Analysis shows GTL viable alternative for US gas producers

Horace O. Hobbs Jr.

Lesa S. Adair

Muse, Stancil & Co.

Addison, Tex.

| Based on a presentation to the GPA Annual Convention, Apr. 15-18, 2012, New Orleans. |

Gas-to-liquids (GTL) technology is now economically viable in the long term in North America and can be deployed in the midstream as an alternative to, or integrated with, traditional natural gas processing schemes or as an alternative to traditional gas marketing channels via integration with transmission operations.

In either scenario, GTL enables natural gas producers economically to convert proven producing gas reserves to oil-based reserves.

Competing gas disposition options such as chemicals manufacturing or LNG export carry execution and project risks similar to GTL but are further burdened by additional market risks and limitations.[Editor's note: See related article on p. 92 of this issue that analyzes the potential for US LNG exports.]

Perceived technology risk historically associated with GTL has been substantially reduced with the completion of several large projects around the globe. In addition, technology enhancements currently under development may one day extend the scope of economic GTL project development to include most gas reserves regardless of project size.

North American natural gas supply fundamentals have been permanently altered with the widespread development of unconventional gas reserves that use technologies developed to exploit shale plays. GTL is poised to be the next "game changer" in the natural gas value chain providing the link between bountiful gas reserves and higher-valued liquid fuels markets.

Commercial GTL technology has been available for 2 decades but has not been employed in the US due to the relative market prices for natural gas and GTL-produced diesel. US economic drivers have not been robust enough historically to offset the substantial project risk associated with developing the scale-up technology and building the first plants.

Unique stranded-gas applications in other parts of the world provided the economic drive necessary for project development, and substantial project experience gained over the last several years has reduced future projects' execution risks. GTL projects today can be viable integration alternatives to enhance wellhead netback realization and provide reliable market outlets for North American producers.

GTL fundamentals

Key drivers of GTL project economics are feedstock and product prices that are driven by supply and demand. In North America, natural gas supply is leveraged by shale-gas exploitation technologies widely adopted in the last 5 years. Natural gas demand is driven largely by a US market that has historically relied upon natural gas from Canada and to a very limited extent imported LNG to balance the market.

In contrast, North American crude oil and refined products markets are fully integrated with global markets, and price levels are therefore determined by worldwide supply and demand. GTL economics are leveraged by the strong and growing demand for diesel products worldwide and to an even greater extent by the relatively high quality of GTL liquids produced.

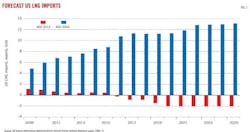

The abundance of North American natural gas reserves and the resulting outlook for relatively low, long-term prices suggest that a midstream integration strategy is necessary to enhance realized wellhead netback prices. To grasp the extent of current natural gas supply outlook and impact of shale-gas reserve development, we need only compare the 2004 forecast by the US Energy Information Administration for US LNG demand with current forecasts. Fig. 1 provides a comparison of the 2012 Annual Energy Outlook to the corresponding 2004 forecast. The consensus outlook less than a decade ago was that the US would become a major LNG importer. Today, LNG project developers are investing in infrastructure, including retooling of existing or announced LNG import facilities, to export US LNG (OGJ Online, May 14 and May 25, 2012).

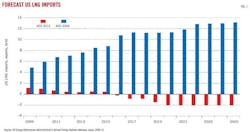

The primary product from GTL is a petroleum distillate that can be sold into existing markets to meet ultralow-sulfur-diesel fuel demand. Fig. 2 shows historical US distillate demand. Although US gasoline demand is flat and expected to decline with the growth in renewable supplies displacing gasoline, US and global demand for diesel fuel is growing and will likely continue to grow.

Diesel fuel quality is also an important issue for suppliers.

US petroleum refiners have invested billions of dollars to retool existing operations to produce diesel grades with very low sulfur content. Most recent refinery expansions and major capital upgrades have focused on the manufacture of diesel fuels, a shift away from the traditional goal of increasing gasoline output.

In today's market, diesel grades are more valuable than gasoline grades at the refinery rack and the retail pump. This shift in relative value away from gasoline to diesel is generally expected to be a permanent, long-term change driven by fundamental transportation demand, thus strengthening the economic sustainability of GTL production.

Fig. 3 depicts the change in relative refined product pricing as the annual average "crack spread," or price difference, between gasoline and Light Louisiana sweet crude oil (LLS) and that of on-road diesel fuel. Diesel has consistently become the most profitable product in both high and low-margin environments.

The exceptional quality of GTL diesel supports project implementation as an attractive long-term integration strategy. The overall quality of liquid fuels has evolved steadily in the last 2 decades with quality changes focused largely on reductions in component emissions and commensurate fuel blending adjustments to meet engine performance requirements.

As Fig. 4 shows, most of the diesel consumed in the US must be processed severely to meet a maximum sulfur content specification of 15 ppm. The sulfur content of diesel supplied to California (California Air Resources Board, "CARB" diesel) is limited even further to 8 ppm. Diesel produced using GTL ("GTL diesel") is essentially sulfur free, thus producing product that is fungible across the market quality spectrum.

With respect to engine performance, GTL diesel lacks the aromatic hydrocarbons found in traditional diesel fuels, resulting in more favorable cetane characteristics (GTL diesel cetane number exceeds 70; refinery-produced diesel typically has a cetane number of 40.) as well as much lower emissions when burned. As a result, GTL fuels have been tested extensively in military jet applications where particulate emissions are undesirable.

GTL diesel can also be used as a high-quality blend stock in the formulation of ULSD, CARB diesel, and jet to meet both current and future emissions and performance requirements.

Table 1 compares GTL diesel quality and common stream US distillate specifications.

Some industry observers have speculated that natural gas prices in 2012 may represent the absolute market bottom and, while crude oil prices have receded from highs in 2011, fundamental structural changes associated with shale and unconventional gas reserve development coupled with strong diesel demand are widely projected to support GTL project development well into the future.

Fig. 5 summarizes the historical and forecast relationship between crude oil and natural gas pricing. As shown, the differential between natural gas and crude oil has grown substantially in the last several years, and the market recognizes the sustainable, fundamental change in US natural gas supplies and global liquid fuel demand in future price expectations.

GTL technology

The original Fischer Tropsch (FT) process developed in 1923 focused on converting coal into liquid fuels. The Germans used this technology during World War II to meet motor-fuel demand and reduce dependence on imported crude oil.

The technology was largely dormant until Sasol developed a coal-to-liquids plant in Sasolburg, South Africa, in 1955. Since then, Sasol has made major technological advances and has developed numerous projects for converting coal and natural gas to liquid transportation fuels.

Early on, natural gas was identified as a superior feedstock for commercial FT operations due to conversion efficiency for producing synthesis gas, ease of handling, and reduced levels of impurities, all of which combine to result in lower capital and operating cost when compared with coal conversion plants.

Many of the barriers to widespread commercialization of GTL have dramatically lowered as a result of advances in catalyst life and efficiency as well as improvements in FT reactor design. Important technological advances have been developed by a variety of energy and technology companies, including Sasol, Royal Dutch Shell, ExxonMobil, Conoco Phillips, Syntroleum, and Statoil. Sasol, Chevron, Shell, and China Petroleum & Chemical Corp. (Sinopec; via Syntroleum) are developing FT projects based on demonstrated, commercially proven technologies. In addition, Rentech is pursuing the development of GTL projects based on bio-mass conversion.

Fig. 6 shows how the GTL process has three steps: natural gas reforming, FT reaction, and fuels refining. The gas-reforming step is very similar to the first step in existing chemical processes for producing methanol or ammonia and presents manageable project-execution risk. The FT reaction step converts the syngas produced by reforming into long-chained hydrocarbons, or FT waxes. The FT section of the plant contains the most proprietary design features involving complex, licensed technology.

Recently completed GTL projects are now operating successfully large FT processes outside of the US and thus have drastically reduced overall project risk, which paves the way for smaller-scale, domestic projects leveraged by abundant supplies of natural gas and the sustainable demand for diesel.

The final step in the GTL process utilizes proven petroleum refining hydroprocessing and isomerization technologies to transform FT waxes into shorter hydrocarbon chains. The process variables in this step can easily be manipulated to produce varying yield patterns of fuels in the naphtha, jet fuel, and diesel boiling ranges to meet the fuel demand patterns (most likely diesel in North America) for local market areas.

GTL projects

GTL projects have been difficult to develop historically for many reasons, not the least of which was uncertainty about commercial viability. The drive to develop stranded natural gas reserves led to development of existing commercial GTL plants in Malaysia, Qatar, and Nigeria.

For these projects, commercial uncertainty was offset by large supplies of relatively inexpensive natural gas pledged to specific projects. For example, Shell's Pearl plant in Qatar is reported to have essentially free feedstock. Development of the South African plants was based upon a lack of domestic liquid hydrocarbon resources. Table 2 summarizes existing GTL plants.

The most recent projects have been associated with construction delays and cost increases. These projects, however, have significantly advanced GTL application understanding to the point that smaller, more competitive commercial projects are now feasible.

GTL project economics

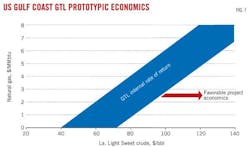

Muse Stancil analyzed North American GTL economics by examining the performance of a prototypic US Gulf Coast GTL plant in Louisiana. Preliminary capital and operating costs developed for the prototype facility and after-tax returns evaluated established a current view of the range of economic viability based on natural gas and crude oil pricing. Fig. 7 presents the results of this analysis.

The GTL plant in this example consumes 200 MMscfd of natural gas and produces 20,000 b/d of ultralow sulfur diesel and naphtha. Specifically, Fig. 7 identifies a commodity-pricing band at which this GTL plant would produce an after-tax return on investment of 10-15%. For example, a natural gas price of $2/Mcf corresponds to economic crude oil prices of about $60-90/bbl at either end of the band.

The $30/bbl variance accounts for differences in project-specific factors, primarily total investment and return, and to a lesser degree operating expenses. The capital cost for a standalone GTL plant of this size can realistically range $60,000-85,000/bbl of product capacity. Operating expenses can range $12-18/bbl in total.

Other site-specific factors such as location advantages and cost savings from integrated operations may alter total investment or operating expenses and will provide substantially superior economics to the base screening evaluation presented here. In the current and expected market environment, GTL has clearly become a viable economic alternative for the disposition of natural gas.

Competing options

Other, more traditional disposition alternatives are available to producers.

Development of LNG export markets and construction of domestic methanol production are being evaluated by many companies. Like GTL, LNG projects also require large resource and capital commitments but in addition carry the burden of political risk associated with export permits. LNG projects typically require relatively long development periods due to the need for large counterparty offtake commitments. Currency and counterparty risks also affect evaluation and long-term investment outlooks for large LNG export facilities.

Methanol projects typically carry lower perceived project risk and require less capital. The size of the global methanol market, however, severely limits the total number of projects that can be economically developed. Table 3 highlights competing investment economics for three potential market alternatives for natural gas on the US Gulf Coast.

Analysis of the competing projects is based on a tolling economic model that uses 2011 annual average prices for commodities. As such, the evaluated economics assume that the producer pays the processor a tolling fee to compensate for operating costs and provide for return of and on capital investment. Thus, the producer takes all of the margin risk on the GTL operations while retaining the option to deliver gas to pipeline sales or GTL production based upon competing netback realization.

The analysis compares a grassroots 20,000-b/d GTL plant with a grassroots 1.27 million tonne/year methanol plant and a 1.2 bcfd brownfield LNG export plant. The GTL netback is compelling when actual 2011 annual average product prices are the basis for evaluation. The Asian LNG netback is superior over this limited time but longer term is likely to experience price pressure from competing Australian LNG projects. Development of a grassroots LNG plant would require a higher tolling fee to achieve the same return and would, therefore, return a lower netback to the producer.