Shale source rocks a game-changer due to 8-to-1 resource potential

P.K. Meyer

Rowayton, Conn.

One way to get a handle on the enormity of potentially producible hydrocarbons contained in shale formations is to estimate how much recoverable oil and gas remain within the source rocks in which they were generated as compared to how much producible oil migrated into "conventional" reservoirs.

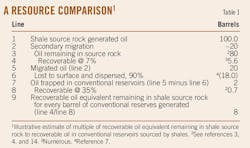

Applying this illustrative methodology indicates that for every barrel of crude oil in conventional reservoirs that constitute the bulk of global crude oil reserves of 1.3 trillion bbl there are 8 bbl of potentially producible oil equivalents remaining in the source rock that generated that 1 bbl of conventional reserves (Table 1).

While this admittedly simplistic illustration could provoke considerable dissent within the petroleum geology community, it should prove directionally correct. As such, one is talking about a world-scale game changer as source rocks are moved into the producible column.

The resulting increase in potentially recoverable global crude oil of 1.3 trillion bbl,1 which constitutes a 40-year supply at current consumption rates,2 could be material.

Speculation as to the extent of the impact of this transformation on alternative energy supplies, the global economy and geopolitics, while certainly warranted, is well beyond the scope of this discussion.

Discussion

Conventional wisdom

It's worth remembering that up until, say, the mid 1990s, source rocks, principally shale-based formations, were recognized as only generating and expelling the hydrocarbons that, in turn, charged porous, reservoir-quality formations within the migration limits of this expelled oil and gas.

The source rocks themselves were not considered producible by virtue of very low porosities and permeabilities as compared to the far higher values characterizing reservoir-quality formations. So, while shale source rocks were considered a prerequisite for finding hydrocarbon-charged, reservoir-quality formations, they were largely "unstudied" as potential reservoirs due to the prohibitive economics of their low porosities and permeabilities.

Now that the subsequent evolution and exploitation of horizontal (directional) drilling and hydraulic fracturing have "unlocked" this otherwise unrecoverable shale oil, not to mention shale gas, the notion of what constitutes resource potential is in the process of being radically enlarged.

Tools define resources. Put radically improved exploitation tools in the hands of an exploration geologist and he will significantly increase what constitutes a recoverable resource.

New paradigm

Now that there are tools to economically recover shale-locked oil and gas, shale formations, intrinsically widespread throughout the world, are being "discovered" at a game-changing rate. This process has really just begun.

Speculative estimates of just how much generated oil remains in shale source rocks range between 45% and 95% depending on the geology of the formation and the quality of the estimate.

At one extreme is the vast 9-11 million acre Bakken Source System3 from which little or no oil has been expelled due to the overlying Lodgepole carbonate seal and such likely analogs as the Nordegg member of the Fernie formation of the Western Canada basin in Alberta.4-6

At the other extreme might be John Hunt's estimate of 45% remaining in source rocks (both shale and carbonate) for oil generated in the last 100 million years.7 EOG Resources Inc., active in the two leading US shale oil plays, the Bakken and the Eagle Ford, estimates that "75% of generated oil [is] still in mother (shale) source rocks."14

The overriding issue here is not the competence of the researchers making these estimates but rather the legacy of lack of economic incentives justifying the requisite study of shale source rocks. Accordingly, the understanding of shale source beds as productive reservoirs still pales in comparison to what is known about the behavior of the "conventional" reservoirs that comprise the bulk of the world's reserves.

As this void is addressed, as often has been the case of analogous instances in the past, shale-based hydrocarbon resource estimates will increase, probably dramatically. A good example of this process is the US Geological Survey, which increased its estimate of Barnett shale recoverable gas resources from 3 tcf in 19968 to 26 tcf in 20049 principally as a result of the implementation of horizontal drilling and hydraulic fracturing.

The subsequent pioneering use of the same tools in the oil-rich Bakken of Montana and North Dakota expanded the estimate of Bakken resource potential from a USGS researcher's unofficial finding of 151 million bbl in 199510 to a published 3.7 billion bbl in 2008.11 Industry estimates utilizing recent data now place Bakken ultimate recovery well north of a 2011 estimate of 24 billion bbl.12 13

Inspired by this pioneering success in identifying an oil-rich shale, a wide ranging search for analogs has already come up with the Texas Eagle Ford, which EOG contends will outstrip even the Bakken.15

This search is being repeated on a global scale ranging from California's Monterey shale to shales in Argentina's Neuquen basin, Canada's Nordegg formation, France's Paris basin, Poland's Baltic basin, and China's widespread but still largely uncharted shale formations…and this is just for starters.

Clearly, a key variable going forward in determining shale oil reserve potential will be the degree of improvement in currently low recovery rates. However, given the steady improvements in recovery technologies across widely varying reservoir geologies over the last 60 plus years, recovery rates are likely to experience marked improvement.

When one is talking presently of only 4-6% recovery for shale oil, an increase to 10% and, in turn, a doubling of potential reserves, is ultimately likely if the past is any kind of prologue.

The takeaway

Somewhat simplistically, this has all been distilled down to the observation in Table 1 that for every 1 bbl of oil reserves in a "conventional" reservoir, 8 bbl of recoverable oil equivalent could well remain behind in the shale source rock that generated this 1 bbl of reserves.

This, by any measure, should be a world-scale game changer for the oil and gas industry.

Well beyond the scope of this discussion is what impact this transformation could have on the global economy, alternative fuels, and geopolitics.

References

1. Basic Petroleum Data Book, Section II, Table 1, American Petroleum Institute, August 2011.

2. "Monthly Oil Market Report," International Energy Agency, Mar. 14, 2012, p. 5.

3. Price, Leigh, US Geological Survey, "Origins and characteristics...of the Bakken Source System…," draft, circa 1999.

4. See Ref. 3, Section 4.04, p. 48.

5. "Nordegg Tight Oil Project: Phase I," Canadian Discovery Ltd., January 2011.

6. "Nordegg…Properties Study," Trican Well Services, August 2011.

7. Hunt, John M., "Petroleum Geochemistry and Geology," W.H. Freeman & Co., Second Edition, 1995, p. 597.

8. Kuuskraa, V.A., et al., "Barnett shale rising star in Fort Worth basin," OGJ, May 25, 1998, p. 67.

9. "An Investor's Guide to Shale Gas," Oil & Gas Investor Supplement, January 2007.

10. Petroleum Intelligence Weekly, Apr. 21, 2008.

11. "National Assessment of Oil & Gas Fact Sheet," US Geological Survey, April 2008.

12. Continental Resources, fourth quarter 2011 conference call, Mar. 6, 2012.

13. "Bakken field recoverable reserves," Continental Resources Inc., Feb. 4, 2011.

14. "Horizontal oil plays in unconventional rock: A game changer," EOG Resources Inc., Barclays Conference, Sept. 8, 2011, Slide 2.

15. Reference 14, Slide 10.

The author

Philip Meyer ([email protected]), a private investment manager for the last 23 years, focuses on the oil and gas industry. Previously he was a partner of F. Eberstadt & Co., where he principally served as a security analyst covering the oil field services and products industry. He is a graduate of Harvard College and the Harvard Business School.

Manuscripts welcomeOil & Gas Journal welcomes for publication consideration manuscripts about exploration and development, drilling, production, pipelines, LNG, and processing (refining, petrochemicals, and gas processing). These may be highly technical in nature and appeal, or they may be more analytical by way of examining oil and natural gas supply, demand, and markets. OGJ accepts exclusive articles as well as manuscripts adapted from oral and poster presentations. An Author Guide is available at www.ogj.com, click "home" then "Submit an article." Or contact the Chief Technology Editor ([email protected]; 713/963-6230; or fax 713/963-6282), Oil & Gas Journal, 1455 West Loop South, Suite 400, Houston, TX 77027, USA. |

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com