Hess to divest assets in Scandinavia, Equatorial Guinea

Hess Corp. reported taking several additional steps in the continued execution of its plan to refocus the company’s portfolio and allocate capital to higher return assets.

The company has signed an agreement to sell its oil and gas interests in Norway to Aker BP ASA for a total of $2 billion. Hess also has started the process of selling its interests in Denmark.

Separately, the firm reported it has entered into an agreement to sell its interests in offshore Equatorial Guinea to Kosmos Energy and Trident Energy for a total of $650 million.

In addition to the divestments, Hess also has started a cost-reduction program expected to deliver savings of more than $150 million/year starting in 2019.

“With the continued success of our asset sale program, we are focusing our portfolio on higher-return assets and reducing our breakeven oil price,” said Chief Executive Officer John Hess. “Proceeds from these asset sales, along with cash on the balance sheet, will prefund development of our world class investment opportunity in offshore Guyana, where we have participated in one of the world’s largest oil discoveries of the past decade—positioning our company to deliver more than a decade of cash generative growth and significant value for our shareholders.”

Hess’ agreement to sell subsidiary Hess Norge, which owns interests in Valhall and Hod fields in Norway, to Aker BP ASA is effective Jan. 1. Valhall and Hod fields produced an average of 26,000 boe/day net to Hess over this year’s first half. Hess holds 64.05% interest in Valhall and 62.5% interest in Hod.

Additionally, Hess will commence a process to sell its interests in Denmark, where it holds 61.5% interest in South Arne field. South Arne field produced an average of 11,000 boe/day net to Hess in this year’s first half.

During this year’s first half, net production from Hess’ assets in Equatorial Guinea averaged 28,000 b/d of oil. Hess holds 85% paying interest and is operator. Tullow Oil Ltd. holds 15% paying interest and Equatorial Guinea holds 5% carried interest.

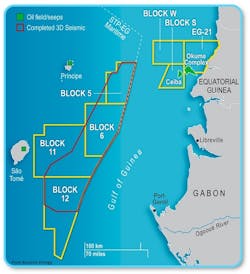

The Equatorial Guinea deal entails Kosmos Energy and Trident Energy acquiring interest in three exploration licenses, as well as Hess’ interest in adjacent Ceiba field and Okume Complex assets offshore Equatorial Guinea on a 50-50 basis. Kosmos will be primarily responsible for exploration and subsurface evaluation while Trident, a newly formed international oil and gas company supported by Warburg Pincus, will be mainly responsible for production operations and optimization.

The transactions capture a material position in proved but underexplored oil basin originally discovered and operated by members of the Kosmos management team.

The deal increases Kosmos’ total gross acreage in the Gulf of Guinea by 6,000 sq km, adding to its existing 25,000 sq km position offshore Sao Tome in the same petroleum system. It also provides exploration opportunities for large frontier prospects, as well as near-field, short-cycle tie-backs through existing infrastructure with good fiscal terms, the company said.

It will add 13,500 b/d of oil of net production and includes 45 million bbl net identified 2P/2C remaining recoverable resource, based on estimates of the buyers.