Downward trend continues for US drilling

The overall US rig count has declined for the third straight week and fifth time in 8 weeks, advancing what could be a partial reversal of a drilling rebound that lasted more than a year.

Baker Hughes’ tally of active US rigs dropped 3 units during the week ended Aug. 18 to 946, down 12 units over the past 3 weeks and up 542 units since its bottom on May 20-27, 2016 (OGJ Online, Aug. 11, 2017).

US oil-directed rigs weighed down the overall rig count with a 5-unit decrease to 763, their largest decline since January. The count is unchanged from July 7 but remains up 447 since its bottom on May 27, 2016.

Gas-directed rigs, which led last week’s losses, edged up 1 unit to 182, flat over the last 3 months but up 101 units since Aug. 26, 2016. One rig considered unclassified came online this week.

The onshore tally edged down 1 unit, with rigs drilling horizontally falling 2 units to 799, down 5 units since July 7 and up 485 units since May 20-27, 2016. Rigs drilling directionally jumped 5 units to 81.

US offshore rigs dropped 2 units—1 off Louisiana and 1 off Alaska—to 16, down 8 units over the last 3 weeks.

Among the news to make waves in the drilling industry this week, rig contractor Nabors Industries Ltd., which has a big presence both US onshore and offshore, agreed to acquire services firm Tesco Corp.

Nabors said the deal will form “a leading rig equipment and drilling automation provider by combining Canrig, Nabors rig equipment subsidiary, with Tesco’s rig equipment manufacturing, rental, and aftermarket service business.” Tesco also operates a tubular services business that “will immediately benefit Nabors drilling solutions’ operation.”

Near-term rig count dive seen

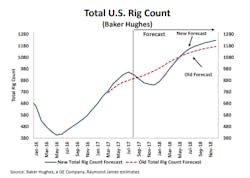

Raymond James & Associates Inc. said this week that it expects about a 100-unit decline in the overall Baker Hughes US rig count in the coming months before an oil price-driven surge commences in 2018.

RJA’s revised forecast comes after several major US exploration and production firms announced reduced 2017 capital budgets and revised second-half drilling plans (OGJ Online, Aug. 14, 2017).

The financial services firm expects “a short-term rig count retracement” given the typical 15-20 weeks between a major shift in West Texas Intermediate prices and a response in rig counts. Another factor is E&P firms “substantially” outspending cash flows this year, which is unsustainable without either reduced drilling spending or higher oil prices, it said.

RJA forecasts a 2017 rig count average of 850 but expects rising oil prices over the next 6 months will drive rig activity to average 1,100 in 2018.

“While US oil production is responding to the increased activity this year, massive US inventory drawdowns leave us convinced that the global oil market is meaningfully undersupplied and will remain so until oil prices rise meaningfully from current levels,” RJA said.

“The math is simple: If oil prices don’t move higher, the US rig count falls even further next year, US oil supply growth slows, and global oil inventories fall to dangerously low levels,” it explained.

DUCs, output rising

RJA noted that the number of drilled-but-uncompleted (DUC) wells in the US has spiked in recent months as fracturing activity has lagged the rig count. “The current tightness of fracturing crews is well documented in recent conference calls,” it said. Another contributor is the continued adoption of pad drilling in the Permian.

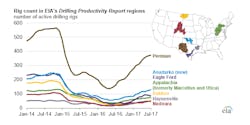

In its latest Drilling Productivity Report released this week, the US Energy Information Administration reported that the DUC inventory of the seven major US oil and gas producing regions grew by 208 month-over-month in July to 7,059, with the Permian increasing 135 DUCs during the month to 2,330 (OGJ Online, Aug. 14, 2017).

The Anadarko region of Oklahoma and Texas, newly added to the DPR, gained 42 DUCs in July to 948, while the Eagle Ford grew by 35 during the month to 1,420.

EIA projects crude production from the Permian to rise 64,000 b/d in September to 2.6 million b/d and Anadarko production to gain 12,000 b/d during the month to 459,000 b/d. Combined output from the seven regions is expected to gain 117,000 b/d in September to 6.149 million b/d.

The agency separately reported that US crude production during the week ended Aug. 11 spiked 79,000 b/d to 9.5 million b/d, up 905,000 b/d year-over-year and near the 2015 peak of around 9.6 million b/d.

This week's state, basin activity

North Dakota and its Williston basin led the major oil- and gas-producing states this week with a 2-unit drop to 51—about where its count has hovered during the last 2 months in Baker Hughes data.

Oklahoma edged down 1 unit to 131 despite a 4-unit jump in the Cana Woodford to 67, its highest level in Baker Hughes' onshore basin data that date back to February 2011. The Ardmore Woodford doubled to 2. The Mississippian fell 2 units to 5. The Granite Wash dropped 1 unit to 14.

Reflecting their offshore losses, Louisiana and Alaska each dropped 1 unit to 65 and 5, respectively. Utah also dropped 1 unit to count 9.

New Mexico edged up 1 unit to 62. California climbed 2 units to 16, its highest point since January 2015.

The Permian was unchanged this week at 377, up just 9 units over the past 2 months and up 243 units since May 13, 2016.

A rig count decline also was reported from Canada, which relinquished 6 units—all targeting oil—to 214, still up 34 units since May 12.

Contact Matt Zborowski at [email protected].