EIA: World liquid fuels supply growth forecast higher in latest STEO

In its May Short-Term Energy Outlook (STEO), the US Energy Information Administration projects that the world’s oil market this year and next will have more supply growth compared with the April STEO, resulting in a lower forecast of crude oil prices in the coming months.

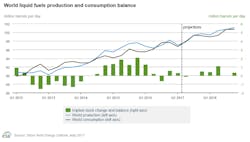

World liquid fuels supply is projected to increase by 1.4 million b/d in 2017 and by 1.9 million b/d in 2018. Compared with the April STEO forecast, those growth estimates are higher by 200,000 b/d in 2017 and 100,000 b/d in 2018.

The upward revision to expected supply growth, EIA said, is based on higher expected crude oil production growth from the US, Brazil, and Canada and more Organization of Petroleum Exporting Countries noncrude liquid production growth.

On the other side of the equation, expected world liquid fuels consumption growth is largely unchanged from the previous STEO, with growth forecast at 1.6 million b/d in both 2017 and 2018.

In this latest STEO, the Brent crude oil spot price is forecast to average $53/bbl in 2017, down from $54/bbl in the April STEO, and $57/bbl in 2018, unchanged from the April STEO. West Texas Intermediate prices are expected to average $2/bbl lower than Brent prices in both years.

Production concerns

Reports from the joint and non-OPEC Ministerial Monitoring Committee suggested compliance with the crude oil production-cut agreement remained high among its members in March.

However, because global oil inventories remain high, several oil ministers among the Organization of Petroleum Exporting Countries, including those of Saudi Arabia, Kuwait, and Iraq, have suggested their respective countries would support an extension to the crude oil production-cut agreement for 6 months beyond the current end date in June.

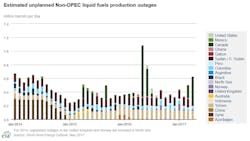

In addition to the voluntarily production cuts in several countries, Canada experienced an unplanned outage at an oil sands upgrader plant, which resulted in lower production of several Canadian crude oil streams.

Upside support for crude oil prices resulting from voluntary production cuts or unplanned outages over the past months has been countered by rising crude oil production in Libya and in the US.

Libya announced at the beginning of May that its crude oil production had increased to the highest level since late 2014.

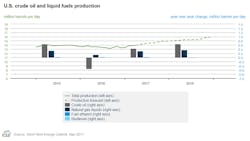

US crude oil production is estimated to have reached 9.1 million b/d in April—the highest level since March 2016. The number of US oil drilling rigs reached a 2-year high at the onset of May. Given the usual lag time between the deployment of drilling rigs and realized oil production, recent rig increases indicate that US oil production will likely rise further in the coming months.

Expectations of supply growth in 2017, particularly in the US, as well as concerns that a potential extension of the agreement will not reduce global inventories as quickly as expected contributed to a sharp drop in crude oil prices in the first week in May.

Inventories, futures spread

EIA estimates US commercial crude oil inventories declined by 7.4 million bbl during April vs. an average increase of 7.4 million bbl over the past 5 years. The decline in US crude oil inventories is likely because of the increase in gross inputs to refineries in April. In this STEO, EIA estimates that refinery inputs reached 17.2 million b/d in April—the highest on record for any month.

For most of April, the WTI 1st–13th month futures price spread narrowed relative to that of Brent, reflecting stronger near-term WTI prices as a result of the decline in US crude oil inventories.

The stronger near-term WTI prices movements relative to Brent suggests the global crude oil market likely did not experience crude oil inventory draws similar to those in the US. However, with the decline of crude oil prices in early May, both WTI and Brent front-month prices weakened significantly compared with later-dated contracts.

Price spreads between Brent and medium-sour Middle Eastern crude oils continue to narrow, making light, sweet crude oil from the Atlantic Basin more price competitive for consumers in Asia.

Reports from the trade press indicate that crude oil exports from West Africa and Europe to Asia have increased over the past few months. In February, for the first time, the US exported more crude oil to China than to any other country. Increased flows of light, sweet crude oil into Asia are lowering prices of local Asian crude oils of similar quality.