MARKET WATCH: Crude prices fall on continued oversupply concerns

Crude oil prices on the New York and London markets declined on Aug. 31, and continued their downward momentum into Sept. 1 after a US government report showed a second consecutive weekly rise in crude stockpiles.

The US Energy Information Administration said US commercial crude inventories increased 2.3 million bbl during the week ended Aug. 26 compared with the previous week’s total (OGJ Online, Aug. 31, 2016). Analysts surveyed by The Wall Street Journal expected a 1.2 million-bbl rise.

A stronger dollar, which makes oil more expensive for buyers using other currencies, also has recently weighed down oil prices. Measured against a basket of other currencies, the WSJ Dollar Index was up 0.6% during August.

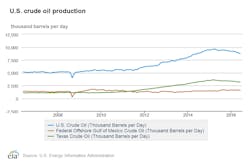

Additional data released by EIA showed US oil production declines during the week ended Aug. 26 and during the month of June. US crude output dropped 60,000 b/d last week to 8.49 million b/d. The Lower 48 accounted for 50,000 b/d while Alaska represented the remaining 10,000 b/d.

For June, EIA said US crude output fell 2.2% month-over-month and 6.6% year-over-year to 8.7 million b/d. Production in Texas, however, declined just 0.7% compared with the May level to 3.17 million b/d, still down 8.4% year-over-year.

Projections from oil and gas consulting firm Rystad Energy indicate US onshore oil output growth could be restored by November on the back of increased activity in the Permian basin of West Texas and southeastern New Mexico (OGJ Online, Aug. 31, 2016).

The federal offshore Gulf of Mexico, meanwhile, took a 4.5% month-over-month drop in June to 1.54 million b/d, still up 9.1% year-over-year.

More gulf output declines can be expected based on data for late August and early September as operators prepare for what is now Tropical Storm Hermine. Gulf oil production had fallen 312,280 b/d as of midday Aug. 31, the US Bureau of Safety and Environmental Enforcement reported (OGJ Online, Aug. 31, 2016).

Energy prices

The October crude oil contract on the New York Mercantile Exchange dropped $1.65 to close at $44.70/bbl on Aug. 31. The November contract lost $1.68 to $45.31/bbl.

The natural gas contract for October gained 6¢ to a rounded $2.89/MMbtu. On the spot market, the Henry Hub gas price was $2.94/MMbtu, up 2¢.

Heating oil for September fell 6.09¢ to a rounded $1.41/gal. The price for reformulated gasoline stock for oxygenates blending for September dropped 3.61¢ to a rounded $1.41/gal.

The Brent crude contract for October on London’s ICE declined $1.33 to settle at $47.04/bbl. The November contract fell $1.84 to $46.89/bbl. The September gas oil contract settled at $414.50/tonne, down $13.50.

The average price for the Organization of the Petroleum Exporting Countries’ basket of 12 benchmark crudes on Aug. 31 was $43.91/bbl, down 1.34¢

Contact Matt Zborowski at [email protected].