OPEC, non-OPEC producers reach oil-production curtailment deal

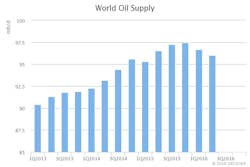

Members of the Organization of Petroleum Exporting Countries and several non-OPEC producers have reached their first joint deal in 15 years to curtail oil output in hopes to hasten market rebalancing.

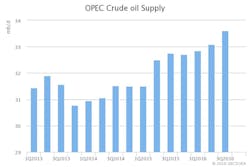

Following OPEC’s pledge to curb output by 1.2 million b/d on Nov. 30, a dozen major non-OPEC producers agreed to cut oil output by an additional 558,000 b/d “to achieve a lasting stability in the oil market in the interest of oil producers and consumers,” the International Energy Agency reported in its most recent Oil Market Report.

In addition to Russia—which had already committed to curb production by 300,000 b/d over first-half 2017—Azerbaijan, Bahrain, Brunei, Equatorial Guinea, Kazakhstan, Malaysia, Mexico, Oman, Sudan, and South Sudan also agreed to reduce output “voluntarily or through managed decline, in accordance with an accelerated schedule,” OPEC said in a news release.

The cuts, which are slated to start Jan. 1, 2017, will continue for 6 months and could be extended to yearend.

Despite the 558,000-b/d target falling short of the 600,000-b/d cut OPEC had hoped for, the agreement marks the largest non-OPEC contribution ever, IEA said, adding, “However, the non-OPEC cut will not be immediate.”

Russian Energy Minister Alexander Novak stated that his country’s reduction will be gradual. Production by the end of March will be 200,000 b/d less than the October level of 11.2 million b/d—Russia's highest level so far. Novak said Russian output would fall to 10.9 million b/d after 6 months.

Along with Russia, Mexico has agreed to cut output by 100,000 b/d, Azerbaijan by 35,000 b/d, and Oman by 45,000 b/d. Mexican officials have stated that the country’s contribution will be made through “managed natural declines,” IEA said.

After falling by 130,000 b/d this year, Mexican oil output is projected to decline by 185,000 b/d in 2017, based on Petroleos Mexicanos’ recently updated business and strategy plan, IEA noted.

“Perhaps most surprisingly, Kazakhstan pledged to reduce production by 20,000 b/d only months after its long-delayed Kashagan project finally started pumping,” IEA said. The field, which is operated by North Caspian Operating Co. and co-owned by Eni SPA, Total SA, ExxonMobil Corp., KazMunaiGas, China National Petroleum Corp., Royal Dutch Shell PLC, and Inpex was finally commissioned in October. Production reached commercial levels in November—more than 10 years behind schedule and at a cost estimated at more than $55 billion.

Ahead of the 10 December meeting, Kazakh Energy Minister Kanat Bozumbayev said the field is expected to yield about 190,000 b/d next year, as the consortium increase volumes towards a 370,000-b/d plateau target.

“Minister Bozumbayev has said that no limits will be placed on output from Kashagan, Karachaganak, and Tengiz. Instead it will delay the expansion of two smaller fields and rely on natural output decline at others,” IEA reported.

“As output at the country’s three largest fields—accounting for nearly 60% of Kazakh crude and condensate output—will not be subject to any output restraints, we have left our Kazakh supply forecast largely unchanged since last month’s [OMR],” IEA said. Kazakh production is expected to increase by 160,000 b/d in 2017.