Market Movement

Market nervous about OPEC's latest output cut

The oil market exhibited nervousness entering 2002 over concerns about whether OPEC will be able to enforce its Dec. 28 announcement to reduce production quotas by 1.5 million b/d for the next 6 months.

The agreement reached in Cairo means OPEC, with 60% of the world oil export market, reduced production by 6.5% starting Jan. 1.

Russia, Norway, Mexico, Oman, and Angola have also pledged production or export reductions totaling 462,500 b/d. OPEC initially stipulated that non-OPEC producers had to reduce oil output by 500,000 b/d before it would again roll back its production quotas.

OPEC´s emergency meeting in Cairo marked the group´s record seventh gathering in a year, surpassing 1974 when the group was coordinating an oil boycott after the 1973 Arab-Israeli war. Last month, most members of the cartel were in Cairo for a meeting of the Organization of Arab Petroleum Exporting Countries. An official OPEC ministerial meeting is slated in March in Vienna.

Analysts question OPEC´s plan

Frederick P. Leuffer of Bear Sterns said OPEC´s plan "appears to be short-sighted and is unlikely to achieve its stated objective."

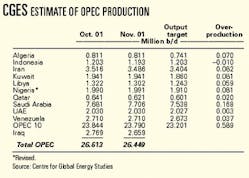

The market´s skepticism was warranted, he said, adding that Bear Stearns continues to maintain its 2002 price forecast for WTI spot at $18/bbl.

"Having seen revenues plummet as oil prices dropped from $37/bbl in late 2000 to less than $20/bbl recently, and watching its market share fall to a 10-year low as a result of cutting production throughout 2001, this plan supposedly is designed to boost revenues and protect OPEC´s market share." Leuffer said the plan might appear to work for the next few months. "However, over the next 6-12 months, we think the plan is doomed to failure."

For instance, he said OPEC has pledged to cut production by more than non-OPEC producers, representing a further decline in market share. OPEC´s market share going forward appears headed for a continued decline because oil prices remain high enough to attract capital for exploration and development of additional barrels worldwide.

"Production will continue to build in Azerbaijan, Kazakhstan, offshore West Africa, South America, and North America. We see production growth accelerating each year in the 2003-06 period. Depending on the speed and degree of economic recovery, OPEC´s market share is likely to decline slowly or rapidly during this time. But either way, we project OPEC´s share to erode further as long as oil prices stay at $20/bbl or higher," Leuffer said.

Regarding OPEC´s record for cheating on quotas, credibility is an important issue, Leuffer noted. "If oil producers do not cut output as promised and oil prices weaken, OPEC may have no other way to restore its credibility but to let prices fall to the low teens."

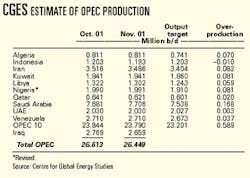

CGES details OPEC´s overproduction

In a note written before OPEC´s Dec. 28 announcement, the Centre for Global Energy Studies said the organization did not need to cut output to stabilize the market. "With no further output cuts, [we] believe prices will stabilize around $18/bbl for Brent ($17.50/bbl for the OPEC basket) in the first half of next year. Although this ought to help a global economic recovery and limit the growth in non-OPEC output, it is not high enough for OPEC´s members."

CGES also noted that OPEC´s call for support from non-OPEC producers in making output cuts came at a time when OPEC´s members were overproducing against their agreed quotas by around 0.6 million b/d (see table).

"OPEC claims to have cut output by 3.5 million b/d [in 2001], but this is only on paper. The real reduction in the output of the 10 members bound by the output agreements has been a more modest 2.8 million b/d between December 2000 and November 2001," CGES said.

CGES said it is not convinced OPEC will be able to reduce its actual output by more than 0.8-1 million b/d, doing little more than implementing fully the existing output targets.

"This cut will be insufficient to meet OPEC´s price target in the first half of 2002 and risks destabilizing the market in the second half of the year by slashing stockcover," CGES said.

CGES analysis indicated that any attempt by OPEC to boost oil prices in the first half of 2002 will destabilizerather than stabilizethe oil market.

With no change in OPEC´s output from the average fourth quarter 2001 level of 26.4 million b/d, the oil market would remain stable in the first half of 2002 at about $18/bbl for Brent, CGES said, adding that oil prices would strengthen in the second half of 2002 as stronger economic growth boosts oil demand.

Under the no-change scenario, dated Brent would average around $21/bbl in fourth quarter 2002, with the OPEC basket around $1/bbl lower, CGES said. OPEC´s share of the oil market would fall to 34.5% in 2002 from 35.5% in 2001 and 36.5% in 2000, as non-OPEC production grows faster than demand.

"The problem for OPEC is that an average price for its basket of crudes in 2002 of $18.50/bbl, with a price below $18/bbl in the first half of the year, is not high enough to meet the immediate revenue needs of its members," CGES said.

Awaiting the recovery in demand

Merrill Lynch analyst Steven A. Pfeifer said OPEC´s 1.5 million b/d quote cut "has significantly reduced the risk of an oil price collapse below $15/bbl. While a recovery in the global economy will ultimately drive a retightening in oil market fundamentals, a key question for energy investors is: "How long can oil prices fall between now and the recovery in demand?" Pfeifer said.

Merrill Lynch´s supply demand model conservatively assumes an actual output reduction of 1.05 million b/d. This assumes zero actual cuts from non-OPEC countries and cuts of 1.05 million, or 70% compliance, by OPEC, Pfeifer said.

Merrill Lynch reduced its 2002 oil price forecast to $19/bbl from $23/bbl for WTI. Pfeifer said the reduction reflects an even weaker than anticipated oil demand outlook caused by the worse global economy in 20 years.

Industry Scoreboard

null

null

Industry Trends

EIA has projected that US energy demand in 2000 will increase 32% to 131 quadrillion btu in 2020, assuming no changes in federal laws and regulations.

In its Annual Energy Outlook (AEO), EIA predicted total energy consumption will grow faster than US energy production through 2020, which means the US will rely more on imports.

"Increasing demand for petroleum is projected to raise the share of demand met by net imports from 53% in 2000 to 62% in 2020 (lower than the 64% share in AEO 2001, due to higher domestic production)," the report said.

US crude oil production will decline at an average annual rate of 0.2%, from 2000 to 2020, to 5.6 million b/d, EIA projected.

EIA also estimated the average world oil price will begin increasing gradually in 2002 after reaching $22.48/bbl in 2001. The average oil price for 2000 was $27.72/bbl.

EIA projects that increases in demand will push 2020´s average oil price, in 2000 dollars, to $24.68/bbl. In last year´s AEO, the 2020 prediction was $22.92/bbl.

The agency projects world oil demand will increase to 118.9 million b/d in 2020 from 76 million b/d in 2000, in part due to higher demand in the US and developing countries, including the Pacific Rim and Central and South America. However, OPEC production is expected to reach 57.5 million b/d in 2020, nearly twice 2000´s number. Non-OPEC production is expected to reach 61.1 million b/d by 2020.

The agency also expects the average wellhead price of natural gas to reach nearly $4/Mcf in 2001 compared with a 2000 price of $3.60/Mcf. It predicts a 2020 natural gas price of $3.26/Mcf. Last year´ AEO called for a 2020 price of $3.20/Mcf.

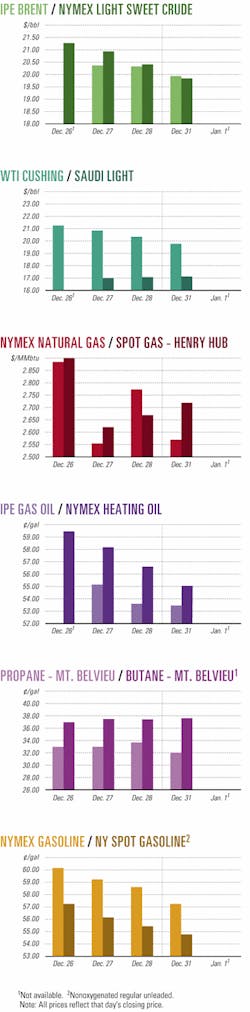

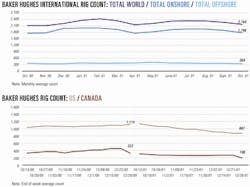

BAKER HUGHES´s survey showed a slight uptick in a recent US rotary rig count.

As of Dec. 28, 2001, the rig count was up by 5, with 887 rotary rigs drilling during the final full week of activity for 2001. However, that increase was just another fluctuation in a general downward trend for US drilling over the past 28 weeks.

For the same period last year, 1,114 rotary rigs drilled in the US and its waters.

All of the gains for the week ending Dec. 28 stemmed from activity in offshore and inland waters, Baker Hughes executives reported. The number of offshore rigs drilling at some time during that week increased by 11 to 119 in the Gulf of Mexico, pushing the nationwide total to 125. There also were 19 rigs working inland waters, up 2 from the previous week. However, the number of active land rigs was down by 8 to 743.

Of the total rigs working, 748 were drilling for natural gas, up 7 from the previous week. The number drilling for oil was down 3 to 137, while 2 rigs were unclassified.

Government Developments

KAZAKHSTAN PRESIDENT Nursultan Nazarbayef seemed to play down a pipeline route through Iran during a Dec. 19 speech in Houston even though he had pushed for that route while visiting with US Sec. of State Colin L. Powell earlier in December.

Responding to a question in Houston about the "most important pipeline routes" to carry oil and gas from the prolific Caspian Sea region to world markets, Nazarbayef said Iran is among a number of potential routes being considered.

Other possibilities include routes through Russia and Poland to the Baltic Sea or eastward to western China, he said.

"Our priority for the near term has already been fulfilled for the next 7-10 years," Nazarbayef said in Russian through an interpreter. However, he later said additional pipeline capacity would be necessary when development of Kazakhstan´s huge Kashagan oil discovery begins after 2005.

At a Dec. 9 meeting with Powell in Kazakhstan, Nazarbayef had urged the US to consider the Iranian route as the most direct and cost-effective means of moving Caspian oil and gas into world markets.

"I say frankly that our investors who work on oil consider that the most beneficial route is through Iran to the Persian Gulf," he said at the time.

Although Powell didn´t rule out an Iranian route, he reiterated the US view, first developed by President Bill Clinton, that routes through Russia and Turkey are preferred and would be sufficient to handle Caspian production.

Weeks later while in Houston, Nazarbayef was less emphatic about the Iranian route during a speech at the James A. Baker III Institute for Public Policy on the Rice University campus.

The future route for an additional pipeline from the Caspian area to outside markets will be "decided by the [participating development] companies after their evaluation of costs of transportation," he said.

IN A STUDY on Artic Gas, two University of Houston professors said the Mackenzie Valley corridor in Canada almost certainly will prove to be the choice route for the proposed Arctic gas pipeline rather than a proposed route following the Alaska Highway.

Ronald Oligney and James Longbottom, in their recently released study, The Imperatives of Arctic Natural Gas Development, also said the capacity of the line should be 12 bcfd, double or triple other proposals, because, "America needs the gas!"

The authors suggested a system that would carry both Alaskan and Canadian gas and that would be developed in four phases.

The first phase would be a Canada-only line from the Mackenzie Delta to Alberta. The proposal for a 1.6 bcfd line would allow the first step to be taken with minimal risk because no international agreement would be required.

The second phase would include a 2.5 bcfd northern Alaska tie-in and a Mackenzie loop; the third, a full-length line loop, carrying 2.5 bcfd of Alaskan gas and 1.5 bcfd of Canadian gas; and the fourth, another full length loop carrying 2.5 bcfd of Alaskan gas and 1.5 bcfd of Canadian gas.

The authors said that market imperatives will favor the Mackenzie Valley route. They predict the proposed southern line will be uneconomic even at $3/Mcf.

Oligney and Longbottom cited studies by the Cambridge Energy Research Institute, Purvin & Gertz, and the Interstate Natural Gas Association of America that the northern route would be cheaper than the southern route.

Quick Takes

The long-delayed project to build a $1.5 billion pipeline to bring gas from the Bayu-Undan field in the Timor Sea to Darwin in northern Australia has been approved by Phillips Petroleum following the settlement of a dispute over the tax regime involved with the East Timor government (OGJ, Aug. 6, 2001, Newsletter, p. 9).

Phillips, in a statement issued late last month, said it welcomes the tax and fiscal package offered by East Timor´s Council of Ministers. However, the deal must first be ratified by Australia, which will share the revenue from the gas project with East Timor, before contracts for the development can be placed.

Negotiations on behalf of the East Timor government have been conducted by the United Nations, which became involved in the issue 6 months ago when the participants in the project said that its viability was threatened. The delay also has threatened the development of other long-term projects in the area, although during the past 6 months negotiations with potential customers for the field´s gas have continued.

The Bayu-Undan field contains estimated reserves of 400 million bbl of condensate and LPG and 3.4 tcf of gas. The field is located in 80 m of water about 500 km north west of Darwin and 250 km south of Suai, East Timor.

Elsewhere on the pipeline front, Santos has quit a $3.5 billion pipeline project to move Papua New Guinea natural gas to Australia. ExxonMobil said it and the other partners-including ChevronTexaco, Oil Search Ltd., and Orogen Minerals-signed a new agreement without Santos. They were negotiating how to divide Santos´s 12.5% stake, ExxonMobil said. Oil Search and Orogen, meanwhile, are presently in merger talks. The 3,200 km pipeline project has been delayed because of a dispute between the partners on how to split revenue from the gas and because of a lack of political support. The companies have yet to give final approval to the project, which originally was to be built by late 2001. The new agreement sets the terms under which the partners would operate, ExxonMobil said. It replaces a previous accord that expired Dec. 31, 2001.

Iran and Armenia will invite Russian and French companies to invest in a new pipeline project linking the two countries, which have agreed in principle to build the 140 km line. Cost of the project is estimated at $120 million with 100 km of the pipeline to be built in Iran. It will have the capacity to supply the Armenian gas network with 1.5 million cu m/day. Armenia´s gas supplies currently come from Russia. Armenian government officials said the project is designed to reduce dependence on a single supplier. However, the two countries will invite Russian interests to invest along with French companies that have already indicated a willingness to become involved in the project, scheduled to start sometime later this year. An initial accord on an Iranian-Armenian pipeline was signed in 1992, modified in 1995, but never implemented because of financial problems.

Algeria´s Sonatrach, Italy´s Enel, and Germany´s Wintershall established a joint venture to carry out feasibility studies for a $2 billion second gas pipeline to link Algeria and Italy. In the first phase, the project would convey 10 billion cu m (bcm)/year of natural gas to Italy. The proposed 1,500 km line would be built in four sections. The first would cross 640 km of Algeria from Hassi R´mel gas field to the northeast part of El Kala. The second stage, 310 km of subsea line, would link El Kala to Cagliari, Sardinia. The third section would connect Cagliari to Olbia, more than 200 km away on the northeastern shore of Sardinia, and the fourth section, about 300 km with a good portion offshore, would connect Olbia to Pescaia, southeast of Florence. A later extension of the pipeline could supply gas to Germany. Sonatrach holds 50% of the JV, Enel 35%, and Wintershall 15%. Algeria is already linked to Europe by two other gas pipelines-the Maghreb-Europe line, which transports 8 bcm/year of gas to Spain and 2.5 bcm/year to Portugal, and the Trans-Mediterranean line, supplying Italy with about 20 bcm/year of gas.

In gas processing news, AltaGas Services joined with Taylor NGL to develop Taylor´s proposed $45 million (Can.) ethane extraction plant at Joffre, Alta.

The federal and provincial governments approved Taylor´s application in September (OGJ, Sept. 17, 2001, Newsletter, p. 9). The plant, near NOVA Chemicals´s Joffre petrochemical complex, will be rated at 250 MMcfd and will have initial production of 10,400 b/d of natural gas liquids.

Ethane will be sold to NOVA Chemicals and the other liquids will be marketed through a partner.

Under the JV agreement, AltaGas and Taylor will each own 50% of the plant and will jointly develop projects that will enhance the value of the facility.

Taylor expects the project to be operational by first quarter 2003.

Taylor owns and operates the Younger NGL extraction plant, the only straddle plant in British Columbia.

China´s Sinopec and CNOOC will build four platforms to develop the Chunxiao complex in the East China Sea.

CNOOC had said it would bring Chunxiao structure in the Xihu Trough on stream in 2004 (OGJ, Dec. 17, 2001, p. 58). The complex, 300 km off Shanghai, is made up of four gas fields: Chunxiao, Tianwaitian, Canxue, and Duanqiao. Production will be transported to Zhejiang province via an offshore pipeline.

The two companies must jointly approve the project. Then the State Development Planning Commission will consider their application. Sinopec and CNOOC have invited Royal Dutch/Shell and Unocal to participate in exploration and production activities in the East China Sea. The two companies have bought the data package from Sinopec and CNOOC.

Currently, Sinopec and CNOOC each hold a 50% stake in investments to develop the oil and gas reserves. CNOOC, which is the designated operator for exploration and production in Xihu Trough, plans to drill 4-6 exploration wells early next year at a cost of $200 million.

The Xihu Trough has 500-800 billion cu m of proven natural gas reserves.

The North West Shelf Venture began production 3 months ahead of schedule from the Echo-Yodel fields northwest of Dampier, Western Australia, operator Woodside Energy said late last month.

Woodside also said the project was within its $205 million (Aus.) budget but did not reveal the exact cost.

Echo and Yodel, on WA-28-P and 23 km southwest of the Goodwyn A platform, will add 37 million boe to the JV´s production over the project´s 4-5 year life.

Two subsea production wells are tied back to the Goodwyn platform via a 12-in. pipeline. Peak production is expected to reach 30,000 b/d of condensate and 300 MMscfd of gas.

Echo-Yodel production will be commingled with Goodwyn production, helping to compensate for Goodwyn´s decline.

The six partners in the venture believe Echo-Yodel has reserves of 37 million bbl of condensate and 400 bcf of gas (OGJ Online, Sept. 28, 2001).

In other production action, Petronas Carigali, a branch of Malaysia´s Petronas, began first production from Angsi field in the South China Sea off Malaysia, 6 months ahead of schedule and 30% below original approved cost. Angsi´s initial flow was 15,000 b/d of oil and 60 MMscfd of gas. At peak, Angsi should produce 65,000 b/d of oil and 450 MMscfd of gas (10% of Malaysia´s current oil production and 17% of its current gas production, respectively). ExxonMobil Exploration & Production Malaysia is Petronas Carigali´s 50% partner in the development (OGJ Online, Mar. 5, 2001). An integrated oil and gas central processing platform is connected to a 52-well drilling platform via a 100-m bridge, as well as a 32-well satellite drilling platform. There are connections to existing gas production facilities at Guntong-D and Seligi-A, a connection to the existing oil production facilities at Tapis, and a new 166-km pipeline from the Angsi complex to the onshore receiving facility. Thai Shell Exploration & Production´s planned revival of production from Thailand´s first offshore oil field is doubtful, officials said. A well drilled in Nang Nuan field this year was a failure, raising questions about the productivity of the field off the Chumphon coast. A previous reentry of Nang Nuan B01 produced 7,500 b/d of light crude (OGJ Online, July 26, 2001). "[The field] poses a technical challenge for us. For one thing, we now know that [Nang Nuan B01] was able to recharge its oil reservoir after 4 years, but we don´t know whether [or] how long it would produce," a Thai Shell executive said. The high temperature of Nang Nuan crude, at 100° C, poses other technical problems for the specially-designed early production facility that would be put in place, he said. At peak, Nang Nuan B01´s production was 12,000 b/d. It yielded 4.25 million bbl of oil before excessive water intrusion stopped production in 1997 (OGJ Online, Nov. 20, 2000).

A Royal Dutch/Shell unit will launch a pilot water injection project in Greater Sirikit field on S1 concession in early 2002. During 2001, the field suffered a rapid drop in pressure, bringing production to 21,760 b/d. Previously, Greater Sirikit field was expected to produce 24,900 b/d. Thai Shell will decide in mid-2002 whether to commit to a full-scale water injection program. In the meantime, it will spend $20 million of its $44 million 2002 budget on the pilot project. In 2002, the company plans to drill 24 development wells, spending $24 million. In 2001, Thai Shell drilled 32 development wells and four exploration or appraisal wells, but still fell short of its oil production target by nearly 13%. In 2002, the company aims to sustain oil production from the 20-year-old Sirikit field at about 20,000 b/d with about 50 MMcfd of associated gas. F India´s ONGC plans to spend 469.7 billion rupees ($9.8 billion) over 5 years to produce 144.28 million tonnes of crude oil and 121.80 billion cu m of gas. In addition to the production targets, ONGC proposes to add 1.07 billion tonnes of oil equivalent new reserves in place and 250.5 million tonnes oil equivalent of recoverable reserves during the period. ONGC proposes to drill 594 exploratory wells during the tenth 5-year plan (2002-07), 100 wells fewer than the ninth plan (1997-2002), but will carry out additional 3D seismic surveys. ONGC´s domestic exploration program will focus on the deepwater sector, which could hold the largest remaining hydrocarbon potential in India. It will drill 35 wells in deep water during the period, four times the number of wells proposed for the ninth plan.

A new delayed coker unit is in full operation at ExxonMobil´s Baytown, Tex., refinery.

The 40,000 b/d unit allows the refinery to convert lower-cost, heavy raw materials into higher-valued, cleaner-burning fuels, said ExxonMobil.

The new coker unit and its related facilities will allow ExxonMobil to process heavy crude oil feedsincluding Maya crude, which will be delivered to the refinery under terms of a supply agreement with Mexico´s Pemex.

"Strict design standards…in planning the project and emissions modeling used to help design the facility have resulted in a decrease at the refinery of both nitrogen oxide and volatile organic compounds emissions," ExxonMobil said.

PetroChina is planning to raise its refinery operations for 2002 to an average 83% from last year´s 79%. The company´s refineries are eager to run at higher levels next year in order to raise their revenues. However, the plan will be subject to adjustment based on domestic demand. Resumption of diesel imports next year will affect the refineries´ operational rate. According to the commitment China made in order to earn its World Trade Organization membership, it will import about 22 million tons of oil products in 2002. Of those total imports, 4 million tons will likely be diesel, which China has banned from importation since 1998 to protect domestic refineries. At the end of June, PetroChina was operating about 95 million tonnes/year of refining capacity, down from 111.23 million tonnes at the end of last year, following closures of some small and inefficient refineries (OGJ Online, July 23, 2001).