Global oil production up in 2012 as reserves estimates rise again

Global production and reserves of crude oil and lease condensate both increased in 2012, according to Oil & Gas Journal's annual Worldwide Production report. Reserves of natural gas increased slightly between Jan. 1, 2012, and Jan. 1, 2013.

OGJ estimates average worldwide oil production in 2012 at 75.72 million b/d, up 2.9% from the 2011 rate.

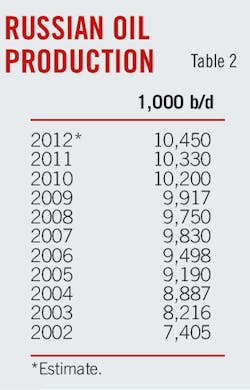

Top producers, their 2012 production averages, and year-to-year changes are Russia, 10.45 million b/d, up 1.2%; Saudi Arabia, 9.96 million b/d, up 6.6%; the US, 6.33 million b/d, up 11.9%; China, 4.08 million b/d, up fractionally; and Canada, 3.095 million b/d, up 6.6%. Evident in those numbers is the surging importance of production from unconventional resources—shales and other low-permeability formations in the US and Canada and oil sands and heavy oil in the latter.

Total average production by members of the Organization of Petroleum Exporting Countries in 2012 is up 5% at 32.1 million b/d. Besides that of Saudi Arabia, large increases have come from Abu Dhabi (6.1%), Iraq (8.4%), Kuwait (10.1%), and Libya, where production rebounded to an annual average 1.375 million b/d after having been slashed by internal war in 2011.

Those and other OPEC gains help offset a 14.7% decline in Iranian production related to international sanctions toughened in 2012. Iran has lost its position as the world's fifth largest producer to Canada.

Nigerian production also has declined in 2012 despite the start-up in April of deepwater Usan field, which is expected to produce 180,000 b/d. Flooding later in the year cut Nigerian production by an estimated 500,000 b/d.

Qatar's oil production this year is down 8.4%, Algeria's 5.9%. Angolan production is up 7.1%, and Venezuelan output is up 1%.

Non-OPEC oil output

The production surges by the US and Canada have helped push non-OPEC production up by 1.4% in 2012. Other notable non-OPEC production gains have come from Brazil (0.7%) and Colombia (2.4%).

Major decreases in non-OPEC production come from Azerbaijan (4.7%), Kazakhstan (2.7%), Syria (46.6%), Yemen (11.2%), and the North Sea. Maintenance outages took their tolls in fields off Norway in 2012, where production declined by 7.5%, and the UK, down 7.3%. UK activity stalled this year in the wake of a tax increase in 2011, but the government has been working with the industry to accommodate taxation to work in mature fields, deep water, and other challenging environments.

Production in Mexico is down 0.6% this year.

Reserves up

OGJ's new estimate for global oil reserves of 1.6 trillion bbl is up 115 billion bbl from the number published at this time last year (OGJ, Dec. 5, 2011, p. 26).

Where possible, OGJ uses data from its surveys and published official estimates. Most reserves estimates come from governments, which control most reserves. Government reserves estimates frequently are influenced by geopolitical pressures.

OGJ subscribers can download, free of charge, OGJ Worldwide Report 2011 tables from the OGJ Online home page at www.ogjonline.com. Click "OGJ Subscriber Surveys," then "Worldwide Production" or "Worldwide Refining." Historical spreadsheets of data presented here are available for purchase from PennEnergy Research. Visit www.ogjonline.com, and click the "Research" tab.

Two big reserves increases this year are from countries where geopolitical controversy is routine: Iran and Venezuela. Having moved large volumes of extra-heavy crude oil into the reserves classification in recent years, Venezuela claims 298 billion bbl. Iran has raised its reserves estimate to 154.6 billion bbl.

For Russia, which doesn't disclose country reserves, estimates vary greatly. OGJ has been conservative in its estimates for Russia but this year increases its estimate by one-third for the world's top producing country to 80 billion bbl. Although many giant Russian fields are mature, the country is considered underexplored, underdeveloped, and amenable to improved production efficiency with the growing application of modern technology. Moreover, a push into the Russian Arctic offshore is set to begin.

For the US, OGJ relies on what had been annual reserves estimates by the Energy Information Administration. Because of budget cuts, however, EIA hasn't updated its reserves estimates since 2010. The estimate here therefore is unchanged.

For China, where exploration is active on a number of fronts, the oil reserves estimate is up about 5 billion bbl at 25.6 billion bbl.

The new estimate for worldwide gas reserves is 6.79 quadrillion cu ft.

Click here to download the PDF of the "Worldwide look at reserves and production"