OGJ Newsletter

GENERAL INTEREST — Quick Takes

API: US oil demand fell in June, first half

US oil demand in June declined by 3% from a year earlier, according to the latest monthly statistical report from the American Petroleum Institute. During this year's first 6 months, demand fell by 2.6%.

"A weakening economy requires less fuel, and this by most measures is a weakening economy," said API chief economist John Felmy. "The fall in demand in June is particularly notable and consistent with other disappointing metrics in the economy, including falling retail sales and contraction in the manufacturing sector," he said.

Gasoline demand in June declined by 2.5% from a year earlier and fell by 1% in this year's first half. Demand for distillates, jet fuel, and residual fuel oil also declined in this year's first half, while distillate and residual fuel oil demand also declined in June. Only demand for jet fuel increased in June, up by 0.7% from a year earlier.

Weak demand bolstered US exports of refined products by 17.8% last month, as refinery utilization averaged 91%, up 5.1 percentage points from May. This marked the first month since July 2011 that refinery utilization exceeded 90%, API reported. US imports of crude and refined products fell in June by 6% to average 10.9 million b/d.

US crude oil production in June increased by 10.7% from June 2011 to average 6.197 million b/d—the highest June output level since June 1998, according to API. Alaskan production in June was down by 9.5% from a month earlier and down by 6.5% from a year earlier to 517,000 b/d. Production of natural gas liquids in the US climbed by 9.4% from a year earlier in June, averaging 2.38 million b/d.

US inventories of crude oil at the end of June were 382.4 million bbl, up 6.7% from a year earlier and down 0.4% from the end of May. June gasoline stocks were down 4% from a year earlier but up 0.6% from a month earlier.

EPA: Dimock water well tests find low contaminants

Sampling of private water wells in Dimock, Pa., has been completed and no significant levels of contaminants requiring further action have been found, the US Environmental Protection Agency's Region 3 office in Philadelphia announced.

"The sampling and an evaluation of the particular circumstances at each home did not indicate levels of contaminants that would give EPA reason to take further action," Regional Administrator Shawn M. Garvin said on July 25. "Throughout EPA's work in Dimock, the agency has used the best available scientific data to provide clarity to Dimock residents and address their concerns about the safety of their drinking water."

EPA visited the community in late 2011, surveyed residents, and received hundreds of pages of drinking water data it received from them, from Pennsylvania's Department of Environmental Protection, and from Cabot Oil & Gas Corp. which had natural gas wells nearby. It determined that sampling to assure that residents had access to safe drinking water after data for some homes showed elevated contaminant levels and several residents expressed concern, the agency said.

It said that overall during its sampling of 64 homes during January-June, EPA found hazardous substances—specifically arsenic, barium, or manganese—that occur naturally in five homes' water wells that could present a health concern. EPA noted that in all cases, the residents now have or will have their own treatment systems to reduce concentrations of these substances to acceptable levels at the tap. It said it has provided the residents with all of their sampling results and has no further plans to conduct additional drinking water sampling.

In a statement, Cabot said EPA's findings are consistent with the water quality data it and state and local authorities previously submitted. "Cabot's operations in Dimock have led to significant economic growth in the area, marked by a collaborative relationship with the local community," it continued.

Repsol agrees to sell Chilean interests

Repsol, acting under a plan to focus on exploration and production, has agreed to sell downstream interests in Chile to a group of Chilean investors led by LarrainVial for $540 million (OGJ Online, June 4, 2012).

Repsol Butano Chile, the unit covered by the agreement, holds a 45% stake in Lipigas, a retail LPG business, and other financial interests.

Repsol's strategic plan for 2012-16 calls for asset sales of up to €4.5 billion. Including the Chilean transaction, the company has completed €1.85 billion in sales so far.

Exploration & Development — Quick Takes

Tecpetrol, PetroNova make Llanos heavy oil find

Tecpetrol Colombia has made a heavy oil discovery at the Pendare-1 exploratory well on the CPO-13 block in the Llanos basin in Colombia.

The well logged a 39-ft gross oil column in basal Carbonera sand and produced at the rate of 166 b/d of fluid, 15% BS&W. Total recovery was 366 bbl of 14.4° gravity oil.

Pendare 1 is the sixth of a nine-well exploratory campaign on the CPO-06, CPO-07, and CPO-13 blocks operated by Tecpetrol in which PetroNova Inc., Calgary, has 20% working interest. Total depth is 3,265 ft.

The well could yield higher volumes if equipped with an electric submersible pump, PetroNova said. It is to be completed in the top of the basal Carbonera sand unit and an extended production test will be performed after all required permits are obtained. The exploratory campaign will resume in 3 months when weather allows cost-efficient access to new locations and all required permits have been received, PetroNova said.

Due to the successful results obtained to date, an overall success rate of 50%, PetroNova will incorporate additional prospects and made an agreement to extend the rig contract.

Shell updates Changbei, other projects in China

Shell and China National Petroleum Corp. have amended the production-sharing contract that covers the 1,693 sq km Changbei tight gas block in China's Ordos basin to cover an extended development phase.

The amendment adds scope to develop more tight gas sands and further develop the already producing main reservoir, Shell said. Subject to government approval and pending the outcome of the appraisal campaign, the new development project could increase the current production plateau of 320 MMscfd of gas. Shell will continue as operator.

Elsewhere in China, Shell and PetroChina have agreed to appraise, develop, and produce tight gas in the Jinqiu block in central Sichuan Province under a 30-year PSC in which Shell has 49% interest. The PSC expires in 2040. Gas production at Jinqiu began in September 2011.

Also in Sichuan, Shell and PetroChina are assessing shale gas opportunities in the Fushun-Yongchuan block. They are also assessing coalbed methane opportunities the Ordos basin, where Shell has an agreement to evaluate resources in North Shilou.

Chrysaor to operate Spanish Point off Ireland

Chrysaor E&P Ireland Ltd. will become operator of the FEL 2/04 and FEL 4/08 licenses and the 11/2 licensing option in the Porcupine basin 200 km offshore western Ireland and will drill two appraisal wells near the Jurassic Spanish Point gas-condensate discovery.

The partners agreed to transfer operatorship to Chrysaor, subject to approval of Irish authorities. Chrysaor's equity in the two licenses will double to 60% in return for drilling one or two appraisal wells. Providence Resources PLC and Sosina Exploration Ltd. will retain 32% and 8% interest, respectively, and Chrysaor will cap their exposure to appraisal drilling costs.

The 2/04 license, in 400 m of water, also contains the Lower Cretaceous Burren oil discovery. Spanish Point's recoverable resource is as much as 200 million boe, and the FEL 2/04 partners pointed out that drilling is also planned in 2013 at the Dunquin exploratory prospect south of Spanish Point.

The just approved 2012 budget includes funds for well design. The initial appraisal well is to spud in the third quarter of 2013 subject to rig availability and governmental approvals.

Drilling & Production — Quick Takes

Schlumberger reports decline in fracing profits

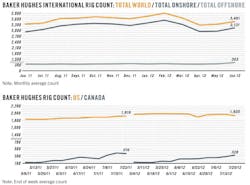

Schlumberger Ltd. reported second-quarter weakness in the hydraulic fracturing market although robust performance in other land businesses and in the US Gulf of Mexico tempered the firm's declining fracing margins. International revenues also helped offset the US-Canada fracing shortfall.

Paal Kibsgaard, Schlumberger chief executive officer, cited spring weather in Canada and continued pricing pressure in the US fracing market as hindering the company's frac profit margins.

He expects those margins will continue to decline during the third quarter, partially because of dwindling demand for dry natural gas drilling. He forecast that the US dry gas rig count will level off about 500 rigs until gas prices improve on the New York Mercantile Exchange.

During a July 20 conference call, Kibsgaard said he hopes Schlumberger will offset declining frac margins with increasing demand for offshore services in the gulf.

"We are obviously well positioned to offset the hydraulic fracturing, but to what extent we can do it is still a bit uncertain," he said, noting that hurricane season creates uncertainty for gulf drilling and production activities.

Buccaneer unit to move jack up to Cook Inlet

Kenai Offshore Ventures LLC (KOV), a partially owned subsidiary of Buccaneer Energy Ltd., Sydney, plans to move the Endeavour jack up rig from Singapore to Alaska, where the rig will be offloaded and later towed to Cosmopolitan, a project in the ice-free southern Cook Inlet.

An undeveloped oil and gas field in 50 ft of water offshore Anchor Point on the Kenai Peninsula, Cosmopolitan has independently estimated proved and probable reserves estimated at 44 million bbl of oil and 90 bcf of natural gas.

Buccaneer Energy acquired 25% interest and became operator of Cosmopolitan earlier this year. BlueCrest Energy II LP, Fort Worth, acquired 75% interest in Cosmopolitan. The seller was Pioneer Natural Resources Alaska Inc. (OGJ Online, Apr. 3, 2012).

The Endeavour is expected to depart Singapore by July 31 for a 21-day voyage. In early November, Buccaneer anticipates towing the rig to the Cosmopolitan project site.

As previously announced, Keppel FELS shipyard in Singapore repaired and modified the Endeavour to meet US offshore drilling standards.

The Endeavour's ability to operate in 300 ft of water makes it suitable for most water depths in the Cook Inlet and northern Alaskan waters. Constructed of steel rated for -10° C., the rig can work safely in the Arctic, including the Chukchi Sea and Beaufort Sea. Endeavour features two blowout preventers.

KOV completed a $68.5 million acquisition of the GSF Adriatic XI jack up rig from Transocean Offshore Resources Ltd., and renamed the rig Endeavour-Spirit of Independence (OGJ Online, Nov. 15, 2011).

The Endeavour is a Marathon LeTourneau 116-C jack up, constructed in 1982 and upgraded in 2004.

Lynden hikes drilling, boosts Wolfberry production

Lynden Energy Corp., Vancouver, BC, will participate in 37 gross (15.6 net) wells on its West Texas Wolfberry project in calendar 2012, up from the 31 gross (13 net) wells previously planned. Twenty wells remain to be spudded.

Production net to Lynden before royalties has averaged 900 b/d of oil equivalent for the past 10 days, including 2 days in excess of 1,000 boe/d. Net production after royalties averaged 700 boe/day. The output is from 37 gross (15.77 net) vertical Wolfberry wells and is 65% oil and 35% gas and gas liquids.

An important contributor to this production growth is a recently drilled well in the Wind Farms Prospect Area that performed considerably above expectations. The well had a 30-day initial gross production averaging 176 b/d of oil and 565 Mcfd of gas and in the last 10 of the 30 days averaged 250 b/d and 999 Mcfd. Lynden has a 43.75% working interest in the well before royalties.

The Wolfberry project covers 18,413 gross and 16,493 net acres, equivalent to 6,509 acres net to Lynden.

PROCESSING — Quick Takes

Barnett shale producer, processor sign asset deal

Crestwood Midstream Partners LP, Houston, will buy from subsidiaries of Devon Energy Corp., Oklahoma City, gathering and processing assets in southwestern Barnett shale for $90 million, the companies reported.

In addition, the firms signed a 20-year, fixed-fee gathering, processing, and compression agreement under which Crestwood will gather and process Devon's natural gas production from a 20,500-acre section. Current gas production under the agreement is about 95 MMcfd.

The transaction is to close in the third quarter.

Being acquired from Devon are 74-miles of low-pressure gas gathering, a 100-MMcfd cryogenic processing plant, and 23,100 hp of compression in the western portion of Johnson County, Tex.

Devon's West Johnson County pipeline and processing plant, built since 2006, are immediately adjacent to Crestwood's Cowtown gathering, which includes the Cowtown and Corvette gas processing plants with combined processing capacity of about 325 MMcfd.

The Crestwood Cowtown and the Devon West Johnson County systems are currently interconnected, and Crestwood has processed gas from Devon's West Johnson County system in the past.

Upon closing, Crestwood will consolidate the systems by increasing system interconnect capacity with the ultimate goal of processing all Devon's West Johnson County gas production in Crestwood's Cowtown and Corvette plants. The integration is to result in future—but unspecified—cost savings for Crestwood and provide Devon with lower wellhead pressures, higher NGL recoveries, and expanded market outlets.

Crestwood and Devon's gathering, processing, and compression agreement will provide for 100% fixed-fee-based revenues to Crestwood and includes a dedicated production area from Devon of about 20,500 acres. The West Johnson County system currently gathers from about 230 wells.

Due to the liquids-rich quality of the gas produced in this portion of the Barnett shale, Devon has "maintained an active drilling and development plan" for West Johnson County this year and expects to continue to develop the properties in 2013.

Canadian PDH unit under consideration

Another operator, this time in Canada, is looking to monetize its propane volumes with a propane dehydrogenation unit (PDH). Tulsa-based Williams Cos. Inc. has announced it is exploring construction of a PDH unit in Alberta.

Only a few weeks ago, Enterprise Products Partners LP, Houston, said it planned to build a 35,000-b/d PDH unit on the Texas Gulf Coast to take advantage of low-cost propane derived from increased NGL production out of nearby shale gas development (OGJ Online, June 21, 2012).

Exactly where it will be built has not been announced or, according to a company spokesman, decided upon. Neither did Enterprise reveal an estimated cost.

A Canadian PDH unit would be a first, according to Williams, and would allow it to increase production of polymer-grade propylene from its Canadian operations. Williams said it is the only firm in Canada producing polymer-grade propylene.

The propane feedstock for the new unit would be recovered at Williams's Redwater plant near Edmonton. The PDH unit would convert propane into higher-value propylene that would then move to the US Gulf Coast. An associated hydrogen by-product would be sold in the Alberta market.

If built, the PDH unit would have a capacity of about 1 billion lb/year. Williams said it estimates capital expenditures of about $600-800 million.

Pertamina to develop Indonesian ethanol projects

Indonesia's state oil firm Pertamina will partner with Celanese Corp. of Dallas to develop synthetic fuel-ethanol projects in the Asian country, Celanese reported.

Under a joint statement of cooperation, Celanese and Pertamina will define potential supply arrangements, production locations, and distribution strategies. This phase along with final investment decisions by each company and acquisition of all regulatory approvals, could lead to production start-up in about 30 months, Celanese said.

The partnership will use Celanese's proprietary TCX ethanol process technology.

Indonesia's current demand for transportation fuel will reach about 25 million tonnes and increase by 6%/year through at least 2020, it said. A 10% blend of high-octane fuel ethanol by 2020 would potentially require as many as four world-scale TCX Technology production units, said Celanese, and therefore reduce Pertamina's gasoline import requirements by more than 30 million bbl/year.

In addition, high-octane fuel ethanol, which improves automobile tailpipe emissions, also may assist Pertamina to meet Indonesia's goals of improving its gasoline and air-quality standards.

PDO lets contract for Saih Nihayda plant in Oman

Petroleum Development Oman (PDO) has let a $100 million contract to ABB of Zurich for a condensate processing plant in Oman.

The Saih Nihayda condensate stabilization plant will be built near the Saih Nihayda gas plant in the northern part of the PDO concession area and will have the capacity to process 4,500 standard cu m/day (about 28,000 b/d) of condensate.

The plant will back up the existing central processing plant to "ensure continued gas production for PDO's domestic and export customers," PDO said.

PDO said the project is central to its goal of sustaining gas flows from its main gas production in the north. The plant is to be completed by yearend 2014.

ABB will be responsible for engineering, procurement, and construction of the stabilization plant, including project management, training, testing, and on-site support for operation, and maintenance after start-up.

In addition, ABB will supply power equipment such as low and medium-voltage switchgear, power transformers, an electrical control system, as well as continuous emission-monitoring systems, and other analytical instrumentation.

TRANSPORTATION — Quick Takes

Enagas to boost France-to-Spain capacity

Enagas subsidiary Transport Enagas SAU will acquire 90% of Naturgas Energy Transport from Energias de Portugal, including 450 km of high pressure gas pipelines and an international connection in Irun, Basque Autonomous Community, pending regulatory approvals.

Enagas plans to build a new compressor station for the system, increasing capacity of the connection from France into Spain to 2.1 billion cu m/year from 0.2 billion cu m/year. This station will have two units and one back up unit, with a total installed capacity of 21,000 kw.

The acquisition will cost Enagas €241 million. The Basque government, through the Basque Energy Board, will retain a 10% stake in the company.

The deal is part of the third European gas directive, stipulating that operators should separate vertically integrated transport activities from other activities, helping increase the independence and efficiency of the European gas system.

Sunoco launches Allegheny Access line open season

Sunoco Logistics Partners LP affiliates Sunoco Pipeline LP and Inland Corp. have begun a binding open season for the Allegheny Access Pipeline project, transporting refined products from the Midwest to eastern Ohio and western Pennsylvania markets.

Allegheny Access will have an initial capacity of 85,000 b/d, expandable to as much as 110,000 b/d.

Sunoco, operator and 83.8% shareholder of Inland, expects the project, using a combination of new and existing assets, to be operational first-half 2014. The open season ends Aug. 20.

Shell Oil Co. and Midwest Pipeline Holding LLC also hold interests in Inland.

Buckeye Partners LP bought 33 refined products terminals and 1,000 miles of pipeline from BP Products North America in 2011, initially including BP's then 50% stake in Inland (OGJ Online, Mar. 21, 2011).

The other shareholders of Inland, however, exercised their rights of first refusal and purchased all of the Inland shares, leaving none available for Buckeye to purchase.

Inland owns 350 miles of active refined products pipelines. Sunoco Logistics' assets include 2,500 miles of refined products pipelines.

KMEP, BP execute agreement for splitter, storage

Kinder Morgan Energy Partners LP and BP North America have signed agreements to provide BP condensate processing and storage at KMEP's terminals on the Houston Ship Channel, the firms jointly reported.

BP has committed more than 40,000 b/d of throughput for KMEP's 50,000-b/d condensate splitter, currently under construction, that will produce such components as light and heavy naphthas, kerosene, and gas oil.

The $200 million splitter has been designed to provide expansions up to 100,000 b/d throughput. BP also will lease an additional 750,000 bbl of storage that KMEP will add at its Galena Park, Tex., terminal.

The expansion is part of KMEP's $75 million investment to build five tanks that will connect to its splitter with piping, manifolds, and pumps.

The company expects the splitter and storage tanks to be operating in first-quarter 2014.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com