MARKET WATCH: Crude prices retreat after rally

Crude oil prices on the New York and London markets dropped on Nov. 7 and continued to retreat on Nov. 8 following a recent surge to 2-year highs.

The shift downward was largely caused by a round of profit-taking by opportunistic traders and a US government report showing an unexpected increase in US crude inventories.

US commercial crude stockpiles gained 2.2 million bbl during the week ended Nov. 3 compared with the previous week’s total, according to the US Energy Information Administration’s Weekly Petroleum Status Report. At 457.1 million bbl, US crude stocks are in the upper half of the average range for this time of year (OGJ Online, Nov. 1, 2017).

Total motor gasoline inventories and distillate fuel inventories fell 3.4 million and 3.3 million bbl, respectively, last week. Both are in the lower half of the average range for this time of year, EIA said.

Separate data from the American Petroleum Institute showed a 1.6 million-bbl decline is US crude stockpiles, with gasoline inventories gaining 520,000 bbl and distillate inventories dropping 3.1 million bbl.

EIA also reported that US crude production last week climbed 67,000 b/d to 9.62 million b/d, up 928,000 b/d year-over-year.

Members of the Organization of Petroleum Exporting Countries are tracking US output and stockpiles as indicators as to whether they should extend their agreement to collectively curb output beyond March 2018. The group, which roped-in several major non-OPEC producers as part of the deal, is scheduled to meet in Vienna on Nov. 30.

Ed Morse, head of commodities research at Citigroup, told Bloomberg that he believes “there’s likely to be disappointment” given the market’s expectation of an extension. “Our base case is that we do not get a full-year extension on Nov. 30,” he said.

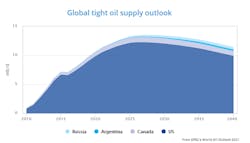

In its World Oil Outlook 2017 published this week, OPEC said it expects strong tight oil production in the next few years but that the surge will be short-lived. The group forecasts non-OPEC supply to expand to 62 million b/d in 2022 from 57 million b/d in 2016, with 3.8 million b/d of the growth coming from US oil production alone as tight oil continues its recovery.

However, OPEC notes the expected growth in tight oil “is heavily front-loaded as drillers seek out and aggressively produce barrels from sweet spots in the Permian and other basins.” The group therefore forecasts the global tight oil expansion to peak in 2025.

Demand for OPEC crude until 2025, meanwhile, is forecast to remain relatively flat at 33 million b/d, with the call on OPEC crude production rising steadily thereafter to 41.4 million b/d in 2040, implying that OPEC’s share of global oil production—including not only crude but also all other liquids—would rise to 46% in 2040 from 40% in 2016.

Energy prices

The December light, sweet crude contract on the New York Mercantile Exchange declined 15¢ on Nov. 7 to $57.20/bbl. The January 2018 contract lost 14¢ to $57.43/bbl.

The NYMEX natural gas price for December increased 1.8¢ to a rounded $2.15/MMbtu. The Henry Hub cash gas price was $3.08/MMbtu, up 5¢.

Heating oil for December decreased 2.03¢ to a rounded $1.92/gal. The NYMEX reformulated gasoline blendstock for December fell 1.47¢ to a rounded $1.82/gal.

The Brent crude contract for January 2018 on London’s ICE dropped 58¢ to $63.69/bbl. The February 2018 contract lost 49¢ to $63.47/bbl. The gas oil contract for November fell $2 to $563.50/tonne.

OPEC’s basket of crudes on Nov. 7 was $62.07/bbl, up $1.05.

Contact Matt Zborowski at [email protected].