US SHALE OIL-GAS PRODUCTION POTENTIAL—1: Shale oil, gas output may reduce, not replace, US crude imports

Richard S. Bishop

Rick A. Baggot

Wayne L. Kelley

Robert E. Fargo

RSK (UK) Ltd.

Houston

What is the potential of domestic unconventional shale oil and gas production to displace oil imports to the US?

The large potential resource volumes reported for shale oil and gas have generated comparably large expectations for increased future oil and gas supplies in both the US and the rest of the world. These expectations include the substitution of domestic gas for imported oil, utilizing domestic gas as a cleaner or safer alternative for coal and nuclear generated electricity, and as well as providing gas exports.

Unfortunately, however, the large resource volumes of unconventional oil and gas are not easily converted to increased delivery rates to meet these expectations. Technology has made these expensive resources reachable, not inexpensive. High prices have made them commercial and are required for their continued development.

This article assumes adequate prices, presents examples of possible supply rates, and presents and a methodology to enable the reader to make estimates about the size and limitations of unconventional energy supplies relative to other sources of energy. The limitations specifically addressed are the timing and rates for potential supply additions and the effort (number of wells and rigs) necessary. In addition, several physical constraints impacting the potential for increased delivery rates are identified but not quantified.

Purposes

The purposes of modeling shale oil and shale gas supply rates are is to provide perspective on the physical and economic controls of US supply rates.

The outcomes of this effort provide ranges (i.e., boundaries, yardsticks, perspective guidelines) that are helpful to framing judgments when constructing distributions about future production rates from these resources. The results are generic but are tied in dimension to US resources.

An ancillary outcome is the computational model itself.

This three-part article is not an attempt to forecast but to show what is possible. The geology, engineering, economics, and politics will integrate to determine the actual outcome. It probably is not possible to forecast an outcome with low uncertainty, but models such as these can help define the ranges of uncertainty.

Limitations of deterministic models

Deterministic models such as the one presented here capture neither the full range of outcomes nor certain dependencies.

Nonetheless, we believe our assumptions are dimensionally reasonable and provide perspective on the effort to translate large, low-quality resource volumes into supply rate. Furthermore, the models used here do not assume technical advances and should therefore be considered conservative.

Shale's potential to reduce oil imports

Ignoring the need to increase the price of gas, there are sufficient domestic gas resources and the physical capacity to expand supply and significantly reduce imported oil over time.

Imported oil is used mainly for transportation within an existing infrastructure. In contrast, it will take years, huge investments, and regulatory efficiencies to put in place a gas infrastructure for transportation, convert vehicles to burn natural gas, or to build plants to convert gas to liquids. The low natural gas prices today, and for the near future, will not support the large capital requirements needed to establish a gas infrastructure for transportation in the near term unless heavily supported by government subsidies (not likely in today's economic environment). Further, gas prices must follow a difficult balance between being high enough to spur domestic development and low enough to maintain a price advantage over oil.

Shale's potential to replace coal or nuclear

Replacing coal and nuclear with gas would require doubling current gas production (i.e., the addition of about 20 tcf/year).

While that is physically possible, production probably cannot (or perhaps would not) be increased sufficiently to substitute for coal and nuclear if there is simultaneous increased demand for gas as a transportation fuel. Thus, the US will need its coal and nuclear resources to satisfy future domestic power demand. This does not rule out local substitutions, but it is unlikely to make a large increase in the use of gas for both power and transportation.

Shale's potential to greatly reduce oil imports

Shale oil development can be increased, and it can offer an important reduction but clearly not a replacement of imported oil.

The domestic oil supply appears to be limited by domestic resource volume. Improvements in completion technology could increase shale oil production rates dramatically, but the oil endowment probably is not large enough to replace imported oil.

Impact on the US economy

In commenting on the economic impact of developing domestic energy, our perspective starts with the recognition that the US balance of payments is a deficit of over $500 billion for 2011. Thus any economic activity—not just energy—that reduces the imbalance can have the same positive effect by keeping the money working in the domestic economy rather than going overseas.

There are many ways to estimate an economic impact, but a simple way is to start with the average household income of $46,000/year in 2008. A savings of $1 billion, if it goes entirely to job creation, could add perhaps 20,000 jobs. Importing 1 million b/d of oil at $80-100/bbl costs $30-36 billion/year.

Thus a 1 million b/d reduction of imported oil, whether it is from increased oil production or increased use of gas in transportation, might result in perhaps 600,000 jobs. This is equivalent to about 0.4% reduction of US unemployment. While this is not a solution to the current unemployment problem, it is movement in the right direction.

The US imports about 9 million b/d of oil, so there is ample incentive to reduce the export of dollars by both increased oil production and the creation of a market for gas transportation.

The future: Competition

Globally, industry is evaluating many shale oil and shale gas reservoirs.1 2

Fig. 1 illustrates the locations of some of the source rocks of the world.3 These are all potential unconventional producers of oil and-or gas in some amount. The US Energy Information Administration has recognized potential for near-term production from 14 shale gas basins around the world, but there have not been similar evaluations of shale oil to our knowledge.4 These shale resources are sufficiently numerous and well known that they will eventually influence the global prices of oil and gas.

While high prices are required to bring shale resources on stream, their production will also help to limit price extremes. With shale gas, LNG will probably limit its price.

Introduction

Significant expectations are based on the large unconventional resource volumes being established in North America and being explored in much of the rest of the world with little regard to production constraints.

This article is an attempt to provide perspective on both the drilling effort required to bring those resources on stream and the physically feasible production rates. This methodology translates resource volumes into supply rate for both shale gas and shale oil.

Considerations of the production plateau

Modeling shale oil or shale gas supply is quite different from modeling conventional reservoirs because of the large number of wells and their rapid decline in production rate.

Thus, in modeling supply rate, it is helpful to think in terms of both an 'instantaneous' or short term supply rate and a long term or plateau supply rate.

The primary controls on increasing supply rate are drilling effort and well decline rate. The term or sustained supply rate and its duration time are largely determined by a combination of drilling effort and estimated ultimate recovery. We will call these "plateau rate" and "plateau duration."

National or regional scale economic strategies must rely upon a sustained production rate lasting several years. The sustained rate or "plateau" is key because it must be both long enough and at a production rate that is sufficiently high to attract large and continuous investment in not only exploration and development but also oil field services and construction of drilling rigs, facilities, and pipelines.

Thus, a core premise of our modeling unconventional production is the "production plateau." This is a rate of production that is stable for several years. While the economic incentive is to produce both conventional and shale reservoirs as quickly as possible, shale reservoirs require more time not just because of production rate but also because of the need to efficiently utilize the related infrastructure of rigs and facilities.

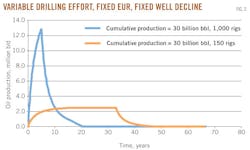

Fig. 2 illustrates end-members of production profiles: one is much too short, the other much too long.

These production profiles are based on two rig fleets of different size but with the same resource base and the same per well EUR and decline curves. The high drilling rate is 1,000 rigs and the lower rate is 150 rigs. Both are drilling one well per month per rig.

Neither of these scenarios, however, is likely, and because there is no historical analog we are left with how one might estimate a plateau production rate and duration that is useful.

In the case of gas, the market requires a plateau production in excess of 2 to 3 decades because power plants require supply for a long period of time. Shale oil does not require such a long plateau, but one is likely nonetheless. A plateau will occur due not only to the large number of wells and the continuous drilling required but also because of the inevitable impediments faced by multiple operators and land owners (financing, permitting, regulatory, etc.).

The variables of drilling effort, well decline rate, and EUR are not entirely independent of one another, but they combine to determine production rate and duration of the plateau. The elements of a production profile are the "time to the plateau production rate" (a function of the number of rigs and well decline), "plateau rate" (a function of number of rigs and well decline), and "plateau duration" (a function of EUR and number of rigs).

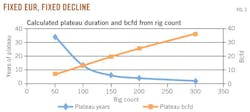

In Fig. 3, the fixed inputs are EUR and decline rate, the variable input is rig count, and the calculated output is billion cubic feet per day of the plateau and the years the plateau will last. Such modeling helps illustrate what is possible for unconventional supply profiles and shows the dependencies of resource volume and drilling effort. These dependent relations help illustrate why volumes alone are an inaccurate predictor of production rate.

Choice of 'type wells'

We recognize there is no "average production profile" for shale oil or shale gas.

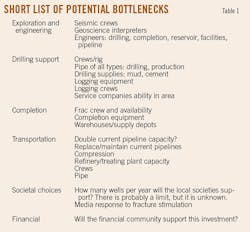

The models we have selected, however, are within ranges currently reported and therefore provide a basis for scaling upwards or downwards. One of our goals is to emphasize that equating resource volumes to supply rates is not a linear relationship. Regardless of the massive size of any unconventional resource, there is a limit to how fast it can be extracted due to the number of rigs available or how fast new rigs can be made available with crews to drill wells, the number of wells a rig can drill per month, permitting requirements, supply limits, seismic crews and seismic processing, etc.

Possible limitations-bottlenecks

We have hypothesized the increase in number of rigs per month used in the model but recognize that many other factors determine the number of wells that can be drilled. Table 1 lists some of the variables that influence the scale of the drilling effort.

The model

The model concept is straightforward:

• Assume representative well production profiles (i.e., decline curves).

• Assume drilling effort (number of rigs, and wells drilled per rig per month).

• Sum individual well production per month (100% chance-of-success for each production profile).

• Limit the results by total resource, area of the resource, or years to drill the resource.

Table 2 summarizes the input data and calculated results.

NEXT: Possible production rates from shale gas.