WPX grabs more Delaware basin acreage in $775-million deal

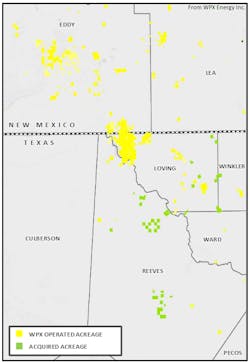

WPX Energy Inc., Tulsa, has agreed to acquire 18,100 net acres in Reeves, Loving, Ward, and Winkler counties in Texas from private equity backed firms Panther Energy Co. II LLC and Carrier Energy Partners LLC for $775 million in cash.

The deal includes existing production of 6,500 boe/d, of which 55% is oil, from 23 producing wells including 17 horizontals, two drilled but uncompleted (DUC) horizontal laterals, and 920 gross undeveloped locations in the geologic sweet spot of the Delaware basin, WPX says. New drillable locations on the acreage include more than 150 long laterals ranging 1½-2 miles.

The firm sees a projected internal rate of return on wells 55-95% at current strip pricing, and estimated ultimate recoveries of 1 million boe for Wolfcamp A and X/Y 1-mile laterals, of which 55% would be oil.

Offset operators in the area include RSP Permian Inc., Anadarko Petroleum Corp., Royal Dutch Shell PLC, Matador Resources Co., Cimarex Energy Co., Concho Resources Inc., and Centennial Resource Development Inc.

WPX plans to close the deal in roughly 60 days using a combination of proceeds from an equity issuance and cash on hand.

Growing Permian producer

WPX is yet another North American exploration and production firm that has reshaped its portfolio over the past couple of years in an effort to sharpen its focus on the Permian basin.

Once completed, the deal will increase WPX’s Permian operations to more than 120,000 net acres and its total gross drillable Delaware basin locations to 6,400 from 5,500. The firm has now added 32,000 net acres in the core of the Delaware at an average cost of $18,600/acre, excluding flowing production, since its purchase of RKI Exploration & Production LLC in August 2015 (OGJ Online, July 15, 2015).

Following its acquisition of RKI, WPX shed about $1.5 billion in assets, including the early 2016 sale of its Piceance basin unit to Houston-based E&P startup Terra Energy Partners LLC for $910 million (OGJ Online, Feb. 9, 2016).

Increased Permian drilling by the firm has resulted in 5 rigs working on its acreage. Incremental cash flow from the Panther Energy and Carrier Energy deal is expected to fund the existing 2-rig program on the acquired acreage, bringing WPX’s Permian rig count to 7.

On a pro forma basis, WPX is now targeting 30% oil growth and 25% overall production growth companywide in 2017. The firm forecasts oil production at 52,000-56,000 b/d, including 9 months of production associated with the Panther Energy and Carrier Energy deal.

Tulsa-based Panther Energy is an E&P company formed in 2013 with a $205-million initial equity commitment from Kayne Anderson Energy Fund VI and members of the Panther II management team. It’s led by Chief Executive Officer Berry Mullennix.

Sugar Land, Tex.-based Carrier Energy also was formed in 2013, receiving $300 million from Riverstone Holdings LLC for the acquisition and exploitation of upstream assets. It’s led by Chief Executive Officer Mark Clemans.

Contact Matt Zborowski at [email protected].