IEA: Global conventional oil discoveries fell to record low in 2016

Global conventional oil discoveries fell to a record low in 2016 as companies continued to cut spending. Also, the number of conventional resources sanctioned for development last year reached their lowest level in more than 70 years, according to the International Energy Agency. IEA warned that both trends could continue this year.

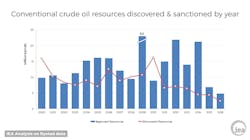

Conventional oil discoveries declined to 2.4 billion bbl in 2016 from an average of 9 billion bbl/year over the past 15 years. Meanwhile, the volume of conventional resources sanctioned for development last year fell to 4.7 billion bbl, 30% lower than the previous year as the number of projects that received a final investment decision dropped to the lowest level since the 1940s.

“This sharp slowdown in activity in the conventional oil sector was the result of reduced investment spending driven by low oil prices. It brings an additional cause of concern for global energy security at a time of heightened geopolitical risks in some major producer countries, such as Venezuela,” IEA said.

In sharp contrast to the slump seen in conventional drilling, the US shale industry is surging. US shale investment rebounded sharply and output rose on the back of production costs being reduced by 50% since 2014.

“This growth in US shale production has become a fundamental factor in balancing low activity in the conventional oil industry,” IEA said.

Conventional oil production of 69 million b/d represents by far the largest share of global oil output of 85 million b/d. In addition, 6.5 million b/d come from liquids production from the US shale plays, and the rest is made up of other natural gas liquids and unconventional oil sources such as oil sands and heavy oil.

A two-speed market

With global demand expected to rise by 1.2 million b/d/year over the next 5 years, IEA has repeatedly warned that an extended period of sharply lower oil investment could lead to a tightening in supplies.

Exploration spending is expected to fall again this year for the third year in a row to less than half levels seen in 2014, resulting in another year of a low number of discoveries. The level of new sanctioned projects so far in 2017 remains depressed.

“Every new piece of evidence points to a two-speed oil market, with new activity at a historic low on the conventional side contrasted by remarkable growth in US shale production,” said IEA Executive Director Fatih Birol. “The key question for the future of the oil market is for how long can a surge in US shale supplies make up for the slow pace of growth elsewhere in the oil sector.”

The US shale industry has lowered its costs to such an extent that in many cases it is now more competitive than conventional projects. The average break-even price in the Permian basin in Texas, for example, is now at $40-45/bbl. Liquids production from US shale plays is expected to expand by 2.3 million b/d by 2022 at current prices, and expand even more if prices rise further.

Deepwater offshore—which accounts for nearly a third of crude oil production and is a crucial component of future global supplies—has been particularly hard hit by the industry’s slowdown. In 2016, only 13% of all conventional resources sanctioned were offshore compared with more than 40% on average during 2000-15.

“In the North Sea, for instance, oil investments fell to less than $25 billion in 2016, about half the level of 2014. Coincidentally, this is now approaching the level of spending in offshore wind projects in the North Sea, which has doubled to about $20 billion in the same period,” IEA said.