Steady growth seen for Canadian bitumen output despite increasing needs for pipeline capacity, gas

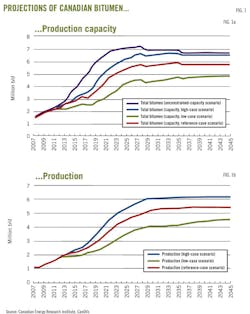

Under especially favorable conditions of economics, politics, and technology, production of bitumen from the Canadian oil sands can reach 3.9 million b/d in 2020 and peak at 6.8 million b/d in 2038 before receding to 6.2 million b/d by 2045.

More likely production rates, in the reference-case scenario of a study published in March by the Canadian Energy Research Institute, are 3.3 million b/d by 2020 and 5.4 million b/d by 2045 (Fig. 1). For perspective, the 2045 bitumen projection in the reference case is slightly below last year's average production of crude oil and lease condensate by the US, the 2011 output rate of which ranked third among all producing countries (OGJ, Dec. 5, 2011, p. 28).

In the reference case, bitumen output peaks at 5.4 million b/d in 2040.

Less likely is a low-case scenario in which bitumen production in Canada grows only to 2.5 million b/d in 2020 and 4.6 million b/d in 2045, its maximum rate of the forecast period.

CERI says oil sands development can be profitable with crude oil prices well below recent levels. Crucial to production rates, it says, are global supply of and demand for oil, extraction technologies, and pipeline takeaway capacity in Alberta. Other constraints include supplies of diluent and natural gas and regulation of emissions of greenhouse gases (GHGs).

The reference case assumes member-nations of the Organization for Economic Cooperation and Development, representing developed countries, have emerged from recession and will continue to recover, supporting slow, steady growth in demand for oil. Crude prices in this scenario remain favorable for oil sands development, rising to a plateau of slightly above an inflation-adjusted level of $100/bbl (2010 Canadian dollars) after 2022.

North American emissions policy in the reference case imposes costs intended to stimulate development and use of oil sands technology, not to shut down the industry. Emissions compliance costs start at $15/tonne of carbon dioxide equivalent and rise to $20/tonne by 2012, after which they rise at 4.5%/year.

In the low-case scenario, economic recovery stalls, oil demand stagnates, and environmental regulations become strict. Development of oil sands stagnates during the next decade in this scenario but resumes after that as protectionist policies are relaxed and economies recover. High compliance costs remain in place, lowering the rate at which new oil sands projects come on stream.

In the high-case scenario, economies of developing and emerging countries recover strongly, creating competition for hydrocarbon resources. Environmental policies encourage development of green technologies but don't offset increases in demand for oil from emerging economies. With competition growing for secure sources of oil, the US turns increasingly to Canadian supplies as its refineries are upgraded to process heavy oil and as high-conversion refineries on the Gulf Coast replace Venezuelan heavy oil with bended bitumen from Canada.

Production trends

All mined bitumen and some bitumen—about 11% in 2010—from in situ production is upgraded to synthetic crude oil (SCO) in Alberta. Last year average SCO production was expected to have increased to 960,000 b/d from 810,000 b/d in 2010.

CERI expects production of bitumen from mining to rise from 850,000 b/d in 2010 to a peak of 2.1 million b/d in 2023 and remain at about that level through 2045. In situ production will rise from 600,000 b/d in 2010 to 3.3 million b/d in 2045, surpassing mined production in 2023.

As growth of in situ production outstrips that of upgrading capacity, requirements for diluent will increase. Generally, companies with integrated mining and upgrading operations can use SCO as diluent, while others use light hydrocarbons such as condensate.

From 200,000-250,000 b/d in 2010, CERI estimates diluent demand will grow to 600,000 b/d in 2020 and exceed 1 million b/d by 2026 before reaching a plateau rate of 1.37 million b/d in 2040. CERI focuses on demand for diluent without accounting for supply, which other forecasters predict will have to come increasingly from foreign sources.

"Diluents availability in the future may become a challenge for oil sands producers," CERI says.

Costs and profits

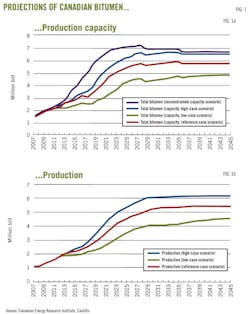

Estimates of supply costs—all costs except transportation and blending—indicate oil sands production is "highly profitable and an extremely good investment for oil sands operators as well as the provincial and federal governments," according to the study.

Under the reference-case scenario, total field-gate supply costs are $44.75/bbl of bitumen or synthetic crude oil for steam-assisted gravity drainage (SAGD) production, $89.62/bbl for mining integrated with upgrading, and $61.05/bbl for stand-alone mining (Fig. 2). Those estimates use 2010 dollars and include a 10% real internal rate of return.

After adjustments for blending and transportation, the supply costs on a West Texas Intermediate-equivalent basis are $64.62/bbl for SAGD, $91.07/bbl for integrated mining and upgrading, and $81.51/bbl for stand-alone mining.

CERI's estimates include costs of compliance with US and Albertan emissions policies harmonized with the current provincial regime. For SAGD, they assume average quality reservoirs.

In comparison with a 2010 CERI study, initial capital costs in the reference-case scenario have decreased 17.6% to $31,952/bbl of capacity for SAGD and by 13% to $72,838/bbl for mining. Sustaining capital costs have increased because of the need for maintenance of mature projects. Nonenergy total operating costs have increased to $9.20/bbl for SAGD and $14.60/bbl for mining.

For fuel costs, the study adapts to Alberta markets projections for Henry Hub natural gas prices by the US Energy Information Administration. In inflation-adjusted terms, the Henry Hub price in that projection rises gradually, settling at about $6/MMbtu in 2034.

Other agencies put costs of bitumen production at similar levels. Alberta's Energy Resources Conservation Board has estimated costs at $47-57/bbl for SAGD, $88-102/bbl for integrated mining and upgrading, and $63-81/bbl for mining alone. Canada's National Energy Board puts costs at $50-60/bbl for SAGD, $85-95/bbl for integrated mining and upgrading, and $65-75/bbl for mining.

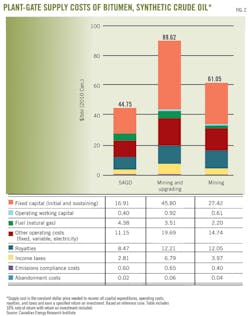

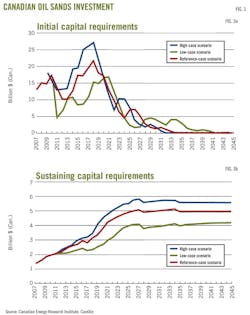

CERI projects that during 2011-45, total initial capital required will be $220 billion in the reference-case scenario (Fig. 3a). The high-case scenario projection is $253 billion and the low case, $190 billion.

In each of the scenarios, annual sustaining capital, which excludes royalty revenues, taxes, and fixed and variable operating costs, exceeds $3 billion by 2045 (Fig. 3b). Annual investment in the reference-case scenario averages $4.3 billion over the projection period and reaches $4.9 billion in 2045. In the high-case scenario, sustaining investments reach $5.6 billion in 2045 and average $4.8 billion/year over the forecast period. The low-case scenario values are $4.2 billion in 2045 and an average of $3.5 billion/year.

Gas requirements

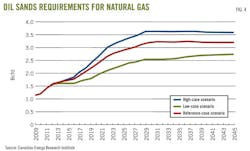

By 2045, according to the CERI study, natural gas requirements of the Alberta oil sands industry will double or triple.

In 2010, gas use was 1.2 bcfd. Gas use in 2045 in the CERI projections will be 3.204 bcfd in the reference-case scenario, 3.586 bcfd in the high-case scenario, or 2.749 bcfd in the low-case scenario (Fig. 4).

"Considering how aggressively shale gas production in the US has come on stream and the potential for shale production in Canada, meeting the oil sands industry's future demand for natural gas should not be a concern," the study says.

Because most in situ projects require the generation of steam and most steam comes from gas-fired generators, natural gas represents the single highest operating cost in projects of that type. Mining requires less gas.

Gas also is needed as a source of hydrogen in upgrading plants.

The usual gauge for energy requirements of in situ projects is the steam-oil ratio, which CERI said is about 2-2.5 for SAGD projects (dry steam) and 3-3.5 for cyclic steam saturation projects (wet steam).

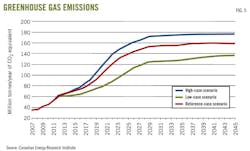

GHG emissions

CERI estimates GHG emissions on the basis of bitumen produced rather than gas used. Its estimates include total emissions from a facility, which can include cogeneration.

They don't differentiate between emissions associated with production and sale of electricity and emissions directly associated with oil produced. They relate to volumes of raw bitumen produced or received at a facility.

Under those assumptions, and even with technical improvements, emissions rise in conjunction with oil sands production in the CERI projections. From 45 million tonnes of CO2 equivalent in 2010, they reach annual levels in 2045 of 159 million tonnes in the reference-case scenario, 176 million tonnes in the high-case scenario, or 137 million tonnes in the low-case scenario (Fig. 5).

Transportation needs

In CERI's reference-case scenario, regional pipeline capacity can handle production beyond 2030 for all the major oil sands regions except Athabasca. There, forecast production exceeds current pipeline capacity by 2015.

At present, pipelines can carry 1.7 million b/d of crude oil from Fort McMurray in the Athabasca region to the Edmonton terminal and 400,000 b/d to the Hardisty terminal. From the Cold Lake region, pipelines can carry 247,000 b/d to Edmonton and 787,000 b/d to Hardisty. Pipeline capacity between the Peace River region and Edmonton is 200,000 b/d of blended bitumen.

Proposed expansions of regional pipelines are for both bitumen and diluent.

Export pipeline capacity from Edmonton and Hardisty totals 3.536 million b/d of light and heavy crude oil, blended bitumen, and oil products. Bitumen production under CERI's reference-case scenario plus other crude production in western Canada will make existing export capacity inadequate by 2015. New pipelines will be needed to carry blended or upgraded bitumen as well as to supply diluent.

"If no other pipeline is built, the current capacity will be able to transport conventional production from western Canada, US Bakken production, diluent volumes, and exports from the oil sands projects that are currently on stream and under construction," CERI says.

Under those conditions, projects now considered approved, approved-on hold, awaiting approval, and announced wouldn't be able to proceed because of the absence of takeaway capacity.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com

About the Author

Bob Tippee

Editor

Bob Tippee has been chief editor of Oil & Gas Journal since January 1999 and a member of the Journal staff since October 1977. Before joining the magazine, he worked as a reporter at the Tulsa World and served for four years as an officer in the US Air Force. A native of St. Louis, he holds a degree in journalism from the University of Tulsa.