Trinidad and Tobago's Atlantic LNG follows initial success with aggressive expansion plans

First in a series

Atlantic LNG Co. of Trinidad & Tobago Ltd. has had little opportunity to rest on its laurels after successfully starting up LNG export sales from Trinidad and Tobago in early 1999.

The consortium operating the first Western Hemisphere LNG export plant to go on line in the past 30 years is in the midst of constructing the next two trains, with startup of Train 2 slated for this year and Train 3 scheduled to go on stream next year.

At the same time, Atlantic LNG is conducting front-end engineering design (FEED) work on a proposed fourth train. And there has been some tentative consideration of a fifth and sixth train.

Meanwhile, additional apparent world-class natural gas discoveries have been made onshore and off Trinidad, bolstering prospects for ample reserves needed to supply such ambitious LNG expansion plans. Some estimates of those potential gas reserves run as high as 100 tcf, although proven and probable reserves total 35 tcf.

All of this is occurring against a backdrop of spirited debate within the two-island nation about the best way to monetize its burgeoning gas wealth. The government of Trinidad and Tobago is trying to develop a master gas plan that focuses on maximizing job creation as well as the most effective ways to monetize gas reserves. That points to more of the kinds of value-added gas chain projects and other industries that are more job-intensive than LNG plants.

However, gas producers generally welcome the LNG option because it is the swiftest way of monetizing the biggest chunk of gas reserves. And with a worldwide boom under way on expanding both export and import infrastructure for LNG, the window for new LNG projects is lowering. That makes the timing of developing a coherent national gas strategy critical for the LNG industry's newest showcase-one that its owners contend may be the model for future LNG plants.

Atlantic LNG is a consortium of units of BP PLC 34%, BG Group PLC 26%, Repsol-YPF SA 20%, Cabot LNG LLC (later acquired by Belgium's Tractebel SA) 10%, and state-owned Natural Gas Co. of Trinidad & Tobago Ltd. (NGC) 10%.

First phase recap, update

Atlantic LNG's first cargo for Train 1 was loaded in April 1999, and the plant was handed over to the owners in June 1999.

It is only the second LNG exportplant to be built in the Western Hemisphere.

The plant at Point Fortin, on the western coast of Trinidad, is based on Phillips Petroleum Co.'s Optimized Cascade process. This process had been used in a commercial plant only once before-one at Kenai, Alas., that started operations in 1969 and is still shipping LNG to Japan for owners Phillips and Marathon Oil Co.

Bechtel International built both the Kenai and Trinidad plants, establishing with the latter a record for the shortest time span between conceptualization and completion for an LNG plant. Construction began in 1996. BP pegged the project's development time from evaluation to completion at 6.5 years vs. the industry norm of 14 years for an LNG complex.

The single-train plant, twice the size of the Kenai plant at a nameplate capacity of 3 million tonnes/year, has two 100,000 cu/m capacity storage tanks and a jetty with three offshore LNG loading arms that can accommodate 135,000 cu m/capacity carriers. Capital cost was $900 million. BP claims that Train 1 has set a new benchmark for LNG unit capital cost at less than $200/ tonne of capacity.

LNG carriers owned by Cabot load every 5-6 days at Point Fortin, carrying gas under contract to buyers in the US and Spain. Cabot is buying 60% of the plant's output for terminals in the US and Puerto Rico, and Repsol-YPF's Spanish gas utility unit Enagas is buying the remainder. Both contracts are set up on netback and take-or-pay terms for 20 years.

Alan Hatfield, Atlantic LNG engineering ser- vices manager, noted that most of the firm's LNG has been shipped to Boston or Lake Charles, La., terminals under a tradeout agreement between Cabot and Repsol-YPF.

Hatfield took note of a dicey situation that developed with a cargo shipped to Boston-when the Matthew LNG carrier was blocked from offloading its cargo at the Distrigas of Massachusetts LLC-operated terminal amid the widespread security fears that followed the terrorist attacks on the US on Sept. 11, 2001 (the carrier was later rerouted to El Paso Corp.'s Elba Island, Ga., terminal).

"When the Matthew was banned in Boston, we had to turn down the plant for 1 day and ran at half rate for about 3 days," he said. "We used the opportunity to change out a molecular sieve, which offsets a future planned shutdown."

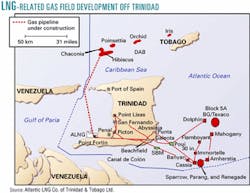

All of the natural gas feeding the Atlantic LNG plant comes from BP's fields off Trinidad's eastern coast. BP laid a 36-in., 125 mile (75 miles offshore) pipeline from its eastern offshore gas fields-among them Cassia, Flamboyant, Immortelle, Mahogany, and Amherstia. Of the 475 MMcfd of gas coming from BP, the LNG plant consumes 10% as fuel gas.

The system will be debottlenecked to accommodate 500 MMcfd of inlet gas, boosting LNG production to 3.3 million tonnes/year.

BP separates the gas and liquids offshore, sending them to shore at Beachfield via 40-in. and 20-in. pipelines, respectively.

"Normally, we don't see any liquids [in the gas stream]," noted Hatfield, who characterized the gas as 1,075-1,080 btu/cu ft, with very little water, 0.4% carbon dioxide, and zero sulfur dioxide.

After the heavier hydrocarbons "fall out" of the inlet gas, BP ships 5,000-6,000 b/d of NGL via a 6-in. line to the nearby Phoenix Park gas processing complex.

The fuel gas fires six General Electric Frame 5-C turbines that provide the plant with electric power. A new design, Frame 5-D, provides 14% more horsepower, so the LNG expansion trains will incorporate Frame 5-D turbines.

"We'll probably go back to Train 1 and upgrade [the turbines] to 5-D's," Hatfield said.

The Optimized Cascade process does not involve water, and CO2 is removed with diglycol amine. The Optimized Cascade process employs a three-way refrigeration process involving propane as a precoolant, ethane, and methane to chill the gas to -260°F.

Project expansion

As 2001 wound down, Atlantic LNG was marking progress on the Train 4 FEED study while nearing completion of construction of Trains 2 and 3. At yearend 2001, negotiations for Train 4 volumes had not yet gotten under way.

That compares with what happened during the construction of Train 1, when year-long negotiations of terms for Trains 2 and 3 were under way. As an incentive to the project sponsors, Train 1 was granted a 10-year tax holiday, an incentive not available for the expansion trains.

All of the gas covered by the first two expansion trains is committed, but only three of the consortium's original members are participating in Trains 2 and 3, said John Andrews, Atlantic LNG chairman. Output from the two expansion trains is earmarked at 62% for Spain and 38% for the US.

Gas for Trains 2 and 3 will be supplied by gas from a new development off the island's northern coast, as well as from eastern offshore fields (see map, p. 27). The volumes will be split 50:50 by BP and BG for Train 2 and 75:25, respectively, for Train 3.

The green light for the first two expansion trains also spurred development of Hibiscus field off the northern coast. BG is developing that 3 tcf field in a joint venture with Veba Oil AG, Agip SPA, and state-owned Petroleum Co. of Trinidad & Tobago Ltd. Hibiscus will provide 50% of the input for Train 2, delivering 225 MMscfd of gas via a 105 km pipeline from a platform in 500 ft of water. Pipelaying was nearing completion late last year-a problematic effort, as the 24-in. concrete-coated pipeline was being laid over a submerged mountain range.

BP, BG, and Repsol-YPF are currently funding Trains 2 and 3, Andrews noted, with the original consortium members not directly participating with equity stakes.

"Cabot backed out, and NGC needed to have the financing done in a certain way," he said. "But we were not going to rearrange the financing just to include them.

Train 2 is expected to come on stream by the third or fourth quarter of this year, and Train 3 would start up about 9 months after that.

The expansion trains would each have capacity of 3.3 million tonnes/ year, bringing the entire complex up to 9.6 million tonnes/year. Trains 2 and 3 raised the bar still further on unit capital costs, says BP, reducing them to $165/tonne of capacity.

The expansions also entail adding another concrete-coated storage tank of 160,000 cu m capacity-the biggest in the world, according to Hatfield-and adding another loading arm to the three on Atlantic's 700-m jetty.

Future expansions

Although the FEED study for Train 4 was approved Apr. 27, 2001, negotiations were still not under way earlier this year. The study was expected to be completed early this year, possibly before the second quarter.

Train 4 would be designed for a capacity of 4.6-4.8 million tonnes/year, which would make it the largest single LNG train in the world.

"We want to show that the Phillips process is scalable," Hatfield said. "If Train 4 comes about, we will have to build another jetty, with Trains 2 and 3 taking 50% of the berth capacity utilization."

One of the holdups on negotiations is that "the country has to identify additional gas reserves" to justify a fourth train, Andrews said. "We're putting ourselves in a state of readiness in the meantime."

The ideal situation would be for work to begin on Train 4 as Trains 2 and 3 are coming on stream, garnering "the efficiencies of not having to demobilize the contractors," Andrews said.

He estimates that construction of the fourth train would require 36-42 months, from groundbreaking to commissioning.

Andrews is concerned that the window of opportunity for Train 4 might be lowering, especially in light of industry's aggressive efforts to reactivate LNG terminals in the US and to develop new LNG terminals in North America, Central America, South America, and the Caribbean.

Even within the Caribbean region and Central America alone, there is consideration of LNG market potential that could supplement the vast potential market in the US, Andrews noted. The major targets under active discussion would be Jamaica (600,000 tonnes/year) and the Dominican Republic (900,000 tonnes/year), but Atlantic LNG also takes note of further potential in Cuba (2.8 million tonnes/year), El Salvador (800,000 tonnes/year), Panama (600,000 tonnes/year), Honduras (500,000 tonnes/year), and Costa Rica and Nicaragua (300,000 tonnes/year each).

And further expansion is also under consideration at Point Fortin, Andrews notes:

"In the event that there are further opportunities for LNG expansion, the existing Atlantic LNG site could possibly accommodate a maximum of six trains."

If Trinidad and Tobago can realize just its currently identified gas potential, that could prove enough reserves to support gas exports of 5-6 tcf/year over a 20-year span, Andrews estimated. That would make the tiny nation one of the dominant players in the global LNG trade for years to come.

Master gas plan

However, the likelihood of that level of gas exports being realized is limited by the country's need to create jobs.

Andrews, whose background includes years of government service, recognizes that need as the source of local opposition to a swift ramp-up of LNG exports by his country, the market opportunity and resource potential notwithstanding.

"Some people tend to look at Atlantic LNG as a mere exporter of resources," he said.

There is ample precedent for a value-added, gas-based industrial expansion in Trinidad: the Point Lisas industrial estate, which got its start in 1959 with the production of ammonia.

Point Lisas is the world's largest exporter of methanol and ammonia today. Currently, there are eight ammonia plants, five methanol plants, a urea plant, a gas processing complex, iron and steel operations, and a power generation complex. A ninth ammonia plant is under construction, and several more large methanol and ammonia plants are under development or discussion.

Hatfield noted that the strong emphasis on jobs creation affected the tone of negotiations for Trains 2 and 3, which were "really tough"-not the least of which involved the project losing its tax-free status.

"On one hand, [the government] wanted this [LNG expansion], but on the other hand they like methanol and ammonia better," he said. "They do a job per btu analysis, and that is how they analyze everything [in the gas value chain].

"Methanol and ammonia plants are really touch-and-go. Their cost of production is more than they can get on the market very often, and sometimes they are shut down for a year or 2 at a time.

"So they wanted something that was more stable for jobs, and that's why they wanted an LNG plant. But they wish it were more labor-intensive. They look at that more than whether or not they make money."

Given the state of the global economy and the plummeting outlook for methanol demand in the US as a result of proliferating bans on the gasoline additive and key methanol derivative methyl tertiary butyl ether, the market for both ammonia and methanol could become even more "touch-and-go."

Such concerns were behind the government asking Gaffney Cline & Associates (GCA) to undertake a master gas plan analysis.

The consultant, in a preliminary assessment last October, made these general recommendations:

- No monetization options should be discouraged. A long planning horizon and technological and market changes demand flexibility in planning. Specific projects may have unique strengths or advantages.

- The government should move towards limiting its risks in projects where export sales for that product have been established and let market fundamentals guide investment and resource allocation decisions. Specifically, it should replace discounted sales of gas and electricity with direct subsidy where required, and it should reduce or eliminate tax holidays.

- The government should invest in infrastructure to attract investors to all projects. This includes industrial estates, port facilities, utilities, shipping, roads, and pipelines.

GCA also made specific recommendations with regard to the types of gas-based industries:

- Methanol: no additional expansion.

- Ammonia-urea: no additional expansion.

- LNG: continued expansion.

- Gas-to-liquids: Undertake with limited government support.

- Iron ore reduction (steel): Consider as an option primarily for employment and expanding job skill sets.

- Aluminum smelting: Consider as an option primarily for employment and expanding job skill sets.

- Power: Price electricity to recover costs.

- Ethylene and polyethylene: Encourage development of a world-scale plant.

- LPG: Continue Caribbean sales expansion.

- Compressed natural gas as vehicular fuel: Encourage development of Caribbean markets.

- Added-value products: Undertake when investor expresses interest.

Some of these proposals match what BP has proposed as a grassroots industrial estate that builds upon the success of Point Lisas. It would be "preplan- ned," integrated, and designed for modular expansion around centralized, shared utilities and services.

Such a site would have at its heart power, LNG, and synthetic gas-petrochemical projects in addition to ammonia and methanol, according to BP's proposal.

While Andrews doesn't see Atlantic LNG diversifying into other gas-based industries, he does see the company remaining a key player in LNG in the Western Hemisphere for years to come.

"The government does want to concentrate on creating jobs," Andrews said. "But the gas reserves can probably support both [LNG and added gas-based industrial expansion]."