US rig count drops again, but drilling growth still seen

The US rig count during the week ended Oct. 13 declined for the eighth time in 11 weeks. But forecasters continued to see growth in both drilling and production in the coming months and years supported in part by steadier crude oil prices.

Baker Hughes’ tally of active rigs fell 8 units this week to 928, matching its largest drop since the end of the drilling dive of late-2014 to mid-2016 (OGJ Online, Oct. 6, 2017). The count is down 30 units since the peak of the subsequent drilling rebound on July 28.

US oil-directed rigs dropped for the seventh time in 9 weeks, shedding 5 units to 743, down 25 units since their recent peak on Aug. 11. Gas-directed rigs lost 2 units to 185 but have remained 180 or above since May. The country’s only unclassified rig also went offline this week.

Six of the 8 units were land-based, with rigs engaged in horizontal drilling relinquishing 6 units to 786, down 24 units since July 28.

Two rigs off Louisiana stopped work, bringing the overall US offshore count to 20. Gulf of Mexico offshore personnel gradually returned this week to rigs and platforms evacuated last week in preparation for Hurricane Nate.

Based on offshore operator reports submitted to the US Bureau of Safety and Environmental Enforcement as of 11:30 a.m. CDT on Oct. 13, 12.6% of US gulf crude oil production remained shut-in, representing 220,466 b/d. BSEE said 7.39% of natural gas production, or 237.92 MMcfd, was still shut.

Texas led the major oil- and gas-producing states with a 4-unit decline this week to 444, down 22 units since Aug. 4. The Eagle Ford dived 6 units to 63, down 23 units since its recent high on June 2. The Barnett’s count halved to 4 rigs.

The resilient Permian edged up 1 unit to 384, down just 2 units since its recent peak on Sept. 22. While growth in the basin has slowed in recent months, it has avoided the precipitous weekly drops seen in regions such as the Eagle Ford.

Oklahoma dropped 3 units to 124, down 12 units since July 7. California fell 2 units to 14. With its offshore loss and no movement onshore, Louisiana now totals 65 rigs working. West Virginia also lost a unit, counting 15.

The Granite Wash of Texas and Oklahoma lost 1 unit to 12. The DJ-Niobrara also was down 1 rig, settling at 25.

North Dakota, Pennsylvania, Alaska, and Kansas each rose a single unit to 51, 32, 6, and 1, respectively. Up 1 unit each, North Dakota’s Williston and the Mississippian of Kansas and Oklahoma total 51 and 5, respectively.

Shale drilling, production forecasts

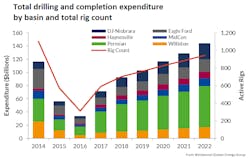

Despite the recent declines, Westwood Global Energy Group forecasts steady rig count growth in the coming years from six major unconventional oil and gas regions, but spending will be more heavily weighted toward completions.

In its outlook for the US drilling and completion market for 2018-22, the research consultancy projects a “strong period of growth and expenditure” for the DJ-Niobrara, Eagle Ford, Haynesville, Midcontinent, Permian, and Williston assuming oil prices gradually increase within $50-60/bbl through decade’s end and rise to $68/bbl in 2022.

Over the period, it expects 9%/year growth in the regions’ rig counts, which collectively reach 978 in 2022. However, of an expected $554 billion in spending, Westwood expects 66% will be on completions and just 34% will be on drilling. That compares with 2014 spending in which 53% was on completions and 47% was on drilling.

The Permian during 2018-22 is expected to account for 42% of total drilling and completions spending and 44% of total well spuds. Within the basin in 2017, completion expenditure will account for 64% of overall spending compared with 42% in 2014, Westwood said.

In its latest Short-Term Energy Outlook released this week, the US Energy Information Administration projects the Permian rig count will continue to grow from an average of 341 units in 2017 to 371 in 2018, as the West Texas Intermediate crude price is forecast to average $49/bbl in this year’s second half and $51/bbl in 2018.

EIA’s monitoring of current rig activity in several producing regions shows continued production gains from tight-oil formations such as shale in the Permian, where overall basin production in the second half is forecast to expand 260,000 b/d from the first half to 2.6 million b/d.

Overall US crude production in the second half will average 9.4 million b/d, up 340,000 b/d from the first half, EIA said. Additional second-half increases are projected in the Niobrara, up 75,000 b/d to 500,000 b/d; the Anadarko, up 42,000 b/d to 460,000 b/d.

“Production in the Niobrara and Anadarko regions has grown continuously since January 2017 in response to increasing rig activity and a monthly WTI price range from $45/bbl to $53/bbl during the year,” EIA explained. “With an expectation that prices will continue to be near this range, rig activity and production are expected to continue to grow.”

Smaller second-half rises are seen from the Bakken, up 31,000 b/d to 1.1 million b/d; and the Eagle Ford, up 5,000 b/d to 1.2 million b/d.

EIA notes that onshore rig-count shifts typically follow WTI price changes with a 4-month lag. Rig counts also move based on operators’ cash flow and profitability, which can act independent of dramatic price changes.

Changes in production then follow rig-count shifts by within about 2 months. “Consequently, the STEO oil production forecast is based on the historical observation that changes in production volumes typically occur about 6 months after a change in the price of crude oil,” EIA said.

Contact Matt Zborowski at [email protected].