IEA: OPEC’s record-smashing performance comes ahead of its Nov. 30 meeting

The outlook for the world oil market is now dominated most by the outcome of the ministerial meeting of the members of the Organization of Petroleum Exporting Countries in Vienna on Nov. 30, the International Energy Agency said in the November issue of its Oil Market Report. OPEC announced 2 months ago in Algiers that it would examine how to set up a supply ceiling between 32.5 million b/d and 33 million b/d.

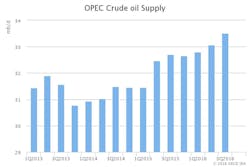

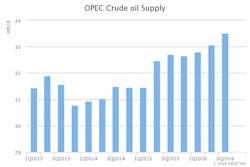

In October, OPEC members pumped 33.8 million b/d, another record-breaking month and well in excess of the high end of the proposed output range, according to IEA estimates.

Nigeria turned in the largest increase after shipments restarted from key export streams that were disrupted by militant attacks. Libyan output continued to bounce back after the reopening of major export terminals. Production from Iraq climbed to an all-time high as oil fields in both the south and the north pumped harder. Iran pushed flows to a presanctions rate of 3.72 million b/d, while Saudi Arabia, the UAE, and Kuwait continued to pump near or or at all-time highs.

As of October, overall OPEC output had risen for 5 straight months, led by Iraq and Saudi Arabia. Early indications in November are that production will remain at this elevated level.

Record production means that OPEC must agree to significant cuts in Vienna to turn its Algiers commitment into reality. “We can’t predict the outcome of the [Nov. 30] meeting, but we can see the scale of the task ahead,” IEA said.

Iran, released from international sanctions earlier this year, has been reluctant to take part in any deal that would limit its production.

Iraq agrees in principle with the OPEC reduction, but has disputed the accuracy of the data used to set the output limits. Baghdad has claimed that secondary sources used by OPEC, which include the IEA, underestimate its production.

“If the OPEC countries do implement their Algiers resolution the resultant production cut will see the market move from surplus to deficit very quickly in 2017, albeit with a considerable stock overhang that will take time to deplete. On the other hand, if no agreement is reached and some individual members continue to expand their production then the market will remain in surplus throughout the year, with little prospect of oil prices rising significantly higher. Indeed, if the supply surplus persists in 2017 there must be some risk of prices falling back,” IEA said.

Non-OPEC production, demand

“Unfortunately for those seeking higher prices, an analysis of the other components provides little comfort,” IEA said.

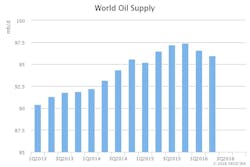

Non-OPEC oil production rose by nearly 500,000 b/d in October, after extensive maintenance and unscheduled outages had curbed output a month earlier and as new fields started up.

October supply was boosted as the giant Kashagan field in Kazakhstan ramped up after finally seeing first oil in September while Azeri production recovered from maintenance. Loading schedules suggest North Sea production also rebounded, while Russian producers recorded yet another record high.

The world’s biggest crude oil producer Russia will see its output increase by 230,000 b/d in 2016, and sustained production at current record levels would result in growth of nearly 200,000 b/d next year. With production also expected to grow in Brazil, Canada, and Kazakhstan, total non-OPEC output will rise by 500,000 b/d next year compared with a fall of 900,000 b/d in 2016. This means that 2017 could be another year of relentless global supply growth similar to that seen in 2016.

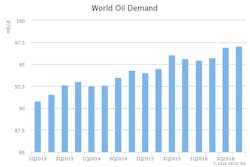

Oil demand growth is forecast to ease to 1.2 million b/d in 2016, having peaked at a 5-year high of 1.8 million b/d in 2015, due to slowdowns in the Organization of Economic Cooperation and Development Americas and China. A similarly paced expansion is foreseen in 2017.

“There is currently little evidence to suggest that economic activity is sufficiently robust to deliver higher oil demand growth, and any stimulus that might have been provided at the end of 2015 and in the early part of 2016 when crude oil prices fell below $30/bbl is now in the past,” IEA said.

Stocks

OECD commercial inventories fell for the second month in a row in September, by 17.1 million bbl to 3,068 million bbl. Taken together, OECD stocks in August-September fell the most in nearly 3 years.

Falls were concentrated in oil products in September as the refinery maintenance season was in full swing. Crude stocks fell 1.7 million bbl because of North America, with gains seen in Asia Pacific and Europe.

Chinese crude stocks built by a strong 29.7 million bbl in September and 84.4 million bbl over this year’s third quarter, up by a cumulative 328 million bbl over the past 12-month period.

Preliminary data point to renewed crude stock builds in the US and Japan in October, while elsewhere refinery maintenance is likely to have capped oil product stock builds. Unless OPEC agrees an output cut at its next meeting, stock builds could continue throughout 2017.