OGJ Newsletter

GENERAL INTEREST — Quick Takes

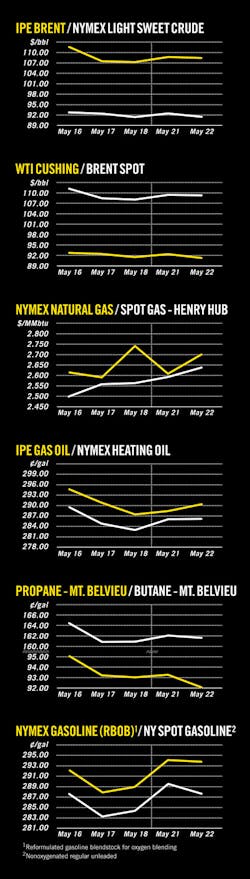

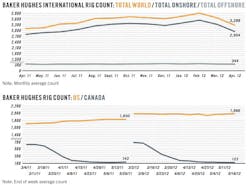

Analyst sees natural gas prices below $3/MMbtu

Natural gas prices are expected to hover below $3/MMbtu for 6-24 months, primarily bouncing between $1.75/MMbtu and $2.50/MMbtu, David Cunningham, managing director of Tudor, Pickering, Holt & Co., told a Mayer Brown LLP energy conference on May 23.

"Long term, we see the price at $5/MMbtu," Cunningham said, referring to average prices on the New York Mercantile Exchange in 3-5 years. He noted that gas producers are getting more efficient and lowering their costs so future break-even levels could move lower.

Currently gas production is not economic because the break-even point for most US gas basins is at least $3/MMbtu, he said. Investors instead have shifted their focus toward liquids plays.

A price of $5-5.50/MMbtu is the price level at which investors will regain confidence in the gas industry, he said.

Associated gas from unconventional liquids plays is a popular topic, Cunningham said. Even though the US currently is in a gas supply overhang, associated gas production still brings revenue for producers.

"Today we are flaring gas in the Bakken because we don't have the infrastructure in place," he said. Many pipeline projects are under way or in the planning stages for the Bakken formation in North Dakota and Montana.

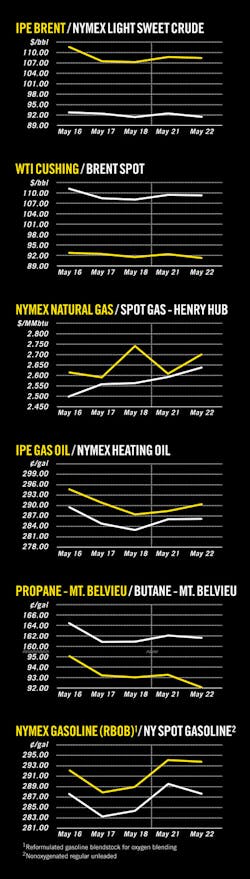

The US needs additional demand for gas, Cunningham said. He believes the rig count will fall in coming months.

Bakken Hunter to buy assets from Baytex

Bakken Hunter LLC, a subsidiary of Magnum Hunter Resources Corp., closed a $312 million acquisition of Baytex Energy Corp.'s nonoperated interests in North Dakota. Baytex, Calgary, noted that North Dakota remains part of its asset base.

The assets sold represented 45% of Baytex's North Dakota net acreage and 40% of its current US production.

"There is no change to our plans to drill approximately 20 to 25 gross (approximately 10 net) wells on our Bakken/Three Folks play in North Dakota this year," Baytex said, adding that it operates almost all of the remaining lands in its US business unit.

Bakken Hunter bought assets that produced 950 boe/d of light oil production based on first-quarter field estimates. The transaction involved 149,700 gross (50,400 net) acres of which 24% is developed, Baytex said.

As of Dec. 31, 2011, the assets were estimated to have proved reserves of 12.4 million boe (8% gas) and proved plus probable reserves of 17.9 million boe (8% gas). Baytex said 10% of the proved plus probable reserves are developed and producing.

MDU Resources unit buys Bakken midstream assets

MDU Resources Group Inc., through its Bitter Creek Pipelines LLC subsidiary, plans to pay $66 million for a 50% interest in Whiting Oil & Gas Corp.'s Bakken midstream assets near Belfield, ND.

The facilities include a new gas processing plant and gas gathering pipeline system connected to the plant. A residue line that ties into the Williston Basin Interstate Pipeline Co. system also is included along with a oil gathering system, an oil storage terminal, and an oil pipeline that connects the terminal to the Bridger Pipeline. Whiting will continue to operate the facilities.

The Belfield gas processing plant has an inlet processing capacity of 35 MMcfd.

The oil terminal is currently under construction with completion expected in the third quarter.

Terms of the acquisition call for Bitter Creek to pay 60% of certain future capital expenditures.

Oil and gas production from Whiting's Pronghorn acreage in Stark and Billings counties, combined with adjacent Stark County acreage owned by Fidelity Exploration & Production Co., an MDU Resources subsidiary, will supply these facilities.

Fidelity and Whiting have a combined seven rigs operating in the acreage feeding the facilities.

New firm targets deepwater subsalt plays

Venari Resources LLC, Dallas, is beginning work as a deepwater Gulf of Mexico exploration company with private financing of as much as $1.125 billion.

The company will focus on subsalt prospects.

Brian Reinsborough, former president and chief executive officer of Nexen Petroleum USA Inc., formed the company while working as executive-in-residence at Warburg Pincus LLC and is chief executive of the start-up firm.

Warburg Pincus, Kelso & Co., Temasek, and The Jordan Co. have agreed to make the investment.

Exploration & Development — Quick Takes

Wintershall group to develop Maria off Norway

An appraisal well north of the 2010 Maria oil and gas discovery in the Norwegian Sea has confirmed the initial resource estimate and supported the upper end of discovery volumes, said Wintershall Norge AS.

Wintershall and partners will therefore assess development options such as a subsea tieback or stand-alone facilities for the field based on results of the 6407/1-5 S well. The appraisal well is 20 km east of Kristin field and 8 km northeast of the Maria discovery well.

Maria is estimated to contain 60-120 million bbl of recoverable oil and 2-5 bscm of recoverable gas.

The appraisal well went to 4,133 m in 297 m of water and cut a 39-m thick oil column in the Garn formation with reservoir quality as expected, a common oil-water contact, and pressure communication. A successful formation test was carried out.

License interests are Wintershall Norge operator with 50%, Petoro AS 30%, and Centrica Resources AS 20%.

Wintershall said it will invest as much as 2 billion euros in exploration and field development in Norway and the UK and is aiming for a production level of 50,000 b/d of oil equivalent by 2015. Knarr, Edvard Grieg, and Cladhan fields should contribute to meeting the target.

Calgary firm to test Vaca Muerta in Argentina

Americas Petrogas Inc., Calgary, said it will spud the La Hoya x-1 exploratory well in early June 2012 with the Jurassic-Cretaceous Vaca Muerta shale as primary objective on the 293,600-acre Totoral block in the Picun Leufu subbasin of the Neuquen basin in Argentina.

The well will be the first test of Vaca Muerta on the block, which Americas Petrogas operates with 90% working interest and in which Gas y Petroleo del Neuquen has 10%.

Projected to 2,000 m, La Hoya x-1 is 16.6 km northwest of the Canadon CN x-2 well drilled by YPF SA in 1962 that tested oil in the Jurassic Quebrada del Sapo sandstone. La Hoya x-1 is on a present-day syncline where the Vaca Muerta reaches its deepest position in the block and where higher formation pressure is expected, the company said.

Geochemical analysis indicates that the Vaca Muerta is in the early oil window. The Picun Leufu subbasin is a relatively unexplored depocenter that in addition to the Vaca Muerta offers opportunities in formations such as the Los Molles shale and the conventional Pre-Cuyo, Mulichinco, Quintuco, and Quebrada del Sapo.

Monterey shale oil eyed at Santa Barbara's Zaca field

Underground Energy Corp., Santa Barbara, Calif., will attempt to complete the Monterey shale at the Chamberlin 3-2 well on the 7,750-acre Chamberlin lease in its Zaca field extension project in Santa Barbara County, Calif.

The well, which went to a total depth of 7,685 ft for the budgeted $2.4 million, is a 300-ft offset to the Chamberlin 4-2, which discovered the Chamberlin East fault block but had mechanical problems. Chamberlin 3-2 encountered 1,700 ft of oil-saturated shale oil shows, including more than 1,200 ft of continuous Monterey oil shows in the deeper Chamberlin East fault block.

Logs confirmed that the oil saturation, fracture intensity, and formation thickness in the lower Monterey reservoir are consistent with the productive Monterey sections in the shallower fault block in the original Zaca oil field to the west. Zaca field wells typically had 1,100 ft of pay.

In the original Zaca field the 61 wells drilled on 10-acre spacing, including later infill wells, had average initial production rates in excess of 200 b/d and cumulative production of more than 540,000 bbl.

Underground Energy will move the Key 98 rig west to drill Chamberlin 2-2 to 4,350 ft into the shallower fault block of the Monterey shale before it releases the rig. That well will offset two Zaca field wells that have produced more than 500,000 bbl/well. In view of the discovery of the Chamberlin East fault block and the potential of deeper structures that Underground has identified by seismic, the company is negotiating for a larger rig capable of more effectively drilling deeper. That rig is expected to arrive in 45-55 days.

Underground also signed a lease on 3,334 net acres that appear to have potential similar to the Zaca field extension project. The company owns 15,384 net acres at Zaca and a total of 70,000 net acres in California and Nevada.

Iran: Giant Caspian deepwater oil find claimed

Iran has claimed to have made a discovery of as much as 10 billion bbl of oil offshore in the Caspian Sea, but few details have been disclosed.

Various press reports quoted Iran's Khazar Exploration & Production Co. as having claimed an oil discovery with pay thickness of at least 78 ft at a drilling depth of about 7,900 ft in a deep but unspecified water depth.

Khazar has been drilling in the Caspian since late 2010 with the Amir Kabir deepwater semisubmersible, formerly called Iran Alborz.

Drilling & Production — Quick Takes

Total confirms G4 well top kill stopped gas leak

Total UK Ltd. said 5 days of close monitoring confirms the success of a May 15 top kill operation on the leaking G4 gas well on the Elgin complex, 240 km from Aberdeen in the UK North Sea. The West Phoenix semisubmersible pumped heavy mud into the well, and the leak was stopped in 12 hr once the kill operation started, Total said. Subsequent inspections confirmed the leak remains completely stopped, Total said.

The G4 well had leaked since Mar. 25, prompting an evacuation of 238 people from Elgin and an adjacent drilling rig, the Rowan Viking. Total stopped production on Elgin and Franklin gas fields (OGJ Online, Mar. 27, 2012).

From an estimated initial gas flow rate of around 2 kg/sec, the leak progressively decreased to 0.5 kg/sec until the well intervention, Total said.

Now that the kill operation has worked, Total said the next step will be for workers to return to Elgin complex and restart the Viking to set cement plugs in the G4 well. The plugging and permanent abandonment phase will take several weeks.

Once the first cement plug is set in the G4 well, the drilling of the ongoing relief well with the Sedco 714 will be stopped. Total, in consultation with the appropriate authorities, said experts decided drilling a second relief well by the Rowan Gorilla V is no longer necessary and has therefore been cancelled.

Repsol declares Cuba deepwater wildcat dry

Repsol SA has declared a dry hole at its deepwater exploratory well in the Gulf of Mexico north of Cuba, press reports indicated May 18.

The well went to 4,500 m in 5,600 ft of water. Repsol is operator with 40% interest for a group that also includes Statoil ASA 30% and ONGC Videsh Ltd. 30%. The well is the first of three the group plans to drill on the six contiguous blocks it holds offshore between Havana and Matanzas.

The Scarabeo-9 semisubmersible will move about 100 miles west-southwest to drill an exploratory well for Petronas of Malaysia and Gazprom of Russia. Petronas and Gazprom have 70% and 30% interests, respectively, in the N44, N45, N50, and N51 blocks.

Then the rig is scheduled to move drill a third exploratory well off the western tip of Cuba, where Petroleos de Venezuela SA holds the N54, N54, N59, and N59 blocks (see map, OGJ, Dec. 11, 2000, p. 42).

Repsol drilled the Yamagua-1 wildcat to 3,410 m in 1,660 m of water on Block N27 in 2004 and said it found "the existence of oil generation in the basin as well as an excellent carbonate complex," but that well was also a dry hole.

Gullfaks subsea compression proceeding

Statoil and Petoro have agreed to install subsea gas compression to handle production from the Brent reservoir at Gullfaks South oil field in the North Sea offshore Norway (OGJ Online, Apr. 13, 2012).

Statoil, operator with 70% interest, says the installation will boost production by 22 million boe/d. The project, including two 5-Mw wet-gas compressors on a subsea template in 135 m of water, is to be complete in 2015. Power and control modules will be integrated on the Gullfaks C platform 15 km away.

Statoil also is installing subsea gas compression in the Asgard area of the Norwegian Sea, where completion also is due in 2015 (OGJ Online, Mar. 28, 2012).

Atchafalaya Bay field due larger pipeline

Operations have begun to install a pipeline that will enable a large increase in production from Marathon gas-condensate field in Atchafalaya Bay off Louisiana, said Petsec Energy Ltd., Sydney.

The $3 million pipeline, to be installed by early third quarter 2012, is to increase the field's production capacity to 50-60 MMcfd. The field operates profitably at present gas prices and the current restricted rate of production, Petsec Energy said.

A group led by private Phoenix Exploration Co. has drilled two wells that are capable of delivering as much as a combined 50 MMcfd. A third well, in 8 ft of water on State Lease 20221, is at 14,700 ft enroute to 19,000 ft.

Private companies have 43.25% working interest in the field, and Apache Corp. has 48.75%. Petsec Energy has 8% interest in the wells and pipeline.

PROCESSING — Quick Takes

Imperial eyes alternatives for Dartmouth refinery

Imperial Oil Ltd. said it will offer its 88,000 b/d Dartmouth refinery near Halifax, NS, for sale while it studies alternatives for the facility that is not meeting its financial expectations.

The company will consider continuing to operate the facility as a terminal and hopes to make a decision by the first quarter of 2013 depending on the response to marketing efforts.

The refinery, which has 200 employees and 200 contractors, produces gasoline, diesel, jet fuel, heating oil, marine fuel, heavy fuel oil, and asphalt. Related terminals operate at Dartmouth, NS, Sydney, NS, Corner Brook, Newf., Sept-Iles, Que., and Cap aux Meules in the Magdalen Islands. The refinery started up in 1918.

Imperial said, "The Dartmouth refinery operates in the highly-competitive Atlantic Basin, which is open to significant global competition. Demand for refined products in the basin has declined in recent years, and despite tremendous efforts by our workforce, the refinery has not met expected financial returns."

API: Gasoline demand posted small increase in April

While total US demand for oil products dipped in April, gasoline demand climbed almost 1% from a year earlier to average 8.842 million b/d, according to the latest monthly statistical report from the American Petroleum Institute.

Overall petroleum deliveries, a measure of demand, were down 0.3% from April 2011. Jet fuel demand declined by 3.2% to 1.404 million b/d, and residual fuel oil demand fell by 28% to 430,000 b/d, API reported. Distillate fuel oil demand climbed to 3.738 million b/d from the year-earlier average of 3.689 million b/d.

"The mixed demand picture reflects an improving but relatively weak economy," said API chief economist John Felmy.

API figures show that total US oil demand through the first 4 months of this year are down 1.8% from the same 2011 period.

US production of crude oil and condensate during April was 5.963 million b/d, up 6.6% from April 2011, while natural gas liquids production jumped by 10% to 2.372 million b/d.

US gasoline production of 9.129 million b/d set a record for any April and for any comparable year-to-date period, API said. Distillate production at 4.27 million b/d was the second highest for any April and also a year-to-date record. Refinery utilization was unchanged from April 2011.

Total US petroleum imports met 55.8% of demand, API reported, as crude and product imports in April were 10.359 million b/d. In April 2011, US imports of crude and products averaged 11.405 million b/d.

Russian refinery due desulfurization boost

Lukoil will use Axens technology for a cracked-gasoline desulfurization unit at its 337,000 b/d Kstovo refinery in the Nizhny Novgorod region of Russia.

The Axens Prime-G+ unit will be able to treat 22,000 b/d of gasoline from a fluid catalytic cracker installed in 2010.

Lukoil also added alkylation capacity in 2011 to become able to produce gasoline meeting Euro-5 standards.

TRANSPORTATION — Quick Takes

GAIL, TurkmenGaz sign gas sale-purchase agreement

GAIL and TurkmenGaz have signed a natural gas sale and purchase agreement for Turkmen gas shipped via the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline. Shri S. Jaipal Reddy, India's Minister of Petroleum and Natural Gas, described the Indian market as "eagerly awaiting the commissioning of the TAPI gas pipeline," citing projections that the gas sector in India will expand at a compound annual rate of 19.5% in the next 5 years.

Reddy said India's consumption of gas would increase from the current 166.2 MMcfd to 473 MMcfd in 2017, prompting the country to focus on both building its LNG infrastructure and expanding its gas pipelines. India's LNG regasification capacity will rise to 48 million tonnes/year by 2017 from 13.5 million tonnes/year now, according to Reddy, who also described the country's current gas pipeline network at 13,000 km long with a capacity of 334 MMcfd but projected to increase to 31,757 km by 2017 with a capacity of 876 MMcfd.

In addition to TAPI and any other opportunities to import gas via pipeline, Reddy said India sought to diversify its sources of LNG supply, not only through purchase agreements but by equity participation in future liquefaction projects and farm-in production agreements.

At roughly 1,680 km and built with 56-in. OD pipe, TAPI would transport gas from Turkmenistan's Daulatabad field to Fazilka, Punjab, India, at a capacity of 27 billion cu m/year, with part of this total drawn off in Afghanistan and Pakistan. With construction unlikely to begin before 2013, the earliest in-service date is 2017.

Kinder Morgan launches pipeline open season

Kinder Morgan Pony Express Pipeline LLC, a subsidiary of Kinder Morgan Interstate Gas Transmission LLC, and Belle Fourche Pipeline Co. have launched an open season to solicit shipper interest for crude oil transportation service on the Pony Express pipeline from a point near Baker, Mont., to Ponca City and Cushing, Okla. The firms expect the pipeline to transport about 100,000 b/d of oil under a joint tariff beginning fourth-quarter 2014 and have secured a long-term commitment with a major anchor shipper for a minimum of 30,000 b/d at startup.

In separate open seasons, Pony Express will offer single-pipeline oil transportation service from the Guernsey, Wyo., area and the Denver-Julesburg basin to Ponca City and Cushing, and additional oil transportation service under a separate joint tariff to the same delivery points.

Pony Express involves converting 500 miles of gas pipeline, originating in Guernsey, Wyo., and ending in central Kansas, to crude oil service and constructing 210 miles of new pipeline between Kansas and Oklahoma. It will also include interconnects with the Platte Pipeline and the Bridger-Butte Pipeline.

Kinder Morgan held an open season on Pony Express last year, describing the capacity of the pipeline as up to 210,000 b/d (OGJ Online, Sept. 12, 2011).

Penn Virginia to expand Marcellus services by 2018

Penn Virginia Resource Partners LP (PVRP) said it plans to spend $380 million for pipeline projects and midstream services in the Marcellus shale by 2018.

A limited partnership, PVRP already has been expanding its Marcellus pipeline assets, including a $1 billion acquisition of Chief Gathering LLC (OGJ Online, Apr. 10, 2012).

On May 21, PVRP announced long-term agreements to extend its gas pipeline in Lycoming County, Pa., and provide gathering and compression services to four Marcellus producers.

Those producers are Royal Dutch Shell PLC unit Swepi LP, affiliates of Southwestern Energy Co., Range Resources Corp., and Inflection Energy LLC, a private company.

SemGroup to build DJ basin crude gathering system

SemGroup Corp. plans to build an oil gathering system in the Denver-Julesburg basin in Colorado. The 37-mile, 12-in. OD Wattenberg Oil Trunkline will transport oil within the DJ basin.

The project will include a 37-mile, 12-in. pipeline system extending between Noble Energy Inc. processing facilities and Rose Rock Midstream's Platteville Station, the starting point of White Cliffs Pipeline. SemGroup last year contracted to add 1.95 million bbl of storage at Cushing, Okla., to handle expanded flows from the DJ basin on White Cliffs Pipeline (OGJ Online, Apr. 4, 2011).

Wattenberg also will include 200,000 bbl of storage and facilities to unload trucks. SemGroup expects Wattenberg to enter service third-quarter 2013, supported by a long-term shipping agreement with Noble.

SemGroup and Chesapeake agreed in February to build a 210-mile crude in Oklahoma, also expected to enter service during third-quarter 2013 (OGJ Online, Feb. 21, 2012).

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com