Oil pipeline operators' 2011 profits soar to record

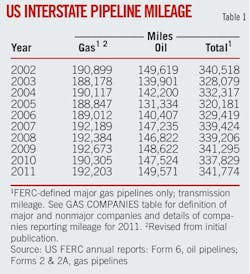

Oil pipeline operators' net income soared to an all-time high of $6.1 billion, a 33.3% increase from 2010 achieved on the back of a nearly 12% increase in operating revenues. The resulting earnings as a percent of revenue of 48.6% were also a record. The strong bottom line coincided with a more than 47% drop in changes to carrier property, as companies pulled back from major additions.

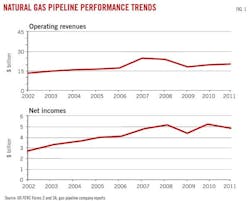

Natural gas pipeline operators meanwhile saw their profits slip more than 6% from 2010's high to less than $4.9 billion. The dip in net income came despite a 3.8% increase in revenues, which reached more than $20.5 billion, their highest level since 2007 (Fig. 1).

Natural gas pipeline companies' weaker bottom lines, in contrast to oil carriers, came at least in part as a result of surging capital expenditures, with additions to plant totaling more than $14.4 billion (a 178% increase from 2010). Roughly $6.35 billion of this total, however, comprised just two projects; expansion at Florida Gas Transmission and building the Ruby Pipeline. Expenditures on operations and maintenance rose 5.3% to slightly more than $7 billion. Proposed newbuild mileage, however, was just 50.3% of 2010's announced build, while planned horsepower additions of 184,405 were 79% of 2010's total.

The easing in anticipated demand saw overall estimated $/mile pipeline costs slip nearly 30% to $3.1 million. Pipeline labor remained the single most expensive per-mile item, despite easing in absolute terms by the same 30% to roughly $1.38 million/mile.

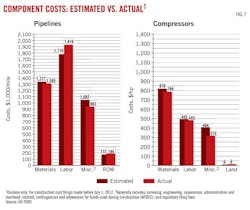

The balance between estimated and actual costs narrowed for both pipeline and compressor projects completed in the 12 months ending June 30, 2012. Actual land pipeline costs varied from projected costs by only $50,000/mile, with lower than expected material and miscellaneous costs cancelling out labor costs that remained higher than expected. Actual compressor station costs were 7.2% less than estimated costs for projects completed by June 30, 2011. The only cost area that was higher than anticipated was land.

US pipeline data

At the end of this article, two large tables (beginning on p. 125) offer a variety of data for US oil and gas pipeline companies: revenue, income, volumes transported, miles operated, and investments in physical plants. These data are gathered from annual reports filed with FERC by regulated oil and natural gas pipeline companies for the previous calendar year.

Data are also gathered from periodic filings with FERC by those regulated natural gas pipeline companies seeking FERC approval to expand capacity. OGJ keeps a record of these filings for each 12-month period ending June 30.

Combined, these data allow analysis of the US interstate pipeline system.

• Annual reports. Companies that, in FERC's determination, are involved in the interstate movement of oil or natural gas for a fee are jurisdictional to FERC, must apply to FERC for approval of transportation rates and therefore must file a FERC annual report: Form 2 or 2A, respectively, for major or nonmajor natural gas pipelines; Form 6 for oil (crude or product) pipelines.

The distinction between "major" and "nonmajor" is defined by FERC and appears as a note at the end of the table listing all FERC-regulated natural gas pipeline companies for 2011 at the end of this article.

The deadline to file these reports each year is Apr. 1. For a variety of reasons, a number of companies miss that deadline and apply for extensions, but eventually file an annual report. That deadline and the numerous delayed filings explain why publication of this OGJ report on pipeline economics occurs later in each year. Earlier publication would exclude many companies' information.

• Periodic reports. When a FERC-regulated natural gas pipeline company wants to modify its system, it must apply for a "certificate of public convenience and necessity." This filing must explain in detail the planned construction, justify it, and—except in certain instances—specify what the company estimates construction will cost.

Not all applications are approved. Not all that are approved are built. But, assuming a company receives its certificate and builds its facilities, it must—again, with some exceptions—report back to FERC how its original cost estimates compared with what it actually spent.

OGJ spends the year July 1 to June 30 monitoring these filings, collecting them, and analyzing their numbers.

OGJ's exclusive, annual Pipeline Economics Report began tracking volumes of gas transported for a fee by major interstate pipelines for 1987 (OGJ, Nov. 28, 1988, p. 33) as pipelines moved gradually after 1984 from owning the gas they moved to mostly providing transportation services.

Volumes of natural gas sold by pipelines have been steadily declining: so that, beginning with 2001 data in the 2002 report, the table only lists volumes transported for others.

The company tables also reflect asset consolidation and merger activity among companies in their efforts to improve transportation efficiencies and bottom lines.

Reporting changes

The number of companies required to file annual reports with FERC may change from year to year, with some companies becoming jurisdictional, others nonjurisdictional, and still others merging or being consolidated out of existence.

Such changes require that care be taken in comparing annual US petroleum and natural gas pipeline statistics. Institution by FERC of the two-tiered (2 and 2A) classification system for natural gas pipeline companies after 1984 further complicated comparisons (OGJ, Nov. 25, 1985, p. 55).

Only major gas pipelines are required to file miles operated in a given year. The other companies may indicate miles operated but are not specifically required to do so.

For several years after 1984, many nonmajors did not describe their systems. But filing descriptions of their systems has become standard, and now most provide miles operated.

Reports for 2011 show an increase in FERC-defined major gas pipeline companies: 92 companies of 157 filing for 2011, from 87 of 146 for 2009.

The FERC made an additional change to reporting requirements for 1995 for both crude oil and petroleum products pipelines. Exempt from requirements to prepare and file a Form 6 were those pipelines with operating revenues at or less than $350,000 for each of the 3 preceding calendar years. These companies must now file only an "Annual Cost of Service Based Analysis Schedule," which provides only total annual cost of service, actual operating revenues, and total throughput in both deliveries and barrel-miles.

In 1996 major natural gas pipeline companies were no longer required to report miles of gathering and storage systems separately from transmission. Thus, total miles operated for gas pipelines now consist almost entirely of transmission mileage.

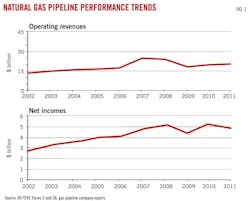

FERC-regulated major natural gas pipeline mileage rose in 2011 (Table 1) to its highest level since 2009. Final data show an increase of 1,898 miles, or 1%.

Rankings; activity

Natural gas pipeline companies in 2011 saw operating revenues rise by nearly $756 million or nearly 4% from 2010, continuing gains seen the year before. Net incomes, however, fell roughly $332 million (more than 6%), reversing much of the gains seen a year earlier.

Oil pipelines fared better, with earnings rising more than $1.5 billion (33%) on the back of a more than $1.3 billion (12%) increase in revenues (Table 2). Product deliveries for 2011 increased by more than 223 million bbl or 3.5%, outweighing a 173-million bbl drop in crude deliveries.

OGJ uses the FERC annual report data to rank the top 10 pipeline companies in three categories (miles operated, trunkline traffic, and operating income) for oil pipeline companies and three categories (miles operated, gas transported for others, and net income) for natural gas pipeline companies.

Positions in these rankings shift year to year, reflecting normal fluctuations in companies' activities and fortunes. But also, because these companies comprise such a large portion of their respective groups, the listings provide snapshots of overall industry trends and events.

For instance, the growth in oil pipeline earnings was driven by the top 10 companies in the segment, for which combined income climbed nearly $800 million. The top 10 companies' share of the segment's total earnings was roughly 55%. Both Enbridge Energy LP and Whiting Oil and Gas Corp had net incomes exceeding $500 million, or combined roughly one third of the segment's total earnings.

Company financial data provide a view of the ongoing condition of the oil and gas pipeline industries.

For all natural gas pipeline companies, for example, net income as a portion of operating revenues slipped to 23.79% in 2011, falling from the record highs seen a year earlier to the lowest level seen since 2007.

The percentage of income as operating revenues for oil pipelines, however, rebounded sharply in 2011, reaching a record 48.63%.

Net income as a portion of gas-plant investment slipped to 3.53%, the lowest level in at least 15 years.

For oil pipelines, net income as a portion of investment in carrier property in 2011 rebounded, rising to 12.43% and eclipsing the previous high of 11.5% reached in 2006. Income as part of investment in carrier property in 2004 stood at 11.4%, having risen steadily toward that level from 6.8% in 1998.

Major and nonmajor natural gas pipelines in 2011 reported an industry gas-plant investment of more than $138.6 billion, the highest level ever, up from $124.7 billion in 2010, almost $121.3 billion in 2009, nearly $105.8 billion in 2008, $95.5 billion in 2007, $88.3 billion in 2006, $84 billion in 2005, more than $83 billion in 2004, nearly $78 billion in 2003, and $74.2 billion in 2002.

Investment in oil pipeline carrier property also continued to rise in 2011, reaching nearly $49.2 billion, after hitting almost $45.4 billion in 2010, $41.6 billion in 2009, $39.1 billion in 2008, almost $35.9 billion in 2007, and rebounding to $32.7 billion in 2006 from the lowest level seen since at least 1997, $29.5 billion in 2005.

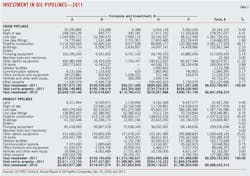

OGJ for many years has tracked carrier-property investment by five crude oil pipeline and five products pipeline companies chosen as representative in terms of physical systems and expenditures (Table 3). In 2003, we added the base carrier-property investment to allow for comparisons among the anonymous companies. The five crude oil pipeline companies in 2011 increased their overall investment in carrier property by more than $91 million (roughly 1.3%). The increase followed a far larger jump in 2010. The general increase was undercut by a more than $70.5 million reduction at one of the smaller companies

The five products pipeline companies also saw their overall investment in carrier property slow in 2011, adding $69.7 million, or 1%, down from the $282.6 million, or 4.3%, increase of 2010. Like the crude oil lines, all companies but one in the products pipeline group increased investment in 2010.

Investment by the five product pipeline companies in 2011 was more than $6.92 billion, continuing a return to growth started in 2003 when investment of more than $4.7 billion was up from 2002's $4.5 billion level.

Comparisons of data in Table 3 with previous years' must be done with caution: In 2004, a major crude oil pipeline company listed there sold significant assets, making comparisons with previous years' data difficult.

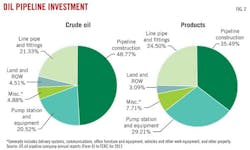

Fig. 2 illustrates the investment split in the crude oil and products pipeline companies.

Construction mixed

Applications to FERC by regulated interstate natural gas pipeline companies to modify certain systems must, except in certain instances, provide estimated costs of these modifications in varying degrees of detail.

Tracking the mileage and compression horsepower applied for and the estimated costs can indicate levels of construction activity over 2-4 years. OGJ has been doing that since this report began more than 50 years ago.

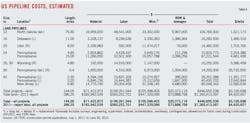

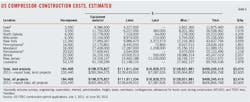

Tables 4 and 5 show companies' estimates during the period July 1, 2011, to June 30, 2012, for what it will cost to construct a pipeline or install new or additional compression. These tables cover a variety of locations, pipeline sizes, and compressor-horsepower ratings.

Not all projects proposed are approved. And not all projects approved are eventually built.

Applications filed in the 12 months ending June 30, 2012, fell sharply for the third consecutive year.

• More than 144 miles of pipeline were proposed for land construction, and no new offshore work. The land level is down from the roughly 286 miles proposed for construction in 2011, the 525 miles proposed in 2010, and the 2,180 miles proposed for construction in 2009 which was the highest level since more than 2,700 miles were proposed in 1998.

• New or additional compression proposed by the end of June 2012 measured more than 184,000 hp, down from the 233,000 hp proposed in 2011, the 200,000 hp proposed in 2010, and substantially from the 664,775 hp proposed in 2009.

Putting the downturn in US gas pipeline construction in perspective, Table 4 lists 11 land-pipeline "spreads," or mileage segments, and no marine projects, compared with:

• 31 land and 0 marine projects (OGJ, Sept. 5, 2011, p. 97).

• 8 land and 0 marine projects (OGJ, Nov. 1, 2010, p. 108).

• 21 land and 0 marine projects (OGJ, Sept. 14, 2009, p. 66).

• 19 land and 0 marine projects (OGJ, Sept. 1, 2008, p. 58).

• 25 land and 1 marine project (OGJ, Sept. 3, 2007, p. 51).

• 42 land and 1 marine project (OGJ, Sept. 11, 2006, p. 46).

• 56 land and 4 marine projects (OGJ, Sept. 12, 2005, p. 50).

• 15 land and 0 marine projects (OGJ, Aug. 23, 2004, p. 60).

• 37 land and 3 marine projects (OGJ, Sept. 8, 2003, p. 60).

• 83 land and 3 marine projects (OGJ, Sept. 16, 2002, p. 52).

All spreads but one in 2012 measured 15 miles or less. This is representative of the nature of current activity, with much of the work focused on connecting new production sources to existing transmission infrastructure rather than building new large transmission lines and only some of it falling under FERC jurisdiction.

For the 12 months ending June 30, 2012, the 11 land projects would cost an estimated $447 million, as compared with $1.27 billion for 31 projects a year earlier.

It is helpful to remember that these statistics cover only FERC-regulated pipelines. Many other pipeline construction projects were announced in the 12 months ending June 30, 2012, but as mentioned earlier, many of these projects involved connecting developing natural gas shale plays such as Eagle Ford and Marcellus to already operating transportation infrastructure and may have fallen outside of FERC's jurisdiction.

A report conducted in 2011 on behalf of the Interstate Natural Gas Association of America concluded that the US and Canada will require annual average midstream natural gas investment of $8.2 billion/year, or $205.2 billion (in real 2010 dollars) total, over the nearly 25-year period from 2011 to 2035 to accommodate new gas supplies, particularly from the prolific shale gas plays, and growing demand for gas in the power-generation sector. The capital investment requirement includes mainlines, laterals, processing, storage, compression and gathering lines. These totals included $20 billion of investment in the Marcellus shale region alone.

Against the backdrop, however, estimated $/mile costs for new projects as filed by operators with FERC continued to retreat from the highs seen in 2010. For proposed onshore US gas pipeline projects:

• In 2011-12, the average cost was $3.1 million/mile.

• In 2010-11, the average cost was $4.4 million/mile.

• In 2009-10, the average cost was $5.1 million/mile.

• In 2008-09, the average cost was $3.7 million/mile.

• In 2007-08, the average cost was $3.4 million/mile.

• In 2006-07, the average cost was $2.8 million/mile.

Cost components

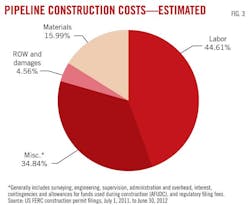

Variations over time in the four major categories of pipeline construction costs—material, labor, miscellaneous, and right-of-way (ROW)—can also suggest trends within each group.

Materials can include line pipe, pipe coating, and cathodic protection.

"Miscellaneous" costs generally cover surveying, engineering, supervision, contingencies, telecommunications equipment, freight, taxes, allowances for funds used during construction (AFUDC), administration and overheads, and regulatory filing fees.

ROW costs include obtaining rights-of-way and allowing for damages.

For the 11 land spreads filed for in 2011-12, costs-per-mile projections eased in all four categories. In 2011 miscellaneous charges actually passed material to become the second most expensive costs category and they retained this position in 2012:

• Material—$495,821/mile, down from $642,594/mile for 2010-11.

• Labor—$1,383,277/mile, down from $1,957,215/mile for 2010-11.

• Miscellaneous—$1,080,169/mile, down from $1,562,722/mile for 2010-11.

• ROW and damages—$141,431/mile, down from $258,127/mile for 2010-11.

The continued slide in material costs was prompted by the prevalence of smaller projects in the 2012 totals. Estimated material costs for the roughly 12 miles of 42-in. OD projects proposed came in at $2,131,390/mile. The rise in miscellaneous costs was driven by companies increasing the amount set aside for contingencies in their estimates.

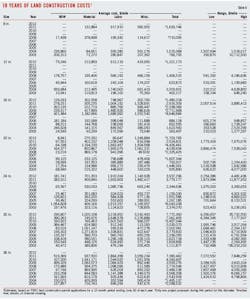

Table 4 lists proposed pipelines in order of increasing size (OD) and increasing lengths within each size.

The average cost-per-mile for the projects rarely shows clear-cut trends related to either length or geographic area. In general, however, the cost-per-mile within a given diameter decreases as the number of miles rises. Lines built nearer populated areas also tend to have higher unit costs.

Additionally, road, highway, river, or channel crossings and marshy or rocky terrain each strongly affect pipeline construction costs.

Fig. 3, derived from Table 4, shows the major cost-component splits for pipeline construction costs.

Labor costs were relatively flat as a portion of land construction costs, remaining the single most expensive category. Labor's portion of estimated costs for land pipelines firmed slightly to 44.61% from 44.27% in 2011, 44.61% in 2010, 37.95% in 2009, and 39.76% in 2008. Material costs for land pipelines saw their share of total costs rebound slightly to 15.99% as compared with 14.54% in 2011 but remained well below the 31.01% seen in 2010, 35.19% in 2009, and 30.93% in 2008.

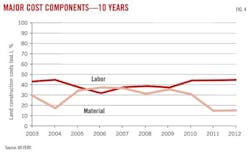

Fig. 4 plots a 10-year comparison of land-construction unit costs for the two major components—material and labor.

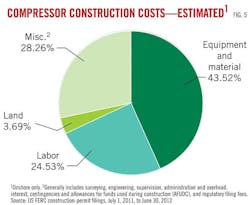

Fig. 5 shows the cost split for land compressor stations based on data in Table 5.

Table 6 lists 10 years of unit land-construction costs for natural gas pipeline with diameters ranging from 8 to 36 in. The table's data consist of estimated costs filed under CP dockets with FERC, the same data shown in Tables 4 and 5.

Table 6 shows that the average cost per mile for any given diameter may fluctuate year to year as projects' costs are affected by geographic location, terrain, population density, or other factors.

Completed projects' costs

In most instances, a natural gas pipeline company must file with FERC what it actually spent on an approved and built project. This filing must occur within 6 months after the pipeline's successful hydrostatic testing or the compressor's being put in service.

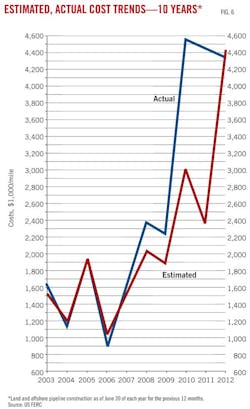

Fig. 6 shows 10 years of estimated vs. actual costs on cost-per-mile bases for project totals.

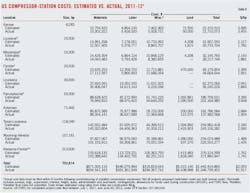

Tables 7 and 8 show actual costs for pipeline and compressor projects reported to FERC during the 12 months ending June 30, 2011. Fig. 7, for the same period, depicts how total actual costs ($/mile) for each category compared with estimated costs.

Actual labor costs for pipeline construction were $148,000/mile greater than estimated costs for the same projects. Overall actual costs, however, were 1.2% lower than projected costs for the 12 months ending June 30, 2012.

Some of these projects may have been proposed and even approved much earlier than the 1-year survey period. Others may have been filed for, approved, and built during the survey period.

If a project was reported in construction spreads in its initial filing, that's how projects are broken out in Table 4. Completed projects' cost data, however, are typically reported to FERC for an entire filing, usually but not always separating pipeline from compressor-station (or metering site) costs and lumping various diameters together.

The 12 months ending June 30, 2012, saw more than 700,000 hp of new or additional compression completed, up sharply from the nearly 240,000 hp the year before.

Horsepower additions remained concentrated in the Gulf Coast and Mountain West regions.

Actual compression costs ran $124/hp lower than estimates, with all major expense categories softening (Table 8). In addition to being lower than anticipated, $/hp actual costs fell nearly $500 from 2011.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.