In its latest Short-Term Energy Outlook the US Energy Information Administration forecasts US crude oil production to average 9.9 million b/d in 2018, which is 200,000 b/d higher than in the previous forecast.

The higher forecast reflects improvements to the rig methodology that captures increased cash flow as production increases, with the largest effect on production in the Permian and Niobrara regions.

Recent capital expenditures by oil companies also supports expectations of higher US production, EIA said. Capital expenditures for 44 US onshore-focused oil production companies increased $4.9 billion between fourth-quarter 2015 and fourth-quarter 2016 based on their public quarterly financial statements. This was a 72% increase in investment spending, the largest year-over-year increase for any quarter by these 44 companies since at least first-quarter 2012.

Company announcements and increases in the number of active oil rigs suggest US oil production companies continued investment growth in this year’s first quarter.

In addition, continued development of the Thunder Horse South Expansion and the Gunflint projects that started in 2016 contribute to higher forecast production in the federal offshore Gulf of Mexico this year and next.

Prices

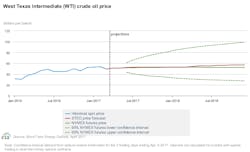

After 3 months of trading in a narrow range, crude oil prices declined in March as US crude oil inventories reached a multi-decade high and as US crude oil production rose.

Between Mar. 1 and Apr. 6, Brent crude oil front-month futures prices declined $1.47 to settle at $54.89/bbl and West Texas Intermediate front-month futures prices declined $2.13 to settle at $51.70/bbl. Brent and WTI average spot prices in March were $3.28/bbl and $4.14/bbl lower, respectively, than the February averages.

Due to reductions in international crude oil supply and rising US crude oil production, the Brent-WTI futures price spread rose 68¢ to $2.76/bbl from Mar. 1 to Apr. 6 reaching a 16-month high on Apr. 5.

In this month’s STEO EIA forecasts Brent prices to average $54/bbl in 2017 and $57/bbl in 2018, mostly unchanged from the March STEO. However, WTI crude oil prices are now forecast to average $2/bbl less than Brent prices in 2017–18. Previously, EIA expected average WTI prices to be $1/bbl below Brent prices.

“As a result of growing US supply, which has lowered US crude oil prices relative to international crude oil prices, more US crude oil is being exported to balance the domestic light sweet crude oil market. Recent export data indicate that the marginal destination for US crude oil is Asia. With US supply continuing to grow in the forecast, EIA expects the marginal destination for US crude oil will continue to be the Asian market,” EIA said.

Based on the assumption that the marginal market supplied by both crude oils has moved from the US Gulf Coast to Asia and the associated transportation costs, EIA expects the spot price spread between Brent and WTI to be $2/bbl in both 2017 and 2018.

Global oil market balance

EIA expects the market to be relatively balanced in 2017 with supply and demand meeting at around 98 million b/d.

EIA expects world crude oil and liquid fuels supply to rise 1.1 million b/d in 2017 and increase 1.9 million b/d in 2018. Compared with the previous forecast, these growth estimates are higher by 100,000 b/d and 200,000 b/d, respectively, because of higher expected US and Brazilian crude oil production growth.

Unplanned supply outages in Libya and market perceptions of an increased likelihood of an extension of the voluntary production cuts may have contributed to price increases at the end of March. EIA currently assumes that OPEC crude oil production volumes will approach pre-agreement levels during this year’s second half.

Expected world liquid fuels consumption growth is mostly unchanged from the previous forecast at 1.5 million b/d in 2017 and 1.6 million b/d in 2018.

India’s oil consumption in 2017 was revised down slightly because of the effects of that country’s demonetization on its liquid fuels consumption, but increases in forecast oil consumption in other countries offset that decline. The recent strengthening of the MSCI Emerging Markets Currency Index against US dollar suggests confidence in economic growth prospects of developing countries.