BHP, CNOOC, European majors among winners for Mexican deepwater blocks

The final phase of Mexico’s first oil and gas bid round featured the awarding of eight of 10 deepwater blocks in the Gulf of Mexico to a variety of global operators. But a busy Dec. 5 began with Petroleos Mexicanos SA’s first farmout to the private sector since the country began energy reform in 2013.

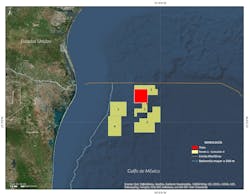

BHP Billiton Petroleo Operaciones de Mexico, a unit of Australia’s BHP Billiton Ltd., received operatorship and 60% interest of Blocks AE-0092 and AE-0093 covering Trion field, located just south of the Mexico’s maritime border with the US.

Pemex Exploration & Production Mexico will hold the remaining 40%. BHP’s bid of $624 million includes a commitment to an additional royalty of 4%, beating a $605-million offer from BP PLC unit BP Exploration Mexico.

Pemex estimates the 1,285-sq-km Trion block, which lies in more than 2,500 m of water about 200 km offshore Mexico, holds gross recoverable resources of 485 million boe. The Mexican state-owned firm made the discovery in 2012 (OGJ Online, Aug. 30, 2012).

Production from Trion is expected to start up in 2023, with output reaching 120,000 boe/d in 2025, says Pemex, which estimates $11 billion will be invested in the project.

Steve Pastor, BHP Billiton president, operations petroleum, commented, “We see attractive potential in Trion and the Perdido trend, and we are pleased to have the opportunity to further appraise and potentially develop this prospective frontier area of the deepwater Gulf of Mexico.”

Active in the US gulf, BHP operates Shenzi and Neptune fields, and has nonoperated interests in Atlantis, Mad Dog, and Genesis. The firm also submitted the most high bids and largest sum of high bids, by far, in the last two US western gulf lease sales as most of its peers retreated from participation due to the low oil-price environment (OGJ Online, Aug. 24, 2016).

Chinese, European firms expand gulf footprints

Up for grabs in fourth-phase Round 1 bidding were four blocks surrounding Trion in the Perdido Fold Belt as well as six in the Salina basin offshore southeastern Mexico. Several multinational firms with existing operations in the US gulf took the opportunity to expand their reaches into the newly opened sector.

In the Perdido Fold Belt, Blocks 1 and 4 went to China Offshore Oil Corp. E&P Mexico, a unit of CNOOC Ltd., whose Calgary-based subsidiary Nexen Energy ULC owns working interests in four Statoil ASA-operated exploration prospects in the US gulf; Block 2 to Total E&P Mexico and ExxonMobil Exploration & Production Mexico; and Block 3 to Chevron Energia de Mexico, Pemex Exploration & Production, and Inpex Corp.

Block 2 interests will be split 50-50 by Total and ExxonMobil with Total as operator. The block covers 2,977 sq km and lies in 2,300-3,600 m of water.

Block 3 will be operated by Chevron with 33.3334% interest, while Pemex and Inpex will each hold 33.3333%. The block covers 1,687 sq km and sits in 500-1,700 m of water. Inpex notes that in addition to Trion field, Great White oil field, which is on production in the US gulf, lies in the vicinity of the block.

In the Salina basin to the south, Blocks 1 and 3 went to Statoil E&P Mexico, BP Exploration Mexico, and Total E&P Mexico; Block 4 to Petronas subsidiary PC Carigali Mexico Operations, and Sierra Offshore Exploration; and Block 5 to Murphy Oil Corp., Ophir Mexico Holdings Ltd., PC Carigali Mexico Operations, and Sierra Offshore Exploration. Blocks 2 and 6 received no bids.

Interests in Blocks 1 and 3 will be operator Statoil 33.4%, with Total and BP each holding 33.3%. Block 1 covers 2,381 sq km and Block 3 is 3,287 sq km. Both are in 900-3,200 m of water. Winning bids for both Blocks 1 and 3 consisted of an additional royalty of 10% on potential future revenues and an additional work program equivalent to 1 biddable well per block.

“The blocks are virtually untested with considerable subsurface uncertainty, but with play-opening potential,” commented Tore Loseth, Statoil vice-president for exploration in the US and Mexico, following announcement of the award.

Three firms individually registered bids while seven consortia did the same. In addition to CNOOC, Statoil and Pemex each submitted bids on their own, albeit without winning an award. Consortia that unsuccessfully submitted bids were Eni Mexico and Lukoil International Upstream Holding BV; and Atlantic Rim Mexico and Shell Exploration & Extraction Mexico.

The highly anticipated fourth phase caps off a first round that involved an active onshore phase marking the entry of 22 firms into the country’s oil and gas sector (OGJ Online, Dec. 16, 2015); a second shallow-water phase that resulted in three of five blocks being awarded (OGJ Online, Sept. 30, 2015); and an underwhelming initial, shallow-water phase with just 2 winning bids out of 14 blocks (OGJ Online, July 16, 2015).

Even more shallow-water blocks are slated to be awarded Mar. 22, 2017, in the first phase of Round 2. That tender involves 15 blocks off Veracruz, Tabasco, and Campeche.

Contact Matt Zborowski at [email protected].