new plant in UAE is not reflected in Tables 2 and 3 because it started up after Jan. 1, 2002.

Closed plants

The only significant permanent shut down of ethylene production capacity occurred in Chevron Phillips' Sweeny plant. The company decommissioned its 181,000-tpy ethylene cracker. The smaller cracker, called Unit 12, has not operated since December 2000 due to decreases in ethylene and ethylene derivative demand.

Ownership changes, mergers

In May 2001, BP PLC took over the 50% share held by Bayer AG in their joint venture, EC Erdölchemie GmbH. BP now wholly owns the 950,000-tpy plant in Dormagen, Germany. In November, BP changed the name of the company to BP Köln GmbH.

In January 2002, Lyondell Chemical Co. said it would buy Occidental Petroleum Corp.'s 29.5% share of Equistar Chemicals LP. This would bring Lyondell's ownership interest in Equistar to 70.5%. Millennium Chemicals Inc. holds the remainder.

Equistar was formed in December 1997 with the combination of the olefins and polymers businesses of Lyondell and Millennium. Occidental joined the partnership in May 1998 with the contribution of the ethylene, propylene, ethylene oxide, and derivatives businesses of Occidental Chemical Corp.

In August 2001, BP PLC, China Petrochemical Corp. (Sinopec), and Shanghai Petrochemical Corp. formed a joint venture to build a 900,000-tpy ethylene cracker and chemicals derivative complex near Shanghai (OGJ Online, Sept. 4, 2001). The $2.7 billion project should begin operation in 2005 at Shanghai Chemical Industry Park, Caojing.

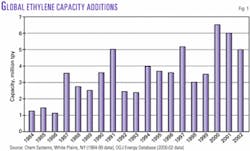

Table 4 lists the top 10 owners of ethylene capacity worldwide. Dow tops the list with 10.7 million tpy of capacity while ExxonMobil comes in second with 7.9 million tpy.

Construction

Of the 6.2 million tpy of expected capacity from major expansions to be completed in 2001, 5.9 million tpy came to fruition. Other expansions and debottleneck projects, however, brought additional capacity up to the forecasted increase of 6.2 million tpy.

Indian Petrochemicals Corp. Ltd.'s 150,000-tpy plant in Thane, Maharashtra, was expected to start up in 2001. According to the company, the plant had not yet started up as of January 2002.

According to OGJ's construction survey, 5.0 million tpy of new capacity will come on stream in 2002 (Table 5). This includes Borogue's 600,000-tpy plant in UAE that started up in January.

Idemitsu Petrochemical Co. Ltd.'s 600,000-tpy project in Tokuyama, Japan, is the largest project expected to come on stream before yearend 2002. Also significant are National Petrochemical Co.'s 520,000-tpy unit in Bandar Imam, Iran, Qatar Chemical Co. Ltd.'s 500,000-tpy unit in Mesaieed, Qatar, and Bharat Petroleum Corp. Ltd.'s 500,000-tpy unit in Tamil Nadu, India.

Worldwide capacity will grow an average 4.2%/year between now and 2006, according to the OGJ construction survey. A substantial amount of capacity, more than 9 million tpy, will come on stream in 2003.

Global market

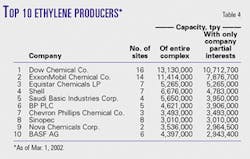

The supply and demand situation for ethylene in 2001 worsened from the previous year. Worldwide ethylene supply exceeded demand by 16.8 million tonnes in 2001, up from a surplus of 9.6 million tonnes in 2000. Worldwide ethylene demand in 2001 was 90.2 million tonnes.

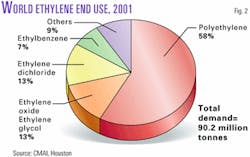

Fig. 2 breaks down this demand by end use. Polyethylene remains the most common derivative from ethylene. It contributed 58% of demand in 2001.

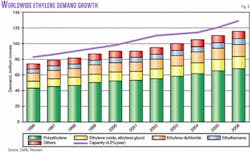

In Fig. 3, Chemical Market Associates Inc. (CMAI), Houston, Tex., forecasts a capacity growth of 4.2%/year and a demand growth of 5.0%/year. Fig. 3 also breaks down demand growth for the different ethylene end markets. CMAI expects capacity to reach nearly 130 million tpy in 2006, which concurs with the capacity increases predicted by the OGJ construction survey.

North American market

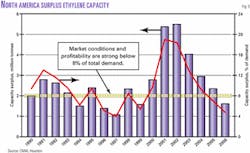

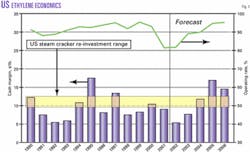

Weak ethylene demand, mainly due to an economic downturn, combined with new capacity, led to historically low cash margins for US producers in 2001 (Fig. 4). US operating rates were also low, at 82% of total capacity, in 2001.

Fig. 4 shows that favorable economics for reinvesting in steam crackers will not occur until 2004.

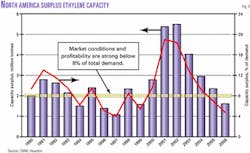

Fig. 5 shows that excess capacity for all of North America was about 5.4 million tonnes for 2001. North America ethylene capacity was 35.4 million tonnes in 2001; therefore, demand was about 30.0 million tonnes, a decrease of 1.0 million tonnes from year 2000.

According to Fig. 5, strong profitability will not return until 2005. CMAI believes, however, that solid US economic growth will resume in 2002.1

Reference

1. Eramo, M.A., Gilmer, R.W., and Teleki, A., "Petrochemical outlook still bleak for 2002," Houston Business, Federal Reserve Bank of Dallas, Houston Branch, November 2001.