STEO: Global oil inventory builds to continue into early 2017

In the September Short-Term Energy Outlook, the US Energy Information Administration forecasts Brent crude oil prices to average $43/bbl in 2016—$1/bbl higher than forecasts in last month’s STEO—and $52/bbl in 2017.

West Texas Intermediate crude oil prices are forecast to average $1/bbl less than Brent in 2016 and 2017.

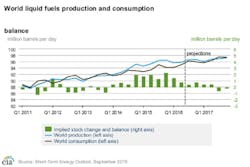

EIA estimates that global petroleum and other liquid fuels inventory builds will average 800,000 b/d in 2016, unchanged from last month’s STEO. Inventory builds are expected to continue into early 2017, and then consistent inventory draws are forecast to begin in June 2017.

Global liquids consumption

EIA now expects global oil consumption to increase 1.5 million b/d in 2016 and 1.4 million b/d in 2017, following a growth of 1.4 million b/d in 2015.

Overall consumption of petroleum and other liquid fuels in countries outside of the Organization for Economic Cooperation and Development is expected to be 1.2 million b/d in 2016 and 1.3 million b/d in 2017.

“India and China are expected to be the largest contributors to non-OECD petroleum consumption growth, with each country’s consumption forecast to increase between [300,000 and 400,000] b/d annually in both 2016 and 2017,” EIA said.

In India, consumption growth is mainly a result of increased use of transportation fuels and of naphtha for new petrochemical projects. China’s growth in consumption of petroleum and other liquid fuels is driven by increased use of gasoline, jet fuel, and hydrocarbon gas liquids (HGL), which more than offsets decreases in diesel consumption.

OECD consumption is expected to increase by 200,000 b/d in 2016 and by less than 100,000 b/d in 2017.

Non-OPEC supply

EIA now expects production outside the Organization of Petroleum Exporting Countries to decline 400,000 b/d in 2016 and 200,000 b/d in 2017. In last month’s STEO, EIA expected non-OPEC production to decline 600,000 b/d in 2016 and 400,000 b/d in 2017.

Forecast total US production of liquid fuels declines by 290,000 b/d in 2016 and remains flat in 2017. This compares with forecasts of declines of 400,000 b/d in 2016 and 200,000 b/d in 2017 in August’s STEO. Declining US onshore crude oil production is partially offset by expected growth in hydrocarbon gas liquids production, Gulf of Mexico crude oil production, and liquid biofuels production.

Among non-OPEC producers outside of the US, the largest decline in 2016 is forecast to be in China: by 190,000 b/d. In 2017, the largest non-OPEC declines are in the North Sea and in Russia, EIA said.

Canadian production is expected to rise in both 2016 and 2017, although annual growth in 2016 will be only 30,000 b/d because of production lost to wildfires in Alberta. However, Canadian production is expected to increase by 250,000 b/d in 2017.

OPEC supply

OPEC crude oil production averaged 31.8 million b/d in 2015, an increase of 800,000 b/d from 2014, led by Iraq and Saudi Arabia. According to this month’s STEO, OPEC crude oil production will rise 700,000 b/d in 2016, with Iran accounting for most of the increase, and an additional 500,000 b/d in 2017. The forecast does not assume a collaborative production cut among OPEC members and other producers.

OPEC noncrude liquids production averaged 6.6 million b/d in 2015, and it is forecast to increase by 200,000 b/d in 2016 and by 300,000 b/d in 2017, led by increases in Iran and Qatar.

EIA estimates that OECD commercial crude oil and other liquid fuels inventories were 3 billion bbl at yearend 2015, equivalent to roughly 66 days of consumption. It forecasts OECD inventories to rise to 3.09 billion bbl at yearend, then fall to 3.06 billion bbl at yearend 2017.