IEA: Oil market’s rebalancing could come faster if OPEC sticks to target

“The waiting game is over,” the International Energy Agency said in the October issue of its Oil Market Report. This is in regard to the fact that the Organization of Petroleum Exporting Countries has effectively abandoned its free-market policy set nearly 2 years ago, setting a new supply target of between 32.5-33 million b/d.

Critical details apart from the target, such as individual country allocations, production baseline, and implementation date, are still to be determined. The price of oil has risen by 15% to more than $53/bbl since the deal, the first to cut supply since 2008.

However, “global oil inventories are far too high—in the view of some producers—and they aren’t being worked off nearly fast enough,” IEA said.

If OPEC sticks to its new target, the oil market’s rebalancing could come faster. Otherwise, even with tentative signs that bulging inventories are starting to decline, the market may remain oversupply through the first half of next year, IEA said.

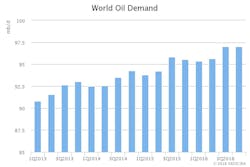

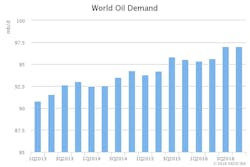

Demand

According to IEA’s latest forecast, world oil demand will rise 1.2 million b/d this year, with a similar expansion expected in 2017.

The demand data for 2015 has been revised upwards by nearly 200,000 b/d since last month’s report to 95.04 million b/d, due to the latest US 2015 data being above that first reported and, to some extent, upgrades of Asian demand outside the Organization for Economic Cooperation and Development.

The major upward baseline data revisions have curtailed the growth estimate for 2016. Quarter-based global demand growth continues to slow, dropping from a 5-year high of 2.5 million b/d in third-quarter 2015 to a 4-year low of 800,000 b/d in this year’s third quarter due to vanishing OECD growth and a marked deceleration in China. After unusually mild winter weather in much of the northern hemisphere in fourth-quarter 2015, year-on-year growth should rebound somewhat in this year’s fourth quarter.

Much weaker-than-expected US oil demand data for July pulled down the estimate of overall demand for the third quarter and for the whole of 2016. Growth estimates fell heavily by 415,000 b/d in July year-over-year, as upgrades to the baseline series further reduced year-on-year comparisons.

Chinese oil demand growth has all but vanished in this year’s third quarter compared with a year ago, pulled down by a substantial slowdown in industrial oil usage. “Some of the slowdown may be temporary due to forced factory closures ahead of September’s G20 meeting in Hangzhou, but the heady gains seen as recently as mid-2015 are unlikely to be repeated any time soon,” IEA said in the report.

Indian demand growth returned with a vengeance, averaging 420,000 b/d in August, according to preliminary data. Strong gains in road transport demand and residential LPG use lent support, more than offsetting declines in naphtha and kerosene.

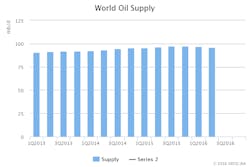

Supply

Global oil supplies rose 600,000 b/d year-over-year in September.

Non-OPEC production in September was up nearly 500,000 b/d from August to 56.6 million b/d on higher volumes from Russia and Kazakhstan. Following maintenance in August, Russian crude and condensate production surged 400,000 b/d to a post-Soviet high above 11.1 million b/d. Kazakh output also recovered from a steeper-than-expected cut during maintenance. Overall non-OPEC output in 2016 is forecast to decline 900,000 b/d to 56.6 million b/d, before rising by 400,000 b/d in 2017.

In the US, while output held up better than expected in July—the latest month for which official data are available—crude oil production dropped below 8.7 million b/d, its lowest since May 2014 and more than 700,000 b/d below 2015.

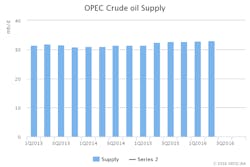

OPEC crude output rose to a record high of 33.64 million b/d, as Iraq pumped at record rates and Libya reopened export terminals. Saudi Arabia, Kuwait, and the UAE held supply at or near historic highs, while Iran sustained presanctions levels of close to 3.7 million b/d. Output from the group’s 14 members stood 900,000 b/d above a year ago.

Stocks

OECD commercial inventories fell in August for the first time since March—by 10 million bbl to 3,092 million bbl—due to a larger-than-seasonal decline in crude stockpiles.

Asia Oceania saw the largest monthly draw in crude stocks. The decline was split between Japan and South Korea, which saw higher refinery runs.

Oil product inventories built by 18.7 million bbl to reach a historical high in August as OECD refinery throughput rose and seasonal restocking of US propane continued.

Preliminary data for September show crude stocks falling in both Japan and the US due to lower imports and despite a heavier refinery maintenance schedule.