NEB: Canada is ‘late entrant’ to global LNG market

Canada is a “late entrant” to the global LNG market and the next several years will be critical, according to a recent report from the country’s National Energy Board.

That report, Canada’s Role in the Global LNG Market, looks at market dynamics, including lower prices and fierce competition.

“In recent years, there have been a number of LNG projects proposed in Canada, and significant investments have been made into their planning and approval,” said Shelley Milutinovic, NEB’s chief economist. “Despite this, Canada has yet to emerge as an active participant in the increasingly competitive global LNG market, but proponents are still actively working on projects on both coasts.”

Global LNG demand has been growing, especially in Asia and parts of Europe, NEB said. Most near-to-medium-term increases in global LNG supply to meet the demand will come from capacity already under construction in Australia and the US.

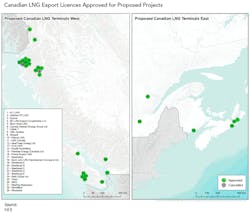

NEB has received 43 LNG export license applications since 2010, and 35 have been approved. Of 24 planned projects, 18 are on the British Columbia coast and the remaining are in Quebec and the Maritimes.

NEB said Woodfibre LNG near Squamish, BC, is the only Canadian project with a final investment decision to proceed (OGJ Online, Feb. 17, 2017).

The Pacific Northwest LNG project near Prince Rupert, BC, received conditional federal approval and a 40-year LNG export license in 2016, but still requires a final investment decision (OGJ Online, Sept. 28, 2016).

NEB said four other projects have received major regulatory approvals.

Advantages for proposed Canadian LNG projects include access to abundant and relatively low-cost gas supplies. They also would have shorter shipping distances to Asian markets from the West Coast compared with facilities along the US Gulf Coast, while East Coast Canadian projects would have shorter shipping distances to Europe.

Challenges include the high costs to develop projects in remote locations with limited infrastructure, and eroding margins due to falling LNG prices in recent years.