AFPM Q&A—1: HTHA questions addressed at annual conference

High-temperature hydrogen attack was the focus of extensive questions and discussion at the 2011 American Fuel and Petrochemical Manufacturers's Q&A and Technology Forum, Oct. 9-12, San Antonio.

In a discussion among panelists and attendees, this annual meeting addresses problems and issues refiners face in their plants and attempts to help them sort through potential solutions.

This is the first of three installments based on edited transcripts from the 2011 event. Part 2 in the series (Sept. 3, 2012) will focus on fluid catalytic cracking. The final installment (Oct. 1, 2012) will focus on crude, vacuum distillation, and coking.

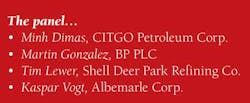

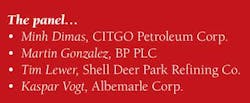

This first session employed four panelists (see accompanying box below). The only disclaimer for the panelists was that they discuss their own experiences, their own views, and the views of their companies. What has worked for them in their plants or refineries might not be applicable to every situation, but it can provide sound guidelines for what would work to address specific issues.

HTHA

How are you managing your units to mitigate risk of high-temperature hydrogen attack? What are monitoring best practices? Should we be concerned about short-term operating periods, such as start-up, shutdown, hot stripping, etc.?

Dimas: High-temperature hydrogen attack (HTHA) is a form of metal degradation caused by hydrogen reacting with carbon in the metal to form methane, normally at high temperature and typically above 400° F. and 50 psia partial hydrogen pressure.

The methane then accumulates in the grains and the voids of the metals and forms blisters.

These weaken the metal and initiate cracks. Alloys of particular concerns are carbon steel, carbon-1/2 moly (molybdenum), 1/2 manganese steels, and 1-chrome alloy.

At Citgo, we evaluate all the hydrotreaters for HTHA using normal operating data and also short-term excursion data, such as hot hydrogen strip. We plot the hydrogen partial pressure and operating temperature on the Nelson Curves to look for the likelihood of HTHA.

We found that most of our hydrotreaters operate on the safe side of the Nelson Curves because of higher alloy. We do have one reactor made of carbon-1/2 moly, and we have increased the inspection frequency to look for HTHA, which is difficult to detect with conventional nondestructive examination methods and may require specialized techniques.

We also plan to upgrade metallurgy of one preheat exchanger that has a carbon steel channel head but cladded with stainless steel.

[Editor's note: Nelson Curves were first presented by G.A. Nelson in 1949 ("Hydrogenation Plant Steels," Proceedings API, 29M [III], p. 163) and later incorporated into API Recommended Practice 941 "Steels for Hydrogen Service at Elevated Temperatures and Pressures in Petroleum Refineries and Petrochemical Plants," www.api.org.]

Gonzalez: The first and most obvious step is to compare temperature and hydrogen partial pressure of vessels and piping against the Nelson Curves, as Minh pointed out. Many refineries add a safety margin of up to about 50° F. and 25-50 psi.

To aid in monitoring, an additional temperature indication between shells or channels of heat exchangers is useful. Again, to reinforce what Minh said, it is important to consider any situation that might result in increased temperature or hydrogen partial pressure, such as start-up on hydrogen-only, operating one heat exchanger train with another train bypassed, or operation with exchangers heavily fouled.

You might also consider replacing any carbon-1/2 moly piping with higher alloy steels.

Vaidy Anathan (Fluor Corp.): This question is very critical for all the reactors, especially those reactors in service beyond the initial design service life of 20-25 years or whatever time frame it was designed for.

Also of special concern are reactors that have been changed in service from one set of process conditions to different processing objectives as the refinery has evolved. Refiners maintain a database of all the equipment and piping that are operating close to HTHA conditions. A good risk management approach is to evaluate the total cumulative time spent at transient conditions and whether they are falling below the curves that Martin just mentioned.

This database is useful for several purposes, including fatigue evaluation studies, equipment and piping recertification, and remaining life analysis. I know some of you have been maintaining a database.

Remaining-life analysis is another key tool. There are benefits from such a database. One is that it helps set the proper inspection priorities while trying to define the long-term maintenance goals of the unit.

Using such databases, we have helped refiners input information into their databases, as well as done some studies of the data. In certain cases, the study showed that replacement of older generation carbon-1/2 moly-type reactors with upgraded material is justified.

The other comment I want to make is for revamps. As you go through revamps, it is important to follow a positive material identification procedure, especially if you are replacing piping elbows of equipment. Make sure that they are tagged properly and that they go in the right place to avoid improper material substitution.

Whenever a unit is being recertified for processing conditions different from the original ones, make sure you go through a technical review of the metallurgy and operating pressures, as well as the temperature alarm settings.

Lewer: This is a very important issue in refineries, and I echo what my fellow panelists have said. I want to add a few other comments along those same lines.

First, when evaluating for HTHA, consider process creep on your units. What I mean is that if you have an exchanger that becomes fouled and your HTHA temperature moves downstream, especially past the metallurgy spec change, then you need to be very aware of those changes. Proper monitoring is key in those areas.

One procedure on which we have been working quite aggressively recently at Deer Park, mentioned already by my fellow panelists, is performing a very detailed review of your system. We have done it on many of our high-pressure hydrotreaters, as well as on our crude units.

The key is doing a very detailed analysis of all of your equipment. We have actually built spreadsheets for each piece of equipment, which contain a list of the metallurgy for that equipment. The metallurgist then sits down with the process engineer to go through the different conditions that can arise on the unit.

Another question: Should we consider abnormal conditions, such as start-up and shutdown? The answer: absolutely yes.

With the process engineer and the metallurgist and for each piece of equipment, given all the situations it may see, we have been trying to come up the maximum amount of hydrogen partial pressure and asking, "What is the maximum temperature that that piece of equipment may see in any one of those abnormal situations?"

We then record it and compare the results with the Nelson Curves. We keep a log and then devise mitigation plans for any area where we may find a risk. Those data create a very helpful log for future engineers when they come onto units. They are able quickly to look at the risks for HTHA in their units.

Kerry Rock (Lummus Technologies): I have a comment for clarification: API 941 has a very specific method for determining hydrogen partial pressure. Because this method may provide a much different answer than a computer simulation would, I urge you to read the methodology [in API 941].

James Esteban (Suncor Energy Inc.): My question is in relation to cladded vessels. Minh, you mentioned that you are looking to replace the channel head: Is this cladded stainless over carbon steel?

The other question is for the rest of the panel: Is it common to look at equipment that is cladded as needing replacement? Or, do you just increase your inspection frequencies?

Dimas: We do both because this exchanger is really a series of six and it is in the middle part.

Temperature-wise, it is borderline; so we do both. We have not found anything suspicious. We also increased the frequency just to look for early detection if there was anything.

Tariq Malik (Egyptian Refining Co.): Regarding the question about HTHA, most of the reactors are lined with 317 SS [stainless steel] or 321 SS; so you really do not have to worry about an H2S attack or high temperature on the reactors circuit.

Also, the circuit from the hot hydrogen exchangers to the reactor outlet and back to the reactor feed, effluent exchangers is normally 317 SS or 321 SS. These days, they are seldom chrome molybdenum or alloy only, mostly solid stainless steel.

Have you successfully dumped, screened, and reloaded spent hydrotreating or hydrocracking catalyst without regeneration during a turnaround? Can you share any best practices during this operation to avoid problems on restart?

Vogt: Yes, we have experience with dumping, screening, and reloading of hydrotreating and hydrocracking catalyst. There are two typical times that this occurs.

One option is after a full cycle. In this case, the spent catalyst has been reused without regeneration, rejuvenation, or reactivation in a lower severity application for which the remaining activity is still sufficient for that process. So, it can be done.

Typically, you can go from a ULSD [ultralow sulfur diesel] unit into a naphtha hydrotreater without the need for any handling, but be aware of potential pressure-drop issues.

The other situation in which this occurs and in which we have experience is immediately after start-of-run. At that point, if you incur, for example, pressure-drop buildup due to loading issues or situations that did not go right during loading or, also for example, the severe maldistribution in the bed, then we have seen customers who have unloaded, screened, and then reloaded the catalyst.

Although it has been performed successfully, more often it leads to further pressure-drop issues.

Best practices: Of course, safety aspects of handling pyrophoric and self-heating material must be addressed first. We believe it is critical to have proper detectors—SOx [sulfur oxide], H2S, etc.—and the presence of proper emergency procedures and properly trained personnel before executing the catalyst dumping, screening, and reloading.

It is also important to dry the catalyst before unloading. Dust and small particles stick to the oily catalyst surface during dumping and screening and are not removed until liquid washing of the catalyst surface, which can lead to fouling in the catalyst bed and reactor internal strain. It can also create excessive pressure drop at restart.

Hydrogen stripping to remove liquid between particles before unloading the catalyst is highly recommended. It is important to split the different catalyst layers by either vacuum unloading guard and grading layers from the top or by side screening after dumping in order to be able to reload a properly designed catalyst system.

If the screening is on site, we recommend using a relatively large screen to ensure that broken fragments and small particles are rejected. The screen will prevent differential pressure drop with the reloaded material.

Providers of on site screening services are typically limited in availability of equipment compared with off site, specialized companies. It is important to have adequate equipment to determine the particle size distribution and screened catalyst. Evaluating the entire length of distribution, not just the average length, is a critical step we recommend for preventing excess pressure drop.

It is also advisable to conduct a pressure-drop test on a pilot scale to evaluate fully the effectiveness of the screening and predict the corresponding pressure drop in the screened catalyst load. Often, some additional fresh guard grading in main bed catalyst is needed to ensure a complete reactor fill.

Gonzalez: Dumped, screened, and reloaded spent hydrotreating catalyst is usually unattractive for various reasons, many of which Kaspar has already mentioned. The main considerations are that you want to do it safely and quickly, and you want to obtain good quality, screened material.

Most catalyst-loading companies can accommodate you by keeping their screening equipment under nitrogen to minimize oxygen exposure. Vacuuming the catalyst rather than dumping it can help simplify screening because you do not mix up many different sizes, as you would if you were to gravity dump. This speeds up the process quite a bit and simplifies the number of screenings you need.

Also, modern vacuuming equipment can result in less breakage of catalyst compared with gravity unloading, a fact which may be surprising.

Lewer: We have occasionally done the "dump, screen, and reload" and have had success with it. There are certain situations where that may be applicable.

I just want to add a few additional comments and best practices to what my fellow panelists have already said.

Extensive planning before you do a "dump, screen, or reload" is absolutely critical. You want to research and hire a catalyst-handling contractor that has state-of-the-art catalyst handling and catalyst vacuuming equipment to ensure that you have proper nitrogen circulation and minimized breakage, as Martin said.

You also want to make sure that you have proper QA-QC [quality assurance/quality control] procedures in place before you start the "dump, screen, and reload." These QA-QC procedures should include, for example, making sure you have a system in place for labeling each sample container as it comes out of the reactor and knowing where it is stored and how everything is managed. So, QA-QC is important to making sure you get a successful reload of your catalyst.

You also want to have clear guidelines before starting the "dump, screen, and reload." These guidelines should define what constitutes an acceptable catalyst to be reloaded into the reactor.

You want to have a system set up for proper on site—or if needed, off site—testing to verify that you are meeting the specs for the catalyst to be reloaded.

Also, confirm that you have extra catalyst on hand. I believe Kaspar mentioned that, too. There are going to be some losses; so be sure you have some extra on hand in case you need some fresh catalyst to account for losses.

Finally, one thing that is often overlooked, especially in a busy catalyst change or turnaround: Is the physical area in the field near your reactors and equipment? There are going to be a lot of different activities competing for that space out there and you need to confirm that you have sufficient dedicated area for your catalyst handling and screening process to ensure that it is properly barricaded.

Also, you want to verify that you have proper protection from the elements for your screening process.

Stephen Perry (Shell Oil Products US): What are the expected losses of the catalyst when screening?

Vogt: Typical losses can be 3-5%.

Gonzalez: It really depends on the L/D [length/diameter] you would impose, and then, as we mentioned, the method of unloading.

So, depending on how much you want to reuse, if you have a new catalyst for makeup, you may want to have a fairly large L/D standard and screen out 10% of your material.

Unidentified speaker (Saudi Aramco): We have two-stage hydrocracker reactors and experienced some dump-and-screening about 21⁄2 years ago. We put it back in the unit. Currently, we are experiencing a high pressure drop in the second-stage reactor.

The question for the audience: Has anyone experienced the same problem?

We reached the limit of high pressure drop across the first bed and across the whole reactor. We have taken a few steps to mitigate or accommodate the problem. We reduced the throughput on the second-stage reactor and reduced the recycled hydrogen, but still the pressure drop is excessive.

So the questions for the audience and for the panelists: Does anyone have that experience? What have you done to resolve it?

Vogt: If I rephrase your comment, it would be that you had a pressure-drop problem in the reactor. You dumped, screened, reloaded, and then you had pressure-drop issue in the bottom part of your reactor?

Unidentified speaker (Saudi Aramco): No. It is at the upper part of the reactor, the first bed, which is in the top.

Vogt: If a pressure drop occurs in the first bed, then it typically has to do with feed: either particulates entrainment or a lot of coke precursors. The bed skin can be easily damaged, which would typically mean a vacuum unloading to solve an issue with the pressure drop.

Unidentified speaker (Saudi Aramco): We are about 6 or 7 months away from the turnaround.

Gonzalez: When you reloaded the reactor, you may have had lower void space than you did the first time because of catalyst breakage, poor screening, etc.

This lower void space would make you more susceptible to building pressure drop, even though the rate of accumulation of fines in the catalyst may remain the same.

Vogt: It is an economic decision. Turnarounds often involve considerable logistics, making it difficult to move that economic decision forward.

If you can obtain them, there are products that would remove some pressure drop, and there are some chemical additives that could possibly help you for a few months. It is also possible to remove part of the bed and thus would require no reloading.

You are going to remove the top bed, and of course the second bed is never designed for particulates catching.

But if you have a very limited time remaining in your cycle, that might be how to manage the throughput or at least help you process all of the feeds you want to use without actually having to install a guard bed. And of course you will see pressure drop buildup very rapidly. But if you only need a few months, then this procedure might be sufficient.

We would, however, recommend replacement either in kind or with a catalyst more suited to the situation that you discovered. When you unload, it is very important to take samples to identify the cause of the pressure drop. Was it particulates? Gum? What is the source of the pressure drop?

With that information you could manage your loads better in the future.

Are there any standard sampling and analytical methods that can be used in the refinery labs accurately to determine the silicon content in the feed to the coker naphtha hydrotreater?

Lewer: As part of the Shell organization, I have access to many people with experience; so I will give them credit here. Many of these comments for our analytical methods for silicon were provided by Thomas Smith, Shell's senior research chemist currently at our Westhollow [Houston] location.

Selecting the proper analytical method depends on the amount of accuracy you want to obtain from your silicon analysis. The first method, very commonly used in our refineries, is inductively coupled plasma (ICP). We found that this technique will give a silicon result that is either equal to or greater than the actual true amount of silicon in the sample and that result depends on the volatility of the silicon present in the sample.

We actually had found that using ICP is a good screening tool if you only want to obtain an initial screening of your stream. If you have any silicon present, it is a good screening tool. But if you need an accurate analysis for use in unit mass balances, you are not going to want to use ICP.

Another method that has just started being used is the monochromatic wavelength dispersive X-ray fluorescence. This new method, according to Thomas Smith, may be able accurately to measure even the volatile forms of silicon. But we are still trying to build a track record with that to determine its applicability for silicon analysis.

Finally, a third method—direct injection nebulizer ICP—involves a special Shell-developed proprietary pretreat step to prevent loss of silicon through its volatility. This system will accurately measure silicon in your sample, including its volatile forms. It is a very custom system, however, and, again, such a Shell special method that we do not have it at our refineries. If we would like to have a sample analyzed by this method, we have to send it to our Westhollow lab.

Now in addition to the analytical methods for measuring silicon, there are some other precautions to consider when you are actually taking samples. We have had issues with cross-contamination when taking our samples for silicon analysis.

One of the different forms of cross-contamination we have seen is when some silicon grease that is used in lubrication for valves in sample station actually caused a false high silicon result in the analysis.

We have used glass bottles that have certain silicates during the manufacturing process that can contaminate a sample. We have even seen those special caps that you can puncture through your sample point in order to take a sample. We have also observed some silicon in that fake rubber on the cap. When you puncture it to take your sample, silicon from the lid contaminates the result.

You can get silicon results in the 1-2 ppm level. Contamination from the lid, however, can give you a reading four or five times as high any silicon that is actually in that sample. So, it is very important to get the proper bottle, lid, and sampling technique to avoid cross-contamination. We went through a long learning curve at our refinery when we had to do a lot of silicon analysis.

Finally, the question asked specifically about feed to coker naphtha hydrotreaters. Many of my comments are general to silicon samples throughout a refinery. To address the question specifically for coker naphtha hydrotreaters, I will say that some of our plants have established what we call a sample compositor, which takes a very small sample with some relative frequency.

You can sample every hour, half hour, 15 min, or whenever you want, but take a small sample on some regular frequency. Let it build over a week then analyze the sample for silicon. In that way, you average the swings you might get in feed silicon content that may be due to coker operation. The drum cycles at the coker can cause variability of silicon in your feed. A sample compositor, therefore, can help average that out and give a representative sample result.

Vogt: As Tim mentioned, we also see ICP as the technique most used. That is the ASTM 5708 that was initially designed to determine the nickel and vanadium in crude and oils.

ICP has become the de facto standard for analysis of hydrocarbon samples for silicon and what we use as the most appropriate measure. The accuracy is about 0.5 ppm with a standard deviation of about 0.25 ppm. The results that come out of that measurement are not very accurate.

During operation, the silicon addition in the coker is, of course, minimized. Because the refinery never wants to experience a foamover, silicon addition is minimized to ensure safe operation. Understanding the amount of silicon used in the feed is complicated because the dose varies with the level in the coker drum. More sophisticated continuous measurement systems, as Tim mentioned, are available and capable of sampling periodically, which can create one-cycle or multicycle coker composite samples. Its spot sample value should, therefore, not be used to predict the life expectancy of the hydrotreating catalyst.

A composite sample is more useful, but we recommend measuring the silicon concentration present on the spent catalyst. After a cycle is completed, back calculate the average concentration in the feed. A properly designed guard bed can lengthen the cycle by catching silicon and other poisons before they reach the main high-activity catalyst bed.

Gonzalez: Kaspar and Tim both mentioned the variability you can get in spot samples from coker naphtha. We have also had good results by putting in the sample accumulators.

I also want to point out that you can validate silicon measurements by comparing them against calculated silicon content, based on chemical addition. To do this, you must estimate how much of the silicon added from antifoam will end up in light and heavy coker naphthas.

We have also been investigating X-ray fluorescence spectroscopy and believe that we can measure down to about 0.5 ppm of silicon with that method.

Finally, mass spectrometry, or specifically GC-MS [gas chromatography; mass spectrometry], can be useful for quantifying concentrations of specific siloxanes that formed from decomposition of coker antifoam.

Thienan Tran (Criterion Catalysts & Technologies): I want to add that the silicon source does not just come from the coker naphtha portion of the feed. These days, most refiners often find that the silicon also comes in with the straight-run naphtha and that silicon can be traced back to the silicon oil at the wellhead. So, we need to pay attention to that silicon source, as well as the coker naphtha portion.

In a recent a case study, we used the last method Tim mentioned: direct injection ICP. By using that method to analyze the spent catalyst and then doing the comparison, we are able to get as close as a 5% difference between the results from the analytical and the spent catalyst analysis.

Gonzalez: Thanks for that comment.

We have also seen some silicon come in with our crudes, particularly some Canadian crudes. In some of those situations, it is silica [silicon dioxide] rather than siloxanes that comes in with crude.

Rather than react chemically with a catalyst surface, as siloxanes do, silica will precipitate in the form of fines in a hydrotreating reactor, specifically, in gas oil hydrotreaters.

It may agglomerate with asphaltenes and clay that are present, even in the middle of the catalyst bed, which results in high reactor pressure drop. This different type of problem is becoming more common.

Lewer: Thank you again for those comments. That is absolutely right.

I want to mention that we have seen silicon starting to come in with our crude. That is why we went through all of our sampling processes a few years ago to try to figure out the best methods. We did a refinery-wide mass balance for silicon.

So, it is important that, if there is a chance for silicon in your crude, look at your refinery-wide mass balance for silicon, not just at the coker naphtha hydrotreater.