CERA: Demand drop to push oil prices lower in 2002

World oil prices should average $6/bbl less this year as the market seeks equilibrium as demand slides.

Joseph Stanislaw, president of Cambridge Energy Research Associates, made that prediction earlier last month as CERA issued its "Global Oil Trends 2002" analysis, prepared in partnership with Sun Microsystems Inc.

"Fear of a recession has a grip on the market. It´s not a war between the Organization of Petroleum Exporting Countries [and] non-OPEC nations. It´s a war against dropping demand," Stanislaw said.

He said that after the 1997-98 market shock, world producers reached general agreement on curtailing production. "I´m quite impressed it´s lasted so long."

He said last time it took a year to get agreement, but this time producing nations have demonstrated "a very fast reaction to a very uncertain situation."

Oil demand, production

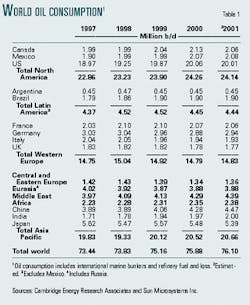

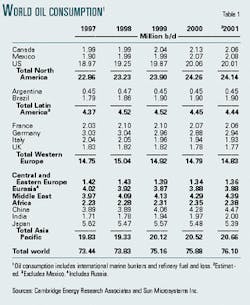

CERA said global oil demand growth has seen a significant slowdown. In 2000, daily global oil demand increased by 700,000 bbl, but 2001 estimates indicate growth of only 200,000 bbl, the smallest year-on-year increase in more than 5 years (Table 1).

It said daily world oil demand is estimated to fall in fourth quarter 2001 by 500,000 bbl from the year-earlier level. Nevertheless, projected 2001 oil demand of 76.1 million b/d will be a record.

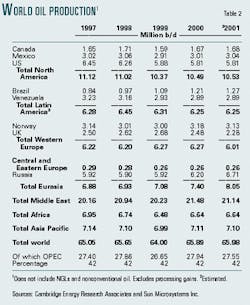

The study said global crude production for 2001, estimated at 66 million b/d, is just 90,000 bbl above the 2000 level (Table 2). The 2001 level is a record, but the year-on-year gain is well below the 1.9 million bbl increase registered in 2000 and is one of the smallest gains since the early 1990s.

"The sizable 2000 increase was largely due to a 1.3 million b/d gain in OPEC output. In 2001, however, OPEC production restraint contributed to a 400,000 b/d decline in OPEC crude oil production on an annual basis. OPEC accounted for 42% of total world crude oil output in 2001."

The study said the global economic slowdown and shocks to the US economy following the Sept. 11 terrorist attacks combined to crimp the recovery in global oil demand that had been under way following the 1998 Asia financial crisis. As a result, global oil consumption is expected to increase a mere 0.3% in 2001.

OPEC, non-OPEC output

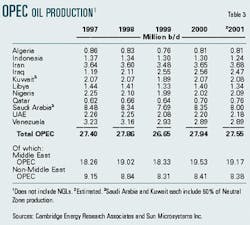

OPEC output is expected to fall an estimated 400,000 bbl in 2001 to an average of 27.55 million b/d. OPEC oil production (not including natural gas liquids) accounted for 42% of global crude supply in 2001, about steady with its share in 2000 (Table 3).

"Non-OPEC oil production (crude oil and NGLs) is estimated at 46 million b/d in 2001, a 500,000 b/d gain over 2000, while OPEC worked to curtail production in an effort to maintain higher oil prices. For much of the year non-OPEC producers continued to enjoy firm oil prices, and a significant portion of the extra revenue was reinvested in growing production."

Reserves, refining capacity

CERA said world proven reserves of crude as of January 2001 grew to 1.027 trillion bbl, up 11 billion bbl from 2000. The US recorded increases of 800 million bbl, mostly associated with ongoing development in the deepwater Gulf of Mexico and on Alaska´s North Slope. OPEC´s estimated proven crude reserves in 2001 stood at 814.4 billion bbl, up nearly 12 billion bbl. OPEC nations had 79.2% of world proven reserves.

The study said growth in global refining capacity leveled off in 2000, as declines in Eurasia and central and eastern Europe offset increases in other regions. Total world refining capacity of 81.5 million b/d has nearly returned to levels of the early 1980s. It said the industrialized regions of North America, Europe, and Japan had 61% of world refining capacity in 1981 but only 49% at the beginning of 2001.

CERA said, "The past 2 years recorded the strongest crude oil price environment since the first half of the 1980s. The price of US West Texas Intermediate crude was between $26.69 and $31.95/ bbl on a quarterly average basis from first quarter 2000 through third quarter 2001. Prices had not averaged that high for so long since 1985.

"Another remarkable characteristic of the oil market in recent years is exceptional volatility. In 1998 the annual average price of Arab Light in nominal terms was $12.30, but by 2000 it had risen to an average of $26.75-an increase of 117%."