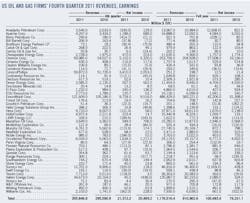

Producers post stunted second-quarter results

Marilyn Radler

Senior Editor-Economics

Laura Bell

Statistics Editor

Oil producers' earnings during the second quarter benefited from strong prices and healthy production volumes, although oil price realizations were down from a year earlier. And higher margins helped boost refiners' earnings during the recent quarter. Weak natural gas prices, however, continued to undercut returns.

A sample of 67 oil and gas producers and refiners with headquarters in the US collectively posted slightly lower revenues and flat earnings compared with those in second-quarter 2011, and 19 of these firms incurred a net loss for the period. In this year's first 6 months, the group's combined net income gained less than 1% vs. their earnings in first-half 2011.

A group of 17 producers and pipeline operators based in Canada reported a combined 65% decline in second-quarter earnings and a 23% decline in first-half 2012 earnings.

Prices, refining margins

Front-month crude futures on the New York Mercantile Exchange in the second quarter averaged $93.36/bbl compared with $102.34/bbl during last year's second quarter.

Meanwhile, Brent crude oil front-month futures prices in this year's second quarter averaged $108.76/bbl vs. 117.02/bbl a year ago.

Cash operating margins in most refining centers increased from a year earlier, and the US East Coast margin swung into positive territory from a second-quarter 2011 loss. US Midwest refining margins in the second quarter climbed 16% to average $28.42/bbl, according to Muse Stancil & Co.

The average cash refining margin in Northwest Europe during the recent quarter was $7.46/bbl, up from $4.05/bbl a year earlier.

Natural gas prices continued to sink from 2011 levels as inventories and production remained healthy. Front-month NYMEX gas averaged $2.354/MMbtu in this year's second quarter vs. $4.378/MMbtu a year earlier.

US-based producers

Second-quarter and first-half earnings results were mixed for the oil and gas producers in the sample of US companies.

Chevron Corp. and ConocoPhillips posted declines in revenues and earnings for both the 3-month and 6-month periods. ExxonMobil Corp. reported a 62% increase in second-quarter net income and a 26% gain for the first half, even as upstream earnings were $8.4 billion, down $183 million from second-quarter 2011.

ExxonMobil's earnings were buoyed by the divestment of the company's downstream and chemicals operations in Japan, from which the company gained $5.3 billion. The company said TonenGeneral Sekiyu KK (TG) purchased its shares in a wholly owned affiliate in Japan for $3.9 billion. As a result, ExxonMobil's effective ownership of TG was reduced to 22% from 50%.

Devon Energy Corp. reported net earnings of $477 million for the quarter ended June 30, 2012, down from $2.7 billion in the second quarter of 2011. The company said a one-time gain of $2.5 billion resulting from the divestiture of assets in Brazil enhanced the company's second-quarter 2011 earnings.

Largely due to growth from the company's Jackfish and Permian basin projects, Devon's oil production averaged 149,000 b/d, up 26% from second-quarter 2011.

Devon reported that a number of production interruptions primarily related to gas processing facilities reduced the company's second quarter production by 16,000 boe/d. The most significant occurrence was maintenance downtime at Devon's Bridgeport facility in North Texas which reduced natural gas liquids production by 10,000 b/d in the quarter.

Canadian operators

Most companies in a sample of Canadian-based producers and pipeline operators reported declines in earnings from second-quarter 2011 as well as lower first-half earnings vs. those a year ago.

Baytex Energy Corp., which reported a 47% increase in second-quarter earnings to $157.3 million (Can.), was the only firm in the sample to report improved net income compared with a year earlier. Baytex posted higher production volumes but realized lower prices.

During the recent quarter, Baytex completed the sale of nonoperated interests in North Dakota to Magnum Hunter Resources Corp. for net proceeds of $313.8 million (Can.), realizing a pretax gain of $175.4 million (Can.) (OGJ Online, May 23, 2012).

Cenovus Energy Inc. reported a 40% decline in second-quarter net income from a year earlier. The Calgary-based company said its operating earnings of $283 million (Can.) were down 28% partly due to the recognition of a $68 million (Can.) exploration expense due to halting work in the Roncott play, an area outside its core operations in the Bakken shale.

Meanwhile, Encana Corp. posted a $1.5 billion net loss for this year's second quarter, as the company recorded a $1.7 billion aftertax impairment charge against earnings due to lower gas prices under the full-cost accounting method.

Under full-cost accounting the carrying amount of oil and gas properties is subject to a quarterly ceiling test. The impairment charge is noncash in nature, does not affect cash flow or operating earnings, and is not reflective of the fair value of the assets.

Given the current pricing environment, Encana said it expects that further declines in 12-month average trailing gas prices will likely result in the recognition of future ceiling test impairments.

Refiners

Among refiners, Marathon Petroleum Corp. reported that higher refining margins helped boost its second-quarter net income to $814 million from $802 million a year earlier.

The Houston-based company said its refining and marketing gross margin increased to $11.13/bbl in the recent quarter from $10.78/bbl in second-quarter 2011, mainly due to a higher Chicago and US Gulf Coast blended crack spread, which climbed by 53% from a year earlier.

Valero Energy Corp. recorded earnings of $830 million for this year's second quarter, up 12% from a year earlier, and $398 million for the first half of 2012, down from $848 million a year earlier.

During the recent quarter, earnings improved at Valero's US Midcontinent and US West Coast refineries, as well as at its Pembroke, UK, refinery, but earnings dipped at the company's Meraux, La., refinery, where throughput margins declined and operating income was $637 million in the 3 months ended June 30 vs. $786 million a year earlier.

Houston-based Phillips 66 announced its second-quarter earnings were $1.18 billion, up from $1.04 billion in the second quarter of 2011. Earnings from the company's refining segment during the recent quarter were $882 million vs. $498 million a year earlier.

Meanwhile, Phillips 66 earned $207 million from its chemicals segment and lost $91 million in its midstream segment. The company completed the sale of its Trainer, Pa., refinery to Delta Air Lines, generating approximately $230 million in proceeds (OGJ Online, May 1, 2012).