FOCUS ON UK NORTH SEA SPENDING, COSTS, EXPLORATION-APPRAISAL, DRILLING, AND RESERVES

Malcolm Webb, chief executive of Oil & Gas UK, submitted the following illustrations to show the recent status and short to medium term outlook for UK North Sea operations. Links to public sources of further information are summarized on the facing page.

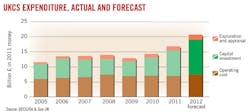

Capital expenditure

• Total expenditure reached almost £17 billion on exploration, developments, and operations last year.

• In more than 40 years to 2011, the industry has spent £486 billion (in 2011 money) by:

• Investing £310 billion in exploration drilling and field developments.

• Spending £176 billion on production operations.

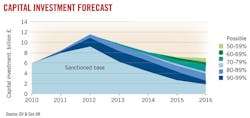

Capital investment

• With a number of large developments receiving field approval in recent years, capital investment rose to £8.5 billion in 2011, 40% higher than 2010.

• Investment is expected to rise in 2012, possibly reaching £11.5 billion.

• Sixteen new fields and major field redevelopments secured approval last year, together requiring £13 billion of capital investment and expected to deliver 1.5 billion bbl of oil equivalent reserves over time.

• Total investment committed or already in progress was £31 billion at the end of 2011, £7 billion higher than 12 months earlier.

Operating costs

• Total operating expenditure remained similar to 2010 at £7 billion.

• This is expected to increase slightly, roughly in line with inflation, to £7.5 billion in 2012.

• Unit operating costs rose sharply to $17/boe because of poor production. The cost per barrel is expected to rise further to around $18/boe in 2012.

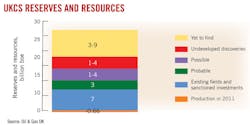

Reserves and resources

• A total of 41 billion boe has so far been recovered from the UKCS.

• Further overall recovery is estimated at 15-24 billion boe.

• Current investment plans have the potential to deliver around 12 billion boe in total:

• 7.1 billion boe from existing fields and ongoing investment.

• 5 billion boe from incremental and new field developments.

• The aggregated portfolio for the UKCS contains around 20% more reserves at the start of 2012 than a year previously.

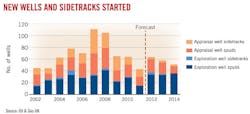

Drilling outlook

• The total number of wells drilled in 2011 including sidetracks was lower than 2010 with:

• 122 development wells (down 6%).

• 14 exploration wells (down 50%).

• 28 appraisal wells (down 18%).

• Part of the fall in drilling activity can be attributed to the unexpected increase in the Supplementary Charge on Corporation Tax from 20% to 32% in 2011's budget.

• Exploration drilling is expected to pick up in 2012 with 64 exploration and appraisal (E&A) wells forecast, although only 40 of those are firmly committed.

Related publications and links

Oil & Gas UK's 2012 Economic Report

http://www.oilandgasuk.co.uk/2012economic_report.cfm

Oil & Gas UK's 2012 Well Services Contractors Report

http://www.oilandgasuk.co.uk/publications/viewpub.cfm?frmPubID=438

UK Trade and Investment's report on UK Oil and Gas World Class Capabilities

http://www.ukti.gov.uk/export/sectors/energy/oilgas/item/156480.html

Oil & Gas UK's 2012 Health & Safety Report

http://www.oilandgasuk.co.uk/Health_Safety_Report_2012.cfm

Oil & Gas UK's Guidance on the Management of Aging and Life Extension for UKCS Oil and Gas Installations

http://www.oilandgasuk.co.uk/publications/viewpub.cfm?frmPubID=436