Oil sands, conventional growth will double Canada's oil output by 2030

Production of crude oil will more than double to 6.2 million b/d by 2030, largely from oil sands, according to the Canadian Association of Petroleum Producers.

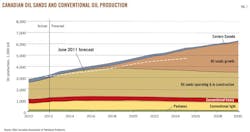

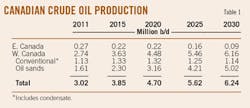

Production last year was 3 million b/d, of which 1.1 million b/d came from conventional resources in Western Canada, 1.6 million b/d from oil sands, and 300,000 b/d from Eastern Canada, CAPP says in a new report (Fig. 1 and Table 1).

The trade group expects conventional production in Western Canada to rise to 1.3 million b/d in 2015 and 2020 before slipping to 1.2 million b/d in 2025 and back to 1.1 million b/d in 2030.

Production from the oil sands region climbs steadily in the CAPP projection: to 2.3 million b/d in 2015, 3.1 million b/d in 2020, 4.2 million b/d in 2025, and 5 million b/d in 2030.

Conventional production from Eastern Canada, CAPP says, will slip to 200,000 b/d in 2015 and stay at that level through 2025 before falling to 100,000 b/d in 2030.

Overall, compared with CAPP's 2011 forecast, total Canadian production is higher by 885,000 b/d by 2025 (OGJ Online, June 13, 2011).

Other sections of the report not summarized here contained discussions of US and overseas crude oil markets for Canadian oil and the development of pipeline and rail transportation infrastructure.

Canada's oil output outlook

CAPP's June 2012 report forecasts higher production relative to the group's 2011 report from both conventional and oil sands areas.

In fact, CAPP said, oil sands continues to be the main driver for future growth, although there has also been a resurgence in conventional production far greater than the group predicted in 2011.

Eastern Canada produced 9% of Canada's total oil output in 2011, and its share of the nation's production is expected to decline to 90,000 b/d in 2030 from 273,000 b/d in 2011, including a 21% decline in 2012 despite contributions from satellite fields that started up in 2010-11.

Eastern Canada's offshore production is to remain relatively stable for most of the forecast and average 220,000 b/d until 2022, supported by satellite fields and the Hebron project starting up in 2017. The decline is steady after 2024.

The bulk of Western Canadian output originates from the Western Canada Sedimentary basin, which covers most of Alberta, Northeast British Columbia, southern Saskatchewan, and parts of Manitoba and the Northwest Territories.

Combined production of more than 3 million b/d in 2011 of crude oil, bitumen, upgraded light oil, condensate, and pentanes plus made Canada the world's sixth largest oil producing country last year.

Oil sands production

The Alberta Energy Resources and Conservation Board estimated at the end of 2010 that the Athabasca, Cold Lake, and Peace River deposits contain remaining established reserves of 169 billion bbl.

The CAPP report shows a fourth area of oil sands potential in northwestern Saskatchewan generally east of the Athabasca-Fort McMurray area.

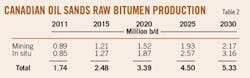

Oil sands production surpassed conventional oil output several years ago, and the outlook is for continued growth (Table 2).

CAPP said, "If the only projects to proceed were the ones in operation or currently under construction, oil sands production would still increase by 54% to 2.5 million b/d by 2020 and then remain relatively flat for the rest of the forecast."

Compared with CAPP's 2011 outlook, Western Canadian oil sands production is higher by 478,000 b/d by 2025.

The higher forecast in 2025 compared with CAPP's 2011 outlook can be attributed to some acceleration project time lines and the inclusion of additional projects that are now considered more likely to proceed due to increased industry confidence and the emergence of joint venture partnerships.

CAPP noted that Asian companies have made a number of direct investments in the oil sands in the last 3 years (Table 3).

Of the remaining established reserves in Alberta, 135 billion bbl is considered recoverable by in situ methods and 34 billion bbl by surface mining. Recovery of raw bitumen using in situ methods is set to surpass production from mining by 2015, a year earlier than CAPP forecast in 2011.

Conventional oil production

A vibrant drilling forecast for Western Canada drives growth in the production of crude and condensate until around 2017, when natural declines are expected to temper the overall growth rate, CAPP said.

Conventional production is forecast to grow from 1.1 million b/d in 2011 to 1.3 million b/d by 2020, then relax to 1.14 million b/d by 2030. Compared with CAPP's 2011 outlook, Western Canadian conventional production is higher by 388,000 b/d by 2025.

"Current estimates of the ultimate potential production recoverable from conventional reserves may still be conservative" because emerging production and completion technologies are still in early stages, CAPP said.

High levels of drilling, especially in the Cardium, Beaverhill Lake, Viking, Bakken, Duvernay, and Montney formations will offset the steep decline in Alberta conventional production that would otherwise be expected.

Russia's largest oil company has formed a Canadian subsidiary, RN Cardium Oil Inc., and picked up a nonoperated 30% equity stake in ExxonMobil's Harmattan tight oil play near Olds, Alta., north of Calgary. The investment, believed to be the first by a Russian firm in Canada's oil and gas industry, could help speed development in the Cardium play.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com