Global ethylene capacity continues advance in 2011

Global ethylene production capacity moved ahead in 2011 but much more slowly than the record-setting pace for 2010, according to Oil & Gas Journal's latest survey of the industry.

Saudi Arabia added 1.2 million tonnes/year (tpy) and Pequiven Polimerica Polinter added 1.3 million tpy in Venezuela. Global production capacities at yearend 2010 had set a record (OGJ, July 4, 2011, p. 100), exceeding capacity added in 2009 (OGJ, July 26, 2010, p. 34) and the (then) record addition in 2008 (OGJ, July 27, 2009, p. 49).

Including estimates for 2012, these 4 years reflect the rapid growth of Asian and Middle Eastern ethylene capacity. OGJ estimates for start-ups for 2012 suggest a return to robust global capacity, possibly approaching 6 million tpy.

Global ethylene production capacity on Jan. 1, 2012, factoring in 2011 additions, was nearly 141 million tpy, up 2.5 million tpy over capacity a year earlier (for 2010) of more than 138 million tpy. Capacity for 2009 was nearly 130 million tpy, 126.7 million tpy in 2008, and 119.6 million tpy in the survey for 2007 (OGJ, July 28, 2008, p. 46). The additional capacity in 2010 represented a net record increase of 6%.

OGJ data show two new worldscale ethylene plants starting up last year; for 2010, eight new plants started up with combined production capacity of 8.65 million tpy.

Regional view

Table 1 shows rankings of the 10 largest ethylene production complexes in the world. The order for 2011 remains unchanged, according to OGJ survey data, and one on the list reported a change in capacity.

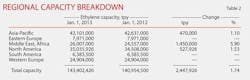

Table 2 ranks ethylene production capacity by region; Table 3 shows changes for individual countries between 2010 and 2011.

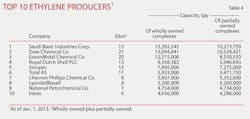

Table 4 lists the top 10 owners of ethylene production capacity worldwide. The first column of capacities presents them for assets owned entirely by one company; the second column shows the total of partial ownerships by each company.

The exclusive, plant-by-plant table, based on OGJ's survey, follows this article.

Construction

If all projects under construction remain on announced schedules, 2012 will see production capacity added at near-record pace: nearly 6.5 million tpy. That pace will fall off considerably in 2013, to a bit more than 2 million tpy.

Beyond 2013, the global construction pace for ethylene and related capacity will begin to accelerate again.

Africa, Asia, Mideast

In North Africa, Toyo Engineering Corp., Tokyo, and ENPPI, an engineering company under the Egyptian Ministry of Petroleum, are building a 460,000-tpy ethylene plant and a 20,000-tpy butadiene extraction plant as part of a petrochemical complex in Alexandria owned by the Egyptian Ethylene and Derivatives Co. (Ethydco), a new company established under the country's new investment law.

Toyo and ENPPI, based on ethylene technology from Lummus Technology, are executing a $600 million lumpsum engineering, procurement, construction, and commissioning turnkey contract. The plant is to start up in early 2015.

This will be Toyo's second ethylene plant in Egypt after a 300,000-tpy plant completed in 2001 for Sidi Kerir Petrochemicals Co.

This is Toyo's 41st ethylene plant project worldwide, said the Toyo announcement, and the fifth project in Egypt.

Under way in Singapore but behind its initial 2011 start-up schedule is ExxonMobil Chemical Co.'s second petrochemical complex on Jurong Island.

A spokesperson for ExxonMobil Chemical told OGJ that major polymer units, such as polyethylene, polypropylene, and specialty elastomer plants, are mechanically complete; commissioning started late in 2011. Phased start-up and "production qualification activities" are under way, she added; commissioning and start-up activities "will continue through 2012."

As initially conceived, the petrochemical project will include a 1-million-tpy ethylene steam cracker, two 650,000-tpy polyethylene units, a 450,000-tpy polypropylene unit, a 300,000-tpy specialty elastomers unit, an aromatics extraction unit to produce 340,000 tpy of benzene, an oxo-alcohol expansion of 125,000 tpy, and a 220-Mw power cogeneration unit (OGJ Online, Mar. 5, 2004). ExxonMobil awarded the design, engineering, procurement, and construction contract for the steam cracker recovery unit to the Shaw Group, while the contract for the steam cracker furnaces was awarded to Mitsui Engineering and Shipbuilding and Heurtey.

Mitsui Engineering and Shipbuilding was also awarded contracts for the polypropylene and specialty elastomers units. The contract for the two polyethylene units was awarded to Mitsubishi Heavy Industries.

In late 2011, China Petroleum & Chemical Corp. (Sinopec) and South Korea's SK Group signed a memorandum of understanding that included, among other ventures, a joint investment on the 800,000-tpy ethylene project in central China.

Reuters cited Chinese media, which stated Sinopec had begun building the petrochemical complex around the end of 2007 in central city of Wuhan.

Total cost of the project was estimated at nearly $3 billion.

In May 2012 in a 50/50 joint venture, Sinopec and Mitsui Chemicals Inc. established Shanghai Sinopec Mitsui Elastomers Co. Ltd. with plans to build an ethylene-propylene-diene terpolymer (EPT) production plant in Shanghai Chemical Industry Park.

The plant will be the world's largest and most advanced EPT production plant, according to the joint announcement, with production capacity of 75,000 tpy. It will begin production in first-quarter 2014.

Total investment of the project was estimated at about $314 million.

As in most recent years, ethylene and related plans in the Middle East are outpacing the rest of the globe.

Earlier this year, Qatar announced long-range plans to invest $25 billion to develop its domestic petrochemical and chemical industry. The expansion will more than double its current petrochemical production, to 23 million tpy from 9.2 million tpy, by 2020.

One Qatari project encompasses a partnership with Royal Dutch Shell to establish a petrochemicals complex in Ras Laffan Industrial City. The $6.4 billion project includes a world-scale steam cracker fed by Qatar's natural gas projects and a monoethylene glycol plant capable of producing up to 1.5 million tpy and 300,000 tpy of linear alpha olefins and another olefin derivative.

Scheduled for second-quarter 2012, Qatar Chemical Co. was to have begun operating Polyethylene 3 Plant, a new low-density polyethylene (LDPE) plant to produce about 300,000 tpy, raising overall LDPE production capacity of the company to 720,000 tpy.

Total costs for the plant was set at about $604 million.

Also earlier this year, Saudi Arabia's Royal Commission for Jubail and Yanbu approved investment of $5.6 billion for projects at Jubail Industrial City.

Al Jubail Petrochemical Co., a joint venture of Saudi Basic Industries Corp. (SABIC) and Exxon Mobil Corp., was authorized to develop a $3.1 billion project to produce ethylene propylene diene monomer, rubber, and black carbon, according to the Saudi Press Agency.

Saudi International Petrochemical Co. (Sipchem) was approved to develop a $7.5 million venture to produce 200,000 tpy of ethylene vinyl acetate and LDPE.

North America

Several relevant announcements have come out of North America in the last 18 months.

In September, Brazilian company Braskem SA, with its joint-venture partner the Mexican group Idesa, described the Ethylene XXI Project. Braskem and Idesa hold 65% and 35% interest, respectively.

The $3 billion project will produce polyethylene for the Mexican market, which the company reported was importing 1 million tpy. Located in the Coatzacoalcos Petrochemical Complex in Nachital, state of Veracruz, the new project will start up in early 2015, a revision of its earlier timetable (OGJ, July 4, 2011, p. 100).

Pemex Gas y Petroquímica Básica will supply the raw material, including natural gas, for the petrochemical complex for 20 years to produce 1.05 million tpy of ethylene, integrated with three polymerization units to produce 750,000 tpy of HDPE and 300,000 tpy of LDPE.

Last year the joint venture chose Technip as technology provider for the plant.

In Canada, Nova Chemicals was considering expanding ethylene and polyethylene based on natural gas supplied by shale production.

The company said it expects to receive feedstock from Marcellus shale ethane as early as mid-2013. In February, it applied to Canada's National Energy Board for an 8-km pipeline extension to link to an existing St. Clair River crossing for Marcellus shale gas.

Nova is expanding its ethylene production at Corunna, Ont., increasing polyethylene production at Moore, and considering a new worldscale polyethylene plant in Sarnia-Lambton. It said the Corunna cracker was being converted to use all NGLs by 2014, from ethane, butane, crude oil, propane, and other materials.

Construction of the $250 million project was set to begin third-quarter 2014.

The US is seeing considerable activity, almost all of which is based on the frenetic pace of shale gas exploration and production and the prospects for cheap, large volumes of natural gas as potential feedstock (OGJ, May 7, 2010, p. 88).

In April 2011, Westlake Chemical announced plans to increase ethane-based ethylene capacity at its plant in Lake Charles, La., in response to new low-cost ethane and other light NGLs becoming available as a result of shale gas production.

Each of two ethylene crackers at Lake Charles is being expanded to provide ethylene for existing internal derivatives units and the merchant market, said the company. Before the projects were announced, capacity of the crackers was 567,000 tpy and 522,000 tpy, according to OGJ figures.

The first cracker expansion will increase capacity by 104,000-109,000 tpy, while also increasing feedstock flexibility, said the announcement. It was originally set to be completed by yearend 2012; the second expansion, by yearend 2014.

In November 2011, Sasol Ltd. said it might spend as much as $4.5 billion to build an ethylene plant in Louisiana.

The company expected to complete the study by June 2013. The company announcement pegged the cost of building plants to produce 1.0-1.4 million tpy plus derivatives would be $3.5-4.5 billion.

Late last year, Chevron Phillips Chemical Co. LP, Baton Rouge, awarded Shaw Group Inc. a contract to license its technology and provide process design for a 1.5-million-tpy grassroots ethylene plant at Chevron Phillips Chemical's Cedar Bayou plant in Baytown, Tex.

In May 2011, LyondellBasell said it was considering debottlenecking crackers at two US plants—Channelview and La Porte, Tex.—and even building a new one.

The move would add 227,000 tpy or more of ethane-based ethylene capacity.

In December, the company announced it would expand the La Porte steam cracker by 850 million lb/year (about 855,500 tpy), for a total capacity of more than 2.5 billion lb/year (about 1.1 million tpy). A LyondellBasell spokesperson told OGJ the capacity expansion is "intended to take advantage of low-cost ethane available on the Texas Gulf Coast."

This expansion is currently in permitting, he added, with projected completion of 2014.

The company is also proceeding with a project to increase capacity to process ethane at Channelview by an additional 500 million lb/year (about 226,800 tpy). That project will be complete this year.

Finally, LyondellBasell told OGJ it is "exploring a modest expansion" of ethylene capacity at Channelview but has yet to announce a decision.

In February of this year, Chevron Phillips announced it was studying whether to build an ethylene plant on the US Gulf Coast.

The chemical company initially announced the feasibility study for a $5 billion cracker near Houston that would begin operations in 2017.

INEOS Olefins & Polymers USA said earlier this year that it will expand ethylene production capacity of its Chocolate Bayou plant east of Houston by 6.5% next year. The company plans to enhance its ethane cracking capacity and develop infrastructure associated with the complex.

By end of next year, the project will add an extra 115,000 tpy of capacity to Chocolate Bayou's existing capacity.

At present, the company operates two crackers at Chocolate Bayou, with combined capacity of 1.792 million tpy.

In December last year, INEOS said it had shortlisted three locations on the US Gulf Coast as preferred locations for its proposed 500,000-tpy ethylene oxide (EO) and derivatives plant. It said it would select a location from Chocolate Bayou, Plaquemine, La., Battleground, and La Porte, Tex.

In response to increased liquids production from Marcellus and Utica shales in Pennsylvania and Ohio, Shell announced in March it had selected a site near Pittsburgh for the potential construction of a petrochemical complex that would process ethane (OGJ Online, Mar. 15, 2012).

Shell said it has signed a land option agreement with Horsehead Corp. for a site in Potter and Center Townships in Beaver County, Pa., about 35 miles northwest of Pittsburgh.

Shell's would be the first ethylene cracker built in the country since 2000. In addition to an ethylene cracker, Shell is said to be considering polyethylene and monoethylene glycol units to help meet increasing demand in the North American market.

In April, Williams Olefins awarded CB&I, Houston, a $300 million contract for a petrochemical plant expansion project in Geismar, La. (OGJ Online, Apr. 10, 2012).

The expansion will increase plant capacity to 1.95 billion lb/year (about 885,000 tpy) from 1.35 billion lb/year.

Williams's board of directors last year approved expansion of the Geismar plant to tap inexpensive feedstock from US shale gas reserves. The expansion project is to be completed by third-quarter 2013.

In April, Dow Chemical Co. announced plans to invest $1.7 billion to build a 1.5-million-tpy ethylene cracker at its Freeport, Tex., center (OGJ Online, Apr. 30, 2012).

Dow said the new ethylene project is on schedule for a 2017 start-up as the company develops feedstock supply arrangements for the plant.

And in June, ExxonMobil Corp. reported plans for a major expansion at its Baytown, Tex., refining and petrochemical complex just east of Houston. Plans call for construction of a 1.5-million-tpy ethane cracker at the complex as well as two 650,000-tpy polyethylene production lines nearby at its plastics plant in Mont Belvieu, Tex. (OGJ Online, June 4, 2012).

ExxonMobil had already filed approval requests with the US Environmental Protection Agency and the Texas Commission on Environmental Quality. The project's final decision will be taken following completion of the review and approval procedure, which is expected to take about a year.

ExxonMobil anticipates the facilities to be online in 2016.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com